Special Report: Fewer wells to be drilled in US, Canada in 2009

Drilling in the US is declining in response to the 2008 oil and gas price collapse and financial crisis in the US, and further drops are expected in the US and Canada in 2009.

Rig counts in the rest of the world, however, have held up fairly well.

Capital spending cuts in connection with the US financial crisis begin in earnest in the third quarter of 2008. Most companies have alerted the investment community that they plan to monitor oil and gas prices closely during 2009 and adjust budgets accordingly. Many pledged to operate within cash flow this year.

It was impossible at this writing in early January to predict how low the US rig count might go before bottoming out.

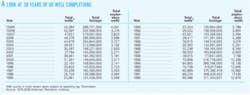

Here are highlights of OGJ’s early year drilling forecast for 2009:

- Operators will drill 43,384 wells in the US, down from an estimated 52,097 wells in 2008.

- All operators will drill 4,291 exploratory wells of all types, down from an estimated 5,474 last year.

- The Baker Hughes Inc. count of active US rotary rigs will average 1,503 rigs/week this year, down from 1,867 in 2008 and 1,768 in 2007.

- Operator will drill 16,290 wells in western Canada, down from an estimated 17,703 wells in 2008.

States and rigs

The 2008 US rig count average of 1,879 compared with 1,850 in OGJ’s January 2008 forecast and 1,840 in OGJ’s July 2008 forecast.

Drilling peaks in the larger states and districts varied from July in West Texas Dist. 8 at 144 units through 90 rigs in North Dakota in the first three weeks in November.

The US total peaked at 2,031 rigs in the weeks ended Aug. 29 and Sept. 12, and the count had fallen to 1,589 by Jan. 9, latest available at this writing. By that time, drilling in the two East Texas districts had held up better than most other areas of the country.

Texas drilling peaked at 958 rigs the week ended Aug. 29 and by Jan. 9 fell to 713.

Operators conducted drilling operations at 186 wells in Alaska in 2008, of which 14 were exploratory wells. OGJ looks for 180 wells to be drilled there in 2009.

Before prices turned south, regulators struggled to keep up with the activity. Colorado, for example, expected to have issued 7,600 drilling permits in 2008 compared with more than 6,300 in 2007. OGJ estimates that only 3,825 wells were drilled in the state in 2008 and looks for a drop of about 18% in 2009.

A Bureau of Land Management decision allowing coalbed methane development in the Montana portion of the Powder River basin isn’t expected to result in appreciable drilling in 2009.

Operators drilled 14 holes in Arizona in 2008, and only one was an oil and gas test. The others are in a carbon dioxide delineation program near St. Johns in Apache County.

Canadian drilling

OGJ looks for a 7.8% drop in Canadian drilling in 2009, far less of a falloff than in the US.

The Canadian Association of Oilwell Drilling Contractors estimated that Canada’s rig count will average 348 this year, a drop of 6% from 2008.

Horizontal drilling in shale gas plays in Northeast British Columbia and in the Bakken shale oil play in the Saskatchewan portion of the Williston basin are expected to markedly extend the average footage of Canadian wells, the group said.

International drilling

The “international” rig count, incorporating North America for the first time, didn’t vary much throughout 2008, Baker Hughes reported.

However, the number of rigs working internationally outside the US and Canada averaged 3,346 in January-November 2008 compared with 3,107 in the same period of 2007.

Busy spots outside the US and Canada on the November 2008 count were Mexico with 78 land rigs and 29 marine units active, Saudi Arabia with 64 land rigs and 12 offshore units, and India with 55 land rigs and 27 offshore units.

Indonesia was running 46 land rigs and 15 offshore units, and Oman had 54 land rigs operating.

In Latin America, Argentina had 77 land rigs and one offshore unit running, Venezuela 68 land rigs and 12 water units, Brazil had 29 land rigs and 30 offshore rigs, and Colombia had 42 land rigs.

In Africa, Egypt led with 45 land rigs and 10 offshore rigs, while Algeria had 25 land rigs at work. Operators mobilized 14 land rigs and one offshore unit in Libya.

Twenty-three offshore rigs and 2 land units were working in the UK.