Largest Lower-48 gas plant running smoothly after 6 months

Commercial operations for both the Alliance Pipeline from British Columbia to south of Chicago and the Aux Sable natural gas processing plant occurred on Dec. 1, 2000. The pipeline came up to its fully contracted flow of 1.3 bcfd.

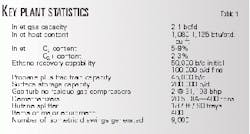

Presented here are the background and major challenges for the Aux Sable plant, which at 2.1 bcfd design capacity is the largest in the US Lower 48.

Conception

Western Canada has long suffered from a shortage of open-access transport systems to move its natural gas and NGLs to market. Alliance Pipeline Ltd. saw the need for a new system to overcome this bottleneck.

Alliance employs new technology and direct routing to compete with older depreciated but less-efficient systems. The new technology consists of two key elements, higher pressure (1,740 psig) and rich gas for dense-phase operation and more-efficient hydraulics.

Alliance can move twice the volume with much less fuel than a traditional 36-in. line. The rich-gas principle means that Alliance is essentially two pipelines in one because it transports both gas and NGL in the gas phase. A typical composition includes gas that is 6% ethane and nearly 3% propane and heavier NGL. This is processed natural gas with a heat content higher than typical, in the range of 1,100 btu/std. cu ft.

This transport benefit means that the gas must be reprocessed at the downstream end of the pipe to recover the NGL. This in turn meant that Alliance needed a new gas plant at the same time as the pipeline mega-project.

Alliance early recognized that Chicago could become a major natural gas hub and sketched its route via a straight line from Northern British Columbia to the southwest of Chicago near Joliet (Fig. 1). This meant that the extraction plant needed to be placed near the delivery end.

Sites in Iowa and three counties near Chicago were considered; the accompanying box shows factors in plant site selection. Three sites met virtually all of the 12 needs.

A site owned by Northern Illinois Gas Co., the gas utility company in the area, was selected close to Channahon, Ill., 13 miles upstream of the pipeline terminus. In the early 1970s during the last energy crisis, a large synthetic natural gas plant was built there during the time when "old gas" was regulated at very low prices in the US.

This regulated environment produced an artificial economy that allowed very expensive gas to be produced by cracking valuable NGL and then rolling it in with the "cheap old gas" to make it cost effective. When first viewed at the site, the old synthetic natural gas plant was being dismantled for scrap, and it is ironic that it is now being used for somewhat the reverse purpose of its former life.

Pipeline infrastructure

Key in siting the plant was the desire to stay close to ethane markets. Only a mile to the west is the Equistar Chemicals Ltd. petrochemical complex which typically uses more than 30,000 b/d of ethane, and 130 miles west of Morris, at Clinton, Iowa, is an Equistar plant of similar size using ethane as a prime feedstock.

Also, several NGL pipelines either terminated on the site (relating to its former life) or passed just south. Fig. 2 shows the convergence of NGL lines on the Morris, Channahon area. The site was also in an industrialized area with strong community support for a new plant.

This support, particularly from Channahon, was crucial in achieving a reasonable tax arrangement. Municipal taxation is very complex in Illinois and 11 different taxing bodies were assessing the plant site.

The Aux Sable plant and Alliance pipeline currently have the same owners. In 1996 and 1997, the owners were primarily western Canadian producers who supported the project in order to improve their market access.

As the project became more concrete, it attracted a number of pipeline companies. Gradually, the producers were bought out until at present, the ownership is Fort Chicago Energy Partners, 26.0%; Westcoast Energy Inc., 23.6%; Enbridge Inc., 21.4%; Williams Gas Pipeline, 14.6%; and El Paso Corp., 14.4%.

Schedule; project scope

The Alliance pipeline developed into a serious project by early 1997 (and was originally targeted for start-up on Dec. 31, 1999). But when it became mired in the regulatory process until summer 1998, Aux Sable had breathing space to decide what kind of plant to build.

The scope for Aux Sable was finalized by October 1998 after alternatives for extraction, processing, and storage and distribution were fully examined, more on which presently.

Final design and material procurement were released then. Start up was scheduled for October 2000.

