Some see eastern gulf Sale 181 as missed opportunity

Oil and gas companies bid on 95 of 233 tracts far off Alabama in the eastern Gulf of Mexico in early December, but some said the federal lease sale was a missed opportunity for industry.

Seventeen companies bid a total $458.9 million at the sale, OGJ Online reported Dec. 5.

Blocks offered were no closer than 100 miles from shore and no more than 24 miles east of the eastern boundary of the Central Planning Area (see map).

Some industry observers were scratching their heads over several established deepwater stars that either were underachievers or did not bid in the first lease sale in those waters since 1988. All of the blocks that drew bids in the sale are in 1,600 m of water or more, which qualify for a 10-year lease term at 12.5% royalty.

"ExxonMobil Corp. and BP PLC didn't even participate, despite their sizeable expertise in deepwater operations," noted Joel L. Riddle with Arthur Andersen LLP.

Before the sale, the Interior Department estimated that the sale area contained 1.25 tcf of gas and 185 million bbl of oil (OGJ, June 11, 2001, p. 41).

Bid highlights

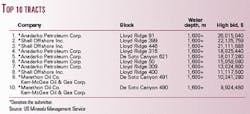

The sum of the high bids was $340.5 million.

The blocks received an average of two bids each, though six received five bids each. All but one of those were in the De Soto Canyon area.

The deepest block to receive an offer was Lloyd Ridge 446 in 2,908 m of water. Anadarko Petroleum Corp., Houston, bid $26,015,040 for Lloyd Ridge Block 91, the highest bid of the sale. The bid was $4,516.50/acre.

Shell Offshore Inc., New Orleans, was the most active bidder, making offers for 48 blocks. It was highest bidder for 28. Anadarko was a close second in success rate. It bid for 33 blocks and was high on 26 of them.

Spinnaker Exploration Co., Houston, was third most active bidder.

The other companies participating were Kerr-McGee Oil & Gas Corp., Dominion Exploration & Production Inc., Amerada Hess Corp., Chevron USA Inc., Petrobras America Inc., Phillips Petroleum Co., Murphy Exploration & Production Co., EOG Resources Inc., Devon Energy Production Co. LP, Unocal Corp., Pioneer Natural Resources USA Inc., Ocean Energy Inc., and Conoco Inc.

Key players

Three active participants-Anadarko, Shell Offshore, and Kerr-McGee-accounted for 70 of the sale's high bids.

Anadarko was the sale's biggest spender. It submitted 33 bids totaling $167.4 million, including $136 million in its 26 high bids for blocks in 7,000 to 9,500 ft of water.

Anadarko Chairman Robert J. Allison Jr. said, "We have gathered and interpreted an extensive amount of information about these (East Gulf) blocks, and we're convinced they hold substantial oil and gas reserves with relatively low geologic risk. Since a lot of the preliminary work has already been completed, the prospects can be drilled ... as soon as late 2002, which makes this addition a good complement to Anadarko's portfolio."

Before this sale, Anadarko had 351 gulf leases, including 109 in deep water. The company also has a partnership with BP to explore 95 deepwater blocks held by BP in the Garden Banks and Keathley Canyon areas of the Central Gulf.

Shell Offshore's 48 bids totaled $127.9 million. Among those were 28 high bids-20 of them uncontested-exceeding $109.6 million.

Shell submitted the second-highest single bid in the sale, more than $22.1 million for Lloyd Ridge Block 399. That block was one of six that drew five bids each, including an offer from Anadarko of more than $21 million for Block 399.

Shell also had the sale's third highest bid, an uncontested offering of $21.1 million for Lloyd Ridge Block 446.

Kerr-McGee, the Oklahoma City company that drilled the first offshore well out of sight of land on Ship Shoal Block 32 in the gulf in November 1947, was still going strong at the sale. It submitted 22 bids, some with partners, that exposed more than $43.4 million. It was apparent high bidder in 16 of those attempts, totaling more than $34.7 million.

That will "give us a presence in new plays that complement our already outstanding deepwater gulf portfolio," said Luke R. Corbett, chairman and CEO of Kerr-McGee.

Assuming the company is successful in obtaining those 16 leases, Corbett said, "We will operate 60% of these high-bid blocks with an average working interest of about 63%, allowing us to continue to enhance our successful exploration and development program in the gulf."

