Discoveries alter Caspian region energy potential

Caspian Production Potential1

First in a series.

Within the past 18 months, a number of key world-class oil and gas discoveries have transformed the outlook for the Caspian Sea region. Russia's already dominant position in the region was strengthened further during 2000 with the discoveries of Yuri Korchagin and Khvalynskoye oil fields on the Severnyi block. But perhaps more importantly, the discovery of Kashagan oil field in 2000, one of the largest fields in the world to be discovered in recent times, has shifted the reserves balance clearly in favor of Kazakhstan.

Due to the large gas reserves found in all the main projects, gas will play an increasingly important role in development of the Caspian region.

At a corporate level, the discovery of Kashagan and subsequent changes in ownership have had a significant impact on the regional reserve rankings, bringing new players into the frame while at the same time relegating some of the more established companies more to the background.

Although the high-profile opportunities more than ever remain in the hands of the majors, for several smaller players, profitable, if lower-profile, Caspian assets are key to their overall success.

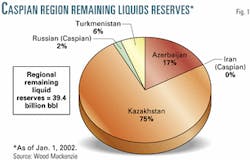

Liquids reserves

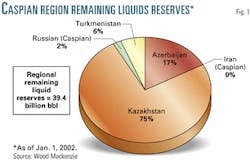

As of Jan.1, 2002, the five Caspian states-Azerbaijan, Iran (Caspian reserves only), Kazakhstan, Russia (Caspian reserves only) and Turkmenistan-are projected to have remaining liquids reserves of 39.4 billion bbl (Fig. 1).

The Caspian is dominated by six key projects (Kashagan, Tengiz, Karachaganak, Azeri-Chirag-Guneshli [ACG], Shah-Daniz, and the Severnyi block in Russia), which contain a combined 26.9 billion bbl, or 68% of the region's total liquids reserves (see map).

For the purposes of this analysis, Wood Mackenzie has estimated Kashagan liquids reserves at a conservative 10 billion bbl, which represents more than 25% of the regional total. The giant discovery has strengthened Kazakhstan's regional reserve position, and it now controls about 75% of the Caspian's liquids.

Further appraisal work at Kashagan and the surrounding Agip KCO (formerly Offshore Kazakhstan International Operating Co. [OKIOC]) acreage could lead to an upward revision of the reserves in the near future, strengthening Kazakhstan's position in the region still further.

Despite the addition of 750 million bbl of reserves from the Yuri Korchagin and Khvalynskoye oil fields in the Russian sector, Azerbaijan remains firmly in the second spot with 17% (6.6 billion bbl) of the Caspian total (Table 1). Exploration drilling in Azerbaijan during 2000 and 2001 has largely been disappointing, casting serious doubt over the ultimate potential of the southern Caspian. Turkmenistan's liquid reserves have more or less remained unchanged at 6% (2.2 billion bbl), while Iran has yet to contribute to the regional total, with exploration drilling unlikely to commence before 2004.

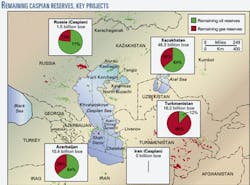

Gas reserves

With estimated associated gas reserves of about 25 tcf, the Kashagan oil discovery has enhanced Kazakhstan's position as a regional gas player, bringing it in line with the vast remaining gas reserves held by Turkmenistan. Kazakhstan and Turkmenistan contribute 45% and 44%, respectively, of the Caspian's 207 tcf total remaining gas reserves (Fig 2).

Despite Kazakhstan's large, well balanced reserve portfolio, much of the gas, and in particular that at the Tengiz and Kashagan fields, is sour and hence costly to develop. With a lack of local or regional markets willing to pay adequate gas prices, much of the Kazakh gas is likely to have negative value for some time due to the costly processing and treatment required.

Although oil currently remains more important to Azerbaijan, it contributes about 10% of the region's remaining gas reserves, primarily due to the giant Shah Daniz gas field. Despite its smaller gas volumes, Azerbaijan has a geographical advantage that has enabled it to secure a significant gas sales contract with Turkey at an international gas price. Unlike some of the other Caspian states, Azerbaijan remains relatively well positioned to gain additional gas market share and capitalize on its gas assets in the longer term.

Due to the major contribution from gas, secure long-term gas contracts or viable gas utilization alternatives will be needed for all the major projects in order to optimize development and investment across the region.

