Peak oil models forecast China’s oil supply, demand

Peak oil models show a widening gap between China’s oil demand and production. The generalized Weng model predicts a peak oil production in China of 196 million tonnes in 2026 and the Hubbert model indicates a peak oil demand in 2034 of 633 million tonnes.

Because forecasts indicate a widening gap between production and demand, China’s government is undertaking various measures to reduce this gap and more measures will be needed in the future. In 2006, China imported 47% of the oil it consumed.

For predicting future oil production and demand in China, this article shows the results of three peak oil models: Hubbert, Generalized Weng, and HCZ.

Peak oil models

The Hubbert model, first published by M.K. Hubbert in 1962, correctly forecast the oil peak in the Lower 48 states in the US.1 2 Chen Yuanqian in 1996 proposed use of the Generalized Weng model,3 4 and Hu Jianguo, Chen Yuanqian, and Zhang Shengzong developed the HCZ model in 1995.5

The Hubbert model has been applied widely in the world, while application of the Generalized Weng and HCZ model has been limited to mostly China.

Although all these models forecast reserves and production of oil fields, they are seldom used to predict oil demand. Based on the theory that everything in the world follows the natural process of “rise-grow-mature-decay,” we believe demand of oil would follow the same pattern and predicting oil demand with these models is feasible.

Table 1, shows the equations used in the three forecast models.

Oil reserves

With improvement of technology and knowledge, China’s discovered reserves have increased steadily (Fig. 1).

The increase of oil reserves in China can be divided into five stages:

- 1907-49, oil discoveries in the Ordos basin and a few other areas.

- 1950-64, large reserves found in the Songliao basin.

- 1965-75, Bohai Bay basin development.

- 1976-90, exploration and development in the east, offshore, and west.

- After 1990, development began in the Tarim, Junggar, and Ordos basins, with production still increasing in these basins.

According to a 2005 assessment of oil and gas resources, China has 21.2 billion tonnes of recoverable reserves.

Oil production

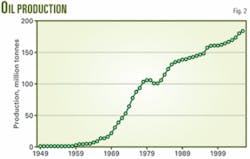

From 1949 to 1957, oil production in China was less than 10 million tonnes/year (tpy). With the discovery of Daqing oil field, oil production increased continually in the 1960s and surpassed 20 million tonnes in 1969. The discoveries in Bohai Bay basin and the additional production in Daqing in the 1970s increased oil production by 10 million tpy, with production surpassing 100 million tpy in 1978.

Although the production increase slowed after the 1980s, it reached 184 million tpy in 2006 (Fig. 2).

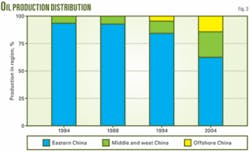

The oil fields in the eastern China are the main contributors to China’s oil production, but with the extensive exploration and development of the Songliao and Bohai Bay basins, the production in the east has started a downtrend from the 1980s (Fig. 3). In 1984, eastern China produced 94% of China’s oil, but this had decreased to 63% in 2004.

The decreasing oil production trend in the main oil producing areas after 30 years of increasing reserves and production means that a new stage of development for China oil industry has started.6

The percent of China’s oil produced in middle and western areas has increased from 6% to 23% in the last 20 years, and these areas now have become an important source of China’s oil production. The middle and western areas, especially the northwest, have the oldest oil fields in China. Exploration in China used to focus on these areas before the discovery of Daqing oil field in the east. But now again with the exploration successes in the Ordos, Junggar, and Chaidamu basins,7 these areas have again attracted more attention.

Production off China also has increased. In 2004, it produced 14.08% of China’s oil compared with only 0.27% in 1984. Offshore production may peak at 40 million tpy in the future.

Although production in eastern China continues to decrease, China’s total production will remain on a plateau because of increases in the middle; west, and offshore.

Predicting oil production

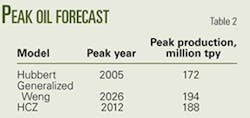

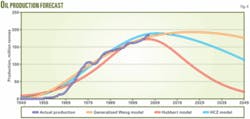

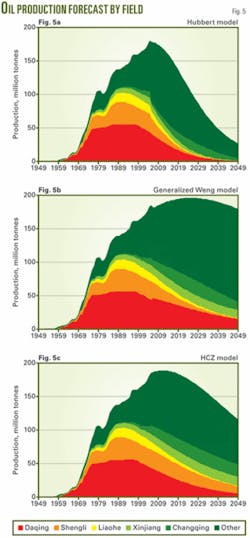

Using a 21.2 billion tonne estimate for recoverable reserves in China, Fig. 4 shows the production forecast from the three peak oil models, and Fig. 5 shows the forecast from these models for individual fields. The three models provide different results (Table 2).

