Eagle Ford tops US oil producers at 1 million b/d

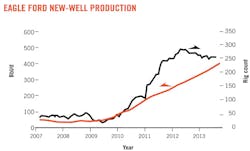

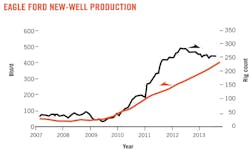

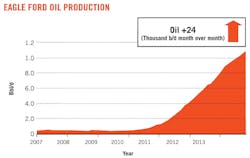

The Eagle Ford produced 1 million b/d in August and that number is expected to rise to 1.09 million b/d of oil through November, according to a recent report from the US Energy Information Agency (EIA). Improved drilling efficiencies have placed the South Texas Eagle Ford shale as the front runner for oil production in the US. The EIA estimates that each rig working in the Eagle Ford is drilling 1.5 wells a month.

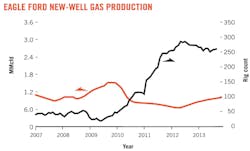

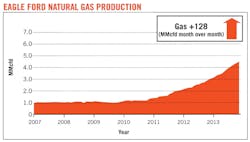

In its October 2013 Drilling Productivity Report, the EIA projected 404 b/d of oil on average would be added for each rig working in the play in November. Natural gas production remained steady in the Eagle Ford at approximately 12 MMcfd, according to the report.

Within the last 2 years, Eagle Ford production has risen steadily. While much of the buzz has centered on oil and gas production, rural towns in South Texas have endured the associated pressures of increased traffic and the influx of population. While much of the new oil and gas activity has contributed greatly to otherwise stagnant tax revenues for these communities, road maintenance and water management have become major challenges for some.

Water pressure

South Texas is naturally prone to drought conditions. With the added pressure of new wells being drilled and completed—which can consume up to 5 million gal of water per well—water has become a scarce resource in some areas.

Texas' 83rd Legislature recently approved three bills as part of a broad package to fund projects throughout the state within its State Water Plan. Senate Joint Resolution 1, House Bill 4 (HB 4) and House Bill 1025 (HB 1025) together comprise an amendment to the Texas Constitution creating the State Water Implementation Fund for Texas (SWIFT). The legislature will appropriate a one-time $2 billion investment from the economic stabilization fund (also known as the Rainy Day Fund) to the SWIFT.

Proposition 6, which enabled the state to implement the plan, was decided on by voters in early November. HB 4 may not be complete until March 2015, according the legislative reports. The goal of the amendment is to make financing water projects more affordable as well as providing ongoing state financial assistance for water supplies.

Most communities are financially challenged by the upfront costs of water infrastructure projects. In order to help municipalities build what they need, SWIFT will make economic opportunities available with low-cost, flexible financing options for water projects.

The system will work through the Texas State Water Plan. With 16 regional water planning groups in the state, each region will compile its own water plan that will project population and water demands and/or supplies throughout the next 50 years. The State Water Plan is updated every 5 years.

The good news for communities in heart of many ongoing unconventional resource development areas throughout the state is that every water user group in Texas is planned for. Cities, rural water users, agriculture, livestock, manufacturers, mining, and steam-electric power are included – roughly 3,000 water user groups – in the current 2012 State Water Plan.

While it may take several years to see new water projects to come online, there is certainly an option in place for communities who have felt the burden on local water supplies due to increased oil and gas development.

Road resources

Another cost of doing business in the Eagle Ford for both county governments and local municipalities is increased road maintenance due to an increase in heavy truck traffic. Both drilling and completion activities require an inordinate amount of trips to haul equipment and/or water to and from each wellsite. As a result, many local governments have been challenged to keep roads well maintained.

The Texas Department of Transportation (TxDOT) is responsible for maintaining state roads, but much of its resources are tied up in major projects in well-populated urban centers such as Houston, Dallas, and San Antonio. Rural communities have had some difficulty keeping up with the pace at which the Eagle Ford shale has expanded.

Also part of HB 1025, the Texas Legislature passed a supplemental bill allocating $450 million to be divided between state roads and county roads damaged in energy development areas. Half of this amount—$225 million— will be allocated to the Texas Department of Transportation, and the other half will be distributed to counties through grants.

Additional support for road repair is provided by Senate Bill 1747 (SB 1747). Authored by Senator Carlos Uresti and sponsored by Representative Jim Keffer, SB 1747 created a grant program for county roads in energy development areas and authorizes TxDOT to administer the program.

Funding for each county will be determined by a formula that takes into consideration weight tolerance permits, oil and gas production taxes, number of well completions submitted to the Texas Railroad Commission, and the volume of oil and gas waste injected per county. In order to receive funding, counties will be required to submit road condition reports, lists and scope of transportation infrastructure projects, and matching funds of 20% of the amount of the grant. Counties that are determined to be economically disadvantaged will be required to provide 10% matching funds.

Counties also are required to create Energy Transportation Reinvestment Zones (CETRZs). According to the bill, a CETRZ is a specific contiguous zone in a county that is determined to be affected by oil and gas exploration and production activities. The zone is designed around a planned transportation project that is established as a method to facilitate capture of the property tax increment arising from the planned project.

The bill outlines the formal legal process for creating the CETRZ, which includes public hearings, adopting commissioner's court order to establish the CETRZ and to describe the boundaries of the zone, establishing an advisory board, determining the amount of the tax increment, and establishing a tax increment account. Counties must dedicate all of the increase in the appraised value of real property located in the CETRZ to their projects.

Per the legislative document, TxDOT will accept applications Feb. 7-14, 2014.

Expansion ahead

Production from the Eagle Ford shale will continue to increase throughout the next several years. While its associated communities have learned valuable lessons for planning around a rapid rise in drilling activity, many more throughout the state will experience this process first hand as new areas continue to be evaluated.

The new legislative backstop should ease some communities into increased industrial activity once new production begins to come online.