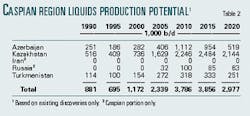

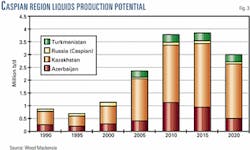

Liquids production

Wood Mackenzie anticipates that liquids production in the Caspian region could exceed 3.8 million b/d by 2015, based on existing discoveries alone-more than triple the 1.2 million b/d achieved during 2000. Kazakhstan and Azerbaijan will continue to dominate regional liquids production in the future, contributing an estimated 2.5 million b/d and 1.0 million b/d, respectively, by 2015 (Table 2).

However, based on existing discoveries alone, Caspian liquids production looks set to decline after 2015 (Fig. 3), future exploration success in the region is expected to add to the production potential presented, possibly extending the plateau of 3.5-4.0 million b/d beyond 2020.

Kazakhstan is expected to provide steady liquids output growth over the short-medium term from the production ramp-up of Tengiz and Karachaganak, with longer-term growth coming from the Kashagan development.

Future liquids production growth in Azerbaijan depends heavily on the sanction and construction of the high-profile Baku-Tbilisi-Ceyhan (BTC) export pipeline. Providing BTC is operational by 2005, the ACG project should be able to realize its full potential, driving Azerbaijan's liquids production up nearly fourfold to more than 1.1 million b/d in 2010.

While future exploration is likely to add to the region's proven liquids reserves and hence production potential post-2010, recent disappointments in the promising Azeri sector have cast significant doubt over the prospectivity of the southern Caspian. Conversely, large discoveries in the Russian and Kazakh sectors in the north have provided increased optimism that future production growth may come from new discoveries made in this region.

In Turkmenistan, liquids production is influenced primarily by progress at the Cheleken and Livanov contract areas. Production is expected to rise to 318,000 b/d by 2010 before going into decline after 2015.

In the Russian sector of the Caspian, production will likely commence from the Severnyi block in 2004, initially from Yuri Korchagin field and thereafter from the phasing-in of Khvalynskoye.

Iran, which has yet to commence exploration in its sector of the Caspian, is not expected to contribute to the region's liquids production before 2010.

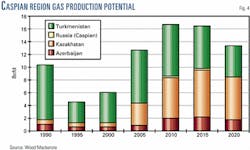

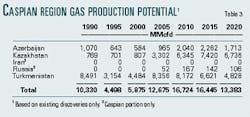

Gas production

Based on existing discoveries alone, the Caspian region has the potential to produce about 16-17 bcfd of natural gas by 2010 (Fig. 4), with the main contributors being Turkmenistan (49%) and Kazakhstan (38%) (Table 3). The key projects driving gas production over the short-medium term in Kazakhstan are the Karachaganak, Tengiz, and Kashagan developments. In Turkmenistan, gas production will be largely driven by the production capacity of existing fields and market demand, rather than by development of new reserves.

Azerbaijan's contribution to the Caspian total will primarily be influenced by the Shah Daniz gas project and the degree to which additional gas sales contracts can be secured with Turkey or neighboring countries. Exploration success is likely to keep regional gas production on an upward trend beyond 2010. Free, sweet gas discoveries, such as Shah Daniz, are considered more likely in the southern Caspian, with significant sour, associated gas anticipated in the northern Kazakh sector.

The potential growth in gas production for the Caspian is significant, although a large proportion of the remaining gas reserves remain stranded without local, regional, or international markets. Turkmenistan and Kazakhstan gas remains subject to Russia's dominance and as a result is largely unable to reach markets willing to pay international gas prices. In a region where potential gas supply is expected to substantially outstrip demand within a decade, securing additional gas markets, obtaining the finances for export pipelines, and managing the technical and political risks remain key if the region is to realize its gas production potential.

Corporate reserves

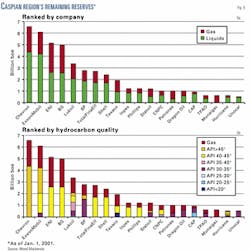

Using Wood Mackenzie's PathFinder database and mapping product, remaining reserves rankings have been compiled for the top 20 companies (excluding the national oil companies) operating in the Caspian region. Despite the discovery of the giant Kashagan oil field by the OKIOC consortium during 2000, Chevron Corp. has maintained its overall position at the head of the reserves rankings due to its 50% stake in Tengiz (Fig. 5a). Chevron and Texaco Inc. reserves have been shown separately to illustrate the relative contribution, prior to their merger to form ChevronTexaco Corp. last October.