The original study for the Alliance project envisioned a fairly simple plant, including a single, large processing train capable of 80% ethane recovery and producing a C2+ NGL stream that would be pipelined elsewhere (probably to Bushton, Kan.) for fractionation.

A parallel business analysis and a front-end engineering and cost estimating study were commenced in late 1997 with the expectation that it would last 6 months. This study opened up several alternatives that promised higher returns.

For one thing, prices for all the products tended to be higher in Chicago, particularly in the winter. This pointed the way towards adding fractionation and product treating at the plant to capture the higher values. The team also expected Alliance to be expanded 2 or 3 years after start-up; building for the expansion was therefore considered.

During this scope-development process, a committee of owners' representatives met frequently and guided the relatively small team working on Aux Sable. As might be expected, the owners tended to have different ideas about how to proceed, depending on their familiarity with the NGL business or their capital availability situation.

The exact gas analysis for processing was also uncertain. The quality of gas depended on the shippers and delivery locations. Finalizing the scope was further complicated by the fact that the Alliance pipeline was project financed and the financiers wanted to be sure that gas processing was always available. They were concerned that it might be essential to reduce the heat content to 1,050 btu/std. cu ft to make deliveries to local distribution companies.

The complexities of getting these studies done and then arriving at a consensus on what to build took nearly a year or double the 6 months originally allowed in the schedule. Ownership changed considerably during that period.

In the end, the following scope was decided on:

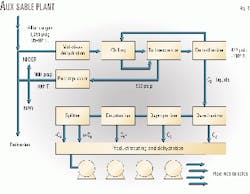

- Two turboexpander extraction trains, each capable of processing 1.05 bcfd (total of 2.1 bcfd inlet).

- Ultimate capability to recover 94% ethane and virtually 100% of C3+ using the Ortloff RSV process.

It was fairly inexpensive to add this capability into the towers. Initially, because the plant's ethane markets could not use that much volume, the amine treating needed to remove CO2 from that level of production was postponed. The Ortloff process had the added benefit of being able to separate out CO2 as long as the recovery was kept to less than 75%.

- De-ethanizing capacity for 100,000 b/d.

- Full fractionation for a C3+ content of up to 50,000 b/d.

- Full product treating to meet GPA specifications. In the case of butanes, it was clear that better than GPA specifications on sulfur content was going to be required. Normal butane specifications as low as 20 ppm were indicated for some buyers.

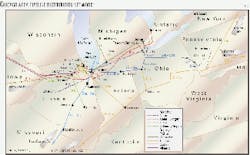

Fig. 3 presents a schematic of the plant; Table 1 presents key plant statistics.

This scope provided for a plant that could always ensure heat-content management on gas delivered. Either train operating by itself could process enough gas to ensure the gas would stay less than 1,050 btu/std. cu ft. Full fractionation and product treating would minimize liquids pipeline tariffs and keep the products, particularly propane, in the premium Chicago market.

While this scope finalization was going on, two parallel processes were being pursued.

The first was the beginning of the detailed marketing. Aux Sable needed to know exactly to whom and how it was going to sell products and how it would use the local pipeline and storage infrastructure to reach those buyers.

This is more complicated than it sounds because most NGL pipelines operate in batch mode and often reverse in different seasons. In fact, the pipeline batch-size requirements were required to indicate the relatively large amount of surface storage needed at Aux Sable; the plant needed the capability to send large enough batches to fit within the schedules.

The marketing analysis resulted in defining the basis for building a number of new interconnecting lines to access existing NGL pipelines and terminals. A key exchange deal with Texas Eastern Products Pipeline Co. was negotiated, as were the access agreements with Kinder Morgan Energy Partners LP and Buckeye Pipeline Co., to ensure that summer production of propane and butane could be cost effectively moved to the US Gulf Coast market.

The second parallel process was the decision on the motive power for the major re-compressors at the plant. A turboexpander plant cools the gas and condenses the liquids by dropping the pressure. After processing, the gas must be recompressed to pipeline pressures for redelivery. Aux Sable required 60,000 hp in two recompressors.

Because the first choice was electrical power to drive these, Aux Sable negotiated with Commonwealth Edison Co. (the major electric utility). It appeared for several months that an attractive power deal could be reached, but this was clouded by the ongoing process of electrical deregulation.

