OGJ Newsletter

OGJ Newsletter

GENERAL INTEREST — Quick Takes

EIA: Light, sweet oil source of US production rise

About 96% of the 1.8-million b/d growth in US production during 2011-13 consisted of light, sweet crude grades with API gravity of 40° or higher and sulfur content of 0.3% or less, the US Energy Information Administration reported on June 6.

EIA forecasts that the US supply of light, sweet crude will continue to outpace that of medium and heavy crude through 2015, as more than 60% of growth will consist of sweet grades with API gravity of 40° or higher.

As a surplus of oil has accumulated from tight formations, policymakers and industry have debated relaxing the US crude export ban to avoid a light-heavy price competition that could jeopardize production growth (OGJ, Jan. 20, 2014, p. 16).

A recent IHS study reported that lifting the export ban could result in higher US production, lower gasoline prices, and the addition of as many as 1 million jobs (OGJ Online, May 30, 2014).

New midstream firm gets $500 million investment

Privately held Navitas Midstream Partners, recently formed in The Woodlands, Tex., "to develop, acquire, and operate midstream assets across multiple basins in North America," has received a line-of-equity investment of as much as $500 million from an affiliate of Warburg Pincus, New York.

The three founding partners and top executives of Navitas Midstream are former executives of Copano Energy LLC., which Kinder Morgan Energy Partners LP acquired last year for about $5 billion (OGJ Online, Jan. 30, 2013).

The Navitas Midstream executives are R. Bruce Northcutt, chief executive officer, who was president and chief executive officer of Copano Energy; James E. Wade, chief commercial officer, who was chief operating officer of Copano Energy's Texas business unit; and Bryan W. Neskora, chief operating officer, who was Copano Energy's chief operating officer.

Members of the management team and other individuals joined Warburg Pincus in the investment.

Range Resources ups budget on Marcellus results

Range Resources Corp., Ft. Worth, reported it will increase its capital budget for 2014 by $220 million to $1.52 billion, citing positive results in the Marcellus shale as the reason.

With the move, 87% of the company's capital program will be directed toward activities in the play.

Range reported its estimated unrisked unproved resource potential as of Dec. 31, 2013, increased to 64-85 tcf of natural gas equivalent, which includes 42-55 tcf of gas and 3.7-4.9 billion bbl of natural gas liquids and crude oil. About 62% of the unproved resource potential is attributable to the Marcellus shale where Range has 955,000 net acres across the play.

Range reported that it pioneered the Marcellus shale play in 2004 with the successful drilling of the Renz No. 1 vertical well.

Noble, Consol to launch Marcellus midstream MLP

Noble Energy Inc., Houston, and Consol Energy Inc., Pittsburgh, have submitted a confidential draft registration statement on Form S-1 to the US Securities and Exchange Commission relating to a proposed initial public offering of common units of a master limited partnership (MLP).

The 50-50 joint venture, to be named CONE Gathering LLC, will own, operate, and develop the companies' jointly owned natural gas midstream assets in the Marcellus shale.

The companies previously formed a JV for the development of Marcellus assets (OGJ Online, Aug. 18, 2011). Last year, the companies reported plans to operate at least eight rigs in the basin in 2014 (OGJ Online, Nov. 5, 2013).

Two join ExxonMobil management committee

Jack P. Williams and Darren W. Woods have been elected senior vice-presidents and members of the management committee of ExxonMobil Corp.

Williams, currently executive vice-president of ExxonMobil Production Co., also will become a vice-president of the corporation. Woods currently is president of ExxonMobil Refining & Supply Co. and a vice-president of the corporation.

Williams and Woods will join a management committee that now comprises Chairman and Chief Executive Officer Rex W. Tillerson and Senior Vice-Presidents Mark W. Albers, Michael J. Dolan, and Andrew P. Swiger.

Exploration & Development — Quick Takes

Firms form JV to tap China's unconventional resources

Sinopec Group has entered into a 15-year joint venture agreement with FTS International (FTSI), Ft. Worth, with the intention of tapping into China's vast unconventional resources.

The new venture, to be called SinoFTS Petroleum Services Ltd. (SinoFTS) and based in Beijing, is the first oil field services collaboration of its kind between a non-Chinese well completion company and a Chinese national oil company, FTSI said.

FTSI will provide Sinopec with its expertise in hydraulic fracturing, using new equipment that FTSI will manufacture in the US and adapt for the Chinese environment.

Sinopec will own 55% of the JV while FTSI will hold the remainder, and it will serve both Sinopec and other exploration and production companies throughout China.