The Hubbert model was accurate for forecasting US crude oil production, but its strict symmetry has received criticism from experts who believe that the model underestimates future production.

Fig. 4 shows that the Hubbert forecast was less than the actual prior to the China’s peak-oil rate and creates a very steep decline after the peak because of the model’s symmetry. This most likely is not a representative forecast.

Because on the changing trend of China’s oil production, peak-oil production will not occur as soon as forecast by the HCZ model. The Generalized Weng model, on the other hand, fits China’s actual production well.

The Generalized Weng model shows China having a peak oil production of 194 million tpy in 2026. This is only about 10 million tpy more than current production.

The Generalized Weng model shows (Fig. 5b) that production of Daqing, Shengli, Liaohe, Xinjiang, and Changqing oil fields will remain a main source of oil production. The production from these five areas will account for 30% of the total production in China in 2050, with the remaining production coming from other regions.

China’s middle and western areas will be an important source of oil production and will make up for the decreasing production in the east.

Oil demand

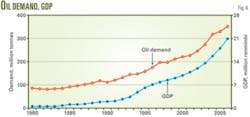

Based on the data from the National Bureau of Statistics of China, China’s economy began to grow rapidly from the 1980s and even faster after 2000. Oil demand is proportional to the fast economy growth. Fig. 6 indicates that the correlation coefficient between China’s gross domestic product (GDP) and oil demand is 99.5%.

The BP Statistical Review of World Energy 2007 says that China’s oil demand growth is one of the fastest in the world, increasing by 7.4%/year in the recent decade. China’s oil demand has reached 350 million tpy in 2006, second only to that of the US. Oil demand because of the fast growing economy still has a potential to grow rapidly. At the same time, China’s oil production is growing slowly, only by 1.5% in the last decade.

This gap between demand and production has reached 166 million tpy, and it seems that the gap will become larger in the future.

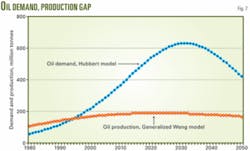

Although the oil production forecast in China with the Hubbert model is low, its forecast of demand for oil is acceptable.10 Our oil demand forecast uses the Hubbert model combined with oil consumption data in BP Statistical Review of World Energy 2007.

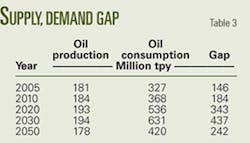

Fig. 7 shows that like oil production, oil demand also has a peak. The peak is reached in 2032 at 633 million tpy. The gap between demand and production continued to become greater after 1993, the year when China became a net oil-importing country. China’s oil imports have increased yearly from 1993 and reached 166 million tpy in 2006. At the time of the predicted peak demand, the gap will reach 446 million tpy.

Table 3 lists the forecast result of oil production and consumption and the gap between supply and demand. After the peak demand, the gap will narrow because of the use of new energy sources and other measures, such as conservation.

The dependence on foreign oil has reached 47%, and the models forecast that the dependence will increase to 50% in 2010, 64% in 2020, and 69% in 2030.

Table 4 compares this import forecast with predictions made by the International Energy Agency (IEA) and the US Energy Information Administration (EIA).11

Narrowing the gap

Some experts think that the dependence on imports should not exceed 60%,12 so that it is time for China to take measures for narrowing the gap between supply and demand.

One action is to speed development of petroleum resources. Fig. 5b shows that large oil fields remain the main contributors to domestic oil production. These fields have produced for a long time and require revitalization. These fields are all in eastern China, which remains the main producing area.

The eastern area inevitably will peak, and China needs to develop the oil fields further in the west, which has several prospective oil and gas basins. For example, the Changqing oil field can increase its production because it is a large multimillion tonne field.

In addition, China National Offshore Oil Corp. (CNOOC) is developing offshore oil fields and its production is increasing dramatically. Offshore has great oil potential and prospects and will become more important with sufficient technology development and investment.

In all, the feasible measures may include developing science and technology, improving the production in eastern oil fields, and actively developing prospects in western and offshore areas.

Another action is to cooperate with oil exporting countries to establish a strategy for oil reserves. The main oil resources of the world are controlled by oil exporting countries, especially the Organization of Oil Exporting Countries. These countries are the main power in the world oil market.

In the case of China, external dependency is becoming greater and this requires cooperating with these countries. At the same time, China is establishing strategic oil reserves to ensure availability of oil. These policies will lessen China’s risk of not meeting the oil demand.