Ultimately, Commonwealth Edison could not provide the attractive power price needed. This meant that just as Aux Sable was about to award a contract for a major motor-driven compressors, the company had to reconsider. It also meant the company had to move quickly to secure gas turbine-driven units.

Fortunately, the company needed two units that were the same as the Nuovo Pignone LM 2500 units that were being used on the Alliance pipeline. Unfortunately, because a gas turbine is more complicated and more expensive to install than an electric motor, the cost went up. A side benefit, however, was that we decided to install waste-heat recovery on the turbine exhaust to provide all the heat needed for the fractionation.

Engineering

Aux Sable called for proposals on a frontend engineering design study in the fall 1997. Delta Hudson Engineering Ltd. (a division of McDermott International Inc. located in Calgary) was awarded the study in late 1997. As described previously, the business drivers increased the scope of the plan dramatically and literally dozens of cases were defined and evaluated.

Originally, Aux Sable had planned to rebid for the detailed engineering. By the time the scope was settled, however, there was no time to pursue a 2-3 month bid and evaluation process. Delta Hudson was released to perform the final design and equipment procurement in late October 1998 after owner approval of the expanded scope and budget.

It was realized that the schedule was tight, but doable at this time.

Delta proceeded with a traditional project management structure and a task force approach. Plant design was split into five main areas. Purchasing was centralized but costs were coded to the five areas. All the key pieces of major equipment were selected by January 1999.

Table 2 shows key items and the vendors.

During the detailed engineering phase, Aux Sable was forced to make three significant scope changes:

- Two additional delivery lines (30 and 36 in.) to one of the downstream receipt points were requested by Alliance. This required expansion of the main east-west pipe rack.

- The main compressor drivers were changed from electric to natural gas turbine drives.

- Facilities were added to ensure that the ethane product met very stringent specifications on contaminants that could impact on the ethane cracking process.

Another factor in the engineering was that the decision to use modular construction where large modules were built offsite and transported to the plant for erection and interconnection. There were several reasons for this:

- Chicago is a high-cost area.

- It permitted the beginning of mechanical work in the module shop, while the site was still having foundations installed.

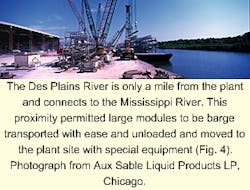

- The plant is less than a mile from the Des Plaines River, which connects to the Mississippi River. Large modules could be barge transported with ease and then unloaded and transported to the plant site with special equipment. Typical modules were up to 30 ft wide, 30 ft high, and 120 ft long and weighed up to 300 tons (Fig. 4).

null

Using modules requires additional design and schedule priorities, and there are now two separate destinations for the millions of pieces bring procured. The modules were inquired, evaluated, and awarded by Aux Sable. The successful fabricator was J. Ray McDermott SA (another division of McDermott International) which constructed the modules in Morgan City, La. Timely material receipt and conrol were keys in module completion.

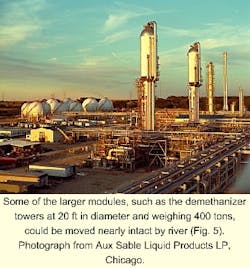

All other material procurement and equipment fabrication were coordinated and controlled by Delta largely using previously established subcontract third parties. Some of the equipment was very large because river transport was available. The demethanizers were more than 20 ft in diameter and 400 tons (Fig. 5).

Delta used Intergraph PDS 3D CADD for design of piping, civil, and electrical. This was successful for the piping where interference and errors were particularly small.

Construction management

Morrison Knudsen Corp., now part of the Washington Group International, carried out construction management. Aux Sable decided that the construction would be carried out by bidding packages in specific areas and selecting subcontractors. This was chosen over direct hire because the area was at full employment and the better union tradesmen tended to be loyal to their traditional employers.

Aux Sable also felt this would be a way to fix and control costs by a combination of lump sum and unit-rate bids. Because the piping job was felt to be too large for available subcontractors, it was split into two packages and bid separately.

Major equipment and materials were generally delivered as planned and did not affect schedule except that some prefabricated structural steel was late. Structural steel is critical because piping and electrical cannot start in an area until that is set up.

