Momentum shifts in favor of development in Colorado

Rachael Seeley, Editor

DENVER, Colo.-Momentum appears to be shifting in the oil and gas industry's favor in Colorado after Gov. John Hickenloooper brokered a compromise that keeps off the November ballot two initiatives that were poised to place greater restrictions on development, and legal and political setbacks befell separate local measures that sought to restrict or ban hydraulic fracturing.

"The message is unmistakable. Colorado's communities through tough state regulations and flexible local authority already have the tools and ability to regulate oil and gas activity to meet their local needs," said Tisha Schuller, president of the Colorado Oil & Gas Association (COGA). The trade group spearheaded legal challenges to several municipal fracing bans.

The biggest looming threat to development was disarmed in early August, when Hickenlooper worked with a fellow Democrat, US Rep. Jared Polis, to keep off the November ballot two initiatives that sought to raise well setbacks and open the door to wide variances in local regulations.

Initiative 88 would have increased the setback requirement for new wells to 2,000 ft from occupied structures, while Initiative 89 sought to grant local governments the ability to supersede state laws to regulate oil and gas development.

Charles Davidson, chief executive officer of Noble Energy Corp., said the state's existing setback requirement, which ranges from 500 ft to 1,000 ft, was just put in place last year and is already one of the most aggressive setback rules in the country. Davidson told an analyst presentation, "The 2,000-ft setback, while a fourfold increase in direct distance, is a sixteenfold increase in terms of total surface area affected. This would have a significant impact on development of oil and gas in certain areas of the state."

The ballot measures, sponsored by Coloradans for Safe and Clean Energy, a group backed by Polis, gathered more than 300,000 signatures-exceeding the threshold needed to be placed on the November ballot.

Hickenlooper's compromise instead forged a commission that will study fracing and present recommendations to the state legislature. The 18-member panel includes representatives of all sides of the fracing debate. It will be chaired by La Plata County Commissioner Gwen Lachelt and XTO Energy Inc. Pres. Randy Cleveland.

COGA estimates 95% of Colorado well activity includes fracing.

Political considerations

Political pressure on Polis likely played a role in the compromise. Colorado is a swing state in the midst of an election year, and Hickenlooper and Sen. Mark Udall, both Democrats, face tough reelection races.

The ballot initiatives threatened to force the Democratic party to choose sides in a battle between environmentalists and the oil and gas industry. They also threatened to mobilize Republicans to vote on election day, potentially tipping the outcome in favor of Republicans.

Polis was likely under pressure to appease not only the local Democratic party but also the national Democratic party, which is facing a battle to maintain control of the US Senate in midterm elections.

As part of Hickenlooper's compromise, the oil industry agreed to drop two ballot initiatives that sought to highlight the financial cost of future proposals to restrict energy industry activity and would have prohibited communities that did so from receiving a portion of associated tax revenues.

Initiative 137 would have required a fiscal impact statement be attached to all future ballot initiatives, and Initiative 121 would have prevented communities that ban energy development from receiving a portion of tax revenue generated by it in other counties.

COGA statistics show the Colorado oil and gas industry directly employs more than 50,000 people and supports over 111,000 jobs. It also provides $3.8 billion in total labor income and $29 billion in economic output annually.

Existing protections

Colorado has some of the most stringent rules and regulations for oil and gas development in the US. Earlier this year, it became the first state to limit methane emissions from oil and gas operations (UOGR, March-April 2014, p. 26). In August 2013, the state passed rules extending setback requirements for oil and gas wells to 500 ft from occupied structures, up from previous requirements for 350-ft setbacks in urban areas and 150-ft setbacks in rural areas.

The ballot initiatives portended even stricter regulations.

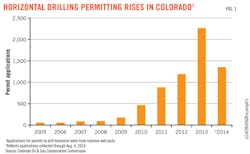

Opposition to fracing in Colorado has risen alongside increasing oil and gas production. From 2007 to 2012, Energy Information Administration (EIA) data show, Colorado oil production rose 89%, and gas production rose 38%. Rising production comes as producers increasingly utilize horizontal wells and multistage fracing to boost production and unlock unconventional formations (Fig. 1).

Colorado is the ninth largest oil producing state in the US and the sixth largest gas producer.

Oil and gas development is surging along Colorado's populated Front Range, and the proximity of wellsites to residential areas is an increasing point of conflict.

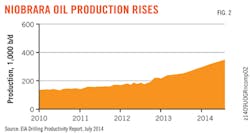

Most notably, new drilling and completion techniques are reviving production in prolific Wattenberg field, which extends beneath growing urban areas northeast of Denver. Wattenberg wells generally target the Upper Cretaceous Codell sandstone and Niobrara shale. (Fig. 2). Industry estimates of retrievable oil in the Niobrara exceed 2 billion bbl.

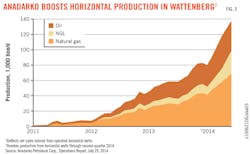

Anadarko Petroleum Corp. is the largest producer in Wattenberg field. In the second quarter, the company operated 14 rigs and spent $579 million to drill 102 wells (see p.23). Production totaled 112,000 b/d of liquids and 339 MMcfd of gas, up from 60,000 b/d of liquids and 274 MMcfd of gas in the year-earlier period (Fig. 3).

