Production from Niobrara shale continues to rise

In Colorado's D-J basin, daily output of oil and natural gas from the Niobrara shale continues to climb. This scenario is expected to continue, despite attempts to limit development on the political front.

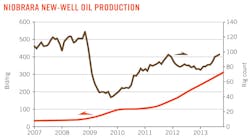

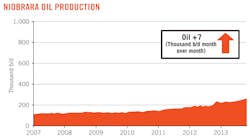

Energy Information Administration's (EIA's) Drilling Productivity Report for October 2013 estimated that each rig working in the play would become 7 b/d more productive in November versus October. Average monthly production additions from one rig working in the play were pegged at 305 b/d in October. With the rig count topping out at just above 100, monthly production additions from one average rig in the play were pegged at 305 b/d in October. Overall daily production from the Niobrara reached approximately 250,000 b/d of oil in October.

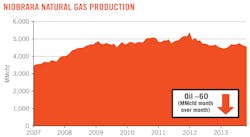

While EIA's report figured the average rig added 1,038 Mcfd of production in October, it predicted that number would fall to 978 Mcfd in November. Overall gas production in the Niobrara is approximately 4.5 Bcfd.

Legacy oil production is on the rise along Colorado's front range stemming from Niobrara development drilling. Production has steadily climbed since 1999, according to data from the Colorado Oil and Gas Conservation Commission (COGCC). In 2012, the Niobrara shale made headlines when oil production exceeded 48 million bbl—a 50-year high.

In mid-October, Houston independents Noble Energy Inc. and Anadarko Petroleum Corp. successfully exchanged 50,000 net acres in the greater Wattenberg area of northern Colorado in southern Weld County.

Anadarko reimbursed Noble $202 million for capital spent to drill and complete wells on the acreage. At the time, Noble said the exchange would lower net production from recent levels by 8,000 boe/d, but that this would be offset by operational efficiencies and cost savings. The company also reported that its D-J basin volumes were expected to increase by at least 20% in 2014.

Noble and Anadarko estimate Niobrara reserves at 2.1 boe and 1.5 boe respectively. Both companies have invested more than $1 billion in developing the Niobrara shale in Colorado this year.

The EIA has estimated that the Niobrara will reach 400,000 b/d of oil production by 2015. Given the rates shown in the month-over-month increases, this target will likely be reached.