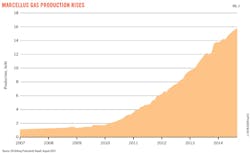

More-efficient rigs, better completions propel Marcellus production above 15 bcfd

Rachael Seeley, Editor

Improvements in drilling and completion techniques, along with additions of regional pipeline and processing capacity, are expected to propel Marcellus shale production even higher in coming years.

In the past 4 years, production from the shale play has risen from 2 bcfd to more than 15 bcfd (Fig. 1). Jordan Grimes, an analyst with Morningstar Commodities Research, said in an investor note that the Middle Devonian shale "now represents 32% of US gas production east of the Mississippi River, and that share will likely grow to nearly 40% in the next few years."

Production continues its ascent even though the number of rigs working in the play has declined to about 80 from a peak of 141 in 2012. Rigs are becoming more productive. Energy Information Administration data show the average rig in the Marcellus added 7.9 MMcfd of production in September, compared with 5.8 MMcfd during the same month a year earlier (Fig. 2).

Wood Mackenzie expects Marcellus production will reach 20 billion cubic feet of gas-equivalent per day (bcfed) by 2020 and account for nearly 25% of total US gas supply. Research and advisory firm IHS is even more bullish. It sees production exceeding 25 bcfed by 2020. In an August address to the Unconventional Resource Technology Conference in Denver, Pete Stark, senior research director for IHS, called the Marcellus the "King Kong" of gas plays.

Shifting completion techniques

Shorter-stage length (SSL) completions along with the use of more water and more proppant per stage are some of the ways that producers are increasing the productivity of wells targeting the Marcellus.

Jonathan Garrett, senior analyst for Wood Mackenzie's Lower 48 Upstream Research Team, said reducing the distance between stages creates a more complex fracture network close to the wellbore, which enhances well productivity.

"If you have a shorter distance between different zones then you have basically more energy closer to the wellbore, and the fractures can become more complex because they are more likely to intersect and create secondary fractures within the rock," Garrett told UOGR.

SSL wells have lateral stage lengths of 150-250 ft, compared with an average stage length of 350 ft for non-SSL wells.

Antero Resources Corp. is utilizing SSL completions along with choke management and increased density drilling to improve the productivity of its Marcellus wells. The company had 15 active rigs in the Marcellus shale in August.

Antero is not alone in utilizing SSL completions. A November 2013 research note by Mark Lear, an analyst with Credit Suisse, noted that SSL completions have delivered "material increases" in estimated ultimate recoveries for EQT Corp., Range Resources Corp., and Rex Energy Corp. in the shale play.

"EQT and Rex specifically have noted not seeing much impact to IP rates but have encountered a much shallower decline rate as a result of tighter stage completions," Lear said.

Discounted regional pricing

Marcellus production growth has outpaced the addition of regional pipeline and processing capacity, leading to bottlenecks and a discounted price for Marcellus gas relative to US benchmark Henry Hub. According to Grimes, "Henry Hub pricing is irrelevant to a producer in the Marcellus shale when it must sell $2/MMbtu gas at the Transco-Leidy basis point."

Morningstar expects new and proposed pipelines will increase takeaway capacity in the Appalachian region by 18 bcfd by 2018. The bulk of the build-out, Grimes said, "is largely being financed in open seasons by producers that are eager to improve their pricing power in the region."

Antero is one producer that is helping to finance the addition of Appalachian pipeline capacity. In August, Antero raised its annual capital spending budget for the Marcellus and Utica shales to $3.7 billion from $2.85 billion and earmarked a portion of the funds for Appalachia midstream investments. The company will this year spend $850 million to install 180 miles of gas gathering pipelines and 370 MMcfd of compression capacity in the Marcellus.

The shale play accounted for 86% of company-wide production in the second quarter. Antero holds 378,000 net acres in the Marcellus and operated 15 rigs there during the period. Net production averaged 770 MMcfed, including 12,600 b/d of liquids.

Chief Executive Officer Paul Rady told a second-quarter earnings presentation that Antero anticipated years ago that the Marcellus would experience "explosive" production growth and knew it would be "critical to build and structure a firm transportation portfolio that would diversify our exposure to Appalachian basin pricing."