Late design drawing did affect construction in some areas. The interface between the vendor electrical drawings and the Delta electrical drawings caused problems. Delta supplied field engineering to assist Morrison Knudson to solve these problems.

In general all of the large equipment including many of the modules had to be set before other parts of the construction could begin around them. This meant that there was intense pressure to get the big pieces delivered.

As a result, some modules were shipped before they were completely finished, and finishing at the site was expensive.

The heavy lifts were able to go ahead on schedule in late 1999 and early 2000 and were completed successfully because of careful preplanning by Morrison Knudson. The subcontracting cost control did not work as well as planned because the drawings were only partially completed when bid. This meant that large amounts of work had to be done on unit rates.

Scope growth was a problem in electrical. The subcontractor had difficulty in attracting adequate electricians to the job site. Finally, Aux Sable increased the hours to 60/week and built up the electrical work force to more than 400.

Many other large electrical projects were proceeding all over the US, and limited availability of electricians in our area was a problem. In an effort to get things moving, Aux Sable transferred part of the work to a second local subcontractor who was able to provide additional tradesmen.

In spite of some problems, the civil, major equipment, and piping parts of the project were essentially finished on schedule in August. In fact, the Delta piping design fit together well because of the 3D design approach. Field changes were small. The electrical part, however, was not finished for nearly another 2 months.

The scope changes described earlier created difficulties during construction. The project used spread footings for foundations for the process areas. These were installed to 7-ft depth by means of mass excavations early in the construction process. After the foundation was poured, the forms were stripped and the area back filled and compacted. Any late arriving foundation designs meant large re-excavation to put in a new spread footing.

Quality control was an area of construction success. Altogether 14,501 butt welds (2 in. and larger) and 15,579 socket and fillet welds were completed on site. Final repair rate was only 1.5%.

There were 825 separate hydrotests of piping and equipment. More than 1,000 tests for soil bearing capacity and 3,000 compaction tests were carried out. More than 3,000 concrete cylinders were taken to ensure that the required 4,000 and 5,000-psi strength was achieved. More than 1,800 electrical loops were fully loop checked.

Commissioning; start-up

Start-up was a major undertaking. The original schedule called for the commissioning and startup process to occur in August and September, but it was delayed by electrical completion. This team completed a walk-down on all of the hydrotest packages.

In addition, the plant was split into 80 turnover packages. Constant effort went towards completing them in the order necessary for start-up. Each package was certified as complete by construction and then checked by the team before the formal sign off and handover of the system.

By the end of August, 35 of 80 systems were handed over. The last systems were not completed until mid-October. Final mechanical and electrical completion occurred shortly afterwards. The utility systems were started up first and then Alliance Pipeline gas was first brought into the plant in October.

As is almost universal, some problems developed during this phase of the project:

- Two or three hydrotest packages were improperly drained and some water got into sensitive equipment such as a turboexpander. That subsequently required disassembly and cleaning.

- A branch connection weldolet to a stainless flare header failed during a blowdown operation. This necessitated a design review and a number of similar connections were changed out.

- Chicago suffered through a record cold spell with heavy snow from the end of October until early January. Every day was bitterly cold with high winds, and soon the site was covered with more than 2 ft of snow. Some insulation was not completed when the cold weather struck, and this led to freezing problems.

- Nuisance shutdowns due to electronic card failures in some pieces of equipment and the overall plant control system caused trouble.

Meanwhile Alliance was having problems of its own that were affecting Aux Sable. In one of the last steps in completion, the pipeline was to pass a series of foam dewatering pigs through each section of the line to remove hydrotest waters and aid in the drying process. Unfortunately, these pigs are very easily abraded, and normally the line would have been given a final cleaning with a steel brush pig to remove foam, soil, and other debris.

The Alliance line has an internal epoxy lining to improve its hydraulic characteristics. Because of concern for this lining, some contractors hesitated to send through the wire brush pig. Consequently, the abraded foam lay in place while Alliance first started up at very low flow rates.

When the pipeline came up towards 50% of design flowrate, debris started to move. In fact, bushels of it piled up in strainers at Alliance compressor stations and at the inlet and bypass to Aux Sable. At the worst, the strainers at Aux Sable plugged up in only half an hour after being cleaned.

