OGJ Newsletter

Firms win MMS royalty in-kind oil contracts

More than 12.7 million bbl of crude oil and condensate from federal leases in the Gulf of Mexico was sold to six companies as part of a royalty in-kind (RIK) sale, the US Minerals Management Service said.

Chevron Products Co., ConocoPhillips, ExxonMobil Corp., Plains Marketing, Sempra Energy, and Shell Trading Co. submitted winning bids. Most of the contracts were for 6 months, with one contract awarded for 12 months.

“A record number of 14 companies submitted aggressive bids on the 34 packages offered,” compared with nine bids in an unrestricted RIK sale concluded in August, MMS Director Johnnie Burton said. “These RIK sales continue to generate very high interest,” she added.

The contracts awarded 12,710,700 bbl of crude, or 53,615 b/d, and provide for delivery to begin Jan. 1, 2007.

In mid-October, MMS sold 114.8 bcf of Gulf of Mexico gas to 10 companies in the first RIK transaction that included production from off Alabama as well as Louisiana and Texas. It said 15 companies tendered a record 115 offers for the RIK gas.

MMS proposes to expand Lease Sale 205 acreage

MMS proposed to expand the available acreage in Outer Continental Shelf Lease Sale 205, scheduled for September 2007. MMS will accept comments on this proposal through Dec. 29.

The proposal seeks to include all available acreage in the Central Gulf of Mexico planning area in Lease Sale 205, which originally only included acreage along the eastern boundary of the Central gulf planning area.

While this additional acreage would be new to Sale 205, it is the same acreage proposed for the other Central gulf lease sales scheduled for 2008-12.

Lease Sale 205 is included in the proposed 5-year program for 2007-12 and the accompanying draft environmental impact statement. The comment period for the 2007-12 program closed on Nov. 24, and the comment period for the draft EIS closed on Nov. 22.

The MMS proposal also includes the acreage that would have been offered in Lease Sale 201, which was originally scheduled for March 2007 and included all of the available acreage in the Central gulf planning area as proposed in the 5-year program for 2002-07.

As part of a lawsuit settlement agreement with Louisiana, MMS has agreed to prepare an EIS before conducting any additional lease sales in the gulf. As a result of this agreement, MMS is cancelling Lease Sale 201 (OGJ, Nov. 13, 2006, p. 27).

Japan objects to Russia’s new pipe import tax

Japan has objected to a decision by Russia to impose an 8% import duty on Japanese-made steel pipe. Nippon Steel, JFE, and Sumitomo Metal Industries are the manufacturers primarily affected.

“Japan expresses deep regret for Russia’s decision to take such a protective measure,” said Japanese Economics, Trade, and Industry Minister Akira Amari in a statement released Nov. 25.

He said Japan might call on Russian authorities to cancel the 3-year tax measure to be imposed starting Dec. 18, reportedly to protect Russia’s industry from the rapidly increasing growth of imported pipe from Japan.

Russia’s import of Japan-made pipes increased to 270,000 tonnes in 2004 from 3,000 tonnes in 2002, mainly due to the implementation of large-scale oil and gas development projects on Sakhalin Island, where the last batch of pipe for the Sakhalin-2 pipeline was delivered Oct. 1.

The Russian tax coincides with efforts of pipe mills in both countries to increase output to match international demand, especially for natural gas pipelines.

In mid-November, Alexander Deineko, head of the Russian Pipe Industry Development Foundation, said investment in his country’s pipe industry could total $1.5 billion during 2006-10.

He said investment in modernization and refitting capacity had reached $1.5 billion over the past 5 years, and he expects the same amount to be invested in the next 5 years.

Equatorial Guinea raises oil royalty

Equatorial Guinea President Teodoro Obiang ratified a new hydrocarbon law increasing the minimum royalties that oil and gas companies must pay to 13% from 10%.

Raymond James & Associates Inc. issued a Nov. 28 research note saying the new law also gives Equatorial Guinea the right to a 20% share in contracts with foreign operators and mandates that producers will be required to pay “any windfall tax that may be imposed by the state.”

The new hydrocarbon law was posted Nov. 24 on the African government’s Mines and Energy web site.

“Equatorial Guinea has historically been welcoming to foreign producers, and these new laws are modest increases as opposed to what the more aggressive governments such as Bolivia and Venezuela have imposed in the last few years,” RJA said.

