Worldwide refining capacity declines slightly in 2001

The worldwide refining industry experienced a significant merger and a major acquisition in 2001, yet failed to add any substantial capacity.

In fact, worldwide refining capacity experienced a slight decrease in 2001. Over the past 3 years, capacity has been essentially flat.

Last year's refining report showed a worldwide capacity of 81.3 million b/cd as of Jan. 1, 2002. This year, OGJ's survey reflects a total capacity of 81.2 million b/cd, or a decline of only 85,000 b/cd.

Increases and decreases in distillation capacity, as well as a slight modification in OGJ's reporting methodology, cancelled out each other.

The South America region contributed to the largest regional decrease in capacity, 186,000 b/cd. This was mainly due to two refineries removed from the survey, along with an adjustment of capacities in Brazil. Africa and Eastern Europe also experienced slight decreases.

The largest regional increase in capacity, about 81,000 b/cd, occurred in the Middle East. A new refinery listing in UAE contributed most of the additional capacity. North America followed with an increase of about 64,000 b/cd and Western Europe was third with an increase of 32,000 b/cd.

Asia had a slight rise in refining capacity of 18,000 b/cd, which is a large decrease from last year when the region added over 500,000 b/cd of capacity.

The OJG refinery survey had one new listing in 2001. One refinery was shut down and two others now operate primarily as terminal facilities. There is one change in reporting methodology from last year's surveyrefineries operating primarily as asphalt producers are no longer listed.

New crude capacity

Sharjah Oil Refining Co. Ltd. told OGJ that it was starting up a 71,250-b/cd refinery in 2001. The refinery is located in the Hamriyah Free Zone in Sharjah, UAE.

Last year's survey mentioned that the Formosa Petrochemical Co. refinery in Mailiao, Taiwan, was scheduled to start up the remaining 300,000 b/d of its 450,000 b/d total capacity in 2001. Now it appears this will occur in 2002 and will be reflected in next year's survey.

Refinery closures

Primary crude refining capacity was shut down mainly in South and North America.

The largest refinery to close down was Premcor's 76,000 b/cd refinery in Blue Island, Ill. The refinery stopped operations on Jan. 17, 2001. Premcor said the refinery would not be cost-effective under EPA's new low-sulfur fuel regulations.

The company said that, although it had spent $70 million on the refinery over the last 5 years, the plant does not generate a return sufficient to justify the additional investment needed to meet "the next wave of low-sulfur, cleaner-burning fuels."

Instead, Premcor will focus on higher-return projects at its other three refineries. It operates a 68,000 b/cd refinery at Hartford, Ill., a 165,000 b/cd plant at Lima, Ohio, and a 225,000 b/cd refinery at Port Arthur, Tex. Premcor will continue to operate its petroleum products storage facility adjacent to the Blue Island refinery.

This was not a good year for Puerto Rican refiners. Caribbean Petroleum Refining told OGJ that its 48,000 b/cd refinery in Bayamon is now operating as an oil terminal.

In March, Sunoco shut down its Yabucoa, PR, refinery as part of an effort to restructure its lubricants business.

The refinery does not have atmospheric distillation, but it is listed in our survey with 34,000 b/cd of vacuum distillation.

In September, Sunoco announced that it had agreed to sell the refinery to Shell Chemical. The agreement is expected to finalize after this survey is published. According to Sunoco, the plant is still shut down. Shell, however, may decide to restart it so we are keeping it in the survey.

In the current survey, refineries whose primary product is asphalt are not listed. The seven delisted plants account for a total of 52,800 b/cd of capacity. Six are located in the US, and one is in Hungary.

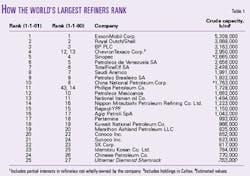

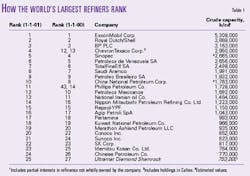

Largest refining companies

Table 1 lists the top 25 refining companies that own the most worldwide capacity. Table 2 lists companies with more than 200,000 b/cd of capacity in Asia, the US, and Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Significant changes from last year involve Chevron, Texaco, Phillips Petroleum Co., and Tosco Corp.

