ExxonMobil group outlines Hebron development details

The Hebron project on the Grand Banks off eastern Canada should start producing by the end of 2017 and recover 566 million bbl of oil over a 30-year productive life, said project operator ExxonMobil Canada Properties.

The partners expected to decide in the first half of 2009 whether they will predrill wells, the company said in a project description filed with the Canada-Newfoundland and Labrador Offshore Petroleum Board.

The project will involve development of Hebron, Ben Nevis, and West Ben Nevis fields in the Hebron Unit in 289-335 ft of water in the Jeanne d’Arc basin 211 miles east-southeast of St. John’s, Newf., and 5½ miles north of giant Terra Nova oil and gas field (Fig. 1).

The province previously said production would begin as early as 2016 and build to 150,000 b/d in 2 years (OGJ Online, Feb. 2, 2009).

Development outline

Initial development will involve Hebron field only, but the unit includes four significant discovery license areas, 1006, 1007, 1009, and 1010.

The four SDLs contain the most likely extent of the oil for the delineated pools in the Hebron Unit, said the project description, filed in part to support environmental studies.

“The Hebron Unit could be expanded if additional studies, seismic or exploration and/or delineation drilling proves that economically recoverable oil pool accumulations extend beyond the currently envisioned boundaries” of the unit, the company said.

A stand-alone, reinforced gravity-based structure would be used to develop the giant field with water injection as the main drive mechanism. That facility would be built at Bull Arm on Trinity Bay 130 km northwest of St. John’s.

Produced gas could be used for artificial lift, production assist in secondary oil reservoirs, and for water-alternating-gas injection to improve recovery in primary producing intervals.

Interests in the four SDLs that comprise the Hebron unit are ExxonMobil Canada Properties 36%, Chevron Canada Ltd. 26.7%, Petro-Canada 22.7%, and StatoilHydro Canada Ltd. 9.7%. The government’s 4.9% stake is held by Nalcor Energy-Oil & Gas Inc., formerly Oil and Gas Corp. of Newfoundland and Labrador.

Hebron reservoirs

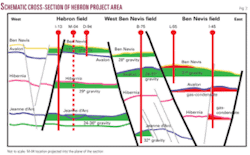

Unit wells have encountered several reservoirs (Fig. 2):

Hebron field: Ben Nevis reservoir, including the fault block penetrated by the D-94 and M-04 wells, and the fault block penetrated by the I-13 well; the Lower Cretaceous Hibernia reservoir, defined by the I-13 and M-04 wells; and the Upper Jurassic Jeanne d’Arc reservoir, including the isolated B, D, G, and H hydrocarbon-bearing sands, defined by the I-13 and M-04 wells.

West Ben Nevis field: Ben Nevis reservoir, penetrated by the B-75 well; Lower Cretaceous Avalon reservoir, defined by the B-75 well; and Jeanne d’Arc reservoir, penetrated by the B-75 well.

Ben Nevis field: Ben Nevis reservoir, defined by the L-55 and I-45 wells; and the Avalon and Hibernia reservoirs penetrated by the I-45 well.

The Ben Nevis pool in Hebron field is likely to yield 80% of the field’s total oil, even though its 20° gravity oil is 10-20 times as viscous as water and reservoir quality is lower than that in Hibernia or Terra Nova fields.

Relative to the Hebron Ben Nevis pool, the Hebron Jeanne d’Arc and Hebron Hibernia pools have higher oil quality, poorer reservoir quality, lower recovery factors, and higher development costs.

Development details

Start-up could occur in 2017 if regulatory approvals were received in 2011 and the partners sanctioned the project in 2012.

The partners visualize a base case development of 35-45 wells, of which 13 could be predrilled. Drilling would continue at least through 2025.

A glory hole would not be used if wells are predrilled because the risk of exposure to potential ice damage for 2-3 years is much lower than for the predicted well life of 20-40 years.

“In addition to the base case development, there is opportunity for the development of additional pools in the Hebron Project Area, depending on the drilling results, production performance (of wells from the initial development), studies, possible delineation wells, new seismic data or some combination of these,” the filing said. For example, the Ben Nevis reservoir in Ben Nevis field could be part of an optional later phase of development subject to filing a supplemental development plan. In that case, the total number of wells could grow to 70 or more.

Gas potential

Gas-oil ratio of Hebron field fluids is relatively low, but ExxonMobil expects the gas yield to exceed what is needed to facilitate oil production.

The partners are developing a gas management plan that will take into account a number of considerations including:

- Utilization of gas for artificial lift in the producing wells.

- Injection of excess produced gas into secondary reservoirs such as the Ben Nevis pool at West Ben Nevis field.

- Potential need to produce back injected gas later in field life.

- Gas injection into primary producing intervals to improve oil recovery, such as water alternating gas injection.