This was a serious problem because it was an 8-hr job to remove the dozens of 1.5 in. bolts and remove 30-in. spool pieces to clean the plant screens. Alliance shut down for several days while very large basket strainers were installed in four of the Alliance pig-receiving barrels to catch the foam and other debris coming from the pipeline.

It took a month of increasing flow to get the pipeline cleaned out.

Commercial operation

With this experience largely behind them, the owners declared the beginning of commercial operations for both the pipeline and the plant for Dec. 1, 2000. Alliance came up to its full flow of 1,325 MMcfd.

Aux Sable operated but continued to have problems with both freezing and nuisance shutdowns for much of December. A lot of the packaged equipment needed extensive troubleshooting before it ran smoothly, and the cold proved to be a severe test of the plant operations and maintenance crews.

To add complexity to the situation, a jurisdictional dispute arose over some construction work that was still being completed while the plant was running. The affected union set up a picket line, effectively withdrawing all union craft help at a difficult time. The rest of the people who worked through it were often putting in up to 70 hr/week. By February, plant operations settled down and have been routinely smooth.

To add to the physical challenges of the start-up, there have been economic challenges as well.

An extraction plant such as Aux Sable removes NGL from the gas and generally returns the energy by buying natural gas. Natural gas prices were rising rapidly as the plant went through commissioning and start-up in the fall. Then in December, prices rose rapidly, reaching levels as high as $14/MMbtu in Chicago. This meant it was uneconomic to extract for a good part of the first 3 months of operations.

Consequently, we were trying to extract as little as possible and still meet the 1,050 btu/std. cu ft for which the Chicago utilities were looking. During the extreme cold, they partially waived this requirement.

Since December, gas prices have come down, allowing Aux Sable to operate solidly in the black. As of June 1, the pipeline is delivering about 1.5 bcfd, and the plant is processing it all. Both trains are running and recovering about 60,000 b/d.

The various downstream systems are carrying it to the most economic markets.

The cost of the Aux Sable plant and associated downstream facilities ended up being slightly over budget and commenced commercial operations on Dec. 1, 2000, aligned with the Alliance Pipeline in-service date. Over the next 90 days, the plant and associated operations were effectively lined out, in spite of the record cold December weather in Chicago, and are now operating smoothly.

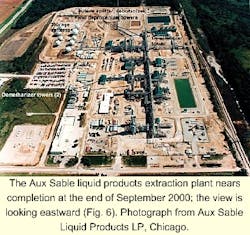

The plant has demonstrated that it is capable of processing more than 1 bcfd in each train; Fig. 6 presents an overview of the current plant layout.

As supply in Western Canada responds to higher prices, the Alliance Pipeline will be expanded to reach a processing level of more than 2 bcfd. Aux Sable will be able to handle that easily.

In fact, the site is capable of significant low-cost expansion for even larger gas streams such as might come from an Arctic pipeline moving gas to Chicago.

The authors

W. Norval Horner is vice-president in charge of gas and NGL supply for Aux Sable Canada Ltd. He was formerly manager of facility engineering for Alliance Pipeline Ltd. with responsibility for both Alliance Pipeline and the Aux Sable plant. He is a professional engineer in BC, Alberta, and Saskatchewan. He has a bachelors degree in chemical engineering from the University of Saskatchewan and a MEng from the University of Calgary.

W.J. McAdam is president and chief executive officer of Aux Sable Liquid Products LP, Chicago. He spent 20 years with Imperial Oil Ltd. with assignments in refining, engineering, petrochemicals, fertilizer, planning, and NGL. He also served as president of MAPCO Canada Energy Inc., managing director of Centurion Gas Liquids Inc., and president of Optimal Energy Inc.McAdam holds an undergraduate degree (1974) in chemical engineering from Queens University, Kingston, Ont., and a masters (1980) from McMaster University, Hamilton, Ont.

Don Berkeley is vice-president for operations for Aux Sable Liquid Products LP, Chicago. He was formerly manager of NGL facilities for Alliance Pipeline Ltd. with responsibility for the design, construction, and start-up of the Aux Sable plant and associated NGL pipelines. He is a professional engineer in BC. Berkeley has a bachelors degree in chemical engineering from the University of British Columbia.