OGJ Newsletter

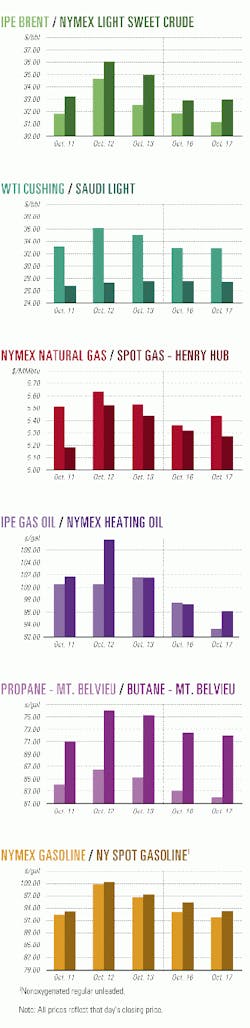

Market Movement

Crude demand trailing supply

As North America, Europe, and Asia head into winter, low crude and product stocks have the market on edge, according to the International Energy Agency.

The market remains nervous despite the fact that the forward price curve has flattened considerably, supply has increased, stocks have started to build, and refining margins have improved.

In its most recent Oil Market Report (OMR), IEA estimates that world oil production averaged 77.43 million b/d in September, up 380,000 b/d from August, primarily due to an increase in Organization of Petroleum Exporting Countries' production.

IEA estimates that worldwide demand for crude in the third quarter of this year trailed supply by 1.6 million b/d. As the futures market has recently moved into mild backwardation, crude stocks are beginning to build, but there is disagreement over the degree to which inventories are growing.

The consensus earlier this month at the meeting of the Houston chapter of the International Association for Energy Economics was that IEA is overstating worldwide supply by a substantial margin and that as long as the market remains in backwardation, any building of crude inventories would be minimal. A second quarter stockbuild of 2.4 million b/d, as reported in the OMR, was deemed unlikely given market fundamentals.

Low heating oil stocks

IEA reports that August crude stocks dipped in Organization for Economic Cooperation and Development European countries and OECD Pacific countries due to a surge in refinery runs, but increased slightly in OECD North America as imports increased, the peak driving season ended, and scheduled refinery maintenance resumed.

There is currently no shortage of crude, but the problem of low product inventories prompts the question of whether the upcoming winter heating season will be mild or unseasonably cold. Will there be enough product available to meet demand when refineries are already running near capacity and stocks are starting the season at unusually low levels?

An increase in refinery throughputs during the third quarter has suppressed crude injections into storage at a time of the year when inventories usually grow. Refinery throughputs in OECD countries increased 1.2% in August to 39.6 million b/d. Despite high levels of refinery utilization, total product stocks for all OECD countries were up only 200,000 b/d in August because of higher demand. IEA estimates September OECD throughputs at 38.8 million b/d.

According to the OMR, total industry stocks in OECD countries fell 400,000 b/d in August on the 500,000 b/d increase in OECD refinery throughputs and a 1-2 million b/d increase in global product demand. Stocks of distillate continue to be a major source of concern, according to the report: "Primary heating oil stocks in key consuming regions are extremely low, and stocks in general need to be replenished before arrival of winter if the Atlantic Basin is to avoid regional supply imbalances. Driven by supply and deliverability concerns, record high natural gas and electricity prices are exacerbating this heating oil situation as they encourage fuel substitution into oil."

Assuming normally cold winter weather, IEA expects worldwide demand for crude oil to increase nearly 3 million b/d in the fourth quarter, with almost half of that increase occurring in Asia, 1 million b/d in Europe, and 400,000 b/d in North America.

null

null

null

Industry Trends

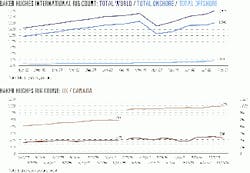

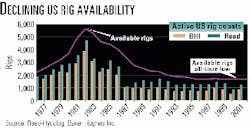

AVAILABILITY OF THE US DRILLING RIG FLEET HAS REACHED AN ALL-TIME LOW.