A third action is to expedite the development and use of natural gas and unconventional oil and gas resources. As a clean energy, natural gas holds much potential and China has large reserves. Natural gas has become more important in China’s energy mix as demand has increased, peak oil looms, and concerns for the environment increase.

Fig. 4 shows a peak for conventional oil, but China also has unconventional oil and gas resources, such as oil shale, coalbed methane, and gas hydrates. These await development and would help provide energy after conventional oil peaks.

Of course, development of these unconventional oil and gas resources still has technical problems, costs, and environmental issues to overcome. The key lies in technical innovation. Only after the industry solves technical problems can costs be reduced, environmental problems be readily solved, and the economical production of unconventional oil and gas resource be realized.

Another action China can take is to advocate conservation for improving energy efficiency. Quick economical development in China has led to increased oil demand and also caused energy waste and low energy utilization efficiency.

To resolve the supply and demand gap, China will have to improve supply and take measures to decrease oil demand by:

- Promoting conservation especially in high-energy-consuming industries and companies.

- Developing energy-economic vehicles.

- Developing and utilizing renewable energy.

- Strengthening management of power demands and hastening the construction of conservation service system.

References

- Hubbert, M.K., “Energy from fossil fuels,” Science, Feb. 4, 1949, pp. 103-09.

- Hubbert, M.K., “Degree of advancement of petroleum exploration in the United States,” AAPG Bulletin, Vol. 52, No. 11, 1967, pp. 2207-27.

- Weng, Wenbo, The Foundation of the Forecasting Theory, Beijing: Petroleum Industry Press, 1984.

- Chen Yuanqian, “Derivation and Application of the Generalized Weng Model,” Natural Gas Industry Journal, Vol. 16, No. 2, 1996, pp. 22-26.

- Hu Jianguo, Chen Yuanqian, and Zhang Shengzong, “A New Model for Predicting Production and Reserves of Oil and Gas Fields,” Acta Petrolei Sinica, Vol. 16, No. 1, 1995, pp. 79-86.

- Zhang Kang, “View on the Potential in the Old Oil Regions in the Eastern China According to the Remnant Recoverable Reserves Change Within Recent 20 Years,” China Petroleum Exploration, Vol. 6, No. 2, 2003, pp. 1-12.

- Chen Yongwu and He Wenyuan, “Some recognitions of the petroleum geological feature and exploration directions in the western China,” Acta Petrolei Sinica, Vol. 25, No. 6, 2004, pp. 1-7.

- Zhang Kang, Life cycle and strategy substitution of oil field, Beijing: Geological Publishing House, 2001.

- BP Statistical Review of World Energy 2007, from http://www.bp.com/ reports and publications.

- Zhao Qingfei and Chen Yuanqian, “Forecast and Analysis of China’s Oil Consumption and Crude Oil Supply,” Oil Forum, Vol. 006, No. 2, pp. 26-28.

- Energy Strategy Research Group, China Science Academy, Research on China’s Sustainable Development Strategy of Energy, Beijing: Science Press, 2006.

- Qiu Zhongjian, and Fang Hui, “Some Opinions about Sustainable Development of Petroleum Resources in China,” Acta Petrolei Sinica, Vo. 26, No. 2, pp. 1-2.

The authors

Feng Lianyong ([email protected]) is a professor at the school of business administration, China Petroleum University, Beijing. He previously worked for the strategy research office of the development research center of China National Petroleum Corp. (CNPC). His main research interests are petroleum economics, energy strategy, and peak oil. Feng has a BS and an MS in management engineering from the University of Petroleum (East China), and a doctorate from the Moscow Petroleum University.

Li Junchen ([email protected]) is a graduate student at the school of business administration, China Petroleum University, Beijing. His main research interests are petroleum economics, energy strategy, and peak oil.

Pang Xiongqi ([email protected]) is vice-president and a professor at China University of Petroleum, Beijing. Pang has been engaged in the research of basin analysis, and oil and gas resource appraisal.

Tang Xu ([email protected]) is a graduate student at the school of business administration, China Petroleum University, Beijing. His main research interests are system engineering management, peak oil, and energy economics.

Zhao Lin ([email protected]) is a PhD student at the school of business administration in the China University of Petroleum, Beijing. His major is petroleum engineering management.

Zhao Qingfei ([email protected]) is a senior engineer with the research institute of petroleum exploration and development of Sinopec, Beijing. His main research interests are reservoir engineering, reserve evaluation, oil industry development planning.