The JV plans to initially focus on the Sichuan basin, where operations for the initial pressure pumping fleet are expected to begin in 2015. FTSI believes further deployments will occur in basins throughout China.

FTSI describes itself as one of the largest well completion service companies in North America, with 1.6 million hydraulic hp deployed in the major US shale basins.

Last month Sinopec formed a JV with Weatherford International to expand the Chinese company's upstream business, focusing on China's shale gas resources.

The company previously signed an agreement with ConocoPhillips for joint research regarding shale gas exploration, development, and production in the Sichuan basin (OGJ Online, Dec. 28, 2012).

The US Energy Information Administration previously estimated that China has 145 trillion cu m of recoverable shale gas resources in the Sichuan and Tarim basins.

Firms join Shell for exploration offshore Nova Scotia

ConocoPhillips and Suncor Energy Inc. are joining Shell Canada as partners in exploring the deepwater Shelburne basin off Nova Scotia (OGJ Online, May 6, 2014).

Shell's six exploration licenses cover 19,845 sq km about 300 km offshore in 500-3,500 m of water.

Under the agreement, Shell will remain operator and have 50% interest. ConocoPhillips is to buy 30% and Suncor 20%.

Shell acquired four licenses in 2012 and two in 2013 for $998 million (Can.). The licenses are good for 6 years.

Shell said it conducted a 3D seismic survey in 2013 covering 10,850 sq km. Pending regulatory approval, Shell anticipates that drilling will begin in second-half 2015.

Eni farms into permit offshore South Africa

Eni SPA has agreed to acquire 40% interest and operatorship in exploration right permit 236 (ER236) offshore South Africa's east coast from Sasol Petroleum International, the upstream oil and gas arm of Sasol Ltd.

The permit allows the company to explore for hydrocarbons on an 82,000-sq-km unexplored offshore area in the Durban and Zululand basins in Kwazulu-Natal province. The permit was granted to Sasol by the South African regulator Petroleum Agency of South Africa (PASA) at the end of last year.

Eni already has an exploration presence in Mozambique and Kenya (OGJ Online, July 2, 2012; May 27, 2014).

Eni says the agreement with Sasol forms part of a wider cooperation between the companies in southern Africa and other areas, mainly focused on maximizing opportunities in the gas value chain.

Drilling & Production — Quick Takes

CAPP eases outlook for Canadian oil output

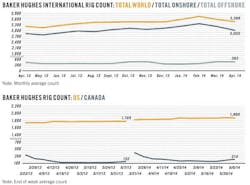

Oil production in Canada will increase at an average rate of 175,000 b/d/year through 2030—but not to as high a level as was forecast a year ago, reports the Canadian Association of Petroleum Producers.

Output from oil sands dominates CAPP's projection, rising from 1.9 million b/d in 2013 to 2.3 million b/d in 2015, 3.2 million b/d in 2020, 4.1 million b/d in 2025, and 4.8 million b/d in 2030.

Last year, CAPP forecast oil sands production in 2030 of 5.2 million b/d. The difference between that outlook and the new one relates to uncertainty about major projects late in the forecast period.

"The difference between the two forecasts later in the period primarily reflects increasing uncertainty regarding project timing related to cost competitiveness and capital availability," the association says. "These impacts are more evident in proposed oil sands projects near the end of the forecast period."

In the new forecast, total Canadian oil production increases to 6.4 million b/d in 2030 from 3.5 million b/d in 2013.

CAPP forecasts an increase in conventional production in western Canada to 1.5 million b/d in 2020-30 from 1.3 million b/d in 2013.

Production in eastern Canada, according to CAPP, will average 200,000 b/d through 2015, rise to 300,000 b/d in 2020, and ease to 200,000 b/d in 2025 and 100,000 in 2030.

But three recent discoveries in the Flemish Pass basin "may lead to increased projections for the region in future CAPP forecasts," the association notes.

Summail gas field starts flow in Kurdistan

DNO International ASA, Oslo, has started production of natural gas from Summail field in Kurdistan, northern Iraq (OGJ Online, Sept. 18, 2013).

The first well came online in late May with production averaging 60 MMcfd, 20% above plan. The gas flows to a Dohuk power plant under an agreement with the Kurdistan Regional Government (KRG).

A second well is due on stream this month. A third will follow later in the summer, taking field production to 100-120 MMcfd.

Osum to buy Orion project from Shell

Osum Oil Sands Corp., Calgary, plans to purchase the Orion oil sands project in Alberta from Shell Canada for $325 million (Can.). The transaction is expected to close at the end of July. Osum will have operatorship and 100% working interest.

