South America M&A deals limited, shift towards local capital

A negative global economic outlook and complex regional conditions will combine with low regional economic growth through 2024 to limit oil and gas-sector merger and acquisition (M&A) activities in South America.

Average regional gross domestic product (GDP) growth of 1.7% is expected in South America for 2023 and a 1.5% increase is projected for 2024, according to a September report by the Economic Commission for Latin America and the Caribbean (ECLAC). The United Nations, meanwhile, predicts that all Latin American subregions will exhibit lower GDP growth compared with 2022: South America is expected to grow by an average of 1.2%, Central America and Mexico by 2.1%, and the Caribbean (excluding Guyana) by 2.8% in 2024.

Other international organizations echo these forecasts. The Organization for Economic Co-operation and Development (OECD) expects the 2023 growth rate to close at 1.5%. Similarly, the World Bank projected a growth rate of 1.5%, while the International Monetary Fund (IMF) projected a growth rate of 1.6%.

While regional inflation is decreasing except in Venezuela and Argentina—both among the top five in countries with the highest inflation rates worldwide—it still impacts operations in the hydrocarbon sector.

In its report “Global Trends in Merger and Acquisition Volume and Value,” PricewaterhouseCoopers (PwC) said Latin America transaction volumes in first-half 2023 increased by 4% compared with second-half 2022 but were 3% lower than first-half 2022. Transaction values remained stable compared with second-half 2022 but were 36% lower than first-half 2022 due to a significant drop in the number of mega transactions.

While macroeconomic conditions will continue to influence transaction activities, there is movement. Mergers and acquisitions “are now a more significant growth engine than in the recent past, and business leaders will use them as a key tool to reposition their businesses, boost growth, and achieve sustained results,” PwC said.

Further, “cash-rich corporations seeking strategic opportunities could be the stars of transactions for the rest of the year, with mergers and acquisitions in the mid-market dominating, and divestitures driving a significant portion of the transaction flow. For buyers, access to capital will be crucial, along with more detailed due diligence, both financially and non-financially.

For sellers, preparation will be the key to success,” the firm continued.

Transactions carried out by foreign buyers represented 58% of first-half 2023 total volume, returning to the trend observed in 2019 and previous years, according to PwC.

Problems

Gonzalo Chiarullo, chief executive officer of Número Bursátil, said the main difficulty in Latin America is related to corporate governance, “which is in its infancy in the region.” Its implementation, he said, along with off balance-sheet sales and the strong influence of unions, forms a complex problem for investors.

“For local entrepreneurs, corporate governance is perceived as a regulatory obligation, whereas international investors demand high standards before investing. Establishing a board of directors that emphasizes control and compliance, objective member selection, and shareholder asset protection is an emerging process in South America,” he said.

Other difficulties, including high tax burdens, underdeveloped infrastructure, and bureaucracy encourage underreporting of domestic sales that not only affects current and future shareholders, but also complicates mergers and acquisitions in the region, he said.

According to Chiarullo, bringing corporate governance up to the standards needed to attract investments requires a years-long, comprehensive process. Latin American companies seeking deals with capital from the US or Europe would need to restructure contracts, regulations, and finances to meet international standards.

The limited presence of financial players, especially in Argentina, also contrasts with the rise of private equity buyers globally.

Deals overview

There were 68 M&A transactions across all industries in Latin America in first-half 2023, according to Bloomberg. Of those deals, 23 have been completed, 16 are pending, 27 are under consideration, and one has been canceled. Of the total deal value of $8.3 billion, $6.3 billion can be attributed to the energy sector.

Completed transactions included a few notable deals:

- 3R Potiguar acquired assets offshore Brazil from Petrobras for $1.48 billion.

- Brazilian oil and gas company Enauta Energia SA signed a $465-million deal with Yinson Acacia Ltd. for provision, operation, and maintenance of a floating production, storage and offloading (FPSO) vessel in Atlanta field, Santos basin. Atlanta lies in 1,500 m of water and has estimated reserves of 106 million bbl.

- Canada-based LNG Energy Group Inc. acquired Lewis Energy Colombia (LEC) Inc. for $100 million.

- Zamajal SA de CV, a wholly owned subsidiary of Grupo Carso, Mexico City, acquired a 49.9% interest in Talos Energy Inc.’s Mexican subsidiary, which holds Talos’s 17.4% stake in the Petróleos Mexicanos (Pemex)-operated Zama field, for $124.75 million.

An asset exchange by Argentina’s Pampa Energía SA also stands out. The company acquired a 45% stake in the Rincón de Aranda shale oil area in Vaca Muerta in June 2023, transferring the Mario Cebreiro wind park to Total Energies SE unit Total Austral.

Pampa Energía now is set to invest $200 million to develop a pilot shale oil project at Rincón de Aranda, the natural gas and electricity company’s first foray into the petroleum sector.

