OGJ Newsletter

Market Movement

Speculation continues over Russia's oil output

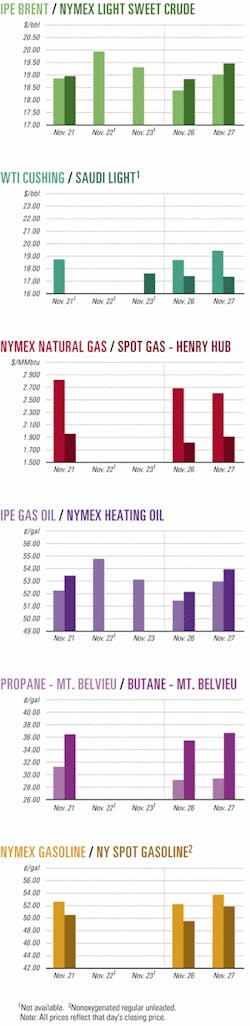

Oil prices experienced a roller coaster ride last week amid speculation about Russian oil output along with a sequence of events that rocked Houston-based trading giant Enron (see NL Bulletin, this page).

OPEC had called for Russia to slash its output by at least 300,000 b/d in order to trigger an OPEC cut of 1.5 million b/d on Jan. 1, 2002. In total, OPEC wants non-OPEC exporters to reduce production by 500,000 b/d. Norway and Mexico have said they would cooperate.

Russia initially responded with a token cut of 50,000 b/d. But then last week, Deputy Prime Minister Viktor Khristenko said Russia will consider larger oil export cuts in January.

At presstime last week, the market was pulling down oil prices because it perceived a market share war in the making. Russia has been the surprising backbone of a recent surge in non-OPEC oil output, a trend viewed with alarm by the Saudis, who have been struggling for 2 years to sustain OPEC cohesion in defense of a targeted price band of $22-28/bbl for a basket of OPEC crudes.

Some analysts have speculated that a market share war between OPEC and non-OPEC will cause oil prices to collapse to an average of $14/bbl (WTI) in 2002. That tracks the view of OPEC, which has warned that oil prices will collapse to $10/bbl if a 2 million b/d cut in production isn't forthcoming.

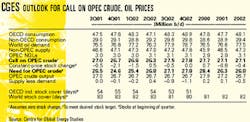

CGES sees Brent stabilizing without more cuts

Current physical market fundamentals do not support an oil price collapse, according to the Centre for Global Energy Studies. It contends that, even with no further output cuts, Brent prices could stabilize around $17/bbl in first half 2002 (see table).

The London-based think tank noted that oil stocks are not high enough to drive oil prices back down to $10/bbl, and stocks are expected to fall, if only modestly, over the winter.

CGES believes Russian producers can live comfortably with a Brent price of $17/bbl and that OPEC economies are more susceptible to the strain of low oil prices than are those of the big non-OPEC oil exporters. It cited the comments of one Russian major oil company CEO who would like to see Brent oil prices stabilize at about $16-22/bbl.

CGES pointed to two areas where OPEC is out of touch in predicting a price collapse. First, oil stocks are much lower than they were in 1998, so the level of inventories would not exert as much downward pressure as they did 3 years ago. Second, a price collapse could occur only in the absence of any demand growth while production levels remain constant.

Yet, another scenario could emerge. Both CGES and other analysts have said Saudi Arabia might be the one to lead OPEC in a round of cuts.

null

null

null

Industry Trends

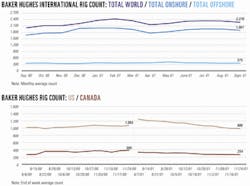

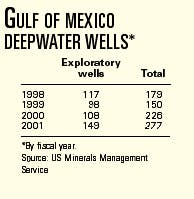

DEEPWATER DRILLING ACTIVITY is increasing in the Gulf of Mexico.

The US MMS reported 277 deepwater wells were drilled in fiscal year 2001 vs. 226 drilled for the previous year (see table).

