Local economies thrive from South Texas Eagle Ford growth

ATASCOSA COUNTY, Tex.—The University of Texas at San Antonio (UTSA) Center for Community and Business Research reported in March 2013 that Eagle Ford shale development added more than $61 billion in total economic impact during 2012. According to the study, the region also supported 116,000 full-time jobs for oil and gas workers.

UTSA devised its report from examinations of the region's 14 oil- and gas-producing counties and six surrounding counties that serve as staging areas for the play, including Bexar County (San Antonio) where shale development has added more than 20,000 jobs. This is up from less than 5,000 in 2011, according to the report.

San Antonio's Interstate Highway 35 is considered the gateway to the Eagle Ford shale. With increased development, housing has come into short supply. "Sales have increased more than 50% over the last two years," said the manager of Alamo Homes, located on the South side of San Antonio. "It's busy, but nobody is complaining."

Manufactured home sales have sky rocketed in South Texas from both oil and gas companies outfitting "man camps" in more remote developments and from individuals relocating to pursue new opportunities in the oil and gas industry. "Roughly, two-thirds of our business right now comes from clients working in the Eagle Ford shale," the manager said.

South of Bexar County in neighboring Atascosa County, net taxable land values have increased dramatically. From 2010 to 2011, the county saw an increase of 8.51%. Through 2012, this number was raised by 29.23%. "Prior to Eagle Ford shale development, we had an expected growth of 4% to 6% annually," said Michelle Cardenas, chief appraiser with the Atascosa County Appraisal District.

With E&P companies moving into the area, the region has experienced a vast amount of development, including both residential and commercial construction. "We've had four new hotels come online within the last 18 months,"

Cardenas said. In addition to hotels and private housing, RV and travel-trailer lots, so-called "man camps," and new subdivisions are changing the landscape in South Texas physically and economically.

According to Cardenas, Atascosa County has rolled back tax status on 3,160 acres of agricultural farmland within the last 14 months, as this property has been transformed into residential subdivisions and commercial space. "With the Eagle Ford shale becoming more established, many are relocating to the area and buying versus renting or commuting," Cardenas said. Ultimately, the growth has led to a shortage in housing in the region. "There are plenty of vacant lots, but houses and existing structures are in short supply now," she added.

Of course, increased capacity has its downside for some. According to one independent hotel owner, "Two years ago we consistently ran at 100% occupancy." The 24-room establishment, located in Dilley, Texas, in neighboring Frio County, runs at about 20% occupancy now. "It's been very slow for the last four or five months." South Texas is now in the early phase of its boom status, and this trend is expected to continue for quite some time.

The current growth culminates from many moving parts including regional headquarter operations, pipelines, rail, supply, services, housing, and logistics infrastructure. In addition, many companies continue to consolidate their long-term positions with new refining and manufacturing investments, particularly further south along the Gulf Coast. For the 20-county area analyzed in this study, the report forecasts a long-term development generating $89 billion annually, with 127,000 jobs added through 2022.

Observed growth

A competing study was released simultaneously to the UTSA report. The Eagle Ford Shale Task Force Report, which was convened and chaired by Texas Railroad Commissioner David Porter, cited the rapid development of the play within the past few years. The Task Force met 10 times from July 2011 to November 2012 to study workforce development, infrastructure (roads, pipelines, and housing), water quality and quantity, regulations, economic benefits, environmental concerns, and other areas related to local South Texas communities.

The report noted the shortage of qualified local candidates, which forces many companies to hire employees from outside the region, creating an influx of transient workers, thereby leading to a housing shortage.

In 2011, the Eagle Ford shale supported 50,000 full-time jobs in its core 14 counties. Maintaining the manpower needed to supply the growing shale play is a clear challenge. The average income of an oil and gas industry job was $117,000, which represents an 18% increase from 2010. According to the report, Texas was generating a windfall of high-paying jobs at a time when the nation's unemployment rate was above 9%; meanwhile, the industry continues to grapple with an acute shortage of well-trained, experienced labor in the South Texas region.

Drilling activity

Both the UTSA and Eagle Ford Task Force reports site job creation as one of the major benefits shale development has provided for the region. Even though the numbers vary from each report, drilling activity in South Texas directly indicates an increase of oilfield employment.

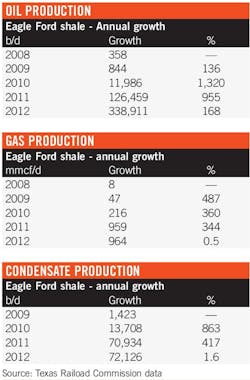

From 2011 to 2013, daily oil and condensate production increased from 100,000 b/d to 700,000 b/d, making South Texas one of the most prominent energy producing regions in the US. The majority of this growth has occurred within the last 4 years. The volume of drilling permits issued by the Texas Railroad Commission has surged to unprecedented levels within the region.

In 2008, the Commission issued 26 permits for Eagle Ford wells. This number increased to 94 the following year, and in 2010 drilling activity rose 974% to 1,010 permits, according to the Task Force report. Permitting more than doubled again in 2011 with 2,826 permits. As of 2012, activity saw a 46% increase with 4,145 permits issued. The liquids-rich area of the play has seen the majority of activity due to stagnant prices for natural gas. Producing oil wells have grown from just 40 in 2009 to 1,262 in 2012. Gas wells have also increased from 67 in 2008 to 855 in 2011.