While citing the annual Reed-Hycalog rig census, financial analyst Raymond James & Associates said that the US drilling rig fleet-despite making marked net gains through mid-1998-encountered 18 months of depressed activity levels, causing rig numbers to plummet.

Raymond James points out that this year the census showed rig fleet availability declining by a net 8 rigs, bringing the total to 1,636-the lowest fleet size recorded in the history of the census (see chart).

"On a Baker Hughes rig count equivalent, we estimate that the maximum sustainable number of rigs today would be in the range of 1,050 in the US. By the end of 2001, this should increase to near 1,150 total available 'Baker' rigs," said Raymond James.

It is important to note that the Baker Hughes rig count only tracks active rigs whereas Reed's rig count surveys the total number of active and inactive rigs available, but only during a 45-day period in the summer.

NEW FUEL REGULATIONS CONTINUE TO WEIGH HEAVILY ON REFINERS.

Jerry Thompson, senior vice-president, refining, for Citgo Petroleum and chairman of NPRA, set the stage for NPRA's annual Q&A meeting, held last week in San Francisco, by warning the industry of the impact of future gasoline and diesel regulations.

In the first decade of the new millennium, Thompson predicted, "We will continue to be at odds with EPA, not over the intent to continue to provide cleaner air benefits, but at the extremes of defining how clean is clean." In the conference's keynote address, Thompson restated the popular $8 billion figure, which has been quoted as the cost for the new facilities needed to produce and distribute low-sulfur gasoline. Although the public might see this cost as just a few pennies on the price of gasoline, he said, the real threat is not actual cost increases, but retail price spikes caused by shortages.

As a result of a continuing low return on their investments-worsened by the advent of Tier 2 gasoline-some refiners will choose to exit the business, Thompson said. In the short term, a shortage will cause price spikes similar to what the US experienced in California in previous years and in the Midwest earlier this year, he said.

Regarding low-sulfur diesel, Thompson supports a 50-ppm sulfur cap, which requires an industry investment of $4 billion vs. $8-11 billion for a 15 ppm cap. Should the industry invest in just enough 15 ppm sulfur diesel to meet demand, any refinery incident or slowdown will cause a price spike for diesel.

Beyond economics, attendees at the meeting also mentioned possible tight resources available to retrofit refineries for new fuel regulations in the future. If most companies decide to implement projects during 2005-07, they said, there will be a dangerously low source of equipment suppliers upon which the industry may draw.

Government Developments

US Rep. Henry Hyde (R-Ill.) earlier this month asked the US FTC to take up an investigation of expected high natural gas prices this winter to determine if they are the result of collusion in the market.

"I don't know what he means given the competitiveness of the industry," said R. Skip Horvath, president of Natural Gas Supply Association.

Horvath noted there are 8,000 producers in the industry. "If you took the top five, they only have a 17% market share, Horvath said. "That's a very low concentration."

In his letter to FTC Chairman Robert Pitofsky, Hyde wrote, "Last year, when prices were lower, producers cut their productionellipse[which] led to the current shortage with corresponding higher prices. Such production cuts could be a legitimate response to market forces. On the other hand, if they were done collusively, they could violate antitrust laws."

Hyde said consumers need to know whether or not producers and utility companies deliberately diminished reserves of natural gas in order to drive the price up.

"Industry sources are hinting in press reports that [the cost of] natural gas used to heat millions of homes may skyrocket as much as 90% in the month ahead, and I think we must move quickly to find out if and why that is true," Hyde said.

Horvath said Hyde is correct in that prices are higher due, in part, to cuts in production after the industry received low prices signals in 1998 and 1999. The good news is that higher prices are drawing more producers into the market to get more gas to market, Horvath said.

ARCTIC GAS MAY FUEL NORTH AMERICAN MARKETS IN THE FUTURE.

Canada is working to improve the transparency of its regulatory environment so that industry can make informed decisions on investments to move arctic natural gas south.

Dennis Wallace, federal associate minister of Indian Affairs and Northern Development, said Canada wants to provide certainty to developers making multibillion-dollar decisions. He said companies are looking for certainty on the regulatory and environmental assessment processes and on the fiscal and royalty framework.

