Ethylene capacity growth flat in 1999; large increase expected in 2000

Global ethylene production capacity increased by only 1.9% in the past year, reflecting the smallest annual increase in capacity in the past decade since 1996.

Despite this dismal growth, the industry is poised for a huge increase in construction activity in 2000.

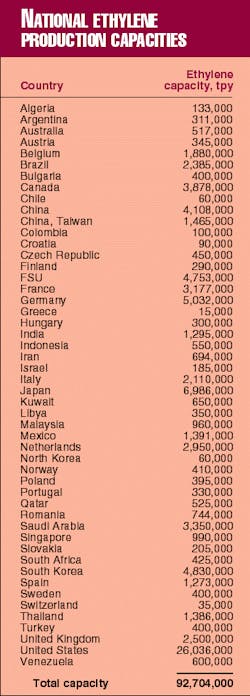

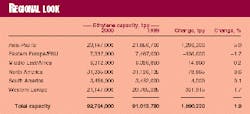

OGJ's annual worldwide ethylene survey, which begins on p. 61, shows that ethylene capacity as of Jan. 1, 2000, was 92.7 million tonnes/year (tpy). Most of this increase resulted from increases in capacity in Asia-Pacific, Western Europe, and North America. Three new grassroots plants were built in the past year, all in the Asia-Pacific region.

Low capacity growth and high demand has somewhat mitigated the oversupply situation in the ethylene industry. US Gulf Coast ethylene prices increased by 58%, from 19¢/lb to 30¢/lb, between December 1998 and December 1999.

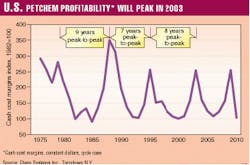

Having experienced a slump since ethylene margins dived in 1995, US petrochemical profits are headed upwards and will peak in 2003, according to Marshall Frank, a managing principal at Chem Systems Inc., Tarrytown, NY. Likely, he said at Chem Systems' annual US seminar in Houston, Asia and Western Europe will experience the same spike in profits in 2003 as the US.

Capacity changes

In the past year, there were only two significant capacity additions.

Rayong Olefins Co. Ltd. had the most significant project in size. It brought its new 600,000 tpy grassroots naphtha cracker on stream in February 1999 (OGJ, Mar. 29, 1999, p. 54). Titan Petrochemicals Sdn. Bhd. commissioned a new 330,000-tpy ethylene unit in Pasir Gudang, Johor, Malaysia, in October 1999.

Sinopec completed the only other new plant before Jan. 1, 2000. Its new Daqing naphtha cracker can produce 60,000 tpy of ethylene.

Several projects were recently completed after Jan. 1, 2000, which did not allow them to be part of the survey:

- India Petrochemicals Corp. Ltd. commissioned its Gandhar, Gujarat, India, 300,000-tpy ethylene plant in February.

- Borealis AB completed its Stenungsund, Sweden, 150,000-tpy cracker in February 2000 (Fig. 1).

- Haldia Petrochemicals Ltd. reported that its 420,000-tpy ethylene plant would come online at the end of February.

- Copesul started up its Triunfo, Rio Grande do Sul, Brazil, 450,000-tpy ethylene plant in March 2000.

The largest nongrassroots plant expansion occurred in Wesseling, Germany. Elenac, a 50-50 joint venture between BASF AG and Deutsche Shell AG, increased the capacity of one of its ethylene units from 560,000 tpy to 700,000 tpy.

Table 1 shows total world ethylene capacity, broken out by country. Table 2 shows regional changes in capacity in the past year.

The Asia-Pacific region shows the largest absolute change in capacity, 1.3 million tpy. This value derives from corrections to ethylene capacities in China and the three grassroots plants that started up this year.

Western Europe had the largest number of expansions in the past year. Most of these occurred in Germany. Besides Elenac, Veba Oel reported an increase of 74,000 tpy in ethylene production capacity at its Gelsenkirchen plant, and EC Erdoelchemie GmbH reported a 30,000-tpy increase in its Dormagen plant.

In contrast to the almost small change in ethylene capacity in the past year, a plethora of new units is expected to come online in 2000. Table 3 lists the new ethylene plants that are scheduled for the next 4 years, according to OGJ's most recent biannual survey (OGJ, Oct. 11, 1999, p. 82).

Although it is unlikely all of these will be completed in 2000, should they all come on stream, an additional 9 million tpy will enter the market.

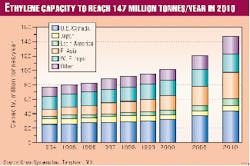

Bruce H. Pickover, a principal at Chem Systems, estimates that ethylene capacity will reach 147 million tpy by 2010. Fig. 2 breaks out the contributions to this capacity up to 2010.

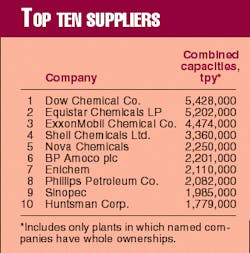

Table 4 ranks ethylene suppliers, counting only those plants in which suppliers have whole ownership. Even with the Exxon-Mobil merger, ExxonMobil retains Exxon's third place on this list. The company has 4.5 million tpy of capacity. In the first two spots, Dow Chemical and Equistar Chemicals LP 5.4 million tpy and 5.2 million tpy of ethylene production capacity, respectively.

Petchem profitability

According to Frank, profitability based on cash cost margins for the US petrochemical industry will begin to improve in 2001 and peak in 2003. The past two peak-to-peak cycles for the industry were 7 and 9 years, and he estimates an 8-year current cycle, which began in 1995.