In September, Tesoro Petroleum acquired the Salt Lake City, Utah, and Mandan, ND, refineries from BP PLC. The refineries have a combined crude capacity of 111,000 b/cd, and increases Tesoro's total capacity to over 390,000 b/cd in five refineries. This moved Tesoro from 19th to 16th largest US refiner.

In October, Chevron and Texaco finalized a merger, which was announced in late 2000, to form ChevronTexaco Corp. The merger vaulted the two companies to 4th on the worldwide list from 12th and 13th. This is primarily due to the fact that Caltex refineries are now included with ChevronTexaco in Tables 1 and 2.

Since Texaco has interests in the joint ventures Equilon and Motiva, the US Federal Trade Commission will allow Shell Oil Co. and Saudi Refining Inc.-the other partners in the venture-to acquire Texaco's share. This has not happened yet, so ChevronTexaco's interest in Equilon and Motiva is still reflected in Table 2.

In September, Phillips Petroleum Co. completed its acquisition of Tosco Corp. In the 2001 OGJ survey, Tosco ranked 3rd in US refining capacity and 14th worldwide. Tosco, based in Old Greenwich, Conn., has grown through acquisitions from a single-refinery company in 1992 to become the big gest US independent refiner and marketer.

Before the acquisition, Phillips ranked 17th among US refiners, and 43rd worldwide, with three refineries totaling 355,000 b/cd. In the current OGJ survey, Phillips now ranks 2nd in the US, behind ExxonMobil, and 11th in the world with a total capacity over 1.7 million b/cd.

In Europe, things have not changed significantly from last year's survey. New to the Western Europe rankings in Table 2 is Petroplus, which significantly increased its crude capacity with the acquisition of the 100,000 b/cd Teesside refinery from Phillips Petroleum.

Isab SpA is now listed under its parent company, ERG Group. Its listing also reflects interests in two other refine ries.

Pending mergers will affect the refining landscape in 2002.

Even after its Tosco acquisition, Phillips Petroleum apparently wants to be an even bigger player the oil industry.

So, in November, Phillips Petroleum and Conoco announced that they would merge their operations.

If this "merger of equals" is approved, it will create a company with 2.6 million b/cd of refining capacity, and interests in 19 refineries.

The 10th and 11th largest refiners in the US, Valero Energy Co. and Ultramar Diamond Shamrock, are also planning to merge.

The merger is expected to close by the end of this year, pending additional regulatory reviews. The new company would become the fifth largest US refiner, ranked behind the just-created ChevronTexaco.

Largest refineries

The world's largest refineries are listed in Table 3.

The order of the refineries in this list is unchanged from last year's survey, although there are a few minor adjustments in the refineries' capacities.

Regional crude capacities

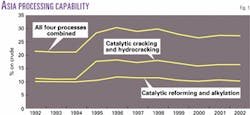

Table 4 lists regional processing capabilities as of Jan. 1, 2002.

The largest change in crude capacity occurred in the Middle East, as previously mentioned, due to the startup of a refinery in UAE.

Asia had the smallest change in crude capacity. The Sinopec refinery in Zhenhai more than doubled its capacity to 342,000 b/cd. This increase was offset by losses in Japan, most notably Japan Energy Co., which idled 90,000 b/cd of crude distillation at its Aichi refinery.

In November, BP announced that it would shut down the oldest and smallest of its three crude distillation units at its Grangemouth, Scotland, UK, refinery.

However, the changes will occur after this survey is published, so any effects of the shutdown will be reflected in next year's survey.

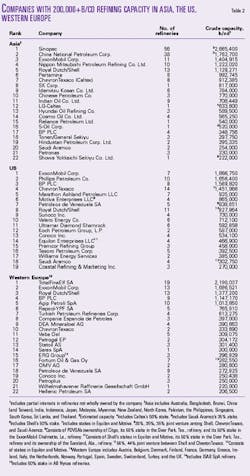

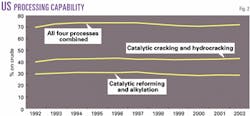

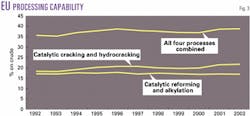

Processing capabilities

Figs. 1-3 show the processing capabilities of Asia, the European Union (EU), and the US. Processing capabilities are defined as conversion capacities (catalytic cracking and hydrocrack ing) and fuels producing processes (catalytic reforming and alkylation) divided by crude-distillation capacity (% on crude).

Countries in the EU include Belgium, Denmark, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, Spain, and the UK.