Range Resources boosts Marcellus shale production above 1 bcfd

Range Resources Corp. plans to further increase its production in the Marcellus shale in 2014 and has set a higher capital spending budget that will enable it to drill even longer laterals and utilize more completion stages at its Marcellus wells this year.

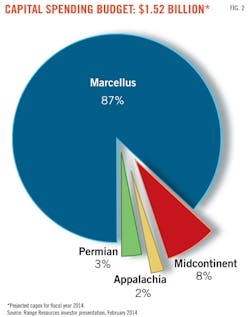

The Marcellus is a key part of the company's portfolio, and Range allocated 87% of its 2014 capital spending budget of $1.52 billion to the formation (Fig. 1). The total capex is $220 million higher than the amount spent in 2013.

Range, which helped pioneer development of the Marcellus, holds nearly 1 million net acres across the formation and is one of its largest producers. Marcellus production reached 1 bcfd in late December and is expected to rise 20-25% in 2014.

Chief Operating Officer Ray Walker said Range has seen strong production growth from the Marcellus over the past 4 years.

"In 2009 we averaged 57 MMcfed from the Marcellus, and in 2013 we averaged 790 MMcfed. That's 1,161% growth over 4 years," Walker told analysts in February.

Production growth has benefitted from continued efforts to optimize drilling and completion—reducing costs and making operations more efficient.

In southwest Pennsylvania, Walker said, Range now drills wells 93% faster than it did in 2009, the cost per foot of lateral drilled has decreased by 24%, and the company averages about 98 frac stages per crew per month—an 87% improvement compared to 4 years ago.

Range's Marcellus shale production averaged 810 MMcfed in the fourth quarter of 2014, up 37% from the same period in 2013, and ended December above 1 bcfd.

The formation accounted for the bulk of the Range's fourth-quarter production of 760 MMcfd of gas, 31,390 b/d of NGL, and 11,220 b/d of crude and condensate.

Improving performance

Part of the company's success stems from efforts to improve well design and completion to unlock greater volumes of hydrocarbons—efforts that are slated to continue this year.

"Most importantly, with this capex budget, we've elected to drill our Marcellus wells with significantly longer laterals and more stages than previously announced," Walker said.

"This will drive greater EURs and better capital efficiencies that will primarily flow through in 2015, and we expect those lateral lengths to get even longer."

In Range's super-rich, wet gas area in southwest Pennsylvania, the company this year plans to increase the average lateral length of horizontal wells to 5,300 ft from an average of 3,894 ft in the fourth quarter of 2013 and raise the number of hydraulic fracturing completion stages used on each well to 26 from 20.

The super-rich wet gas area refers to a portion of Range's acreage that has a much higher btu content than the average wet Marcellus well, Range spokesperson Matt Pitzarella told UOGR. "What this really amounts to is that you produce significantly more condensate, as well as the heavier and more valuable NGLs," he said.

A super-rich well produces, on average, nearly four times the amount of condensate of a typical wet Marcellus well.

Fifteen gross wells (14.6 net) were brought online in the super-rich, wet gas area during the fourth quarter. Initial, 24-hr production rates averaged 2,160 boe/d gross (1,738 boe/d net) with 67% of production composed of liquids. Walker expects the extended laterals and increased completion stages will result in an average estimated ultimate recovery factor of 2.05 million boe/well in this area.

Range also is optimizing drilling and completion in the dry gas area of its southwest Pennsylvania leasehold. Plans call for increasing the average lateral length of wells drilled in this area to 5,200 ft and utilizing 26 stage completions in 2014, an increase from 2,950 ft laterals with 14 stages in 2013. This is expected to result in an average EUR of 13.4 bcf/well.

In total, Range brought 28 net Marcellus wells online in southwest Pennsylvania during the fourth quarter and turned 10 net wells to sales in northeast Pennsylvania.

Range is also experimenting with tighter well spacing at two pilot projects with encouraging results.

The company has so-far completed two, 500-ft spaced pilot projects in the super-rich and wet gas areas of the Marcellus shale in Washington County, Pa. The wells, which have been online for 3½ years, are spaced 500 ft apart and yielding EURs that are about 80% of the EURs for wells spaced 1,000 ft apart.

Assuming full-scale development, Range figures tighter well spacing could add 12-15 bcfe of resource potential to its holdings in the super-rich and wet gas areas of the Marcellus.

The company plans to continue improving the efficiency of its Marcellus operations, Walker said, through initiatives that include better completion designs, longer laterals, closer spaced laterals, and drilling into multiple reservoirs from the same pad site.

Testing the Utica

Range also plans to drill an exploratory test this spring that will target the Utica/Point Pleasant formation in Washington County, Pa.

Range figures 400,000 net acres of its Marcellus shale leasehold in southwest Pennsylvania is prospective for the Utica/Point Pleasant, based on gas-in-place analysis, delineation from offset activity, and other geological data.

"We have all the ingredients for a highly productive well including thickness, the right maturity, very high gas in place, exceptional rock quality, high pressure, a 3D survey, and it is at very reasonable and workable depth," Walker said.

Initial production test results are expected by yearend. Walker said the company figures the Utica/Point Pleasant formation is about 130 ft thick in the area with 10% porosity. Gas in place is expected to be as high as 140 bcf/sq mile or more.

If the test is successful, further exploration of the Utica/Point Pleasant could lead to increases in Range's proved reserve base, building on gains recorded last year. The company's proved reserves rose 26% to 8.2 tcfe at yearend 2013, and 612% of production was replaced.

"We think [the Utica/Point Pleasant formation] has the potential to be hugely economic and a great play that we can really ramp up in and develop in as the years go forward," Walker said.

Data from the US Energy Information Administration show that production from the Marcellus shale neared 14 bcfd in February 2014, up from roughly 10 bcfd in the year-earlier period.

With Marcellus producers like Range planning to increase their production further this year, those rates are likely to continue rising.