Wallace said the Canadian government believes gas in the Alaskan North Slope and Mackenzie Delta-Beaufort Sea regions will be developed.

While speaking last week at a Ziff Energy conference in Calgary, Wallace told delegates that industry is questioning whether the federal government is prepared to respond effectively and in a timely way to major oil and gas developments in the Arctic.

He said the public attitude in Canada's far north is now vastly different than it was 25 years ago when public opposition and poor economics scuttled ambitious plans for arctic gas development. Now, he said, aboriginal and other northern residents support developments that will allow them to participate with equity investment and employment.

Quick Takes

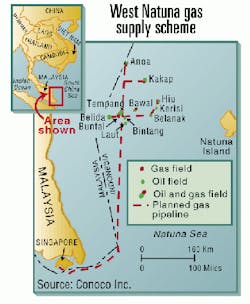

GAS SUPPLIES FROM INDONESIA'S WEST NATUNA FIELDS ARE TO ARRIVE EARLY IN SINGAPORE.

First supplies of Indonesian natural gas to Singapore will arrive in 2 months-some 6 months ahead of schedule-even as Malaysia signs an initial agreement with Indonesia to buy gas from the same West Natuna fields (OGJ Online, Oct. 16, 2000).

This follows the completion of a 640-km subsea pipeline connecting Singapore with the West Natuna fields. The pipeline is ready to make first delivery in December, said one source. SembCorp Gas, which is buying 325 MMcfd of Natuna gas from Indonesia's Pertamina under a 22-year purchase agreement, confirmed that it was ready to deliver gas to its customers on Jurong Island a few months ahead of schedule but did not specify a date.

The company's major customers include SembCorp Cogen, Tuas Power, and such petrochemical companies as ExxonMobil and Basell Eastern, a JV between Royal Dutch/Shell and BASF.

In other pipeline action, TotalFinaElf will undertake a feasibility study for a "southern route" pipeline to transport oil from Kazakhstan via Turkmenistan to Iran, according to Paris-based newsletter Petrostrategies. Citing "reliable sources," the energy weekly reported earlier this month that the Kazakhstan government awarded the French energy firm an "official operator's mandate" to look into a pipeline that would run from the recently discovered giant Kashagan oil field to the Iranian town of Neka. The proposed export line would cost some $1.6 billion to construct and would carry 500,000 b/d to refineries in northern Iran. Capacity could be raised to 1 million b/d for another $500 million, Petrostrategies reported.

The Alberta Energy and Utilities Board (EUB) reports 860 failures in Alberta pipelines in the 12 months ended Mar. 31, 2000, a 14% increase over the previous year. The report covers almost 174,000 miles of pipelines, and problems included cracks, leaks, and breaks. EUB said that, on inspection of 376 older pipelines, 241 had proved unsatisfactory, and 81 of 379 inspections of new lines also revealed unsatisfactory conditions. Overall, the EUB said 64% of pipelines checked were ruled unsatisfactory, compared with 52% in inspections a year earlier. Minister of Resource Development Mike Cardinal said the province would not compromise public safety, but announced no specific measures to deal with the problems.

Algonquin Gas Transmission and Duke Energy Gas Transmission applied earlier this month for FERC approval to construct the HubLine project-an offshore natural gas pipeline from Beverly, Mass., to Weymouth, Mass. Maritimes & Northeast Pipeline (M&NP) also applied for FERC approval for the third phase of its 650-mile Maritimes & Northeast gas pipeline project. The expansion would extend the existing Maritimes system in Methuen, Mass., to Beverly, where it would interconnect with the proposed HubLine project. The interconnect will allow gas produced off eastern Canada by Sable Island Energy to be transported to New England and the US Northeast. The HubLine project involves construction of 30 miles of 24-in. mainline pipeline primarily offshore between Beverly and Weymouth along with ancillary facilities onshore. Affiliates of Duke Energy hold a 37.5% interest in the M&NP system. Other partners include Westcoast Energy (37.5%), ExxonMobil (12.5%), and NS Power Holdings (12.5%).

