DEEPWATER GULF DECOMMISSIONING–3: Lease, revenue status determine short-term decommissioning activity

Mark J. Kaiser

Louisiana State University

Baton Rouge

Mingming Liu

China University of Petroleum

Bejing

Opportunities abound in the prolific deepwater Gulf of Mexico (GOM), but several production structures have reached a stage in their lifecycles at which decommissioning is the next plan of action.

In this series we have looked at the trends and risks in deepwater decommissioning (OGJ, Feb. 3, 2014, p. 60) and the types of structures that comprise the current inventory (OGJ, Mar. 3, 2014, p. 22).

This third of the four-part series describes the status of structures grouped by their lease and gross revenue positions and their proximity to eventual decommissioning. This information will be used in Part 4 to infer removal activity in the GOM.

Lease status

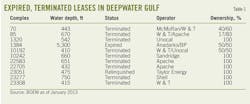

As of June 2013, 10 GOM structures existed on expired, terminated, and relinquished leases in waters deeper than 400 ft, according to data from the Bureau of Ocean Energy Management (Table 1).

Expired and terminated leases have ended by operation of the law. A relinquished lease is voluntarily surrendered by the title holder of record.

On expired, terminated, and relinquished leases, operators must permanently plug wells and decommission structures within 12 months. Most structures with these lease classifications are to be decommissioned by the end of 2015. If the lease is part of a unitization, if the structure is seeking recertification as a hub or junction platform, or if extenuating circumstances apply (e.g., hurricane destruction), decommissioning can be delayed.

If a structure stops producing but the lease it sits on continues to produce, specific guidelines stipulated in Notice to Lessees (NTL) 2010-G05 apply. In this case, the operator has 5 years to plug the well and decommission the structure from the time it stops producing and no longer serves a useful function.

In the GOM around June 2013, Apache Corp. had two structures on terminated leases. Unocal, SandRidge Energy Inc., Royal Dutch Shell, and Stone Energy Corp. each had one structure on a terminated lease.

Anadarko Petroleum Corp. operates the Red Hawk spar, which ended production in 2008 and now sits on an expired lease. An eight-pile fixed platform owned by Taylor Energy Co. at Mississippi Canyon 20 was destroyed by a mudflow during Hurricane Ivan and resides on a relinquished lease where cleanup operations have been ongoing since 2005.

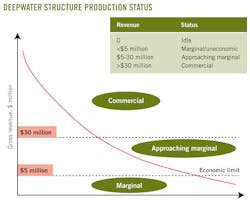

Revenue thresholds, structure classification

Structures with 2012 gross revenue of less than $5 million are classified as near or below their economic limit and as such are "marginal producers." Structures with gross revenues of $5-$30 million are assumed to be approaching their economic limit and classified as "approaching marginal status." Structures that generated more than $30 million in 2012 are assumed to be commercial (see accompanying figure).

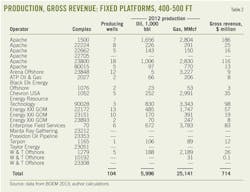

Fixed platforms, 400-500 ft

Five fixed platforms in 400-500 ft of water did not produce in 2012 (Table 2). Two of the structures (Nos. 23212, 23353) are processing hubs and pipeline junctions and will remain in service as long as they serve a useful purpose.

Apache's complex No. 22705 is ready for decommissioning because its well inventory has been abandoned and all the conductors removed. W & T Offshore Inc. structure No. 23308 had all its wells plugged but 10 conductors remain to be cut and pulled. Taylor Energy's hurricane-destroyed structure No. 23501 requires 16 well abandonments, and it will be several more years before the structure is decommissioned.

Two fixed platforms generated gross revenue of less than $5 million in 2012, putting them in the marginal production category. W & T Offshore's structure No. 10192 produced 31 MMcf of natural gas in 2012 and generated about $100,000 in gross revenue but had no producing wellbores as of January 2013. Black Elk Energy's complex No. 1076 produced 23,000 bbl of oil and 53 MMcf of natural gas in 2012 from two producing wellbores and generated about $3 million in gross revenue.

Nine structures generated gross revenue of $5-30 million in 2012 and are approaching marginal production status. Three of these structures (Nos. 23848, 2027, 23893) generated gross revenues of less than $10 million, and half of them were held by fewer than three producing wells. Structures approaching marginal status may already fall below their economic limit, or opportunities may exist for operators to sidetrack and tie-back marginal reservoirs or to convert the structure to another function when production stops.

Six of the 17 producing platforms generated more than $30 million and are not expected to require decommissioning for several years. All of these structures are considered commercially productive. Three structures generated revenue of $30-90 million, and another three structures generated more than $90 million: Apache's No.1500 and No. 23800, and Energy Resource Technology's No. 90028.

