OGJ Newsletter

Market Movement

OPEC maintains current oil production

As expected, OPEC decided July 3 to keep oil production at the current level of 24.2 million b/d.

Delegates of the 10 OPEC nations-Iraq is excluded from quota decisions-agreed to maintain production during an informal meeting in Vienna that preceded their formal meeting at OPEC headquarters.

Sec. Gen. Alí Rodríguez Araque said the group's decision took into consideration the possibility that Iraq might resume exports in the near future.

The OPEC meeting was delayed while the United Nations Security Council members discussed an extension of sanctions. Under the oil-for-aid program begun in December 1996, the UN earmarks about 60% of Iraq's oil export revenues for humanitarian goods, such as food and medicine. The UN Security Council July 2 deferred action on a UK-US joint proposal to impose "smart sanctions" against Iraq.

The delay presumably opens the door for resumed Iraqi oil exports of 2 million b/d. A month ago, Iraq halted all oil exports to protest the Security Council's consideration of a revised oil-for-aid program rather than a complete repeal.

The UK and US withdrew their smart sanctions proposal rather than risk a threatened Russian veto in the Security Council. The plan would have allowed Iraq to import more civilian goods while tightening controls on smuggled oil and banned weapons.

The existing oil-for-aid program, which requires the proceeds from oil export sales to be used for the humanitarian goods and oil field repairs, will be extended for 5 months.

China and France, the other two permanent members of the Security Council with veto powers, had agreed to the revised sanctions. Iraq opposed them and wanted all restrictions removed.

The Russian government argued the UN should adopt a broader, temporary sanctions program that Iraq could support and that would be a preparation for the eventual lifting of all sanctions.

Acting US Ambassador James Cunningham said the administration of President George W. Bush will intensify talks with the Russians in coming months regarding the smart sanctions proposal.

US Secretary of State Colin Powell had pushed for smart sanctions in order to focus the primary goal of the economic restrictions, which was to deny Iraq imported military hardware rather than punish its civilian population.

OPEC delegates said that if a resumption of Iraqi exports does trigger world oil prices to drop outside the group's $22-28/bbl target, then OPEC will hold a special meeting to consider reducing production quotas. OPEC's next regular meeting is planned for Sept. 26-27.

Iranian oil minister Bijan Namdar Zanganeh was reported by the Iranian news agency as saying that global demand this year would likely be lower than originally anticipated, due to the slowdown of both the US and European economies.

Financial analyst UBS Warburg stated that, with the withdrawal of the smart sanctions proposals, Iraq is "likely to restore oil exports almost immediately." The analyst said, "ellipseWe see oil prices remaining weak in the near term until seasonality becomes OPEC's friend in [the second half of this year]."

In addition, the analyst said that if oil prices continued to soften, an interim quota cut of at least 500,000 b/d could be announced by the organization as soon as later this month or in August.

In the meantime, Heather Rowland, UBS Warburg global oil economist, forecast that OPEC would be "committed to protecting the bottom of its price bandellipseIt will rely on its automatic mechanism for this," but would not necessarily "require 10 consecutive working days below $22/bbl OPEC basket to move," she said.

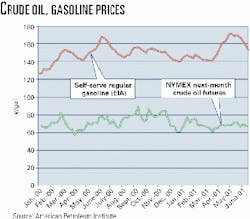

Gasoline prices falling

API reported that US gasoline prices dropped to nearly 20¢/gal below May's high.

Gasoline prices continued to fall during the week of June 22, dropping by more than 6¢/gal to a nationwide average of $1.538/gal, including taxes, API said. Noting that gasoline prices track crude prices, API reported on June 27 that the US "has imported more than 60% of its petroleum needs" this year. Gasoline inventories were up 3.7 million bbl during the week ended June 22, having risen more than 30 million bbl since early April. The June 22 gasoline inventories were 9% above the level for the same period last year.

Meanwhile, gasoline production has run at record levels for this time of the year for 11 consecutive weeks, as refiners worked to maximize output for the summer driving season.

"Earlier in the year, low inventories, coupled with higher demand and lower output on a year-over-year basis, contributed to gasoline price volatility. Since then, the situation has reversed, leading to the moderation in prices seen over the last several weeks," API said.

Gas injections expected to weaken

Industry analysts have predicted that the high pace of natural gas injections will further weaken gas prices in the coming weeks. Industry recorded its fourth consecutive-and eighth out of the last nine-100 bcf-plus storage injection. According to AGA, 108 bcf of natural gas was injected during the week ended June 22.With this latest injection, the year-over-year storage surplus has grown to 150 bcf.