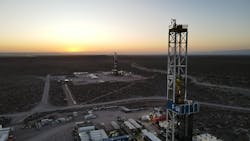

Argentina’s economic volatility and uncertainty will persist in 2024, potentially leading to the departure of multinational companies. ExxonMobil Corp., for one, is evaluating its interests in seven unconventional oil and gas assets in Argentina’s Neuquén basin, according to an August report by Enverus. Interested counterparties include QatarEnergy, Pan American Energy Corp., Geopark Ltd., and Vista Energy SAB de CV (Fig. 1). Officially, ExxonMobil Exploration Argentina (EMEA) is seeking farm-in investors, but asset sales were not ruled out, an ExxonMobil source told OGJ in early August.

Argentine assets continue to be undervalued compared with their regional and international counterparts. An Argentine company can be worth as much as 60% less than a similar one in the US or Europe.

Some companies are shedding assets due to the country’s macroeconomic and political instability. These include Molecular Energies PLC’s agreement to sell its Argentina oil and gas operations to PLLG Investments Ltd. At the time of the agreement, Robert Shepherd, Molecular Energies’ financial director, said the proposals represented the best interests of the company. “It is clear that the market is not appreciative of investment in Argentina and the current economic and political environment combined with the rampant inflation and severe restrictions on foreign investment have led the independent directors to conclude that the divestment of our Argentine business is appropriate.”

In other deals, Eco (Atlantic) Oil & Gas Ltd. agreed to acquire a 60% stake in the Orinduik license in Guyana from Tullow Oil PLC; Bharat Petroleum Corp. is set to acquire Brazilian assets from Videocon Industries Ltd.; Interoil Exploration and Production ASA and Selva María Oil SA will purchase 65% of Echo Energy PLC’s working interest in Santa Cruz Sur; and Petrolera Aconcagua Energía SA agreed to acquire multiple concessions in Argentina from Vista Energy for $30 million.

Daniel Kerner, executive director for Latin America at risk consultancy Eurasia Group, said that “45% of companies and investors believe that the opportunity for M&A in the region has never been more favorable, but they are not blind to the risks: 35% consider them to be higher than ever.”

An increase in acquisitions is expected over the next 2 years, especially in Latin America, a recent report by KPMG noted. The report detailed expectations of a 60% rise in purchases by private equity funds, a 57% increase in sales by these funds, and a 56% uptick in corporate carve-out sales.

On the other hand, Ernesto Díaz, senior vice-president for Latin America at Rystad Energy, said “the only countries making moves in terms of upstream management are Brazil and Guyana, the only ones growing in production in Latin America. Meanwhile, Colombia, Argentina, and Mexico are facing difficulties.”

Colombia, which faces gas shortages in the next 5 years, is searching for supply. At the time of LNG Energy Group’s acquisition of LEC, the latter was actively developing multiple formations on the north coast of Colombia near infrastructure connected to major gas markets. The deal was partly financed by Macquarie Group, which, in October 2023, also agreed to finance $13.3 million for LEC, now a subsidiary of LNG Energy, to continue work commitment guarantees for its exploration and development blocks in the country.

The deal is an example of one part of the three-prong plan Colombia is using to address its gas shortage, which include imports, development of existing projects, and new offshore discoveries. Colombia’s Ecopetrol SA plans to drill the Orca Norte-1 delimiting well in fourth-quarter 2023, with the aim of verifying its resource potential. Additionally, an Ecopetrol-Gran Tierrra Energy Inc. joint venture plans to invest $123 million to extend the life of mature fields at Suroriente block in Puerto Asís, Putumayo.

Díaz noted a significant difference between Argentina and other countries in Latin America. “Argentine state interventionism is unparalleled in the region. Nowhere else does the government set prices by decree or interfere in private sector contracts as it does in Argentina,” he said, noting the situation hampers development of the country’s oil and gas sector.

“It’s not the same in countries like Guyana, Brazil, Colombia, or Mexico, where some rules of the game can change, taxes or royalties can be increased, thus causing legal uncertainty. The imposition of prices and changes in contract conditions through decrees or resolutions only happen in Argentina and Venezuela.”

Across Latin America, during 2019-23, 54% of M&A transactions were cross-border (a buyer from a different country) and 46% were domestic, according to a report led by Juan Tripier, deals senior manager, PwC Argentina.

“The main cross-border buyers come from the US, Canada, the UK, Spain, Norway, and France (representing about 45% of all cross-border transactions). There were also several cross-border transactions carried out by regional players, mainly from Brazil (Raizen, a bioenergy company in partnership with Shell), Argentina (Pluspetrol), Colombia (Ecopetrol), Mexico (Vista), and Chile (Lipigas), which made investments outside their home countries.”

“Asia is not yet a significant investor in the region,” the report noted, “however, there was notable activity from the United Arab Emirates (Abu Dhabi Investment Council) and China (CNODC). It is worth mentioning that only two transactions were recorded from Chinese players in the last 2 years, indicating that their presence in the oil and gas sector in the region remains relatively limited.”

Financial or private equity investment in the regional industry remains limited. “The oil and gas sector, especially offshore, requires longer-term investments and, in some cases, higher-risk investments, which are often more suitable for strategic investors, especially in a volatile region like Latin America,” the PwC report noted.

About the Author

Camilo Ciruzzi

South America Correspondent

Ciruzzi is a journalist based in the Argentine province of Río Negro. He has over 30 years of experience in radio and print media. Ciruzzi studied Communication Sciences at the University of Buenos Aires and specialized in energy, political economy, and finance.