Portugal's Petrogal repositions itself as energy multinational

Portugal's state-owned petroleum firm Petrogal has embarked on an ambitious plan to reposition itself as a multinational energy firm.

The strategy, dubbed Projecto XXI, has an initial aim of making Petrogal one of the best energy companies in Spain and Portugal-particularly in natural gas and refined products distribution, according to its chairman, Manuel Ferreira de Oliveira.

Beyond that, Petrogal is targeting expansion of its interests in a portfolio of investments around the world, in both upstream and downstream sectors.

But a knotty issue of state vs. private ownership remains a tough one to untangle for the strategy to mark progress.

Continuing tussle

The company's new plan emerges amid a continuing tussle between the government, which owns two thirds of the company, and a group of private investors known as Petrocontrol, which will control the rest of the shareholder structure resulting from the choice of a new strategic partner.

The government is expected to announce shortly the name of a strategic partner for the newly established energy holding company Galp Petroleos e Gas de Portugal. Audits by investment houses Merrill Lynch and Credit Suisse First Boston have valued the new holding company at 478.36 billion escudos.

Originally, plans called for a 15% stake that would be given to the newcomer to come proportionally from both the government's shares and Petrocontrol's position. However, apparently in response to fears about the continued preponderance of the government's role in the new holding company, Petrocontrol has indicated that it is unwilling to see its position eroded in favor of the new strategic partner.

That position was bolstered significantly as a result of recently announced government plans for Portugal's energy sector. A recent decision to create the energy holding company Galp Petroleos e Gas de Portugal-incorporating both Petrogal and gas company Gas de Portugal (GDP)-means that Petrocontrol gets involved in the country's new and fast-growing gas industry. The arrival of gas though a new gas pipeline linking Algeria with Spain and Portugal has led to a massive increase in gas sales. GDP controls the gas pipeline company Transgas as well as regional gas distribution companies. It is also a joint-venture partner in telecommunications company ONI, which started offering long-distance telephone services when the Portuguese telecommunications market was liberalized on Jan. 1, 2000.

Petrocontrol, which is owned by local investors, will have to pay a further 8 billion escudos in order to get a 33.44% stake in the new holding company. This leaves the state with direct ownership of 60.56%. Two state-controlled companies, power generator EDP and the savings bank Caixa Geral de Depositos, will each own a further 3% of the company; this means that the government effectively controls 66.56% of Galp Petroleos e Gas de Portugal.

Competing bids

Four groups have bid for the 15% stake in the Galp holding company: Italy's ENI, Spanish power company Iberdrola, Tulsa-based Williams International, and Elf Aquitaine SA (recently acquired by TotalFina SA). The front-runners are ENI and Elf, which is already present in the retail market with a small service station network. Ferreira de Oliveira was recently quoted in the Italian press as saying, "ENI and its subsidiary Agip [SPA] have a profile that fits completely with Petrogal's expectations." ENI also was reported to have submitted the highest bid.

Iberdrola is thought by industry analysts to have little chance partly because it has little track record in oil and gas and partly for political reasons about concerns of Spanish investment in strategic sectors of the Portuguese economy. These concerns are also cited as being the main reason why the government failed to invite Repsol-YPF SA to put in a tender.

Economics Minister Pina Moura said the Spanish company had not been discriminated against. Rather, he said, the exclusion was based on Repsol-YPF's size and the need for a balanced partnership guaranteeing competition: "Galp needs to have a medium-sized company as its partner."

Political concerns

Following parliamentary elections in October, which delayed the choice of the new strategic partner, the Socialist government has been returned to power.

Moura, who has overseen the Petrogal restructuring process over the past 4 years, has been given a new "super ministry" that includes both the economics and finance departments. This means that he will be well-placed to push through his plans.

The government will be keen to get the energy sector into order. It aims to float the holding company Galp by the end of 2001 at the latest. This will allow the government to raise cash and Petrocontrol shareholders to realize a return on their investment. The company invested in Petrogal more than a decade ago at a price it claims was inflated, given the financial state of the company. One of Petrocontrol's investors, the Portuguese entrepreneur Manuel Boullousa, has already said it does not make strategic sense to hold on to his shares. And other Petrocontrol investors, such as the Espirito Santo banking group, are unlikely to see this as part of their core business.

However, another local bank, Banco Portugues de Investimento, has expressed a serious interest in acquiring a stake in the new company. However, talks over the size and price of the stake it is to acquire have been put on hold until a clear strategic plan is put in place for the new company. BPI also says that it first wants to see which company the government will choose as Galp's strategic partner before it makes a final decision.

2000 goals

For Petrogal itself, the new year will be focused on getting itself into condition for the flotation of the Galp holding company.

It explains the importance of Projecto XXI, which already integrates the oil business of Petrogal and the gas business of GDP.

In order to successfully concentrate on the production, transportation, refining, distribution, and sale of crude oil, oil products, and natural gas, Petrogal has set eight basic targets:

- To develop its own production of hydrocarbons.

- To prepare its refineries to meet environmental and market demands.

