Comment: Market gives OPEC opportunity to improve oil reserves data

It is time for members of the Organization of Petroleum Exporting Countries to reevaluate their oil reserves and publish more accurate data than they do now. Present market conditions create a unique opportunity for such an improvement by encouraging OPEC members to produce oil at or near capacity rates. These conditions are likely to continue for some time to come, reducing both the relevancy of OPEC quotas and the associated incentive to exaggerate reserves.

Analysis of OPEC oil reserves-more than two thirds of the world’s total-is increasingly important. Knowledge about future global oil production, which may be approaching a peak, and the kind of oil likely to be produced depends greatly on facts about OPEC reserves.

Yet OPEC’s past handling of reserves data creates strong doubt about currently published reserves for the key OPEC members.

While OPEC countries have the right to keep their oil reserves figures confidential, they must realize that oil is a strategic commodity, vital to the world and its economic well-being. OPEC members therefore have a moral and human duty to give accurate data on their oil reserves for their own benefit and for that of the rest of the world.

Future production

It is estimated that 78% of the world’s proved oil reserves are in OPEC countries. More than 60% of global reserves are concentrated in countries around the gulf region of the Middle East.

Much research has been done regarding present oil reserves and the prospect of future oil supplies. One of the concepts is “peak oil.” Some analysts believe that global production of oil, a finite resource, will have a beginning, middle, and end and that at some point it will reach a level of maximum output, after which it must decline.

According to this theory, oil production follows a bell-shaped curve, with the peak production occurring when approximately half of the oil has been extracted. This may happen to a single well, an oil field, an entire region, and perhaps the world. Consequently, oil becomes more difficult and expensive to extract.

Supporting this theory is the correct prediction by M. King Hubbert in 1956 that US production would peak in the late 1960s. Production did peak in 1970 and declined thereafter regardless of the oil price and improved technology.

The subject of peak oil has been well researched.1 And forecasts have appeared in the general media that a production peak will happen as early as next year, making oil more expensive.2 3

A peaking of oil production would have major economic consequences in a world that depends heavily on cheap oil, especially in markets such as transportation, lubricants, and petrochemicals where oil cannot be replaced easily.

It is therefore the duty of oil researchers to try to determine whether currently published figures for world oil reserves are reliable and accurate and can be used to determine the future of global oil supplies.

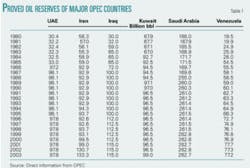

Analysis of reserves and production data from some of the major oil-producing countries raises serious questions (Tables 1 and 2).

Reserves questions

A striking and often-observed feature of the reserves data in Table 1 is the series of sudden increases by several OPEC members in the 1980s. For example:

• In the UAE in 1986 oil reserves increased by more than 64 billion bbl.

• In Iran in 1986 oil reserves increased by 34 billion bbl.

• In Iraq in 1987 oil reserves increased by 28 billion bbl.

• In Kuwait in 1984 oil reserves increased by 26 billion bbl.

• In Saudi Arabia in 1988 oil reserves increased by 85 billion bbl.

Thus, between 1984 and 1988 oil reserves in these countries increased by 237 billion bbl.

One of the explanations for the huge increases in oil reserves in just 5 years is that these countries were seeking increased production quotas from OPEC. At the time, an individual country’s quota was in part determined by its reserves.

Another observation from Table 1 is that reserves in some gulf OPEC countries remained exactly the same over many years. Examples:

• During 1987-95 total oil reserves in the UAE remained at 98.1 billion bbl, while during 1996-2003 they remained at 97.8 billion bbl.

• In Iran during 1986-93 total oil reserves remained at 92.9 billion bbl.

• In Iraq total oil reserves during 1987-95 remained at 100 billion bbl.

• In Kuwait total oil reserves during 1991-2002 remained at 96.5 billion bbl.

• In Saudi Arabia during 1991-98 total oil reserves remained almost the same at around 261 billion bbl.

What explanations can these countries give for such long periods without changes to their reserves?

Production confusing

The picture is even more confusing when oil production in these countries is taken into consideration as shown in Table 2. Examples:

• In Kuwait total oil reserves remained unchanged at 96.5 billion bbl during 1991-2002, while oil production totaled 7.75764 billion bbl.