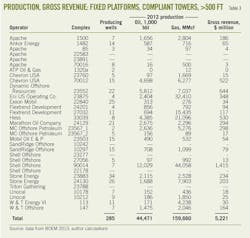

Fixed platforms, >500 ft

Six fixed platforms in waters deeper than 500 ft did not produce in 2012 (Table 3). One platform operated by Triton Gathering LLC (No. 23788) last produced in 2003 and is currently serving as a pipeline junction. Four structures have completed most of their well abandonment work and are progressing toward decommissioning.

Apache's structure No. 22583 is ready for decommissioning. SandRidge still needs to cut and remove four conductors on No. 10242. On Nos. 23891 and 23277, one well/structure remains to be abandoned. Cognac (No. 22178), the first jacket installed in water deeper than 1,000 ft, has recently been recertified as a junction platform.

Three fixed platforms in waters deeper than 500 ft generated less than $5 million gross revenue in 2012 and probably all fall below their economic limits, putting them in the marginal production asset category. On Cinnamon (No. 85), three wellbores produced 3,000 bbl and 97 MMcf in 2012, or about 31 bo/d/well. On Spirit (No. 70016), eight wells produced 500 MMcf in 2012, or about 171 Mcfd/well. ATP Oil & Gas Corp.'s structure No. 1320 had two wells producing 12 MMcf in 2012, or on average16 Mcfd/well.

Six fixed platforms generated gross revenue of $5-30 million and are approaching marginal status. Chevron's Tick (No. 23760) generated $15 million in 2012 primarily from the Ladybug tieback, MC Offshore Petroleum's Marquette (No. 23567_2) generated $17 million, Shell's Enchilada (No. 23277) generated $13 million, Unocal's Ligera (No. 10178) and Cerveza (No. 10212) generated $18 million and $25 million, respectively, and W & T Energy's Virgo (No. 113) generated $30 million.

There were four fixed platforms with gross revenue of $30-100 million, seven structures with gross revenue of $100-500 million, and two fixed platforms with gross revenue greater than $500 million. All of these structures are commercial producers.

Shell's Salsa (No. 90014) serves as a hub for the Salsa and Sangria subsea tiebacks and generated the most revenue among fixed platforms at $1.4 billion in 2012, followed by Bullwinkle (No. 23552) at $644 million, Crystal (No. 23875) at $348 million, Marquette (No. 23567_1) at $298 million, and Lobster (No. 24129) at $294 million.

Compliant towers

Compliant towers Baldpate (No. 33039) and Petronius (No. 70012) generated $530 million and $522 million in 2012.

Lena (No. 22840), the oldest of the three compliant towers, is approaching marginal status. In 2012, Lena produced 313,000 bbl oil and 276 MMcf gas from 25 wells, generating about $34 million in gross revenues. Sidetrack opportunities may exist in Lena's large well inventory.

Floating structures

Anadarko's Red Hawk spar No. 1384 was the only floating structure that did not produce in 2012 (Table 4). No floating structures were marginal producers, but MC Offshore Petroleum's Jolliet TLP (No. 23583), the first TLP installed in the GOM, is far along its decline curve. Jolliet produced an average 64 bo/d/well from 12 wells generating $31 million. Pisces Energy's Prince TLP (811) generated $35 million in 2012 from two wells producing 434 bo/d/well and is positioned to serve as a hub platform.

In 2012, 22 floating structures generated gross revenue of $100-500 million, five generated $500 million-1 billion, five $1-2 billion, and seven generated more than $2 billion.

BHP's Shenzi TLP (No. 1899) generated $3.7 billion, more than any other structure in the gulf, followed by Chevron's Tahiti spar (No. 1819) at $3.3 billion and BP's Thunder Horse semisubmersible (No. 1101) at $2.7 billion. Five floating structures started production in the last 2 years: ATP's Mirage/Titan semisubmersible, Energy Resource Technology's Phoenix mobile offshore production unit, LLOG Exploration Co. LLC's Who Dat semisubmersible, Shell's Perdido spar, and Petrobras's Cascade and Chinook FPSO.

In August 2012, ATP filed a petition for reorganization under the Chapter 11 Bankruptcy Code citing the after-effects of the drilling moratorium that followed the 2010 deepwater Macondo blowout and resulting spill. An affiliate of Credit Suisse AG purchased ATP's Clipper and Telemark hubs in 2013, but the semisubmersible Gomez, which ceased production in 2012, was not part of the package.

Lenders have agreed to allocate $44 million to decommissioning, but if expenses exceed this level the other working interest owners will have to pay for the remaining cleanup cost when the bill comes due.

Manuscripts welcomeOil & Gas Journal welcomes for publication consideration manuscripts about exploration and development, drilling, production, pipelines, LNG, and processing (refining, petrochemicals, and gas processing). These may be highly technical in nature and appeal or they may be more analytical by way of examining oil and natural gas supply, demand, and markets. OGJ accepts exclusive articles as well as manuscripts adapted from oral and poster presentations. An Author Guide is available at www.ogj.com, click "home" then "Submit an article." Or, contact the Chief Technology Editor ([email protected]; 713/963-6230; or, fax 713/963-6282), Oil & Gas Journal, 1455 West Loop South, Suite 400, Houston TX 77027 USA. |