- To consolidate the distribution of oil products within the Iberian peninsula.

- To expand its cogeneration business.

- To selectively expand into Portuguese-speaking countries.

- To develop its chemicals business, namely aromatics.

- To play a significant role in Portugal's natural gas project.

- To adequately reward its shareholders by attaining profitability levels in line with the capital employed.

Petrogal has seen its financial situation steadily improve as a result of its drive towards greater efficiency. Unaudited results for first half 1999 showed an increase in profits to 17.3 billion escudos, up 15.6% from the same period the prior year. Revenues for the period totaled 367.5 billion escudos, down 13.4 billion year-to-year. The forecast for full-year results was for a profit of 33.4 billion escudos vs. the 1998 figure of 32.5 billion.

Domestic plans

Meanwhile, the company plans to invest about 220 billion escudos over the next 3 years on environmental measures and improving efficiency in its downstream operations. The investment program is aimed at bringing the company into line with European Union directives. The plan is divided into three areas: environmental aspects, improvements to the refining process, and enhanced energy efficiency.

In order to meet EU regulations, due to come into effect in 2003, Petrogal is to build a series of new processing units at its refineries at Sines and Matosinhos. Work at Sines will include expanding and upgrading the refinery's catalytic cracking unit. Given the cost, Portugal had asked the EU to extend the timeframe required for eliminating the sulfur content in gasoline to 2003 from the current mandate of 2000.

At the Matosinhos refinery Petrogal is constructing a platformate splitter to produce three side cuts: an overhead light, a heart cut, and a heavy cut. The heart cut, with a benzene content of 40-50 wt %, will feed the Arosolvan benzene-toluene extraction unit at the Porto refinery.

In addition, Petrogal recently announced that it is to team up with the European downstream joint venture of BP Amoco PLC and Mobil Corp. (now part of ExxonMobil Corp.) and Borealis AS to build an underground LPG storage facility at Sines. Three underground caverns will be excavated to a depth of 118 m to create 80,000 cu m of LPG storage capacity. Asea Brown Boveri has won the construction contract for the project, which is to come on stream in mid-2001.

International expansion

The internationalization policy put in place by Petrogal aims at fueling the company's business in geographic areas where competitive advantages are available, adding on to the domestic market.

Upon this basis, it selected markets and segments potentially offering greater capital gains or easier penetration, in line with profitability and risk analysis criteria established for each of these zones.

Accordingly, Petrogal's preferred markets are the Iberian Peninsula and Africa.

Beyond Africa and Spain, Petrogal is considering building a 200,000 b/d refinery at Pernambuco, Brazil. If it decides to go ahead, it will do so in a consortium including Brazilian state oil firm Petroleo Brasileiro SA (Petrobras). The companies are also planning other alliances. They could include oil production and refining in Angola and Petrobras moving into the Portuguese market.

According to Ferreira de Oliveira, Petrogal's market share will drop in Portugal, and for this reason the company plans to speed up its overseas expansion program and to establish strategic alliances with companies such as Petrobras. He also noted that Portugal would form a European bridgehead for Petrobras.

Spain

Petrogal's international activity in Europe is primarily carried out through Petrogal Espa

Petrogal Espanola currently has a network of 184 service stations. Its 2% market share makes it the biggest of the foreign oil companies operating in Spain that do not possess local refineries.

However, analysts see the possibility of Petrogal selling its Spanish operations, given the level of saturation of the Spanish market and the lack of room for further expansion.

They argue that Petrogal expansion into the Spanish market has been too rapid and that it could take at least another 3-4 years for the company to reach a break-even point.

Productivity at its service stations, they note, lags behind that of its competitors.

After a period of rapid growth during 1991-95, Petrogal Espanola has stagnated. The company has regularly run its operations at a loss, and several of its units are patently unprofitable, given the level of competition. According to figures supplied to the Spanish authorities, Petrogal Espanola's accumulated losses last year stood at about 2.4 billion escudos.

In 1996, the company incurred its largest-ever loss at 840 million escudos. In 1995, the loss totaled 416 million escudos. The losses are a result of reduced trading margins due to competition in the Spanish market and the cost of expansion, and they came in spite of revenue growth-72 billion escudos in 1997, up from 43 billion in 1993.

Over the last few months, Petrogal has reportedly received offers from multinationals, including Italy's Agip, interested in buying its Spanish subsidiary and retail network.

However, Ferreira de Oliveira has repeatedly said that Petrogal would continue to operate in both Portugal and Spain. In 1998, the company managed to post a profit of 398 million escudos.

Angola

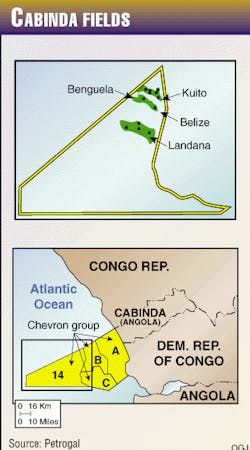

In line with its strategy to ensure its own production covers at least 15% of the Portuguese refining slate, Petrogal is actively expanding its position in crude oil production in Angola. It has a 9% stake in rights to Block 14 off the Angolan enclave of Cabinda, which recently started production (OGJ, Jan. 17, 2000, p. 26), and more recently acquired 5% stakes in another three ultradeepwater exploration blocks off Angola. The company was selected in the tenders launched at the end of 1998 by Angolan state oil firm Sonangol and will take part in groups led by Elf and ExxonMobil holding Blocks 31, 32, and 33.

