Northwest Territories, NEB assess potential of Canol shale oil reservoir on Mackenzie plain

The Devonian Canol shale in Canada's Northwest Territories holds an estimated 145 billion bbl of oil in place while the thinner Bluefish shale contains an estimated 45 billion bbl OIP, Canada's National Energy Board and Northwest Territories jointly said.

In a government assessment of the two formations, NEB and the Northwest Territories government officials stopped short of giving estimates for recoverable oil reserves, saying Canol and Bluefish well test results are not yet publicly available.

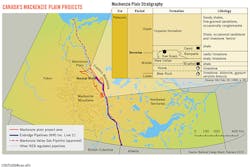

The MacKenzie plain area has attracted oil and gas exploration for decades following a 1920 discovery in Norman Wells oil field, where an accumulation of oil is trapped in the updip end of a Middle Devonian reef (OGJ, Feb. 20, 1995, p. 94).

The Canol shale and Bluefish zone extend between the MacKenzie and Franklin Mountains. The MacKenzie plain is part of the Mackenzie Arc exploration region within the Northern Canadian Mainland Sedimentary Basin. The Canol area is remote and lacks infrastructure.

Recently, NEB said 14 exploration licenses have been granted for Canol since 2010-11 for a total of $627.5 million (Can.) in work-bid commitments. Seven exploration wells were drilled since 2012.

OIP estimates were calculated using a probability model also used to assess volumes in British Columbia's Montney formation and Saskatchewan's Bakken formation, NEB said.

Northwest Territories Minister of Industry, Tourism, and Investment David Ramsay said, "This study confirms what we have known all along-that there is significant petroleum potential."

NEB said the closest available comparison to the Canol shale's recoverability is the Permian basin of Texas, where operators report expected recovery factors around 3%.

Large areas of the Canol shale are at much shallower depths than other shale oil prospects, and the lower pressures might make recovery more difficult, NEB warned. If a 3% recovery rate were possible, the Canol shale could produce 4.35 billion bbl, NEB said.

Majors explore Canol

ConocoPhillips Canada received approval in 2013 from the Sahtu Land and Water Board to use horizontal drilling and multistage hydraulic fracturing for exploration in Canol. The major later applied to the Northwest Territories for a significant discovery declaration for a well south of Norman Wells.

"We have applied for a Significant Discovery Declaration and although this, as well as a subsequent Significant Discovery License, is a positive indication for a play, it does not indicate commercial viability," a ConocoPhillips spokeswoman told UOGR. "We keep this information confidential for 2 years so we are unable to provide any further details."

As of June 4, she said ConocoPhillips planned no additional exploration in the Canol shale for the foreseeable future.

"We will return to the area in the 2015-16 winter drilling season to complete a well-suspension program, a common industry practice to verify the secure condition of a well for the long term," she said. "Although this isn't the right time to move forward with further exploration activities, the Canol program will continue to be a part of those discussions for possible future development when the time is right."

In July 2012, Shell Canada Energy took a farmout from MGM Energy Corp., Calgary, to earn an interest in MGM's 466B exploration license in the Central Mackenzie Valley by financing drilling one or two wells in the Canol shale oil.

Chief landholders in the play at that time included Husky Oil Operations Ltd., ConocoPhillips Canada Resources Corp., MGM, Shell Canada Resources Ltd., and Imperial Oil Resources Ventures Ltd. (OGJ Online, Nov. 4, 2011).

Leases targeting Canol-Hare Indian and Bluefish of Devonian age lie generally from 60 km northwest to 180 km southeast of Norman Wells along the Enbridge pipeline that ships crude from giant Norman Wells oil field to Edson, Alta.

MGM noted Husky Energy was first company actively working the play, having shot 220 sq km of 3D seismic and drilled and cased two vertical wells during the 2011-12 winter.

The Canol/Hare Indian was 30-170 m thick at 1,000-2,500 m and the Bluefish was 15-25 m thick at 1,000-2,700 m, MGM said, adding both were highly brittle with 70-80% quartz content and less than 5% clay.

Total organic carbon was 4-25% in the Canol-Hare Indian and 2-9% in the Bluefish, MGM said, adding it expected the plays to be liquids-dominant.

In June 2013, MGM Energy said it had surrendered its exploration licenses in the Central Mackenzie Delta region where it explored in shale formations. MGM Energy turned back EL 456, EL 457, EL 458, and EL 459, which had been scheduled to expire in January 2016.

With the surrender, MGM Energy was relieved of its obligation to fulfill its commitments relating to the licenses.