C3 processing margins hold firm; prices drop

Fourth-Quarter 2004

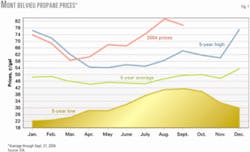

Energy and propane prices declined in fourth-quarter 2004, while US Gulf Coast processing margins remained strong. Average spot prices declined to 78¢/gal at Mont Belvieu, Tex., and 82.4¢/gal at Conway, Kan. West Texas Intermediate (WTI) prices declined to $43/bbl.

Propane stocks continued to run above normal. Petrochemical demand increased to 375,000 b/d in November.

Extraction rates continued at below average rates of less than 525,000 b/d. A month ago, January natural gas bid week prices were on track to average $6.50-6.75/MMbtu on the Texas Gulf Coast. Refinery production continued at below normal rates of less than 330,000 b/d. Imports remained strong at nearly 200,000 b/d in the fourth quarter.

Pricing

Energy prices continued to soften from November averages with WTI down 11.5% and propane down 10-11% at Mont Belvieu and Conway (Fig. 1). Few of the reasons for this decline are logical.

Slowness in weather-related demand for heating oil and propane has been real; but as usual, the markets overreacted to 1 week's worth of data or one short-term weather forecast. The fundamentals have not changed significantly; US and world demand continues to be strong: Motor gasoline and distillate consumption is at or near record levels and weather-related demand for propane and natural gas is increasing. Bullish propane prices are caused by refinery propane production hitting 5-year lows.

Other factors include the continuing weakness of the US dollar against the Euro, which is important because world crude is valued in US dollars; high energy consumption in India and China; the Russian situation with Yukos; increasing winter-related demand in Europe and elsewhere; and potential terrorist disruptions of energy supplies. In addition, unregulated hedge funds have increased dramatically the volatility in world energy markets.

The transition, therefore, from season-to-season pricing will not be smooth. Propane will be more competitive with No. 2 heating oil, especially on the US East Coast.

The latest weekly data show heating oil stocks at 49.9 million bbl, near a 5-year low, which could push prices higher with extended cold weather. Prices could have increased in January, but the bounce would be short lived if it did occur.

In the intermediate term, prices should weaken moderately through the summer with significant price volatility. Energy demand will continue to be strong as the economy matures through this business cycle.

At the end of 2004, the propane-to-No. 2 ratio increased to 1.1:1 on a ¢/btu basis. The average propane-to-WTI ratio was 76.3% (spot C3 cash prices vs. crude futures).

Propane supply

Processing margins remained strong on the US Gulf Coast in fourth-quarter 2004 at more than 20¢/gal; fractionation spreads continued at more than 35¢/gal (Fig. 2). Despite these prices, propane extraction fell to new 5-year lows, less than 525,000 b/d, according to the US Department of Energy's Energy Information Administration (EIA). This suggests that the outages caused by Hurricane Ivan have taken 15-20,000 b/d out of current supply.

More than 550 MMcfd of natural gas production are still offline and may not come back until the end of first-quarter 2005. We therefore lowered our forecast for propane extraction levels by this amount until February.

Imports from Canada and offshore have fortunately made up this 600,000 bbl/month loss. As the year began, natural gas bid-week averages for January appeared ready to settle between $6.50-6.75/MMbtu, which will allow processing margins to continue at 8-10¢/gal. Anadarko Basin margins should reach 10-12¢/gal.

After this month, margins will increase gradually to more than 15¢/gal and extraction levels will return to 530-535,000 b/d through late spring.

The latest natural gas draw of 151 bcf left nearly 2.7 tcf of working gas in storage as of Dec. 31, 2004, which is 279 bcf above our 5-year average. Our projections, based on average weekly changes, would put the 2005 storage build peak at 3.45 tcf, a new record high.

Fourth-quarter 2004 refinery production experienced continued weakness of less than 330,000 b/d because high-severity processing increased the propylene in refinery C3s. Imports remained strong at nearly 200,000 b/d during fourth quarter.

Marine propane imports, exports

Waterborne imports of 2.3 million bbl were scheduled for December 2004.1 As is normal for this time of year, 83% of those cargoes were destined for the US East Coast. January 2005 imports, as of early last month, were on tract to reach nearly 1.2 million bbl, all of which are headed for the US East Coast.

The K/D/S Promix LLC fractionator, Napoleonville, La., has the capacity to fractionate up to 145,000 b/d of mixed NGLs. Promix is a 50/50 joint venture of Dow Chemical Co. and Enterprise Products Partners LP, which operates the facility.

Spot price netbacks for the western Mediterranean Sea and the Atlantic North Sea were strongly negative at -$25 to –$31/tonne into the US Gulf Coast. Spot price netbacks into the US East Coast were $4/tonne from the western Mediterranean and –$7/tonne from the Atlantic North Sea. These conditions make it likely that only contract cargoes will move to the US.

