Economics incentivize deferring unconventional well completions

Randall Collum

Ben Chu

Genscape Inc.

Sugar Land, Tex.

The market has responded with a steepened contango to incentivize storage of crude, and the relatively higher price for delivery a year from now had widened toward the end of the first quarter to as much as $9-12/bbl compared with the next month delivery.

Contango creates incentives to store oil, and some operators look to their own shale wells in the South Texas Eagle Ford, Permian basin, and elsewhere as an avenue to store oil until commodity prices improve.

For the week ending Mar. 27, US commercial crude storage added an additional 4.8 million barrels to already record high commercial stocks. A total of 471.4 million barrels were reported, well above the pre-2015 high of 399.4 million barrels reached in April 2014, before last year's summer demand season. Arguably, the growth in unplanned supply disruptions in Nigeria, Libya, and Iraq, from less than 500,000 b/d average in 2012 to just over 2 million b/d by April 2014, masked the unrelenting expansion of US unconventional supplies and delayed the ultimate freefall in global oil prices of the past winter.

The latest forecasts of US crude oil production from Genscape, global provider of fundamental data and analysis for the energy commodity and finance industries, peg 2015 production at 477,000 b/d further growth before finally turning to a year-over-year decline of 372,000 b/d in 2016.

The last week of March 2015, for example, the crude contango narrowed despite continued record storage levels and very strong builds. As of early Apr. 7, with the move in crude to $53/bbl for West Texas Intermediate, the 1-year contango narrowed even further, just inside of $7/bbl, keeping forecasting efforts dynamic.

Producers respond to contango

On the exploration and production side, a number of oil producers announced toward the end of the first quarter that they are solving for the contango in the crude curve, factoring in expectations of lower service costs due to lower oil prices and the need to meet drilling rig and lease drilling commitments, while also conserving capital, by doing one thing: drilling wells but deferring completions.

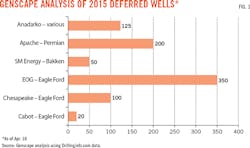

Cabot Oil & Gas Corp., Chesapeake Energy Corp., EOG Resources Inc., SM Energy Co., Apache Corp., and Anadarko Petroleum Corp. alone have announced 845 well completion deferrals in the Eagle Ford, Bakken, Wattenberg, and Permian.

In addition, Continental Resources Inc. has stated it has the ability to "defer a significant amount of activity to await a better commodity price environment and lower oil field service cost," and, after the first quarter, deferred 25% vs. previously planned levels of completion activity in the Bakken formation.

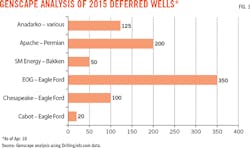

The impact of these 845 deferrals, if they were to all come online in the same month, would be about 373,000 b/d of oil and 528 MMcfd of gas (See Fig. 1-2).

Using a rough rule of thumb that the first 12 months of a new horizontal well averages approximately 50% of first full-month initial production, the impact over 12 months of production would be 68 million bbl of oil and 96 bcf of gas.

Genscape's economic models indicate the New York Mercantile Exchange oil price decline to $45/bbl has priced out the majority of the Eagle Ford and Bakken oil plays except for the very cores of the plays. Besides completion deferrals, rig counts are expected to decline further based on the forward curve, and this expectation is supported by Genscape's economic findings.

Delving a bit into underlying commercial drivers of deferrals, the following comparisons can be made using Genscape's economic models for added color and understanding:

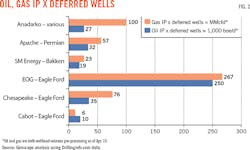

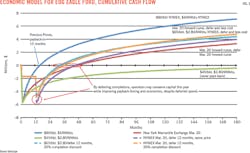

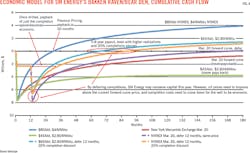

EOG Eagle Ford

EOG is well positioned in the core of the Eagle Ford play. In the current commodity pricing situation, returns are marginal given the uncertainties. Payback is either 46 months with an Internal Rate of Return (IRR) of 16% in the case of receiving forward curve prices, or never and -2% IRR if the $45/bbl WTI price were to persist.

Deferring completions and receiving the improved pricing in the forward curve not only saves capital this year, but would pay back the well investment slightly faster (in 45 months with 19% IRR). If further savings of 20% off the completions cost are realized, which are approximately 70% of total well costs, then drilling economics improve significantly and payback of investment dollars come much more quickly: ranging 32-35 months despite spending much of it 12 months later, whether receiving the improved pricing in the forward curve or assuming a step change to $65/bbl WTI from $45/bbl. IRR in these cases are 27-28% percent.

SM Energy Bakken

In contrast to EOG's position in Eagle Ford, SM Energy has acreage that is not quite at the very heart of the Bakken play. SM Energy said that what it calls its Gooseneck play is in the shallower portion of the Bakken, north of the Brockton-Froid Fault.

SM Energy's acreage that it calls the Raven/Bear Den play is in what Genscape refers to as the McKenzie/Williams Core. The best part of the Bakken economically is the southern part of the Nesson/Antelope geologic structures.

In the current commodity environment, well investment for SM Energy's Raven/Bear Den play is estimated to never pay back, whether considering a fixed $45/bbl WTI /$2.80 MMbtu Henry Hub, or the increasing prices of forward curve.

Even the higher realized prices of the forward curve, or using $65/bbl WTI and crediting a 20% savings on the completion portion of the spend (approximated at 70% of well capital costs), yields a payback period of 5-8 years and IRR of 6-7%, which is far from economic returns.

SM Energy appears to be choosing to drill because crews currently are drilling efficiently. For SM Energy, it might ultimately be more expensive to ramp down and then ramp back up that capability.

SM Energy executives have explained their strategy: "Our approach [is] to go ahead and drill those rigs where we are drilling very efficiently like we are on the Bakken and then just backlog the completions... This will allow us to take advantage of completion cost deflation when we enter 2016, we'll also be able to accelerate quickly if we see an improvement in the commodity prices." It is also apparent that they need higher prices.

The crude oil contango market in the US has created a massive incentive to store oil, and while traditional storage hubs reach record high levels, operators also are using their own wells for storage pending improved market conditions.

Deferring the completion of wells makes economic sense by allowing capital conservation while banking on the forward curve.

As of Apr. 10, more than 800 wells were being deferred by Cabot, Chesapeake, EOG, SM Energy, Apache, and Anadarko alone, accounting for about 373,000 b/d of oil and 528 MMcfd of gas. Understanding and accounting for well completion deferrals is critical to gain a more complete understanding of today's market drivers.

Genscape analysts have developed additional detail behind the shale play breakeven analysis with the key operators analyzed within proprietary models. In the Bakken, Eagle Ford, Marcellus, and Utica alone (four key areas of oil and gas growth), Genscape has compiled 108 different operator play economic models to calculate breakeven prices and to delve deeper into understanding drilling and completion economic drivers. Analysts also monitor operator quarterly conference calls, daily production nominations, and forward spending plans to inform and enhance oil and gas production forecasts.