Steve Spence, Osum's president and chief executive officer, said by linking Orion with its nearby Taiga project, the company "has a unique opportunity to build a significant production platform in the Cold Lake region."

Orion is about 18 km southwest of Taiga, which has received regulatory approval for construction and operation of a 35,000-b/d facility (OGJ Online, Sept. 12, 2012).

Orion has been producing commercially since 2007 using steam-assisted gravity drainage. Production in the first quarter averaged 6,700 b/d of bitumen from 22 well pairs. Osum is a private oil sands producer established in Alberta in 2005.

Construction begins on Uintah basin crude upgrader

FUELogistics Inc. has started construction on an oil upgrader in Duchesne, Utah, specifically designed to process waxy crude sourced from the state's Uintah basin.

The $50 million, 36,000-b/d plant will use the company's low profile-fluid catalytic cracker (LP-FCC) technology to upgrade the black and yellow wax typically produced from Utah's largest oil-producing region, said FUELogistics.

Codeveloped with Process Innovators Inc. and supported by grants from the US Department of Energy as well as the state of Utah, the newly patented LP-FCC technology works by substantially decreasing the pour point to make the upgraded crude more economical to transport via pipeline, rail, or truck without the expense and complexities of heating it, according to Glenn Guglietta, FUELogistic's chief executive officer.

The LP-FCC's low-profile, multireactor design also serves as a cost-effect solution for bringing the region's crude to market compared with the more-expensive FCC technology typically used to refine the heavy, waxy crudes, Guglietta added.

The recent start of construction begins the first phase of what will be a three-phase master construction plan, according to the company's web site.

Phase 1 includes the initial installation of a 2,000-b/d LP-FCC upgrade unit, which is scheduled to be completed and on line by the end of this year's third quarter.

Phase 2 of the plan, which is due to be completed by first-quarter 2015, will add another 4,000 b/d of upgrading capacity, bringing the plant's total capacity to 6,000 b/d.

A third and final phase of construction will increase crude upgrading capabilities at the plant to its nameplate capacity of 36,000 b/d by yearend 2015, the company said.

PROCESSING — Quick Takes

Washington refinery finds new owner

Global commodities logistics and trading firm TrailStone Group has acquired US Oil & Refining Co. (USOR), including the 42,000-b/d Tacoma, Wash., refinery, from Astra Transcor Energy NV, a subsidiary of Compagnie Nationale a Portefeuille SA, Belgium.

The acquisition marks TrailStone's entry into North America's physical crude oil and refined products markets, the company said.

In addition to the Tacoma refinery, the purchase includes 2.7 million bbl of storage capacity, a fleet of 630 rail cars, and a multiyear storage and 30,000-b/d throughput agreement at a rail terminal in the Bakken shale, according to TrailStone.

TrailStone will also assume ownership of USOR's Tacoma deepwater terminal, which houses two docks equipped to handle up to 125,000-dwt vessels, as well as loading racks for wholesale clean product and asphalt, the company said.

Other assets included in the sale are three double-hulled barges on long-term charter and a dedicated proprietary jet fuel pipeline to US military installation Joint Base Lewis-McChord.

The USOR executive team—including Robert B. Redd, USOR's CEO—will remain on board as part of the acquisition to help implement business plans for future growth and profitability, according to TrailStone.

"USOR is extremely well-positioned to capitalize on the rapidly changing dynamics of the North American oil market, and we look forward to working with Bob Redd and his team to build a leading liquids supply and trading franchise at TrailStone," said John Redpath, TrailStone's head of oil and agriculture.

Terms for the acquisition were not disclosed. TrailStone is backed by New York-based Riverstone Holdings LLC, an energy and power-focused private investment firm.

Chevron releases final EIR for Richmond project

Chevron Corp. has released a long-awaited final environmental impact report (EIR) for the modernization project at its 257,000-b/d Richmond, Calif., refinery.

The final EIR was released on June 9 following a public comment period on the draft EIR that closed on May 2, Chevron said in a statement announcing the document's release.

According to an introduction to the 2,500-page report, comments received on the March draft EIR did not identify new significant impacts, result in a substantial increase in the severity of impacts, or introduce feasible project alternatives or mitigation measures for the project that differ considerably from those already addressed by Chevron.

The final EIR, however, does provide responses to each comment received on the draft EIR and, where necessary, revises the report to address those public comments as well as correct or clarify material from the draft version in accordance with the requirements of the California Environmental Quality Act (CEQA), Chevron said.

