Rail a key transportaion link for Bakken crude

As production in the Bakken tight oil play ramps up at an unprecedented pace, producers are increasingly relying on railroads to bypass overwhelmed pipelines and move crude to market.

Production is coming online faster than pipelines can be built, straining the region's limited takeaway capacity. The existing rail system enables producers in North Dakota and Montana to bypass pipeline bottlenecks and sell their light, sweet Bakken crude in Canada, where it is blended with bitumen, and at refining markets along the East, West, and Gulf coasts.

N. Foster Mellen, senior oil and gas analyst with Ernst & Young, estimates that nearly three quarters of Bakken crude production, or around 700,000 b/d, is transported by rail. Production from North Dakota rose from 81,000 b/d in 2003 to nearly 950,000 b/d in October 2013, making North Dakota the second largest oil producing state in the US after Texas.

The surge of Bakken production has disrupted regional crude flow patterns. A recent Ernst & Young report, coauthored by Mellen, said crude production from the Midcontinent region was historically low and declining before the unconventional oil and gas revolution. Regional pipeline systems were geared toward moving crude in from Canada and the Gulf Coast to supply regional refineries. Now the Bakken boom has turned that supply scenario on its head.

Mellen told UOGR that a clash of growing Bakken production coupled with infrastructure constraints has created some "significant price distortions" for landlocked Bakken crude.

Weighing options

Producers that rely on the railroad system to transport Bakken crude to market have found that the relatively high transportation cost of rail is more than offset by the higher prices crude commands once it arrives at its destination.

Figures compiled by Ernst & Young estimate the cost of transporting Bakken crude to the Gulf Coast by rail is about $6/bbl more expensive than shipping it by pipeline (see table).

Bakken crude sent by rail to the Gulf Coast in November sold for $28.55/bbl more than what it sold for in North Dakota. EIA data shows the price of Louisiana Light Sweet, the benchmark for light sweet crude at the Gulf Coast, averaged $104.20/bbl during the month while North Dakota benchmark Williston basin sweet crude sold for $75.65/bbl.

Bakken crude sold for an even higher premium along the East and West coasts, where it obtains Brent prices set by the international market. Brent sold for a $32.14/bbl premium to Williston basin sweet in November.

A recent study by the Energy Policy Research Foundation (EPRINC) explained, "shippers are willing to pay more for the transportation of crude oil if it means getting it to a higher value market, thus ensuring a higher netback."

Other advantages

Though moving crude by rail is generally more expensive than long-term pipeline transportation, rail capacity can be brought online far more quickly than pipelines can be permitted and built.

Other advantages to rail, listed by Ernst & Young, include lower upfront costs, shorter transportation contracts, the ability to reach several refining markets, and the flexibility to respond to changing market conditions.

Rail also grants Bakken crude direct access to refining markets along the East and West coasts that are not connected to the Bakken region by pipeline.

Many Bakken rail takeaway projects have come online in recent years. The North Dakota Pipeline Authority said rail capacity rose from 275,000 b/d in 2011 to 775,000 b/d in 2012, and the figure was expected to climb to 880,000 b/d as early as late 2013.

The list of producers that ship crude out of the Bakken by rail includes EOG Resources Inc., Continental Resources Inc., Kodiak Oil & Gas Corp., and Hess Corp.

Allen Good, senior equity analyst with Morningstar, told UOGR, "Really, everyone in the Bakken is looking toward rail."

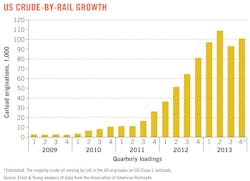

The trend of moving oil by rail is not confined to the Bakken play. A report by the trade group American Association of Railroads estimated that around 11% of total domestic crude production in the US was moved by rail during the first three quarters of 2013, up from a negligible percentage just a few years ago. North Dakota and the Bakken region accounted for the vast majority of new rail car originations.

Rail risks

Though rail solves many near-term transportation issues for producers, it also presents a degree of risk. Three high-profile accidents involving explosions of rail cars carrying Bakken crude in 2013 generated increased scrutiny of the transportation method by regulators in the US and Canada.

Forty-seven fatalities were reported in July at the scenic resort town of Lac-Megantic, Que., after a runaway train carrying Bakken crude derailed and exploded. In November, a train filled with Bakken crude on its way to the Gulf Coast derailed, causing explosions and fires in rural Aliceville, Ala., and a series of explosions rocked Casselton, ND, on Dec. 30 after a crude train collided with a derailed train carrying soybeans.

Although railroads have a strong record of delivering loads safely—with AAR reporting that roughly 99.998% of hazardous material carloads moving by rail arrive at their destination without an unintended release—one large mishap can cast a shadow over the entire industry.

"Accidents bring more attention to things, like Macondo did to the offshore drilling industry," Mellen said.

In order to reduce the likelihood of a hazardous materials release during an accident, AAR in November urged the US Department of Transportation (US DOT) to tighten construction standards for rail cars used to transport flammable liquids and update safety equipment on existing cars.

The recommendations call for new cars to include an outer steel jacket around the tank car with thermal protection, full-height heat shields, and high-flow capacity pressure relief valves. "The problems in all of the really big accidents are failures with the tank cars. Both industries—both the rail industry and the oil and gas industry—are struggling with a mismatch of the infrastructure equipment we have in place and the demand for it." Mellen said.

Of the roughly 92,000 tank cars moving flammable liquids today, AAR figures 78,000 would need to be retrofitted to meet the tighter standards or phased out. Another 14,000 cars in compliance with the latest standards might also require some upgrades.

The Pipeline and Hazardous Materials Safety Administration (PHMSA), overseen by US DOT, has stepped up oversight of crude by rail transportation. The agency in early 2013 launched a program of unannounced inspections, called Operation Classification, that call for sampling and testing Bakken crude to ensure that it is properly labeled before it is transported.

Preliminary results of the operation, conducted jointly with the Federal Railroad Administration, found that Bakken crude may be more flammable than other traditionally heavy crude grades and prompted PHMSA to issue an alert. "Emergency responders should remember that light sweet crude oil, such as that coming from the Bakken region … pose significant fire risk if released from the package in an accident," the agency said.

Rail rolls on

Tighter safety regulations could slow down the growth of crude-by-rail transportation, but Ernst & Young figures that the sheer number of projects and energy companies that have invested in rail infrastructure indicate that rail will continue to play a role in transporting crude out of the Bakken for years to come.

"Anytime you have the high profile accidents like we've had, rightfully there is concern. I would say that it is doubtful, very doubtful that crude-by-rail transportation could ever be prohibited…," Mellen said. "That being said, there will be much more attention paid, particularly in the short term, to tank car issues."