Meanwhile, the agency's count of rigs working in 1,000 ft of water reached a high of 47 in mid-November, up from the 39 rigs working in that depth as of January.

The number of working rigs in 1,500 ft of water-a more conservative definition of deepwater used by most oil and gas companies-rose to a high of 43 compared with 32 in that water depth at the start of the year.

MMS said 9 rigs were working in ultradeep water, defined as 5,000 ft or deeper, as of Sept. 30, compared with 8 rigs working in that depth at the start of the fiscal year.

THE AVERAGE US WELL DEPTH has increased nearly 40% since 1980.

Raymond James & Associates said 2001 will record the most significant single-year increase in average drilling depth that the US has ever experienced.

"We expect average well depth this year to increase to roughly 800 ft, or a whopping 14% over last year," RJA reported.

Although improved technology and higher natural gas prices have allowed producers to go after discoveries that would have been economically unfeasible a decade ago, RJA noted that commodity prices still must justify the costs of deeper drilling.

"The single biggest reason for the sharp decline in depth per well in 1999 was lower commodity prices. Deeper reserves are generally not economically viable at prices below $2.75/Mcf," RJA said.

Although 2001 natural gas prices have fallen significantly below the level of late 2000, gas prices remain well above historic levels.

"Likewise, oil prices have dipped recently due to OPEC positioning, however, oil prices have been mostly steady holding in the mid-$20 level for the past 2 years. Overall, both commodities have provided stronger support for deeper drilling programs over the past several years," RJA said.

Another factor contributing to the trend toward deeper drilling is the focus on natural gas drilling. Natural gas typically is found deeper than oil wells. Rigs drilling for natural gas account for more than 80% of the US rig fleet.

"Oil service companies stand to gain the most from deeper drilling as demand for their services increases exponentially with well depth," RJA said, predicting the average US well depth will continue increasing in the future.

Government Developments

US CONGRESSIONAL REPUBLICAN LEADERS last week criticized Senate Democrats for delaying floor debate on energy reform legislation until next month. They vowed not to give up efforts to attach their bill to other pending legislation.

"Energy is a key issue. We want to debate and vote on it now. Or we want a time certain next year with an up or down vote on final passage," Senate Republican Policy Committee Chairman Larry Craig (R-Ida.) said in an interview off the Senate floor.

Assurances from Senate Majority Leader Tom Daschle that he would move energy legislation to the floor early next year were not enough for Craig (see related story, p. 36).

A key stumbling block over moving an energy bill forward has been whether the government should lease a portion of the Arctic National Wildlife Refuge to oil companies for drilling.

"What Sen. Daschle said...was politics. He is opening up the opportunity to bring up the bill to allow John Kerry (a Democratic senator from Massachusetts who opposes leasing) and others to filibuster and then opine how tragic it is he has to pull down [the] energy bill and move on to other issues," Craig said.

An energy bill that passed the Republican-controlled House in August includes an ANWR drilling provision.

But Senate leasing proponents say they still do not have the 60 votes needed to shut off a potential filibuster of any legislation that would allow ANWR leasing. They do, however, believe they have a simple majority of lawmakers that would approve ANWR.

"With no assurances on an up or down vote, Frank Murkowski (R-Alas.) (ranking member of the Senate Committee on Energy and Natural Resources) will try to attach it any chance he gets. Anything that moves that is amendable," will be a target, Craig said, adding that the pending farm bill could be the next target.

SEBASTIAO REGO BARROS-currently Brazil's ambassador to Argentina-was appointed last month to executive director of Brazil's National Petroleum Agency (ANP). Barros replaces former ANP executive director David Zylberstajn, who was named head of the organization when it was founded in 1988. Zylberstajn resigned from the post in September.

Barros also worked in the Brazilian embassies in Russia and the Ukraine. His appointment still needs to meet approval from Brazil's senate.

THE PARTIAL PRIVITIZATION of Thai state-owned oil and gas firm PTT PLC-formerly known as Petroleum Authority of Thailand-sparked strong local and overseas demand for its shares.