Oil companies having operations in Equatorial Guinea include ExxonMobil Corp., Devon Energy Corp., Marathon Oil Corp., and Hess Corp. In addition to ratification of the new law, the government extended the closing date of its 2006 Licensing Round to Mar. 31, 2007, from Jan. 31, 2007, saying this was “to allow prequalified companies to fully evaluate the available acreage.”

Gazprom marketing directly to French consumers

Russia’s gas giant Gazprom officially launched Gazprom Marketing & Trading France Nov. 24 in Paris to further develop a total upstream-to-downstream natural gas export strategy. Describing France as “a strategic market,” it intends to sell gas directly to consumers rather than through wholesalers.

GM&T France, which started operations in October through UK subsidiary Gazprom Marketing & Trading Ltd., is targeting medium and large industrial and commercial customers.

Gazprom Vice-Pres. Alexander Medvedev said the aim is to supply, within the next 2-3 years, 2 billion cu m of gas directly to consumers in France and to have as many as 1,000 customers within 5 years.

GM&T France wants easier access to transport networks and infrastructure to deliver its gas “to the consumer’s door,” and Medvedev said Gazprom would acquire local companies and set up joint ventures for this purpose.

GM&T France has begun extending activities to electricity and is planning to become involved in CO2 emissions trading, oil products, and chemicals, said Medvedev.

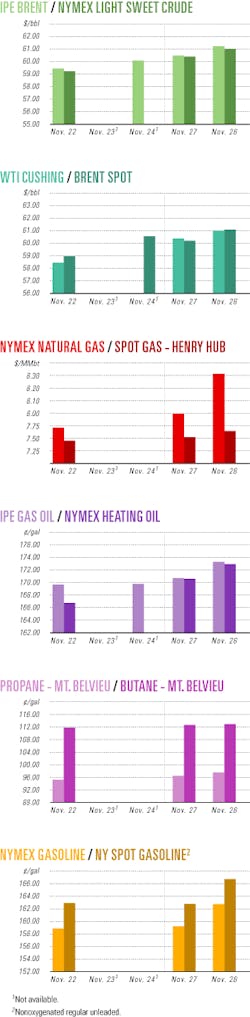

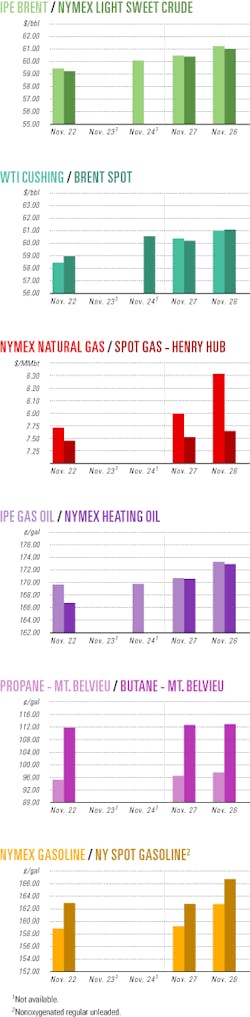

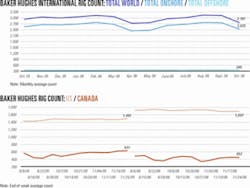

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesExxonMobil advances Piceance tight gas work

ExxonMobil Gas & Power Marketing Co. has signed a 30-year agreement with Enterprise Products Partners LLC for gathering, compression, treating, and conditioning services for natural gas it is developing in tight sands of the Piceance basin of Colorado.

ExxonMobil began a development program last year of about 270,000 gross acres it holds under lease in the area. Company officials have estimated recovery potential at more than 35 tcf and predicted the area will produce gas for more than 50 years.

At a presentation for analysts early in November, ExxonMobil Senior Vice-Pres. Stuart McGill said an initial development project on the leasehold is producing about 50 MMcfd. A first production phase of 150-200 MMcfd is in the “definition stage,” he said. Later stages are planned.

“There is the potential for gross production to reach some 1 bcfd at its peak,” McGill said.

ExxonMobil is using proprietary “multizone stimulation technology” and drilling multiple deviated wells from individual locations.

“We now routinely fracture 40-50 sands/well and recently completed 64 of these fractures in a single wellbore,” McGill told the analysts.