ExxonMobil Corp. has closed the gap significantly to within 500 million boe, with its 16.67% stake in the Kashagan discovery. In addition to its previously stated liquids reserves estimate, Wood Mackenzie used a conservative reserve estimates of 25 tcf of gas for Kashagan, which could be revised upwards following further appraisal.

Even allowing for this upward revision of Kashagan reserves, the newly consolidated ChevronTexaco should easily be able to maintain its lead position in the Caspian.

Although initially part of the OKIOC consortium that made the Kashagan discovery, BP PLC, along with Statoil ASA, decided to sell its interests in Kashagan to the remaining partners. In doing so, BP has slipped down the reserve rankings from the third position to sixth, while OKIOC members ENI SPA and BG PLC have moved into the third and fourth spots, respectively. OAO Lukoil has also moved ahead of BP following the discovery of Yuri Korchagin and Khvalynskoye oil fields in the Russian sector of the Caspian.

While familiar faces remain in control of the majority of the Caspian reserves, the Kashagan discovery has thrust several new companies into the reserves rankings, including TotalFinaElf SA, Royal Dutch/Shell Group, Inpex Corp., and Phillips Petroleum Co.

It is clear that the region's reserves base is very much dominated by the majors and supermajors, for which the Caspian region provides a significant part of their overall global reserve base and is likely to remain a focus for future reserve additions. The top 20 companies in Fig. 5a control about 60% of the region's remaining oil and gas reserves, with the remainder largely in the hands of state organizations.

Hydrocarbon quality

Fig. 5b highlights the remaining Caspian reserves by hydrocarbon gravity and clearly demonstrates that a large percentage of the remaining Caspian liquids are very light. The Tengiz and Kashagan fields in Kazakhstan contain very light oil (>40° API) that has moderate sulfur content but is relatively high in mercaptans. As these fields contribute a significant proportion of the region's remaining reserves, this hydrocarbon type dominates the rankings. Chevron, ExxonMobil, ENI, BG, TotalFinaElf, Shell, Inpex, and Phillips have Caspian portfolios that are dominated by this light, moderate sulfur crude. It should be noted that Kazakh crude tends to have associated sour gas, which represents a significant issue in terms of the processing cost and the environmental implications for sulfur disposal.

Azeri crude tends to be slightly heavier and sweeter than that in Kazakhstan and as a result BP's Caspian portfolio is dominated by 30-35° API Azeri light, which is sulfur-free. Although associated gas at the ACG fields is sweet and does not require expensive processing, it is required that all gas is delivered to State Oil Co. of the Azerbaijan Republic free of charge and therefore has no real value for BP.

Despite the Caspian region being dominated by various types of light crude, several companies operating in Kazakhstan have portfolios that contain a significant proportion of heavy, sulfurous oil. In particular Texaco and Central Asia Petroleum (CAP), which operate North Buzachi and Kalamkas fields, respectively, on the Buzachi Peninsula, have liquids portfolios with a large percentage of <25° API, 2% sulfur crude. In addition to the added cost of extracting the heavy oil, the crude is difficult to transport and realizes a price discounted to Brent crude.

ENI's and BG's reserve portfolio is more biased towards gas than many other companies, with a 50-50 split between liquids and gas. Much of this gas is contained within Karachaganak field and will have little direct value, as about 40% will likely be reinjected at the field to enhance liquids recovery.

Despite many companies' large gas reserve portfolios, much of this gas has little value due to the lack of a significant market, and in many cases, such as at Tengiz and Kashagan, the gas is likely to have a negative value on the project due to high processing costs in the short term. However, if full international gas prices could be secured for Caspian gas, it would have a significant economic impact on many of the large gas and gas-condensate projects in the region in the longer term.

Production outlook

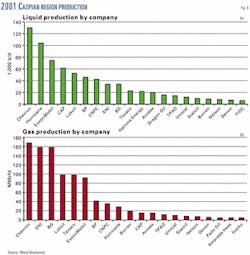

Caspian liquids production in 2001 was dominated by a handful of companies that have interests in only a few large Caspian projects (Fig. 6a).

Chevron continues to head the rankings with its 50% stake in Tengiz, while ExxonMobil's 25% interest in Tengiz and 8% interest in ACG position it in third spot. This lead will be retained for some time, with the incorporation of Texaco's production into the new ChevronTexaco.