Demand from foreign institutional investors was five times the volume expected, prompting authorities to make 920 million shares available, up from 800 million.

Shares offered to local investors were increased to 64.24% from 60%, while foreign institutional investors have agreed to acquire the rest.

PTT late last month set the initial public offering price at 35 baht/share, raising total proceeds to $631 million.

The Thai Finance Ministry will continue to own about 75% of PTT, which has a monopoly on gas distribution.

Quick Takes

CASPIAN OIL has begun flowing through the 900-mile, $2.65 billion Caspian Pipeline Co. (CPC) export pipeline from Tengiz and other oil fields in western Kazakhstan to a new terminal on the Black Sea near Novorossiysk, Russia. The terminal has received first oil and will operate at its capacity of 600,000 b/d in the first half of 2002.

The Russian Federation holds a 24% interest in CPC; the Republic of Kazakhstan has 19%, LukArco 12.5%, ChevronTexaco Caspian Pipeline Consor- tium 15%, Rosneft-Shell Caspian Ventures 7.5%, ExxonMobil Caspian Pipeline 7.5%, Sultanate of Oman 7%, Agip International 2%, BG Overseas Holdings 2%, Kazakhstan Pipeline Ventures 1.75%, and Oryx Caspian Pipeline 1.75%.

Tengiz field, which has potential reserves of 6-9 billion bbl, is operated by the Tengizchevroil (TCO) JV, whose partners include ChevronTexaco 50%, ExxonMobil 25%, Kazakhoil 20%, and LukArco 5%. Tengiz currently produces 260,000 b/d. Capital spending in Tengiz over its expected life is expected to be about $20 billion.

Elsewhere on the pipeline front, product deliveries have resumed following resolution of a 12-day pipeline strike at Marseille, France. A blockade of the port, begun in mid-November after talks failed, prevented about 40 oil tankers and cargo vessels from entering or leaving. BP, ExxonMobil, and TotalFinaElf said they had cut output at nearby refineries as a result of the strike.

Florida Gas Transmission has applied to FERC for another 33.3 miles of pipeline and 18,600 hp of compression at existing stations on its 4,800-mile South Texas-to-Florida gas pipeline system. The $105 million proposed Phase VI expansion will provide 121 MMcfd of incremental firm transportation capacity for electric power generation and growing demand among local distribution companies. Construction is slated for late 2002, with service to be phased in by June and November 2003. Construction is under way on the Phase V expansion approved earlier this summer. Its initial stage is expected to be in service by April. The two projects will transport a combined 550 MMcfd of gas to Florida, expanding the system to more than 2.2 bcfd by mid-2003.

INNOVATIONS and a plant shutdown take center stage in refinery developments this week.

Statoil has introduced a process to convert gas, which previously would have been flared, into propylene, a raw material for plastics production. The process is being tested at Statoil's industrial plant at Tjeldbergodden in central Norway. The German technology group Lurgi developed the technology and built the process equipment. The demonstration plant arrived in Tjeldbergodden in November.

Statoil researchers believe large-scale methanol factories are the future solution for gas produced in areas lacking necessary infrastructure for export. Currently, large volumes of gas are flared. The demonstration plant will show if the technology can be used at a large plant.

If the demonstration plant performs well, Lurgi may build a large-scale plant in 2-4 years, said Lurgi. When the plant comes on stream, the objective is to achieve a yield of 70% propylene from the methanol.

The unit is currently being tested for leaks and checked thoroughly, and production is expected to begin in early December.

BP said the first commercial unit to use its proprietary OATS gasoline desulfurization technology has come on stream. The process is based on catalytic conversion of thiophenes into high boiling compounds that can be readily removed from the gasoline stream by fractionation, BP said. The unit, at the Bayernoil refinery at Neustadt, Bavaria in Germany, has the capacity to produce 15,000 b/d of low-sulfur gasoline to meet German regulations that will restrict maximum sulfur concentrations to 10 ppm by 2003. The 260,000 b/d refinery complex is a JV of BP, Agip, and Ruhroel, itself a JV of Veba Oil Refining & Petrochemicals and PDVSA. BP expects that two other plants using the process will come on stream in 2002.