AKER MARITIME PLANS TO BUILD A WATER INFECTION PLATFORM IN THE NORWEGIAN NORTH SEA

BP and Aker Maritime signed a letter of intent for Aker Maritime to design and build a 2.8 billion kroner water injection platform for Valhall field in the southern half of the Norwegian North Sea. Aker Maritime will build the jacket substructure and the entire topsides, including water injection equipment and drilling module.

The Aker Verdal yard will construct the jacket, which will be 99 m high and will weigh 4,000 tonnes. Aker Stord yard will be in charge of constructing the 8,500-tonne topsides and for hook-up and commissioning of the entire platform. Engineering will start immediately, while fabrication work at Aker Stord will start in April 2001 and at Aker Verdal in August 2001.

The steel jacket is scheduled for delivery in July 2002. The platform deck will leave Aker Stord in August 2002. The platform will start drilling injection wells on Oct. 1, 2002, and will start injecting water into the reservoir to increase pressure and oil production in Valhall field in April 2003.

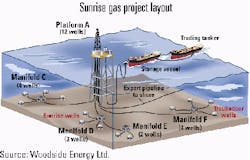

TOPPING DEVELOPMENT NEWS, partners in the Sunrise-Troubadour-Sunset gas field development project estimate that it will take $2.5 billion (Aus.) to finance the first phase of its Sunrise gas project, which would establish the Timor Sea as Australia's fourth major gas production hub (see schematic). The entire project involves the development of the Timor Sea fields and the construction of an associated methanol and syngas plant near Darwin, Australia (OGJ, Oct. 16, 2000, Newsletter, p. 9). Field partners include operator Woodside Petroleum, Shell, Phillips Petroleum, and Osaka Gas. The project also would supply gas to the Australian communities of Darwin, Mataranka, Gove, and Mount Isa, officials said. Some $700 million worth of new onshore pipelines would have to be built.

Chevron unit Cabinda Gulf Oil and its partners in Angola's offshore Block 14 have awarded to Coflexip Stena Offshore Group (CSO) and ABB Offshore Systems the Kuito Phase 1C development project on the block. This is the third development phase for the field, in 400 m of water. Phase 1C consists of an additional subsea production center with 7 wells producing through a 12-slot manifold and an additional 4 water injection wells at the existing 1B water injection center connected to the Kuito FPSO. CSO will design, build, and install all flowlines, risers, umbilicals, and associated jumpers required for the manifold and subsea tree hook-up for phase 1C. It will also transport and install the manifold and umbilical termination units supplied by ABB and hook up three subsea trees to the manifold and associated umbilicals. Installation is scheduled for summer 2001. Cabinda Gulf Oil holds a 31% interest in Block 14. Its partners are Sonangol, 20%; ENI unit Agip, 20%; TotalFinaElf, 20%; and Petrogal, 9%.

Norsk Hydro awarded a $109 million contract earlier this month to Aker Maritime to build the drilling module for the Grane oil field platform in the North Sea. Aker Maritime's engineering work in Kristiansand, Norway, will start immediately. The drilling module will be built and assembled at Aker Stord in western Norway. The fabrication work will begin in May 2001. The company estimates the module will be mechanically completed on Dec. 15, 2002. The fully tested and commissioned drilling module with derrick, weighing 5,500 tonnes, should be delivered to Hydro on May 1, 2003. The Grane field, some 185 km west of Stavanger, Norway, will be developed with an integrated accommodations, process, and drilling platform mounted on a steel jacket. Combined total investments are estimated at $1.63 billion. The Grane field, which has an estimated 700 million bbl of recoverable oil, will reach a maximum output of 214,000 b/d in 2005. The oil will move by pipeline to a terminal northwest of Bergen, Norway.

Husky Oil Operations and Petro-Canada awarded Maersk/ Seabase the front-end engineering design contract for an FPSO to be used in White Rose field development off eastern Canada. The contract will finalize the functional design, engineering, and operational aspects of the FPSO to determine firm costs for the production facility. A significant portion of this contract involves the bidding of the topsides, including the design, engineering, acquisition, fabrication, and hook-up. Husky is also issuing requests for proposals to design the project's subsea production systems, which include subsea trees, templates, manifolds, flowlines, umbilical lines, and control systems. Bids are due in early December with a contract anticipated in the first quarter of 2001. The White Rose oil field is in the Jeanne d'Arc basin on the Grand Banks 350 km east of Newfoundland.