• In the UAE during 1987-95 total oil reserves remained at 98.1 billion bbl, while production totaled 6.65433 billion bbl. A similar situation occurred in 1996-2004, when total oil reserves remained at 97.8 billion bbl, while oil production totaled 7.22374 billion bbl.

• In Iran total oil reserves of 92.9 billion bbl remained exactly the same during 1986-93, while production totaled 8.31837 billion bbl.

• In Iraq total oil reserves remained at 100 billion bbl during 1987-95, while production totaled 4.33301 billion bbl.

• In Venezuela total oil reserves during 1999-2003 averaged 77.2 billion bbl, while total production was 4.7764 billion bbl.

• In Saudi Arabia total oil reserves remained at an average of 261.4 billion bbl during 1991-97, while total production in these 7 years was 20.86378 billion bbl.

What exactly happened in these countries in the specified periods? Was it possible that oil reserves were increasing by exactly the same amount of oil production? There is large doubt about this.

Where do we go from here? The world needs to know the truth about these figures. This does not apply to OPEC alone. Non-OPEC countries as well as international oil companies must give accurate and honest accounts of their total oil reserves.

The world also must know the percentage of heavy oil in total reserves. This is very important for planers of oil refineries to determine what kind of processing capacity will be required to meet future demand for oil products.

Signs of peak

Signs have appeared that a peaking of oil production already may have started and that the era of cheap oil may be coming to an end sooner rather than later.

During the last 3 years annual global oil demand increased by very high levels of about 2 million b/d due to the rapid growth in the economic development of Far East countries, including China and India, as well as of the US.

In those 3 years, world oil production did not match the increase in demand; consequently, surplus global production capacity dwindled to 1.5 million b/d, mainly in Saudi Arabia. However, most of this capacity is heavy crude. The oil market suffers from the shortage of light crude and light oil products, particularly in the US.

It is not easy to increase oil production for two reasons: 1. The oil industry is capital-intensive and needs huge investments, and 2. lead times in the oil industry are relatively long-in the range of 3-10 years from when oil is found to when oil products from the discovery reach the consumer.

The International Energy Agency estimates that in the next 25 years global oil demand will increase by 40 million b/d. It is doubtful that world oil production will increase by the same amount. For example, Saudi Arabia, which reports reserves of more than 260 billion bbl, plans to expand production capacity only from its present 11 million b/d to 12.5 million b/d by 2009 and 15 million b/d by 2020. Where will the rest of the oil supplies come from to meet the expected increase in global oil demand?

It is therefore very possible that the peak-oil phenomenon will start soon and that oil prices exceeding $50/bbl may indicate the beginning of the end of cheap oil.

Dialog needed

The only logical way to prepare for a potential oil crisis is through a dialog among consumers and producers about future oil production, reserves, crude quality, and the adequacy of currently available data.

Saudi Arabia is aware of the need for such a dialog. Several years ago it established an institute in Riyadh for this purpose. Regretfully, the institute has produced little tangible work and will not be effective and creative as long as it has no mechanism to implement and enforce its decisions.

Yet the timing is good for that or a similar forum to work toward real improvement in the quality of reserves data. With its member countries likely to be producing at or near capacity levels for some time, OPEC has little motivation to apply its production quotas. The members, in turn, have diminished motivation to use reserves estimates to influence quota assignments.

The opportunity is therefore at hand for OPEC members to address the reliability of the reserves data they report and to make improvements where necessary. The importance of reserves data to understanding and preparing for peak oil production makes those improvements vital to the world. ✦

References

1. For example, see www.peakoil.net.

2. Vidal, J., “The end of oil is closer than you think,” The Guardian, Apr. 21, 2005.

3. Legget, J., “The twilight zone,” The Independent, Apr. 25, 2005.

The author

Ali Hussain is an honors graduate in economics and political science of Baghdad University and holds MA and PhD degrees in oil industry economics from Exeter University of the UK. He served as a professor of economics at Baghdad University and Al Mustansiriyah University in Iraq in 1974-76, as a senior researcher at the Ministry of Oil in Iraq in 1976-81, and as a senior researcher in the Economics and Finance Department of OPEC in Vienna in 1981-86. From 1986 to 1995 he worked in the international oil industry, where he organized a number of scientific symposia and participated in numerous international conferences in the fields of international energy markets and the role of OPEC in these markets. He has worked as a consultant since 1995. His e-mail address is [email protected].