Waterborne exports continued to be insignificant at less than 10,000 b/d through yearend 2004. Total exports averaged about 25-35,000 b/d.

Petrochemical demand

The improvement in cracking economics that began in November 2004 continued into December; cash costs dropped nearly 5¢/lb of ethylene for the lightest feedstocks. Natural gasolines, refinery raffinate, naphthas, and ethane-propane mix were the best feedstocks, but high-purity ethane and propane were also profitable. The price increases that occurred 2 months ago have helped significantly.

For the sixth month in a row, total feedstock demand averaged nearly 1.8 million b/d in December.2 Propane demand increased in November to 375,000 b/d and should continue at that level or higher in December. Continued weakness in the US dollar has helped the petrochemical industry tremendously and will continue to do so because it partially offsets high feedstock and natural gas costs, and the recent monomer price increases. Propane demand for the fourth quarter 2004 will likely settle to be 357,000 b/d.

US propane inventories

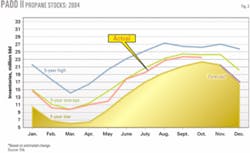

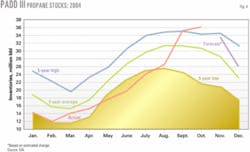

Inventories at the end of October 2004 hit a new 5-year high of 68.4 million bbl, according to EIA.3 Similar to September, the final number was adjusted from weekly data, but this time it was adjusted upward by nearly 1 million bbl. These adjustments are effectively insignificant at these stock levels, but they do indicate that the weekly data are indeed preliminary.

Stocks had declined significantly by yearend 2004 to 52 million bbl, but this is still 2 million bbl greater than the 5-year average. The largest inventory draw will be due to petrochemical demand, but demand due to space heating will increase in January and February.

Despite the expected strong consumption, end-of-winter stock levels should be higher than previously expected, about 28-29 million bbl (Table 1). This should have provided some upward support for prices early in the New Year but will dissipate rapidly due to lower demand unless crude oil prices surge again.

Regional inventories

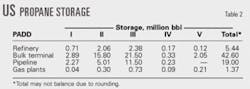

Table 2 shows propane storage at the end of October 2004.

PADD I stocks increased to 5.9 million bbl in October and continued a 4-month trend of remaining above average. Waterborne imports are still helping to maintain stocks at comfortable levels. Stocks will have remained above normal through yearend even though colder weather should have accelerated drawdowns.

PADD II stocks were at normal levels in October with total primary storage of 23.2 million bbl (Fig. 3) despite a large demand from crop drying. Colder weather will have drawn stocks down to 17 million bbl by yearend, the lower end of its normal range. Space heating demand should have then accelerated through January, possibly pushing stocks down to 12 million bbl. Imports from Canada and the US Gulf Coast will be needed to maintain reasonable markets. Large price spreads should encourage imports into the region.

PADD III stocks increased to 36.1 million bbl, a new 5-year high, at the end of October even though petrochemical demand was strong. Despite the expected significant draws through yearend 2004 led by stronger petrochemical demand, stocks will likely have ended the year above average at 26 million bbl (Fig. 4). This accounts for outflows to the Midcontinent.

Canadian inventories

Stocks decreased at a smaller-than-normal rate of 750,000 bbl in November, helped somewhat by milder fall weather, according to Canada's National Energy Board.4 The normal draw is 1.1 million bbl. This left Canadian stocks at their 5-year average of 8.6 million bbl and should minimize any concerns about adequate winter supplies.

Much cooler weather, in addition to exports to the US Midcontinent, should decrease stocks at a faster rate during the rest of the winter. During December, the split between Eastern and Western Canada had a better balance of 52:48. Eastward flows should slow now that inventories have been established there. Extraction rates should be strong due to strong incentives from demand and pricing. F

References

1. "Waterborne LPG Report," Commercial Services Inc., Dec. 22, 2004.

2. "Hodson Report," Jacobs Consultancy, December 2004.

3. "Petroleum Supply Monthly," US Energy Information Administration, Washington, DC, October 2004.

4. "LPG Underground Inventories in Canada," National Energy Board, December 2004.

The author

Michael Horvath Jr. ([email protected]) is president of M. Horvath & Associates, Houston, and author of The Propane Market Strategy Letter. He served as director of business development at Tauber Oil Co. until retiring in early 2004. Horvath has more than 35 years' experience in the NGL, petrochemical, and consulting businesses. He holds a BS (1972) in chemistry and mathematics from the University of Houston and has taken postgraduate courses in business law and economics. Horvath is a member and past chairman of the Houston Chapter of the Gas Processors Association and the Gas Processors Suppliers Association.