IN EXPLORATION NEWS, AMG Oil said it will team up with Orion Exploration to gain strategic expertise and additional funding for its Canterbury basin project in New Zealand.

Orion Exploration will earn a 10% interest in the Canterbury basin project by reimbursing AMG for a portion of past exploration costs and by contributing 20% to the cost of drilling both the Ealing-1 and Arcadia-1 wells.

Drilling of the Ealing-1 well is to begin this month and to be followed immediately by the Arcadia-1 well (OGJ Online, Sept. 25, 2000). Both Ealing-1 and Arcadia-1 wells will take 3 weeks to drill to their target depths of 6,000 ft.

Following completion of funding obligations by Orion and AMG on the Ealing-1 and Arcadia-1 wells, AMG Oil will hold a 70% interest in the area. Indo-Pacific Energy will hold 20%.

POLAR TANKER PLANS TO BUILD A FOUTH MILLENNIUM-CLASS TANKER FOR ALASKAN TRADE.

Polar Tanker-the shipping unit of Phillips Alaska-plans to build a fourth millennium-class tanker to carry crude oil from Alaska to the Lower 48 West Coast and Hawaii. The fourth ship contract is worth $197 million. The first of the tankers, the Polar Endeavor, will enter the Alaska trade in early 2001 (OGJ, Sept. 18, 2000, Newsletter, p. 9).

The decision to build a fourth such tanker for the Alaska trade reflects Phillips's plan to increase its Alaska production to 400,000 boe/d from the current 350,000 boe/d, said Kevin Meyers, president of Phillips Alaska.

The 125,000 dwt crude oil tankers feature double hulls, twin engine rooms, twin propellers, twin rudders, and a sophisticated navigation and control system. New Orleans-based Litton/Avondale Industries will build the tankers. The new ship, yet to be named, will enter service in early 2004.

In other tanker action, Qatar Shipping signed a $75 million contract with Shina Shipbuilding to design and build two chemical carriers in the 35,000-45,000 dwt class by the end of 2002. Another 37,000 dwt vessel has been taken on option. The vessels will be built at Shina's Kyongnam shipyard. Qatar Shipping is also planning to build two or three LPG vessels to carry ammonia, propane, butane, and vinyl chloride monomer to support exports by Qatar Fertilizer Co., Qatar Vinyl Co., and Exxon's proposed GTL project.

A NEW LLDPE PLANT WILL BE BUILT IN IRAN

Enerchem International, on behalf of Iran's Amir Kabir Petrochemical, awarded Technip a 100 million euro contract for a new linear low-density polyethylene plant to be built at Bandar Imam in the Iranian coastal free zone.

Based on BP's proprietary gas-phase Innovene technology, the plant will have a production capacity of 300,000 tonnes/year. Technip will provide the license, engineering, procurement, and construction supervision services to be carried out by Technip's Lyon bureau in France. The project is due on stream in 35 months.

SMEDVIG'S WEST NAVION DRILLSHIP IS KICKING OFF A BUSY STRETCH.

The rig spudded the first wildcat off Lofoten, Norway, said Statoil. The well, 6710/10-1, is in the Nordland VI exploration province of the Norwegian Sea and will be completed in 30 days. West Navion will then be moved to spud an exploration well near Statoil's Norne field in the Norwegian Sea.

Statoil holds a 40% interest in Production License 220. Other interest holders include the government with 30% and Amerada Hess and Fortum Petroleum each with 15%.

In other drilling happenings, Burlington Resources awarded Grey Wolf a 2-year, $11.6 million contract to use Grey Wolf's Rig 558 land drilling rig, one of the largest land drilling rigs in the world. The rig will drill in the Madden Deep area of Wyoming's Wind River basin. Grey Wolf anticipates it will spend $5 million to meet contractual obligations.

This special analysis of the IEA's Oil Market Report and its effects on the international oil market was provided by Marilyn Radler, Economics Editor.