Cost looms over hydrogen’s role in energy transition

Achieving the decarbonization targets of the Paris Agreement will require that hydrogen meet 15% of global energy demand by 2050. Current forecasts by DNV, however, predict that hydrogen use by then will total roughly one-third of that amount, with the primary impediment being cost.

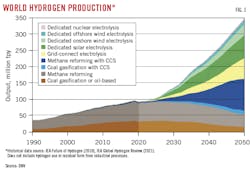

To reach even these levels of production will require outlays approaching $7 trillion, according to DNV, with another $530 billion needed for ammonia terminals and $180 billion for pipelines. Most of the hydrogen produced, 61%, will be used in manufacturing. Fig. 1 shows hydrogen production by type.

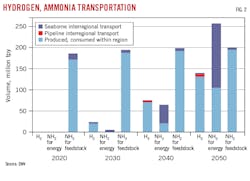

DNV also projects that between them, hydrogen (14%) and ammonia (35%) will make up nearly half of the global shipping-fuel mix by 2050. Seaborne shipments of ammonia over this period will increase 20-fold, reaching 150-million tonnes/year (tpy).

These are the most likely outcomes. Reaching the hydrogen targets required to get to net-zero instead will be even more expensive, with one of the largest costs being transportation. Dedicated pipelines to deliver sufficient hydrogen produced via grid-based electrolysis to reach net-zero by 2050 will require $1.35 trillion, with an additional $1.7 trillion needed to build the production systems themselves. DNV notes that further investments will need to be made for any dedicated hydrogen production from renewable power and for build-out of associated infrastructure for integration of this production into hydrogen supply chains.

Initial pipeline transport of hydrogen for heating purposes will likely be achieved by blending it into the natural gas system. This can be done up to a 20% hydrogen concentration. Finished hydrogen will be readily shippable on modified pipelines, but the bulk of international trade will be seaborne as ammonia (Fig. 2).

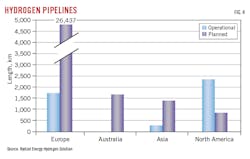

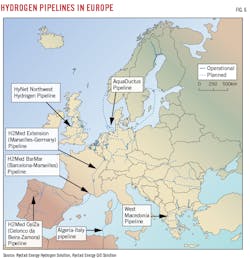

More than 4,300 km of hydrogen pipeline are already in place, with 90% of it in Europe and North America, according to Rystad, which estimates that about 91 planned hydrogen pipeline projects totaling 30,300 km will enter service globally by 2035.

DNV estimates that more than 50% of hydrogen pipelines globally will be repurposed from natural gas service. Cost considerations will be the primary driver, with gas pipeline conversion expected to cost as little as one-tenth as much as new construction.

The primary factor to be overcome in repurposing pipe for hydrogen service is hydrogen embrittlement. Polyethylene coatings and sleeves offer a potential solution but have yet to be tested at-scale.

Global activity

DNV expects Latin America to become a major hydrogen exporter, supported by the low levelized cost of hydrogen production and the region’s solar and wind power potential. Of the 25 million tonnes/year expected to be produced in the region by 2050, about 75% will be exported as ammonia and almost half will be shipped to North America. DNV anticipates that portions of South America’s natural gas pipeline network will be repurposed to deliver hydrogen to coastal plants for conversion to ammonia and export.

Similar to Latin America, DNV sees the Middle East and North Africa’s availability of broad swathes of territory for potential renewables development as an advantage in terms of becoming a global hydrogen supplier, particularly when the region’s already plentiful natural gas resources and advantageous geographic position are also considered. It projects about 1.5 million tpy of hydrogen to be shipped to Europe and the Indian subcontinent by 2050, mostly by pipeline from North Africa, and about 12 million tpy of ammonia to travel from the region by ship to other destinations.5

Europe’s approach to hydrogen varies by country, with some (Germany) expected to become large-scale importers and others (France, Italy, Denmark, Spain) planning large additions to production capacity. Electrolyzer production-capacity targets in place for 2030 range from 4 Gw in Spain to 6.5 Gw in France.