Under the new, fee-based agreement, ExxonMobil dedicates to Enterprise production from 29,000 acres in Rio Blanco County. Enterprise has the option to recover NGL beyond liquids recovery required to make the gas meet pipeline specifications.

Enterprise expects to invest $185 million on new plant and pipeline facilities related to the agreement and to complete construction late in 2008. It will extract liquids at a gas processing plant it is building at the Meeker hub. The plant will have initial capacities of 750 MMcfd of inlet gas and 35,000 b/d of liquids extraction. A planned later phase will boost capacities to 1.3 bcfd of gas and 70,000 b/d of liquids.

Turkmenistan claims supergiant gas find

The reported discovery of a supergiant gas field near the town of Iolotan in the Amu Daria basin of Turkmenistan would, if confirmed, help justify construction of a gas pipeline to China.

The field is said to contain 23 tcf of gas at 16,400 ft, but it was not clear whether this is the recoverable volume or the amount of gas in place. Turkmenistan, which already pipes gas to several countries and intends to serve several more, invited China National Petroleum Corp. to develop the field, press reports said.

Iolotan is east-northeast of supergiant Dauletabad-Donmez gas field, discovered in 1976 with estimated ultimate recovery of 49 tcf from a reservoir at about 9,800 ft (OGJ, June 3, 1991, p. 104).

Endeavour makes gas strike in UK North Sea

Endeavour International Corp., Houston, said its Columbus well in the UK North Sea encountered a gross gas column of at least 125 ft in the Palaeocene Forties formation.

Testing operations are under way on Block 23/16f with results expected by midmonth. It is anticipated that additional appraisal drilling will be required.

Endeavour is operator of the drilling and testing operations and holds a 25% working interest in the license, which is operated by Serica Energy PLC.

Statoil lets contract for Trestakk studies

Norway’s Statoil ASA has let a contract to a unit of John Wood Group PLC to perform feasibility and conceptual studies for facilities modifications associated with the Trestakk subsea field development expected to be tied into the Aasgard platform in the Norwegian Sea.

The £2 million contract commits Wood Group Engineering (North Sea) to evaluate options for the topsides modifications on the Aasgard A and Kristin floating production facilities and to verify the alternatives required for concept selection. Wood Group aims to prepare the selected concept to the required level for full project sanction.

The project involves a number of challenges in high-pressure, high-temperature systems, Statoil said.

Eni Goliat appraisal encounters deeper oil

Eni Norge AS has found deeper oil pay during appraisal drilling of its Goliat oil discovery on Production License 229 in the Barents Sea off Norway.

Its 7122/7-4 S on the South Goliat structure encountered an oil column in Early Triassic Klappmys sandstone. The well also confirmed a deeper oil-water contact in the Late Triassic Realgrunnen subgroup and proved a gas-oil contact in Middle Triassic Kobbe.

The Transocean Polar Pioneer semisubmersible drilled the well to a TD of 2,366 m subsea in 372 m of water. The license is 50 km southeast of Snohvit field and 85 km northwest of Hammerfest (OGJ, Nov. 13, 2006, p. 31).

Eni owns 65% interest in and operates PL 229.

Firm shoots seismic survey off Seychelles

PetroQuest International has acquired 2,500 line-km of seismic data off Seychelles in the East Africa island nation’s first seismic work in 14 years.

“It is being processed at the moment, and the government is keen to build on its oil and gas business,” said Chris Matchette-Downes, vice-president of business development at Black Marlin Energy Ltd., which is conducting geophysical work for PetroQuest.

PetroQuest’s 20,000-sq-km block is in the southern portion of the Seychelles plateau (see map, OGJ, July 6, 1998, p. 85). The reservoir is believed to be coarse-grain Karoo sandstones with porosities of up to 23% at 8,000 ft for the reservoir horizon.

“Over 15 large structures were mapped by Texaco and Amoco in the past,” Matchette-Downes said. “New seismic has verified the presence of large leads.” Oil shows and locally derived tars have been classified as having come from Paleozoic and Lower Mesozoic regional sources.

The seal comprises interbedded shales and a thick Cretaceous shale section.

Sinopec to develop Iran’s Yadavaran oil field

Iran has invited China Petrochemical Corp. (Sinopec) to finalize an agreement initiated in 2004 for development of Iran’s Yadavaran oil field (OGJ, Apr. 18, 2005, Newsletter).

The Petroenergy Information Network, operated by Iran’s oil ministry, said Sinopec would also secure oil and natural gas supplies.