UBS Warburg Analyst Ronald Barone wrote in a research note, "With the exception of the Northeast [and] Mid-Atlantic regions, moderate demand throughout several key cooling regions, combined with a further widening in contract spreadsellipseshould result in a further expansion in the surplus."

His calculations "suggest a going-forward weekly injection requirement of 69 bcf [or 9.8 bcfd] to reach 3 tcf by Nov. 1. This compares with last year's average actual refill rate of 63 bcf/week [9.0 bcfd] and the prior 6-year average of 64 bcf/week [9.2 bcfd]."

Barone said gas futures contracts continue to be pummeled by the string of strong injections, while spot market gas prices also are declining.

"Given overall fundamentals [including absent demand], we expect further weakness ahead," he said.

Meanwhile, Salomon Smith Barney analyst Robert Morris wrote in a research note, "We believe that natural gas prices are likely to lack any sustained momentum leading up to next winter."

null

null

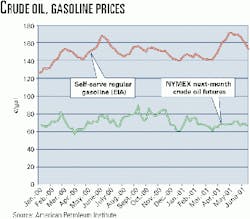

Industry Scoreboard

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

Industry Trends

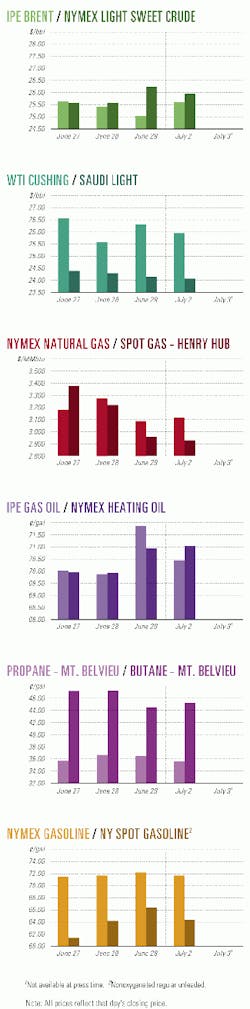

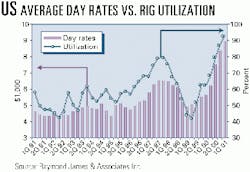

DESPITE THE RECENT SLUMP IN NATURAL GAS PRICES, CURRENT PRICE LEVELS STILL SUPPORT SUBSTANTIALLY HIGHER LAND DAY RATES, according to Raymond James & Associates.

In a recent research note, analyst Marshall Adkins said investors are concerned that dipping gas prices will mean reduced day rates for land rig companies. But Adkins foresees climbing day rates.

"Even at gas prices in the low $3[/Mcf] range, returns for [exploration and production] companies more than justify a land rig newbuild cycle. Accordingly, we believe the land rig day rate growth story remains very much intactellipse(see chart).

"According to the most recent data from Land Rig Newsletter, average US land rig day rates are now nearly 40% higher than their quarterly average peak in 1997 and headed higher.

"More importantly, leading-edge day rates are now nearly double the first quarter averageellipseand edging closer to replacement cost levels."

FALTERING GAS DEMAND WOULD SLASH US PRODUCTERS' CASH FLOW BY 20% DURING THE NEXT YEAR, Simmons & Co. said, triggering cancellations of North American drilling projects. And this trend consequently would cut drilling contractors' earnings. Simmons lowered its gas price projection to $3.50/Mcf from $4/Mcf.

Simmons Senior Analyst Dan Pickering predicted earnings reductions of 10-15% among major international service companies and earning reductions of 50% for some North American offshore and land drilling contractors: "That might sound like a big number, but there's a ton of operational leverage in those businesses," he said in a recent conference call.

He cautioned, "This is an air pocket, not a meltdown of the energy sector. We've got a North American gas issue, not an overall energy issue." Simmons expects a rebound of the traditional large industrial markets for gas-namely the manufacturers of fertilizers, chemicals, and metals. But meanwhile, rapid replenishment of gas inventories has softened prices. He predicted $3-3.50/Mcf price levels for up to the next 6 quarters.

US DRILLING ACTIVITY has DIPPED SLIGHTLY BOTH ONSHORE AND OFFSHORE, WITH FEWER RIGS DRILLING FOR GAS.