Kerr-McGee is the gulf's largest independent leaseholder, with the largest number of deepwater gulf blocks among its peers. With the 16 new blocks, the company will have interests in 372 deepwater gulf blocks and operate more than 70% of those leases with an average working interest of 50%, officials said. It will increase its gulf leaseholdings by more than 92,000 gross acres to 3 million gross acres.

On sale day, Kerr-McGee noted that it spudded the 100%-owned Hornet prospect in late November in 3,700 ft of water on Green Canyon Block 379.

It is also drilling the Merganser prospect in 7,800 ft of water on Atwater Valley Block 36 (see map). If successful, the well will provide a hub for the Atwater Valley area, where the company has more than 25 blocks.

The company said the South Titan prospect, in 6,300 ft of water on a six-block cluster in the northeastern Walker Ridge area, was to spud in December. Its interest is 50%.

Other bidders

Spinnaker submitted 26 bids totaling $9 million and was apparent top bidder for only 8 for $3.4 million. Dominion made 22 bids for a total $17 million, coming out on top in only 5 for $6.3 million.

Amerada Hess submitted 20 bids for almost $13.8 million, but was high in only 8 for $6.8 million. Chevron USA Inc. made 12 bids totaling nearly $10 million, with only one apparent success of $237,643. Petrobras America made 11 attempts totaling $6 million, with only 4 high bids of $1.8 million.

Phillips didn't register a single top bid out of 10 offerings totaling $12 million. Conoco also was unsuccessful with its two bids totaling $450,400.

Some of those companies are among the most experienced deepwater operators. An earlier study by energy analysts Douglas-Westwood Ltd. and offshore data specialists Infield Systems reported that Petroleo Brasileiro SA (Petrobras) and Royal Dutch/Shell Group have brought more than 1 billion boe of deepwater reserves on stream during the last 5 years.

Within the next 5 years, it said, Petrobras has 3.3 billion boe of prospects expected to come on stream; BP, 2.5 billion boe; ExxonMobil, 2.4 billion boe; Royal Dutch/Shell, 2.3 billion boe; and ChevronTexaco Corp., 1.5 billion boe (OGJ Online, June 11, 2001).

Marathon registered 14 top offers totaling $28.3 million at Lease Sale 181, out of 16 total bids for a combined $33.4 million.

EOG and Devon were among the most focused participants in the sale, with each registering three top bids out of four offerings. EOG's top bids totaled $8.3 million out of a cumulative offering of $8.5 million. Devon's top bids amounted to $2.77 million out of total bids of $2.8 million.

Final results of the sale will be announced after the US Minerals Management Service reviews the bids. The agency can reject bids that it deems too low.

Lost opportunity

The National Ocean Industries Association criticized a decision earlier this year by the Interior Department to pare back acreage in Sale 181. "The acreage that was to be included in Lease Sale 181 was cut by nearly 75% earlier this year, even though the deleted tracts were specifically identified for leasing by the previous two administrations because of their importance to the national energy supply," said NOIA.

The White House decided to cut back the sale after the governor of Florida, the president's brother Jeb Bush, and Florida lawmakers in Congress said they feared the original parameters of the sale might pose an environmental risk to their coast. Lease sale proponents said the sale would not incur any environmental risk because it was at least 100 miles off Florida and was in federal waters.

Even more troubling to NOIA is the fact the area originally designated for leasing is not included in the current administration's Draft Proposed 5-Year Plan for offshore leasing for 2002-07.

Tom Fry, president of the National Ocean Industries Association, said, "Energy is the oxygen that our economy breathes, and it is the fundamental underpinning of the high quality of American life. By removing key resource areas, which can be rapidly integrated into already existing infrastructure from the 5-Year Plan, the administration is denying itself the flexibility necessary to effectively plan for and manage our energy future."

He warned that if the current draft plan is approved, producers could not access the disputed area until 2008 at the earliest.

"Placing energy resources off limits at this crucial time of economic and geopolitical uncertainty is tantamount to planning a crisis," Fry said.

American Petroleum Institute said holding the sale showed the US commitment to developing secure domestic energy sources. "We are pleased by the robust interest in this sale demonstrated by the oil and natural gas industry," said Betty Anthony, API's upstream general manager.