Germany has been planning its recent spate of LNG import terminal projects to be adaptable for future ammonia deliveries. The country is also targeting 5 Gw of domestic hydrogen production by 2030.

Spain, France, and Germany are among the countries committed or considering cross-border hydrogen pipelines, according to Rystad, while the UK with its extensive gas grid is well-positioned to switch from natural gas to hydrogen.

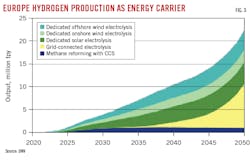

A 1-Gw electrolyzer will produce 150,000-182,500 tpy of hydrogen. European Union (EU) targets are for at least 40 Gw of electrolyzer capacity to be in place by 2030 (compared with 6 Gw by 2024). DNV, however, sees total production of pure hydrogen as an energy carrier falling short of these goals, reaching 3.5 million tpy in 2030 and 23 million tpy by 2050 (Fig. 3).

The EU also plans to reach 10 million tpy of domestic renewable hydrogen production and 10 million tpy of renewably sourced imports, both by 2030. Rystad expects Europe’s green hydrogen production to reach 7.9 million tpy by the target date, with imports reaching 5.4 million tpy: 3.4 million tpy from Africa and 1 million tpy each from the Middle East and UK-Norway.

A group of 31 European gas transmission system operators has come together to form the European hydrogen backbone (EHB) initiative to make sure the region comes as close as it can to hitting these targets. EHB anticipates roughly 28,000 km of hydrogen pipeline to be in place by 2030 (Fig. 4) and 53,000 km by 2040, with 60% of the latter number made up of repurposed natural gas line. Rystad expects EHB to reach 83% of its 2030 target.

“The steady increase in pipeline projects for hydrogen is an early sign that the energy transition is gathering pace,” says Rystad’s senior analyst for hydrogen, Lein Mann Bergsmark. “Europe, with its extensive gas grid is well placed to make the jump. Switching infrastructure from gas to hydrogen is possible and cost effective. But the greatest barrier is not financial, but the physical properties of hydrogen itself which differ substantially from oil and gas.”

Hydrogen demand in Organization for Economic Cooperation and Development (OECD) Pacific countries (Australia, New Zealand, Japan, and South Korea) will more than double to 15 million tpy by 2050, from less than 8 million tpy in 2020, according to DNV. Supply is expected to roughly match this demand, with a shortfall of roughly 1.5 million tpy expected to be imported from China.

Ammonia’s regional demand growth will be roughly equivalent to hydrogen, reaching about 12 million tpy by 2050, mostly as an energy carrier. Limited production, however, will lead to 8 million tpy of this being imported by 2050 (Fig. 5).6

US

The approach to hydrogen development in the US has centered on hubs. The Infrastructure Investment and Jobs Act (IIJA, 2021), authorized a program of regional clean hydrogen hubs. Congress appropriated $8 billion for the Department of Energy (DOE) to make awards to support at least four demonstration projects involving networks of clean hydrogen producers and consumers and the connecting infrastructure.

DOE’s hydrogen program includes more than 400 projects spanning research and development (R&D), systems integration, demonstrations, and initial deployment activities by universities, national laboratories, and industry. DOE says the regional clean hydrogen hubs authorized in IIJA will validate the claimed benefits (environmental and otherwise) of the hydrogen economy and identify technology needs.

The department launched an initial funding opportunity in September 2022, planning to select 6-10 regional hubs with combined total funding of $6-7 billion and a “preferred maximum” of $1.25 billion/hub. The balance of the $8 billion appropriated for the hubs would be reserved for additional hubs or other supporting activities. The department is requiring a minimum 50% cost share from nonfederal sources and anticipates that projects will be executed over 8-12 years.