Baker Hughes reported 1,275 rotary rigs working in the US as of June 29. That's 2 fewer than the previous week but up from 920 during the same period last year. The number of rigs drilling for gas dipped slightly to 1,056. The number drilling for oil increased slightly to 217, leaving 2 rigs unclassified. In the Gulf of Mexico, ODS-Petrodata Group reported 185 mobile offshore rigs under contract out of a fleet of 212, for a utilization rate of 87.3%.

Government Developments

THE BUSH ADMINISTRATION HAS CUT BY 75% THE ACREAGE TO BE OFFERED IN EASTERN GULF OF MEXICO LEASE SALE 181, in a response to concerns by Florida officials.

Early last week, US Sec. of the Interior Gale Norton said, "We have listened and worked carefully with officials and affected citizens around the 181 lease area. The outcome is a balanced and common-sense proposal."

The modified 181 area was reduced to 1.5 million acres from 5.9 million acres. In addition, the acreage is at least 100 miles from any portion of the Florida coast.

Norton said that future oil production developed as a result of the sale would help the US reduce its dependence on foreign oil. "The proposal also works to meet the president's commitment to develop our nation's energy needs in an environmentally safe way," Norton added.

MMS projections estimate the adjusted area contains 1.25 tcf of natural gas and 185 million bbl of oil.

Industry officials, however, maintained that the lease properties dropped from consideration could contain up to 90% of the area's total production potential.

"We are very disappointed in this decision," said Tom Fry of the National Ocean Industries Association. "It comes at a time when we need new supplies, and this is one of the few areas in the Lower 48 where we can drill without a moratorium in place."

PAKISTAN IS LOOKING FOR INTERNATIONAL INVESTORS TO INCREASE DRILLING ACTIVITY IN AN EFFORT TO DOUBLE ITS OIL AND NATURAL GAS PRODUCTION BY 2012, government officials said late last month in Houston.

The country needs $3-4 billion of new investment to jump-start its ambitious energy program, and the government is offering incentives by liberalizing its policies and privatizing state-owned operations, officials said.

The goal is to increase Pakistan's oil production to 100,000 b/d over the next 11 years from 56,000 b/d currently and its gas production to 5 bcfd from 2.4 bcfd.

To accomplish that, Pakistani officials want a quantum leap in exploration drilling to at least 100 new wells/year, up from 15 wells/year at present.

Moreover, Pakistan needs 6 million tonnes/year of added refinery capacity to eliminate expensive imports of fuel oil, officials said.

In addition, the country needs to add oil pipelines and to further de- velop a natural gas pipeline infrastructure, officials said.

Pakistan's total proven remaining reserves were estimated at 25.9 tcf of gas and 298 million bbl of oil.

Quick Takes

STATOIL SAID IT MADE A SMALL OIL DISCOVERY IN THE DANISH NORTH SEA IN RECORD TIME.

The Stine Segment II discovery was drilled in 60 m of water 7 km east of Siri field, which Statoil operates on the Danish continental shelf. The Noble George Sauvageau jack up drilled the well in less than 10 days. The well was drilled almost vertically to 2,091 m below sea level, where oil was found in the Paleocene sand.

Statoil's Geir Tungesvik, who was in charge of the drilling operation, said the wildcat sought to find more oil to produce through the Siri platform, which "has a production capacity of 50,000 b/d but currently produces about 30,000 b/d."

The rig was been moved to a site near the Siri platform, where it will drill a 7,200-m horizontal well to develop the Stine Segment discovery. First oil is expected in September.

In other exploration ventures, Malaysian state oil firm Petronas awarded Block SB 303 off Sabah to a Sabah Shell Petroleum-led consortium. Other operators have explored parts of SB 303, and 15 wells have been drilled in the area. Tiga Papan oil field and Titik Terang gas field are on the block. The partners will spend at least 28 million ringgit, or about $7.4 million, to drill two wildcats, acquire and process seismic data, reprocess old seismic data, and perform an integrated subsurface study of Tiga Papan. Sabah Shell, with 50% interest, will operate SB 303; Shell Sabah Selatan will own 10%; and Petronas Carigali will own 40%.

A well on Cairn Energy's Block KG-DWN-98/2 off Andhra Pradesh, India, flowed 80 MMscfd through a 1-in. choke from two zones at a combined stabilized rate, constrained by equipment limitations. DWN-R-1, which is 26.5 km southwest of the N-1 discovery, was drilled to 2,330 m TD and found several gas pay zones below 1,870 m. The company estimated the well found 750-1,000 MMcf of dry gas. A second well, to be drilled later this year, will appraise the discovery. The rig will be moved to prospect P, 12.5 km northwest of DWN-R-1. Cairn is assessing the R-1 find's commerciality. Cairn owns 100% equity interest in the block; Indian state oil company ONGC has no back-in right.