Perhaps unexpectedly, Hurricane Hydrocarbons Ltd. with estimated remaining reserves of only 520 million boe, lies in second place through its operated onshore assets in eastern Kazakhstan (Kumkol North, Kumkol South, South Kumkol, KAM, and Kazgermunai). Although Wood Mackenzie anticipates that Hurricane's net oil production will increase to about 140,000 b/d in the next couple of years, unless new reserve additions are made in the short term, Hurricane's production is likely to go into decline around 2005.

With the continued ramp-up of Tengiz production, Chevron alone is expected to head the liquids production ranking for several years to come, with net Caspian oil production estimated to reach 335,000 b/d by 2010. BP has the potential to reach a similar level within the same time frame from the ACG and Shah Daniz developments, providing that key infrastructure is sanctioned and put into operation by 2005.

By 2010, it is estimated that 57% of the Caspian's liquids production will come from just four fields or complexes-Tengiz, ACG, Karachaganak, and Kashagan. The key partners in these consortia are therefore expected to dominate the liquids production rankings in the longer-term.

Chevron has moved ahead of BG and ENI in the gas production rankings due to its decision to acquire an additional 5% stake in the Tengiz project from the Kazakh government during 2000 (Fig. 6b). With the inclusion of Texaco gas reserves, ChevronTexaco is set to dominate gas production in the short term.

ENI and BG remain only 10 MMcfd behind Chevron at 157 MMcfd, thanks to the continued production ramp-up at Karachaganak. Lukoil, Texaco, and ExxonMobil, with 90-100 MMcfd, remain some way behind the top three due to their much smaller interests in the Karachaganak and Tengiz projects.

These companies are expected to remain at the top of the gas production rankings for several years to come. As production from these giant Kazakh fields continues to ramp up, BP and Statoil could close the gap around 2010 when production from Shah Daniz and ACG fields is likely to peak. The conclusion of additional gas contracts could allow Shah Daniz to reach its full gas production potential, allowing BP and Statoil to close the gap yet further.

Major companies that are noticeable by their absence from the Caspian production rankings include Shell, TotalFinaElf, and Phillips. These companies are likely to make an appearance in both the liquids and gas production rankings when the Kashagan development is brought on stream after 2005.

Key variables

To recap the key variables in this analysis:

- The Caspian region has reserves of 39.4 billion bbl of liquids and 207 tcf of gas (75.8 billion boe) with the potential to produce 3.8 million b/d of liquids and 16.7 bcfd of gas in 2010.

- The majority of reserves and production potential in the Caspian region is controlled by six key projects (Kashagan, Tengiz, Karachaganak, ACG, Shah-Daniz and the Severnyi block in Russia) and relatively few companies.

- The six key projects contain over two thirds of the total liquids reserves in the region.

- Gas will play an increasingly important part in the timing and commercial success of these key projects. About 44% of the production potential of the region could be provided by gas in 2014.

- Over 60% of the reserves and production potential of the region, based on proven reserves alone, is provided by Kazakhstan.

- The top 20 companies in the region control 60% of the Caspian's oil and gas reserves.

- Chevron is the leading oil company in the Caspian, and the new merged company ChevronTexaco is well positioned to dominate oil and gas reserves and production rankings in the Caspian for several years.

- Chevron also has the lightest crude (46.9° API) due to its 50% share in massive Tengiz field. Even with the addition of Texaco's heavy (19° API) North Buzachi reserves, ChevronTexaco will still have the lightest crude in the region, hence its strong preference for use of an "oil quality bank" for transportation through the Caspain Pipeline Consortium pipeline.

While the ranking tables provide a useful indication of companies likely to succeed in the Caspian, they do not take into account the technical, financial, political, and market risks that face all companies operating there. Each project is subject to varying degrees and types of risk, and those companies best able to successfully manage such risks in this volatile region will ultimately succeed and be the most profitable.

The authors

Hilary McCutcheon has worked at Wood Mackenzie for 5 years since graduating with an MA in Russian interpreting and translating. She has been involved in coverage of various parts of the former Soviet Union (Central Asia, Caucasus, and Timan-Pechora) and now focuses on commercial analysis of Central Asia.

Richard Osbon has a BS in geochemistry from the University of Manchester and an MS in basin evolution and dynamics from the University of London. He worked for ARCO British Ltd. as an exploration geologist focused on the UK North Sea before joining Wood Mackenzie in January 2000, where he now is a research consultant on the Former Soviet Union team.