Concept papers were due Nov. 7, 2022, and full funding applications Apr. 7, 2023. State governments, many in combination with private-sector entities and one or more other states, have announced interest in more than 20 hydrogen hubs and stated their intention to apply for funding. At least four private alliances also declared interest in pursuing regional clean hydrogen hubs (OGJ Online, Dec. 5, 2022).

HyVelocity Hub—a US Gulf Coast hydrogen hub being organized by Chevron Corp., Sempra Infrastructure, Ørsted AS, Air Liquide SA, GTI Energy, AES Corp., ExxonMobil Corp., and Mitsubishi Power Ltd., among others—was among the projects to apply for DOE funding. Its project would be centered on the US Gulf Coast of Texas and Louisiana.

This stretch of Gulf Coast already contains the world’s largest concentration of hydrogen production, customers, and energy infrastructure, with a network of 48 hydrogen production plants and more than 1,000 miles of dedicated hydrogen pipelines.

HyVelocity’s plans will accelerate DOE’s clean hydrogen policy goals, including its Hydrogen Shot, which seeks to decrease carbon emissions to not more than 2 kg of carbon per 1 kg of hydrogen produced, and reduce the cost of clean hydrogen by 80% to $1/kg in 1 decade. To this end, HyVelocity is collaborating with several other proposed regional hubs to facilitate an interconnected, national framework for hydrogen production and end use (OGJ Online, Apr. 10, 2023).

Chevron also has entered into a joint study agreement with Angelicoussis Group, through its energy transition division, Green Ships, to explore how tankers can be used to transport ammonia. The study will evaluate the ammonia transportation market, existing infrastructure, the safety aspects of ammonia, potential next-generation vessel requirements, and a preliminary system to transport ammonia between the US Gulf Coast and Europe.

Chevron last year formed a consortium with Air Liquide, LyondellBasell Industries NV, and Uniper SE to evaluate development of hydrogen and ammonia production infrastructure along the US Gulf Coast (OGJ Online, Oct. 19, 2022).

One of the furthest advanced production portions of these efforts is ExxonMobil’s plans to build a 1-bcfd low-carbon hydrogen production plant and 7-million tpy carbon capture and storage system at its 561,000-b/d integrated refining and petrochemical complex in Baytown, Tex. Announced in March 2022, the project would use hydrogen produced by the plant as fuel for Baytown’s olefins plant, reducing the total complex’s Scope 1 and Scope 2 CO2 emissions by as much as 30%.

ExxonMobil doesn’t plan to take final investment decision on the project until 2024 but is already in discussions with potential offtake customers for surplus volumes, with 2027-28 timing. It has also contracted with Technip Energies for front-end engineering and design of the project.

Most recently, the operator let Topsoe AS and Honeywell UOP LLC contracts to deliver technologies for the project. Topsoe will license its SynCOR hydrogen technology that will enable production of low-carbon (blue) hydrogen by converting natural gas into hydrogen and carbon dioxide (CO2) in the presence of steam. It will also serve as the project’s technology integrator, including guaranteeing the carbon intensity of both the hydrogen produced and carbon captured. Honeywell will license its CO2 fractionation and hydrogen purification systems to the project (OGJ, Mar. 6, 2023).

Bibliography

DNV, “Energy Transition Outlook 2022, A global and regional forecast to 2050,” Oct. 13, 2022.

DNV, “Energy Transition Outlook 2022, Executive Summary,” Oct. 13, 2022.

Rystad Energy, “Building the Future: hydrogen pipelines start to materialize in Europe,” Apr. 3, 2023.

Satyapal, S., “2022 AMR Plenary Session,” June 6, 2022.

Satyapal, S., testimony during US Senate Energy and Natural Resources Committee Clean Hydrogen hearing, 117th Congress, 2nd Session, Feb. 10, 2022.

US Department of Energy, “Bipartisan Infrastructure Law: Additional Clean Hydrogen Programs (Section 40314): Regional Clean AHydrogen Hubs Funding Opportunity Announcement,” DE-FOA-0002779, Sept. 22, 2022.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.