THE PROPOSED CONSTRUCTION OF AN LNG TERMINAL ON MEXICO'S EAST COAST WILL TARGET THAT COUNTRY'S GROUWING AS DEMAND.

Shell Gas & Power, owned by Royal Dutch/Shell, and El Paso Corp. unit El Paso Global LNG will jointly develop a $300 million LNG regasification terminal at Altamira, Tamaulipas state.

The partners have proposed the terminal to target escalating gas demand in northeastern Mexico, largely driven by growing electric power demand. Economists say Latin America's No. 2 economy could face blackouts by 2004 without expanded generating and transmission capacity. Mexico has opened its largely state-run power sector to some private investment, but officials advocate additional liberalization to attract more private investment.

Mexican President Vicente Fox is expected to submit an electricity reform bill in September. The government hopes private investors will finance half of the $50 billion power infrastructure investment that Mexico estimates it needs within 10 years.

Shell and El Paso did not reveal initial capacity of the terminal, but said it would be expandable to 1.3 bcfd. The 50-50 joint venture acquired land rights at the Altamira port and has begun design studies.

The terminal tentatively is slated to accept LNG imports in 2004. The project will market gas directly to Pemex, industrial users, and power producers.

In other gas processing news, GTL Bolivia signed a memorandum of understanding with Rentech to use its proprietary gas-to-liquids technology. After execution of a licensing agreement, GTLB will design a 10,000 b/d GTL plant to be built in Bolivia. Rentech said the final license agreement could grant GTLB the right to operate an additional 50,000 b/d. F Saudi Aramco awarded Technip a turnkey contract for installation of a 100 MMscfd natural gas compression train and associated facilities at the Abqaiq gas plant. The train will be an addition to an existing train, also built by Technip during Shaybah oil field development, and completed in 1999. Other facilities will include a heat recovery system for both trains, a primary flare fed by new flare lines running through the Abqaiq facilities to the existing flare lines, and an expanded control system. Technip plans to start work this month, with completion targeted for mid-2003.

A US-AUSSIE ALLIANCE IS PROCEEDING WITH A $250 MILLION (AUS.) NATURAL GAS PIPELINE PROJECT IN SOUTH AUSTRAILIA.

Subject to licensing agreements, Duke Energy International and Australian gas transmission company GPU GasNet plan to construct the 670-km Southern Gas Pipeline project, which will extend from Port Campbell through western Victoria to Adelaide, South Australia.

The companies are preparing a draft environmental impact statement and a request for a pipeline survey license. If approved, construction on the line could begin in 2003, with completion in 2004.

The proposed line would interconnect with GPU's system to transport contract gas into Melbourne from the Otway basin and Moomba. Gas for the line might come from BHP Petroleum's yet-to-be-developed Minerva field off western Victoria and from nearby Otway basin fields (OGJ Online, Jan. 30, 2001).

In other pipeline development news, Enbridge Pipelines and Lakehead Pipe Line Partners plan to proceed with the proposed $450 million (Can.) third phase of the Terrace oil pipeline expansion project. Terrace Phase III will add 140,000 b/d of capacity to the pipeline system and will complete an expansion announced in 1997. Enbridge owns a Canadian pipeline system that connects with Lakehead at the US border near Neche, ND. Enbridge will install additional pumping stations and other modifications. Lakehead will build 120 miles of 36-in. line on its system between Clearbrook, Minn., and Superior, Wis. Lakehead applied for US regulatory approval, and Enbridge will apply for Canadian approval by fourth quarter 2001. Construction could begin in the US as early as January 2002, and the project could be placed in service in 2003. x Harken Energy bought a 45-km crude oil pipeline to transport growing production from Palo Blanco field in the Llanos basin of Colombia. The pipeline extends from Palo Blanco field across the Cusiana River to a station at Santiago. Consequently, Harken negotiated a transportation agreement with the owner-operator of a pipeline that transports oil from the Santiago station to the north as well as to other export points. The contract increases transportation capacity from Harken's Palo Blanco field to nearly 3,000 b/d. With its recently drilled Estero No. 2 well, the company has the production potential to utilize that capacity. The field's production previously was restricted by contractual pipeline capacity restraints to about 1,000 b/d.

