Rystad Energy: US shale bankruptcies not ‘industry-wide epidemic’

Despite a wave of financial adversity that has tormented US onshore E&P companies lately, Rystad Energy does not view this as a harbinger of doom for the shale industry’s future.

“In a nutshell, we do not believe the recent bankruptcies that have beset a number of shale players are indicative of an industry-wide epidemic,” says Alisa Lukash, a senior analyst on Rystad Energy’s North American shale team.

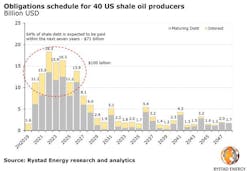

During the next 7 years, the top 40 US shale oil producers are expected to spend about $100 billion on debt instalments and interest unless further debt refinancing is applied.

These drillers, which accounted for nearly half of US shale crude production in 2018, are facing interest payments of $2.6-5.1 billion/year, while the maturities schedule totals roughly $71 billion during 2020-26.

During this year’s first half, this peer group generated $23.7 billion in cash flow from operations while spending $28 billion on capital expenditures. Overall the considered peer group has more than $112 billion in outstanding debt, with a combined enterprise value of $355.5 billion as of September.

“These numbers indicate a lack of financing to deal with the burden of the obligations. Given the low levels of external capital additions during the past 10 months, the probability of debt refinancing in the coming quarters seems relatively slim,” Lukash noted.

Rystad Energy expects further acreage restructuring and merger and acquisition activity in the industry, but emphasizes that many operators have managed to combine production growth with balanced spending and debt reductions.

“One should be careful about extrapolating based on a few distressed companies. The peer group is very diverse both in terms of acreage quality and in capital efficiency,” Lukash said.