Combination of Whiting, Kodiak, to create top Bakken producer

Rachael Seeley, Editor

The recent acquisition of Kodiak Oil & Gas Corp. by Whiting Petroleum Corp. is set to create the largest producer and most active driller in the Bakken-Three Forks tight oil play.

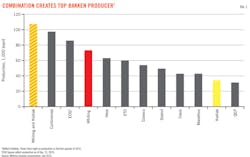

Together, the companies will hold 855,000 net acres of leasehold and an inventory of 3,460 net drilling locations. Combined production from the tight oil play exceeded 107,000 boe/d in the first 3 months of 2014 (Fig. 1).

According to Raymond James Financial, the $6.0 billion all-stock deal is the largest corporate energy buyout in more than 18 months.

During a call to discuss the acquisition, Mark Williams, senior vice-president of exploration for Whiting, said the companies hold interfingered acreage positions across the central and eastern Williston basin, and Whiting understands Kodiak's acreage position well.

Central basin potential

Williams said the potential for wells with high production rates exists in the central Williston basin area surrounding Tarpon field in McKenzie and Williams counties. In this area, Whiting is testing enhanced completion techniques and tighter well spacing in the Middle Bakken and is beginning to drill into the first and second bench of the Three Forks.

In June, the Skaar Federal 41-3TFHU in Tarpon field was completed in the second bench of the Three Forks flowing at an initial production rate of 6,071 boe/d. The well was completed with 30 stages using a cemented liner and plug-and-perf technology. An offsetting well, the Skaar Federal 41-3TFH was completed in the Upper Three Forks flowing 6,634 boe/d.

In comments to the Baker Hostetler Shale Symposium in July, Williams said Tarpon is in the most productive part of the Williston basin, and recent wells have yielded initial production rates ranging from 6,000 to 8,000 b/d.

The acquisition will add to Whiting's portfolio Kodiak's central basin leasehold in Koala, Polar, and Smokey fields. An evaluation of Kodiak's leasehold has yielded numerous additional drillsites. Whiting's knowledge of the Tarpon area helped increase the companies' Williston basin drilling inventory. Since the start of 2014, the companies have added 821 locations to their combined drilling inventory, increasing it to 3,460.

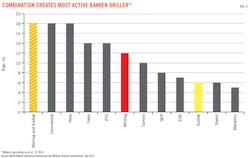

Whiting this year began exclusively using cemented liners at its Bakken wells and now utilizes multiple perforations for each frac stage. The completion design better isolates the perforations to fracture the reservoir and is improving well results.

Coiled tubing tests

The company is also testing coiled tubing frac completions in conjunction with cemented liners. A test in Missouri Breaks field, which straddles Richland County, Mont., and McKenzie County, ND, yielded higher initial production rates and lower completion times than in earlier wells. "For an 11% incremental cost increase we got about a 73% increase on our early rates in this well relative to the open annulus completions that we were doing before," Williams told the shale symposium.

In addition, a coiled tubing frac job can be performed in 3-4 days compared with the 10 days needed for a plug-and-perf job, Williams said.

Whiting believes there is further room for completion improvement. "I believe that we're still very early in the game of optimizing completion techniques. I think our recovery efficiencies are going to go up significantly from where they are today over the next year or two," Williams told analysts.

He added: "When we look at Kodiak's position we see not just what they are now but what we think they can become as we continue to develop new completion technology."

Economies of scale

One advantage of the merger is expected to be a lower cost structure for Kodiak. The average Bakken well costs Kodiak $9.2 million to drill and complete-$700,000 more than Whiting pays. The merged company expects to close the cost gap by January.

James Volker, chief executive officer of Whiting, expects Kodiak to benefit from the improved pricing that Whiting receives from suppliers and service companies due, in part, to its larger operations and strong business relationships. "I think that, pretty quickly, can be brought to bear on all the wells that we're drilling. All of them-both for Kodiak wells and the Whiting wells," Volker said.

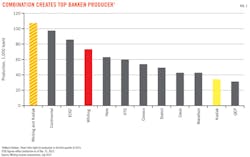

Whiting plans to accelerate Kodiak's drilling program. By the end of 2015, the company expects to put five more rigs to work on Kodiak's leasehold-increasing that rig count to 12. Drilling is also ramping up on Whiting's existing acreage. In July, three rigs were being moved in to increase its rig count to 14.

The accelerated drilling has positioned the combined company to overtake Continental Resources Inc. and Hess Corp. to become the most active driller in the Bakken (Fig. 2).

The Bakken is already a core area for Whiting and will grow in importance after the merger. The Williston basin produced 73,325 boe/d in the first quarter of 2014-accounting for 73% of Whiting's production. Production was up 27% from the prior-year period.

Before the merger announcement, Whiting held 683,800 net acres of Bakken leasehold and planned to allocate 41% of its $2.7 billion capital spending budget to the Northern Rockies region-which consists primarily of the Bakken.

Flaring considerations

Whiting is also prepared to meet North Dakota's first mandated flaring reduction target (UOGR, May-June 2014, p. 4.) Lynn Helms, director of the North Dakota Department of Mineral Resources, said in July that Whiting is capturing and utilizing more than 74% of the natural gas it produces in North Dakota. The state expects all Bakken operators to meet or exceed this threshold by Oct. 1, and those that fail to do so could be subject to production curtailments.

Kodiak, meanwhile, has been lining up third-party-gas-gathering and processing capacity to meet the Oct. 1 deadline. Volker said: "I've been impressed, personally, by the work that's been done over the past 6 months to basically get Kodiak ready to meet those requirements ... As a combined entity, I can assure you that we will have plenty of cushion with respect to those rules."

An investor note by Scott Hanold, an analyst with RBC Capital Markets, shows that Kodiak flared 35% of its North Dakota gas production in the first quarter, down from 42% in last three months of 2013.

The merger is expected to close in the fourth quarter, assuming regulatory and shareholder approval. Kodiak shareholders are set to receive .177 share of Whiting stock for each share of Kodiak common stock that they hold.

Shareholders of Kodiak, which has focused exclusively on the Williston basin, will see their asset base diversified to include Whiting's operations in the Niobrara shale in northeast Colorado and an enhanced oil recovery project in Texas.

Once the deal closes, Kodiak shareholders will own 29% of the combined company, which will be led by Whiting's management team and based in Denver.

Lynn Peterson, chairman, president, and chief executive officer of Kodiak, will serve on the board of directors alongside James Catlin, Kodiak's vice-president of business development.

The combined entity will have an initial enterprise value of $17.8 billion and proved reserves of 606 million boe, 80% oil. Production from all operating areas is expected to exceed 152,000 boe/d in 2014.