CALIFORNIA'S PUBLIC UTILITY COMMISSION VOTED TO EXEMPT REFINERIES FROM ROLLING BLACKOUTS THIS SUMMER.

The commission voted 5-0 late last month to enact its earlier draft decision (OGJ, June 25, 2001, Newsletter, p. 7). The draft was proposed after several of California's 12 refineries petitioned for waivers. An April commission rule failed to give refiners automatic exemptions from blackouts. Meanwhile, Gov. Gray Davis also urged the PUC to ensure power for refiners.

"California's refineries are net producers of much-needed electricity. Shutting down these facilities during rotating outages contributed to an even tighter electrical supply that should be avoided," Davis wrote in a letter to the PUC.

Meanwhile, Valero Energy still expects its proposed acquisition of competitor Ultramar Diamond Shamrock to close on schedule even though the FTC has requested additional information. The deal is expected to be finalized in the fourth quarter, and the combined company would have 13 refineries and 23,000 employees in the US and Canada. Valero would become one of the largest US retailers. Both companies are based in San Antonio. (OGJ Online May 7, 2001).

US PRESIDENT GEORGE W. BUSH'S RESOLVE TO APPLY THE IRAN-LIBYA SANCTIONS ACT, NOW UP FOR RENEWAL, IS BEING TESTED.

Italy's ENI and Naftiran Intertrade signed a $1 billion buyback contract with National Iranian Oil Corp. to develop Iran's Darquain field. ILSA provides for punishment of non-US companies that invest more than $20 million/year in Iran or Libya.

ENI and Naftiran plan to invest $550 million in the project over 65 months. ENI will operate the development phase, with 60% interest, and NIOC the production phase, with 40%.

ENI already owns holdings in South Pars gas field and in Doroud and Balal oil fields. ENI CEO Vittorio Mincato said this is the first onshore oil project awarded to a non-Iranian company under Iran's buyback scheme.

In other development news, Esso E&P Norway submitted to government authorities its development and operational plan for Sigyn field in the Norwegian North Sea. Field partner Statoil said the plan for the gas-condensate field on Block 16/7 involves a subsea template tied back to Statoil's Sleipner East field. Statoil owns 50% interest in Sigyn, while Esso E&P Norway parent ExxonMobil holds 40% and Norsk Hydro, 10%. Statoil said it will play "a leading role" on the 2 billion kroner development, encompassing the Sigyn West and East reservoirs. Offshore development work is slated for summer and autumn next year.

BG GROUP AND ITS PARTNERS HAVE BROUGHT BLAKE OIL FIELD IN THE OUTER MORAY FIRTH ON STREAM, 18 months after project sanction.

The project, 64 miles from Aberdeen on Blocks 13/24 and 13/29b in the northern North Sea, was brought on stream 2 months ahead of target and 10% below budget. It cost £145 million to develop.

BG attributed the better-than-expected results to close collaboration with the field's contractors and partners. BG estimates gross field reserves at 70 million bbl.

Blake is producing 40,000 b/d, which will increase to 60,000 b/d later this year. Oil is produced through the Bleo Holm floating production, storage, and off-loading vessel at Talisman Energy UK's nearby Ross field.

BG operates Blake, with 44% interest; Talisman owns 53.6%, and Paladin Resources owns 2.4%.

The companies plan to drill more wells later this year to appraise a possible field extension.

Topping production news in Canada, increased drilling activity curbed Alberta's oil production decline from 11% in 1999 to 2% in 2000. That word came late last month from the Alberta Energy and Utilities Board. The AEUB predicted operators would drill 2,700 successful oil wells this year and next, leveling to about 2,500/year until 2010. In its annual report, AEUB said higher prices created momentum in oil well drilling activity. Production of conventional crude was 274 million bbl, and the number of successful oil wells increased to 2,700 last year from 1,630 in 1999. AEUB said 206 million bbl of reserves were added in 2000, bringing the total to 1.8 billion bbl, a 3.4% drop from 1999 but a smaller decline than the previous year.

Calgary firms Genoil and Synenco Energy signed an agreement to pilot-test Genoil's heavy oil upgrading technology. Synenco has bitumen reserves of about 2 billion bbl at its Athabasca oil sands lease and coal reserves of more than 100 million tonnes on a neighboring lease. Synenco is planning a world-class heavy oil upgrading facility with a minimum capacity of 75,000 b/d. Genoil has retrofitted its pilot upgrader and moved it to Kerrobert, Sask. Demonstration of the technology at Kerrobert could lead to a commercial demonstration plant in 2002.