Under the 2004 informal agreement, Sinopec would pay Iran up to $100 billion over 25 years for oil and gas purchases and for a 51% stake in Yadavaran field.

China would be able to buy 250 million tonnes of LNG and 150,000 b/d of Iranian crude oil at market rates over that period.

“All elements of the contract have been finalized, and it is in the final process for signing by Sinopec,” said National Iranian Oil Pres. Gholamhossein Nozari.

Drilling & Production - Quick TakesConocoPhillips starts up Alpine satellite

ConocoPhillips has brought on line a second Alpine satellite oil field, called Nanuq, on Alaska’s North Slope.

Nanuq, 3 miles south of Alpine, is expected to reach peak production of 15,000 b/d of oil in 2008.

Production from Nanuq, as well as from Fiord-the first Alpine satellite-will be processed through the existing Alpine facilities. Together, the two fields are expected to have peak production of 35,000 bo/d in 2008 (OGJ, Aug. 21, 2006, Newsletter).

Nanuq field was developed exclusively with horizontal wells. It will have gas and water injection. The Nanuq development plan involves 19 wells.

ConocoPhillips used 50 miles of temporary ice roads to move construction equipment, facilities, drilling rigs, and drilling supplies to the site, which is 35 miles west of Kuparuk field on the border of the National Petroleum Reserve-Alaska.

Alpine, Nanuq, and Fiord oil field interests are ConocoPhillips Alaska Inc. 78% and Anadarko Petroleum Corp. 22%.

ConocoPhillips is pursuing state, local, and federal permits for additional Alpine satellite developments, including the recently announced Qannik discovery, which flowed an average 1,200 b/d of 30° gravity oil from a 25-ft thick sandstone overlying the Alpine reservoir at 4,000 ft (OGJ, July 24, 2006, Newsletter).

Gorgon geosequestration gets government grant

Chevron Australia’s Gorgon gas project is still alive following an Australian government grant of $60 million (Aus.) towards the company’s proposed carbon capture storage project on Barrow Island.

The $850 million (Aus.) carbon dioxide geosequestration project is expected to be the largest of its kind in the world.

The plan is to inject 125 million tonnes of excess CO2 produced during the life of the Gorgon LNG project planned for Barrow Island off Western Australia.

The offshore Gorgon gas field has about 12% CO2 content, a figure that prompted the geosequestration project.

Environment Minister Ian Campbell says the underground storage of Gorgon CO2 has the potential to reduce Australia’s greenhouse emissions by as much as 3 million tonnes/year.

The government’s funding will provide for a commercial-scale demonstration project that liquefies the CO2 stream and injects it into reservoirs 2.5 km under the island.

The project includes long-term monitoring to ensure the integrity of the storage. The funding, however, is conditional on the Gorgon Gas project meeting environmental approvals.

Co-op programs to drill nine N. Sea wells

Six independent oil companies plan to drill nine wells next year in the central and northern UK North Sea with two semisubmersible rigs under two cooperative programs managed by AGR Peak Well Management Ltd., London.

The companies involved are Antrim Resources (NI) Ltd., three wells; Nautical Petroleum PLC, two wells; and Bow Valley, Vermillion Rep SAS, Ithaca Energy (UK) Ltd., and Xcite Energy Resources Ltd., one well each.

One of the programs will begin next April and the other, next May. The semis will come from Transocean Offshore (North Sea) Ltd. and Dolphin Drilling Ltd. AGR Peak Well Management will provide full well project management, including rig and support services.

Processing - Quick TakesTechnip to supply HDS unit to Polish refinery

PKN Orlen SA has awarded Technip a contract worth €67 million for construction of a diesel oil hydrodesulfurization (HDS) unit at its 376,500 b/cd refinery in Plock, Poland.

This project, which will enable the refinery to increase production of high-purity diesel oil in compliance with the European Norm, also includes a wild naphtha-stripping unit and a gas amine treating-regeneration unit.

The HDS unit, which will be based on the Albemarle ultradeep HDS process, will produce 260 tons/hr of high-purity diesel oil, with a maximum of 10 ppm (wt) of sulfur. It will be one of the largest of its kind, Technip said.

Construction of the unit is scheduled for completion in June 2009.

The contract covers license, basic and detail engineering, procurement and supply of equipment and materials, supervision of construction, precommissioning and commissioning, start-up, and test runs.

