PetroIndex: Independents thriving on high oil, gas prices

The price for West Texas Intermediate crude oil posted prices has averaged $33.41/ bbl for the first half of this year compared with $28.15/bbl for the same time last year.

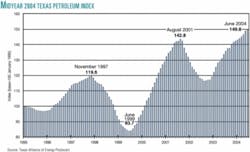

The average price for the last 12 months was more than $30/bbl for the first time in the history of the Texas Alliance PetroIndex, sponsored by the Texas Alliance of Energy Producers, Wichita Falls, Tex.

The index reflects a composite number of more than 20 Texas oil and gas production and exploration indicators.

"As opposed to previous periods in which prices for crude oil and natural gas spikedUthe current price scenario is one of measured, steady improvement over time, allowing for the slow, healthy buildup of activity. And what it has done in Texas is to give the state's independent companies their first real opportunity—since the shakeout resulting in the departure of the majors from the Texas [E&P] scene—to establish a strong foothold and begin to thrive and prosper," Karr Ingham, petroleum economist and president of Amarillo, Tex.-based Economic Reporting, told a news conference July 22.

For the index oil price, Ingham uses average WTI postings. For gas, he averages first-of-the-month prices from Waha Hub and the Houston Ship Channel.

The average spot gas price for the first half of the year has been $5.45/ Mcf compared with $5.63/Mcf for the same period last year.

Index trends

The monthly index is based at 100 in January 1995. For June, the index was 149.8, which is the highest since August 2001 when the index was 142.8. Ingham expects the index will break 150 this summer. Regarding a yearend index forecast, Ingham forecast that the December index would be 158 or 159.

"The world may well be entering a new phase of energy economics, in which rapidly rising demand may outpace the supply of crude oil and natural gas on a virtually continual basis. This is the recipe, in fact, for what is now occurring—sustained strong prices, arrived at steadily over time.

"And that, in turn, is the recipe for solving the industry's traditional problems—short, troublesome cycles; labor and equipment shortages; and volatile, unreliable pricing trends," Ingham said.

Ingham anticipates a leveling off of the index statistics because energy commodity prices are remaining higher for longer periods. "It's been relatively steady in this cycle," he said. "We've moving out of a recovery into a steady period."