By 2016, Rady said, Antero will have the ability to send about 50% of its gas production to the Gulf Coast, 20% to Midwest markets, and the remaining 30% to Appalachia or eastern-directed markets.

The company is also constructing gathering facilities in Doddridge, Tyler, and Ritchie counties, W. Va., to connect its wells to compression facilities and processing. Antero now processes 600 MMcfd of rich gas from the Marcellus shale through MarkWest Energy Partners LP's 600 MMcfd Sherwood complex in West Union, W. Va. Capacity at the facility is slated to increase by 800 MMcfd by the third quarter of 2015.

Production shut ins

Carrizo Oil & Gas Inc. is also taking steps to mitigate the discounted pricing of Appalachian gas. Instead of investing heavily in pipeline and processing capacity, Carrizo is shutting in some production, deferring completions, and reducing its Marcellus rig count to zero.

Carrizo in August reduced its annual Marcellus shale capex to $35 million from $65 million in 2013. It plans to drill just one net well in the Marcellus this year and is allocating more of its budget to liquids-rich plays like the Eagle Ford and Niobrara shales.

The company holds 4,400 net acres in the core of the dry gas portion of the Marcellus in Susquehanna and Wyoming counties, Pa. During the second quarter, it produced 59.4 MMcfd from 24.1 net Marcellus wells, which accounted for 30% of company-wide production.

In a presentation to the EnerCom investor conference in August, Carrizo noted increasing seasonal price swings in Appalachia and said it plans to limit production when local gas prices are especially weak. This year, it will only frac wells needed to maintain leases. Regulatory filings show 2.4 net Marcellus wells were brought online in the second quarter, and 4.3 net wells were awaiting completion.

Speaking to an analyst presentation of second-quarter results, Sylvester Johnson, chief executive officer of Carrizo, said "Given the extremely challenging local market pricing environment in Appalachia, we have elected to defer our remaining 2014 completion activity until next year. We're also continuing to shut in a significant amount of our production volumes when prices get too low."

Unintended consequences

Garrett said, "The oil and gas business in the Marcellus has kind of been a victim of its own success with all of the production. So, if you look at the northeast part of Pennsylvania where all of these monster dry gas wells have come online lately, the discount that a lot of those operators are receiving relative to Henry Hub has been quite significant. Less so in the southwestern part of the play where there's more flexibility in terms of which markets that gas can go to."

Each operator's strategy is specific to its leasehold opportunities, Garrett said. Operators with exposure to plays rich in oil, condensate, and NGL, like the Eagle Ford and the Bakken, are likely to allocate the bulk of their capital spending budget to those areas.

This is the case with Carrizo. The company this year allocated $500 million of its $830 million annual capital spending budget to the Eagle Ford shale and operated three rigs there during the second quarter, accounting for the majority of its five-rig drilling program.

Antero, meanwhile, is transitioning the focus of its Marcellus development program toward liquids-rich areas. The company holds more than 373,000 net acres prospective to the Marcellus in northern West Virginia and southwestern Pennsylvania and, in the first 6 months of the year, spent $239 million to add 35,000 net acres in core, liquids-rich portions of the Marcellus and neighboring Utica shales.

Seventy Marcellus wells were completed and placed online by Antero in the first half of the year. Of these, 47 were online for more than 30 days at the end of June, yielding an average 30-day IP rate of 12.9 MMcfed.

Garrett said companies that focus on the Appalachian basin, or the Marcellus shale, are drilling their best prospects. "Even at these prices, there are still a lot of great places to drill," Garrett said. Many portions of the play remain profitable despite the gas selling at a discount to benchmark Henry Hub.

One company focused on the Marcellus is Cabot Oil & Gas Corp. Cabot has produced more than a dozen record-setting wells in the core of the dry gas portion of the play in Susquehanna County, in northeast Pennsylvania. "There's no liquids component there, but these are some of the best gas wells ever drilled in the US," Garrett said.

Cabot's Marcellus shale production increased to nearly 1.3 bcfd in the second quarter from 20 MMcfd in 2008.

Continuous improvement in drilling and completion techniques along with productive wells and increasing pipeline and processing capacity have many analysts expecting Marcellus production will continue rising for years to come. Wood Mackenzie estimates more than $90 billion in value remains in the play and about $289 billion of capex will be spent over its lifetime-more than any other unconventional play. "There's still a lot in the tank," Garrett said.