Brad Holly, vice-president of operations for Anadarko, said the passage of Initiative 88 would severely limit Wattenberg activity.

"If I showed you a map of every occupied building with a 2,000-ft circle [around it] you'd see that basically the whole field is covered in circles. It essentially shuts down oil and gas development," Holly told the Young Professionals in Energy (YPE) Shale Symposium in Denver in July.

Prepared for a fight

Holly said the ballot initiatives highlight the importance of public outreach and encouraged industry workers to serve as community advocates-engaging in conversations about their work with peers and on social networks like Facebook and Twitter.

"The people in Colorado are very smart. They don't want to hear from a celebrity; they want to hear from you-someone that has an aunt, an uncle, or a mom or dad that's in the business. They want to know what you think. You work in it every day-Is it safe? Is it reliable," Holly said.

Outreach work, he noted, was important to the job security of Colorado oil and gas workers. A study by the University of Colorado at Boulder found that a state-wide ban of hydraulic fracturing would lead to a loss of 68,000 jobs in its first 5 years.

Other Colorado producers are recruiting employees to serve as community advocates. Among them is Noble, which will spend $2 billion in Colorado's Denver-Julesberg (DJ) basin this year, and Whiting Petroleum Corp. Whiting is running four rigs at its Redtail Niobrara field in Weld County, Colo. Net production from the DJ basin field averaged 4,550 boe/d in the second quarter, up 59% from the first 3 months of the year.

Mark Williams, senior vice-president of exploration and development for Whiting, told the YPE event, "There is no substitute for one-on-one contact."

Another producer working to improve industry perception in Colorado is Encana Corp. The DJ basin accounts for one third of Encana's oil and NGL production. The company spent $128 million in the DJ basin during the first half of the year and increased the play's liquids production 41% year-over-year to 10,300 b/d.

Other operators working in Colorado include Berry Petroleum Co. LLC, Bonanza Creed Energy Operating Co. LLC, WPX Energy Rocky Mountain LLC, Marathon Oil Co., Pioneer Natural Resources USA Inc., and Samson Resources Co.

The industry was preparing to spend $50 million to defeat the ballot initiatives this year. Efforts included a television and online advertising campaign, as well as an educational campaign highlighting the economic contributions of oil and gas activity and ongoing work to reduce the environmental impact of operations.

The industry is already working to meet a statewide mandate to reduce fugitive methane emissions that was enacted earlier this year. Other efforts include the widespread adoption of pad drilling and unique programs at individual companies. For instance, Anadarko has installed a water-on-demand system that eliminates the need for heavy trucks to haul water to and from wellsites during fracing.

Momentum shifts

Momentum began shifting in industry's favor this summer.

In July, a third and even more-sweeping ballot initiative targeted at fracing was the first to be dropped. Citing a lack of funds, its sponsor, the Colorado Community Rights Network, determined it would be unable to collect the signatures needed for inclusion on the November ballot. Initiative 75, known as the Community Rights Amendment, sought to amend the state constitution to give communities the ability to prohibit nearly any industrial activity-including fracing.

Efforts also paid off in Loveland, Colo., where a 2-year moratorium on hydraulic fracturing was voted down in July. The Loveland effort is noteworthy because neighboring Weld County generates 85% of Colorado's oil production and is home to much of Wattenberg field.

Weld County leads the state in permitting. Last year, 2,468 well permits were issued in the county, accounting for 61% of all permits issued in the state and generating more than $200 million in tax revenue.

According to Holly, "The way we won Loveland was really a door-to-door campaign that many of our industry colleagues-Anadarko, Noble, Encana, and Whiting employees-undertook to really go door-to-door and tell people about our industry."

Prior to the Loveland defeat, five Colorado municipalities-all in the vicinity of the Wattenberg field-had passed fracing bans in the past 2 years. These include Ft. Collins, Lafayette, Broomfield, Boulder, and Longmont.

A 5-year, voter-approved fracing moratorium in Fort Collins was struck down by a Larimer County judge in August.

The Longmont ban was the first to pass in the state in 2012. It was challenged by COGA and struck down in July by a Boulder County district judge who found it conflicted with state authority. That ban remains in place while the municipality prepares an appeal to a higher court. A separate lawsuit filed by the state, which challenged the municipality's oil and gas drilling regulations, was dropped as part of Hickenlooper's compromise.

Unresolved issue

Paul Enockson, a partner at the Denver offices of the law firm Baker Hostetler, will watch with interest to see what happens with Hickenlooper's fracing panel.

"There's going to be a study group working the issue and, presumably by the legislative session next year, they'll make some recommendations," Enockson told UOGR. He said the issue could resurface if the legislature does not pass something that appeases groups opposed to fracing.

Anadarko and Noble are preparing for future challenges. The companies last year formed Coloradans for Responsible Energy Development (CRED) to spread the message that fracing can be performed safely and to promote awareness of the role oil and gas plays in the state economy.

According to Holly, "Our goal was to win the hearts and minds of Colorado and become an accepted industry in the state. We're not actually fighting one ballot initiative; we're in this for the long haul. We think it's a 5-plus year campaign, and it's a real educational campaign."