Observing the cycles in Fig. 3, peak levels for 1995 and beyond are noticeably shorter than that for 1988. This drop reflects the tremendous increase in capacity between 1989 and 1995, about 27 million tpy of new capacity, according to OGJ surveys.

In June 1989, world ethylene production capacity was 52 million tpy (OGJ, Sept. 4, 1989, p. 53). At the end of 1995, production capacity stood at 79.3 million tpy (OGJ, May 13, 1996, p. 49).

Almost 100% capacity utilization for ethylene plants upped US petrochemical profitability in the fourth quarter of 1999. Supply is tighter than usual as a result of increased demand and scheduled and unscheduled outages in 1999.

As a result of a small fire in April, Equistar shut down ethylene production at one of its units for more than 1 month. About the same time, Union Carbide had unplanned ethylene outages at complexes in Taft, La., and Texas City, Tex. Dow Chemical shut down its 580,000-tpy plant in Freeport, Tex., for several days as a result of mechanical problems in June.

Ethylene supply in the rest of the world also mirrored the tightness of US supply.

In October 1999, Nova Chemicals Corp. shut down its Corunna, Ont., plant, for 3 weeks for compressor repairs. The plant has an ethylene capacity of 725,000 tpy. Israel's Carmel Olefins Ltd. plant halted production for several months during a planned turnaround that lasted longer than usual, beginning in April 1999.

Asia was also hit with a series of outages. Plants in Malaysia, Indonesia, Thailand, and South Korea temporarily stopped production near the middle of the year for maintenance work.

According to Frank, increased demand in East Asia caused Western European profits to increase significantly, even more so than the US, in the fourth quarter.

Although mechanical problems and increased demand helped raise margins and prices in the recent past, raw material prices will likely decrease later in the year as new construction adds to ethylene and propylene production capacity in 2000.

There are six major challenges that affect world petrochemical industry, said Frank:

- Cyclicality of profits.

- Instability of feedstock costs.

- Mergers and acquisitions.

- Environmental regulations.

- Impact on petrochemical imports caused by China's entry into the World Trade Organization.

- Growth of e-business.

World demand

Frank used ethylene demand as a barometer for the petrochemical industry. Growth for ethylene demand for various regions is all positive between 2000 and 2005. The average global annual growth rate for this 5-year period is 4.6%.

The Middle East will have the highest rate of annual ethylene demand, about 10.1%/year, followed by East Asia, whose ethylene demand will grow about 7.5%/year.

The US, Europe, and Japan will have lower-than-average rates of demand growth.

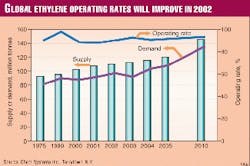

Chem Systems estimated that global ethylene demand for the next 10-year period is about the same as the 2000-2005 period, 4.5%/year. Thus, world ethylene demand will reach 136 million tons by 2010. Demand is about 88 million tons today.

Fig. 4 shows global ethylene supply and demand. Operating rates are expected to peak in 2003.

The driving force for ethylene consumption, said Pickover, is polyethylene production. Polyethylene production accounts for a majority of ethylene end uses-61%.

Asia

According to a presentation on Asia by Pickover, Asia rebounded from its 1997 financial crisis in 1999. Malaysia, the Philippines, South Korea, Thailand, and Singapore all had at least 3% gross domestic product (GDP) growth in 1999. On the other hand, prolonged violence in Indonesia prevents it from achieving GDP growth.

In spite of a recent tight market for ethylene in the general world, Japan holds steadfast to its decision to rationalize capacity to cut costs and increase operating rates. Mitsubishi Chemical Corp. announced plans in February 1999 to cease production at its smallest ethylene plant in Japan, a 270,000-tpy plant in Yokkaichi, by the end of 2000.

On the tail of Mitsubishi's announcement, Show Denko KK (SDK) announced in April 1999 that it will permanently shut down the smaller of two ethylene units at its Oita, Japan, petrochemical plant. By shutting down plant No. 1 and increasing the production capacity of plant No. 2 from 524,000 tpy to 600,000 tpy, SDK expects to be able to continuously operate its ethylene plant at full capacity and achieve a cost reduction of around 3 billion yen/year. This savings will be a result of improvement in energy and lower fixed costs.

In South Korea, Hanwha Chemical Co. and Daelim Industrial finalized the mergers of their Yeochun naphtha crackers in December 1999. The new company, called Yeochun Petrochemicals, will have a capacity of 1.2 million tpy of ethylene, the largest for any one private company in Asia.

In contrast to Hanwha's and Daelim's joint venture, after more than a year of negotiations, South Korean companies Hyundai Petrochemical and Samsung General Chemical called off their pending merger in February. The withdrawal of Mitsui & Co.'s stake in the joint venture apparently led to the collapse of discussions as Mitsui was needed as a source of capital to reduce combined debt (OGJ, Oct. 11, 1999, p. 25).

US industry

The US has the largest ethylene capacity in the world. Since last year, mergers and acquisitions have changed the names of several players.

The combined assets of Exxon Chemicals Co. and Mobil Chemicals gave ExxonMobil a combined ethylene production capacity of 3.9 million tpy in the US. Comparing it with other US ethylene suppliers, it is second on the list behind Equistar, which has 5.2 million tpy of ethylene capacity, all in the US.

The next large merger, that for Dow Chemical and Union Carbide Corp., is undergoing regulatory reviews by both the Federal Trade Commission and the European Commission. The companies expect conclusion of the reviews by the end of the second quarter. This merger will give the new Dow Chemical 16% of US ethylene capacity, or 4.1 million tpy, moving it ahead of ExxonMobil in the US.