Contract let for fourth Khalda gas plant train

Khalda Petroleum Co. (KPC) has hired Petrofac of London to design and construct a fourth gas-conditioning train at Salam on the Khalda Concession in the western desert of Egypt, said Apache Corp.

KPC is a joint venture of Apache and Egyptian General Petroleum Corp.

The fourth train, combined with a recently approved third train, will increase total conditioning capacity for production from Apache’s Jurassic gas reserves to 710 MMcfd of gas and 66,000 b/d of condensate (OGJ Online, Nov. 15, 2006).

Each train will have capacity to process 100 MMcfd of sales gas and 14,000 b/d of sales condensate. The expansions are scheduled for completion by late 2008.

This is the second train contract that KPC let to Petrofac during November, and it increases the value of the total Khalda contracts to $375 million from $200 million.

Lurgi’s technology selected for plants in China

Datang International Power Generation Co. Ltd. and Shenhua Ningxia Coal Industry Group have awarded Lurgi AG two contracts for the first two commercial-scale propylene plants based on Lurgi technology for the production of plastics from coal. The plants, expected to be the largest in the world according to Lurgi, will be built in China.

Total capital investment for both projects amounts to more than €2 billion.

Lurgi’s contracts, valued at more than €100 million, cover the technology license, engineering services, and supply of special equipment. Certain proprietary equipment and major machinery are to be supplied from Europe, but most materials will be purchased in China.

The plants, due on stream in late 2008 and early 2009, will produce about 500,000 tons/year of polypropylene from coal. They will incorporate Lurgi’s technologies for raw gas conditioning, methanol synthesis (5,000 tons/day of methanol with the Lurgi MegaMethanol process), and Methanol-to-Propylene (MTP).

The Lurgi MegaMethanol technology will provide feedstock for the company’s MTP process. MTP complexes constitute the first step to diversification into the field of coal-to-chemicals and fuels in China, Lurgi said.

Transportation - Quick TakesJapanese firms to form LPG operations alliance

Mitsui & Co., Sumitomo Corp., and Marubeni Corp., all of Japan, are reported to be negotiating to form an alliance by yearend for the joint procurement of liquid petroleum gas (LPG), operation of tankers to carry it, and eventual consolidation of their respective distribution and storage facilities.

The companies apparently view their proposed alliance as a way of strengthening their operations, as competition is increasing among Japan’s 20 or so LPG wholesalers due to shrinkage of the wholesale market and a doubling of the cost of supplies from Middle East producers.

Marubeni operates its LPG business indirectly through Marubeni Liquefied Gas Inc, while Mitsui imports and sells LPG through Mitsui Liquefied Gas Co. Sumitomo imports LPG directly and sells it through Sumisho LPG Holdings Co.

Shanghai LNG building LNG terminal in China

Shanghai LNG Co Ltd. is building an LNG terminal at Zhong Ximentang Island in China’s Zhejiang province, with plans for the facility to become operational in the first half of 2009.

The complex, which includes docking facilities, a regasification plant, and an undersea pipeline, will have an initial capacity of about 3 million tonnes/year-enough to process newly contracted supplies.

In October, Petronas subsidiary Malaysia LNG signed deals with Shanghai LNG Co. Ltd. to supply up to 3.03 million tonnes/year of LNG for 25 years (OGJ Online, Oct. 30, 2006).

Shanghai LNG Co Ltd. is a joint venture of the Shenergy Group Ltd., 55% and CNOOC Gas & Power, 45%, a wholly owned unit of China National Offshore Oil Corp.

Indonesia to choose LNG partner by yearend

Indonesia’s state-owned oil and natural gas company PT Pertamina and its partner the Medco Group are still in the process of selecting a Japanese partner for a 2 million tonnes/year liquefaction plant they plan to build in Senoro, Sulawesi, starting in 2007.

A spokesman said the two firms have yet to decide whether Mitsui Corp. or Mitsubishi Corp., both of Japan, will become the working partner for constructing the LNG facility.

“We have already been late too long, therefore, a decision has to be made by the end of this year,” said Pertamina executive Tri Siwindono, who said LNG produced at the plant would be exported to Japan.

The plant will liquefy gas from Pertamina’s wholly owned Matindock block and from the Senoro block owned equally by Pertamina and the Medco Group.