The release came just days after a California-based environmental group filed a lawsuit requesting a California superior court to revoke a permit that would allow the company to proceed with the $1 billion modernization project based upon alleged violations of CEQA by the regulatory agency that issued and subsequently renewed the permit.

While the currently planned modernization project at Richmond will not change the basic operation or capacity of the refinery, it will provide the plant flexibility to process crude oil blends and gas oils containing higher levels of sulfur.

But the replacement of some of the oldest processing equipment at the refinery with safer modern technology conforming to some of the toughest air quality standards in the US will enable the plant to meet stricter state and federal air pollution regulations despite processing crudes with higher sulfur content, according to Chevron (OGJ Online, Mar. 19, 2014).

While the company expects the City of Richmond Planning Commission will consider the final EIR and modernization project sometime in June, specific dates have yet to be confirmed, Chevron said.

PDVSA restarts FCC unit at El Palito refinery

Petroleos de Venezuela SA (PDVSA) has completed maintenance on the cyclones system of the fluid catalytic cracker (FCC) unit at its 126,900-b/d El Palito refinery near Pto. Cabello, Carabobo state, the state-owned company confirmed.

The unit is now in the process of restarting, PDVSA said.

While the company said the restart process for the FCC is proceeding in accordance with established safety procedures, a timetable for the unit's full return to service was not disclosed. Other units at the refinery, as well as a connecting pipeline system and adjoining marine terminal, continue to operate normally, the company said.

The FCC came down for maintenance last month following the discovery of an internal fault in the unit's cyclone system, according to a May 6 release from PDVSA.

The same unit was taken off line earlier in the year for preventative maintenance to correct leaks of air and water vapor in the starting line of the plant's regenerator (OGJ Online, Jan. 21, 2014).

TRANSPORTATION — Quick Takes

Phillips 66 to buy Beaumont marine terminal

Phillips 66 agreed to purchase Unocal's 7.1-million bbl storage capacity terminal near Beaumont, Tex. The Beaumont terminal will be the largest terminal in Phillips 66's portfolio.

The Beaumont terminal provides deepwater access and multiple interconnections with major crude oil and refined product pipelines, serving 3.6 million b/d of refining capacity. The terminal also has:

• 4.7-million bbl of crude storage and 2.4-million bbl of refined product storage.

• Two marine docks capable of handling Aframax tankers and one barge dock.

• Rail and truck loading and unloading.

Phillips 66 expects the purchase to close next quarter, following receipt of regulatory approvals. It did not disclose terms.

Enterprise Products Partners LP last month began refined products exports from its reactivated marine terminal in Beaumont (OGJ Online, May 20, 2014).

Open seasons start for Eagle Ford pipeline

Victoria Express Pipeline LLC has opened a binding open season for long-term commitments of transportation of crude oil and condensate through a pipeline under construction in the Eagle Ford shale play of South Texas.

The 56.4-mile, 12-in. Victoria Express Pipeline, expected to be in service July 1, will have ultimate capacity to carry 100,000 b/d from the Blackhawk central delivery point in DeWitt County to the inlet of a Devon Gas Services LP terminal at the Port of Victoria. The port allows access to shallow-water barge-loading facilities.

Victoria Express Pipeline, a subsidiary of Devon Energy Corp., also is building a receipt point, the Highway 77 transfer station, 8 miles north of Victoria in Victoria County and might add a destination point at Point Comfort in Calhoun County.

The company started a nonbinding open season for expressions of interest in long-term commitments on the new pipeline to Point Comfort.

Both open seasons opened May 27 and will end at 5 p.m. CDT on June 19.

AER lays charges against Plains unit for 2012 spill

The Alberta Energy Regulator said environmental charges have been laid against Plains Midstream Canada ULC for a 2012 pipeline incident (OGJ Online, June 8, 2012). AER said 2,900 bbl of sour crude were released from the Rangeland pipeline into the Red Deer River near Sundre, Alta.

AER cited a federal charge under the Fisheries Act and a provincial charge for failing to report a release of crude oil from a pipeline as required under Alberta law.

The provincial charge stems from an Alberta Environment and Sustainable Resource Development (ESRD) investigation that found the company failed to report the release as required within Alberta's Environmental Protection and Enhancement Act.

CorrectionA recent Newsletter item with the headline "OMB may ask SEC to propose fresh Dodd-Frank rules," incorrectly reported that a US Securities and Exchange Commission notice of plans to begin fresh work on foreign disclosure rules under the Dodd-Frank law originated at the White House Office of Management and Budget (OGJ, June 2, 2014, Newsletter). The notice at an OMB web site actually was one of several that the SEC placed there in late May. |