Petrogal has a 9% stake in the Block 14 consortium, giving it ultimately a net 9,000 b/d of production. Chevron Corp. unit Cabinda Gulf Oil Co. Ltd. (CABGOC) 31%, Sonangol 20%, TotalFina 20%, Agip 20%, and Petrogal 9% hold rights to this 1,560-sq mile block.

In April 1997, CABGOC discovered Kuito field, which it estimates contains at least 1 billion bbl of oil reserves and lies in 200 m of water.

Under a fast-track schedule, production is expected to ramp up to 100,000 b/d by 2002. The FPSO used in the initial phase of the Kuito field development has a 100,000 b/d crude oil production capacity, along with a 150,000 b/d liquids processing capacity and a 36 MMcfd gas compression system that reinjects all produced gas into the reservoir. The FPSO also has a water reinjection capacity of about 110,000 b/d.

Elsewhere on Block 14, three other discoveries have been made in deeper waters southwest of Kuito field (see map). In January 1998, the Landana field was found, followed by the Benguela discovery in July 1998 and the Belize find in October 1998. Test flow rates from these three discovery wells were 10,000-20,000 b/d, comparable to those in Kuito field.

Although water depths are greater than 300 m at Landana and Benguela-Belize is in just under 200 m of water-crude oil quality appears good, with gravities around 36°.

Under a fast-track development plan, Chevron is considering bringing Benguela field on stream after Kuito, with initial production levels comparable to those at Kuito. Potential reserves at Benguela, Landana, and Belize could total more than 1 billion bbl, Petrogal said.

At the same time, Petrogal was reported to be considering taking a signficant stake in a consortium being put together by Sonangol to build a major refinery in southern Angola, at a cost of $1.5-1.8 billion. Although Petrogal declined to comment on the report, it is thought that, under the plan, Petrogal would take a 30% stake in the consortium, Sonangol would take 40%, and the rest would be held by a foreign oil company, possibly Petrobras.

Other Africa

Elsewhere in Africa, Petrogal is active in Mozambique, Guinea-Bissau, Cape Verde, and Sao Tom

Petrogal has announced a $3 million, short-term investment in a retail sales network in Mozambique. Established at the end of 1997, Petrogal Mozambique will operate in the country's oil and natural gas sectors. Petrogal has also transferred to this new company its 76.0% stake in Mo

Petrogal also set up in 1997 Petrogal Guin

In the public invitations to tender for the assets of Guin

In Cape Verde, Petrogal purchased in 1997 a 32.5% stake in Enacol. This company holds a 26% share of the local market and has a network of 23 service stations. It has, moreover, ensured that all the necessary conditions are in place to supply Cape Verde with competitively priced products from Petrogal's Sines refinery.

East Timor

In another former Portuguese-administered territory, Petrogal is pursuing opportunities in the emerging nation of East Timor, struggling for its independence from Indonesia.

The head of the East Timor pro-independence group Fretilin and a member of the National Council of Timorese Resistance (CNRT), Mari Alkatiri has admitted to talks with Petrogal. The Portuguese oil company has already been given the go-ahead from Lisbon to work with CNRT to help exploit an independent East Timor's oil reserves. This effort is to include training Timorese technicians. CNRT is also negotiating with Shell, Alkatiri said, mostly about the exploitation of natural gas. Shell reportedly has confirmed large reserves of gas on East Timor.

The Portuguese government denied any secret agreement with CNRT to develop oil finds for East Timor, although it has admitted to talks with Alkatiri.

The weekly O Independente reported that a secret pact was indeed made by CNRT leader Xanana Gusmao and Portuguese Foreign Minister Jaime Gama. The newspaper reported that, in January 1999, Alkatiri met with Gama and Petrogal officials to agree on a 10% stake in East Timor's future offshore oil industry for the Portuguese company. Petrogal since has denied any such predetermined arrangement, noting 10% would be a small portion for the Portuguese, who have been supportive of East Timor over the last 24 years.

In 1989, following years of boundary disputes, the Indonesian government agreed with Australia to divide the Timor Sea area in what is called the Timor Gap.

Since then, significant oil and gas discoveries have been made in the area, mainly in the Australian-administered part of the Timor Gap. However, if Portugal's state oil firm is to invest in the area, it will first need to sort out Australia's legal claims. There remain questions over the legal status of the Timor Gap treaty in light of East Timor's pending independence.

Petrogal Chairman Manuel Ferreira de Oliveira

Projecto XXI has an initial aim of making Petrogal become one of the best energy companies in Spain and Portugal-particularly in natural gas and refined products distribution.