On a less positive note, Crown Central Petroleum is investigating the cause of a fire last week at its 100,000 b/d refinery on the Houston Ship Channel at Pasadena, Tex. Crown said the fire occurred while LPG was being transferred from a pressurized vessel. One employee was treated for second-degree burns at a local hospital and released, but there were no other serious injuries, and the company said no hazardous levels of any substance were detected outside the refinery. Crown said that LPG, released to the atmosphere in what appeared to be an equipment failure, ignited and caused a second vessel containing LPG to rupture. The incident occurred while the plant was being shut down for routine maintenance and upgrades. The entire refinery has been shut down, and a restart date is undetermined.

SAUDI ARAMCO awarded Halliburton's Energy Services Group a contract for $140 million of development work at Qatif field in eastern Saudi Arabia. The initial scope of the 3-year project will be to drill oil and water wells, using drilling optimization software, extended-reach drilling, and installation of multilateral systems.

In addition to Halliburton's well construction, reservoir evaluation, and completion services, the contract will include Landmark Graphics's geophysical, geological, and drilling software. Multiple wells will be directionally drilled from a single drilling pad, and, to minimize personnel required at the wellsite, the company will use information systems to transmit real-time data.

Qatif field is 40 km long and extends 6 km offshore. It has produced from six zones. The main reservoirs have been the Upper Jurassic Arab C (31° gravity oil) and Upper Jurassic Arab D (38° gravity). It also produces from the Arab A carbonate, Arab B carbonate, Middle Jurassic Fadhi* carbonate, and Upper Jurassic Hanifa carbonate.

Statoil's Byford Dolphin drilling rig is once again under tow in the Norwegian Sea after being adrift for over 24 hours Nov. 22-23 in foul weather and heavy seas 140 miles off the northern Norwegian coast (OGJ Online, Nov. 22, 2001). No losses were incurred during the drift. The rig is proceeding to the Mikkel field on the Halten Bank where Statoil is carrying out a program of development drilling. There the rig is scheduled to plug a well on blocks 6407/5 and 6. Mikkel field has estimated recoverable reserves of 138 MMboe and 20.4 billion cu m of gas. Statoil is operator, with a 50% interest in the field. Other partners are ExxonMobil Norway 40%, and Norsk Hydro 10%. Gas deliveries are planned to begin in 2003.

KERR-MCGEE made an oil and gas discovery on Block 05/36 in China's Bohai Bay that tested 6,049 boe/d of light oil and gas from five drillstem tests.

CFD 12-1S-1 well had more than 215 ft of hydrocarbon-bearing sands in the Dongying, Guantao, and Lower Ming formations.

The well was drilled on a structure 5 km south of the 12-1 field area to test the Dongying formation that is productive in the 11-2 field area and the 12-1-5 well. The rig was moved 1.5 km southwest to appraise the discovery.

Kerr-McGee operates the block and has 50% interest. Newfield Exploration has 35% and an Ultra Petroleum Corp. subsidiary has 15%.

"This well tested one of the higher flows ever recorded from the Dongying in the Bohai Bay," Michael Watford, Ultra Petroleum chairman, president, and CEO, said. "Had we tested several of the Guantao zones in this well, we may have exceeded 7,000 boe/d for a total flow.

"In addition to the excellent economics of the light oil, the possibility exists to use the gas found in this well to power the production equipment on our CFD 11-1 and 11-2 fields, potentially reducing costs and improving our production economics across the blocks."

Cairn Energy has a second discovery on Block RJ-ON-90/1 in Rajasthan, western India. RJ-H-1 well is 50 km north of the Guda-2 oil discovery drilled in 1999. RJ-H-1 was drilled to 1,837 m MD and found several hydrocarbon-bearing units below 1,400 m. A drillstem test on a 27 m perforated interval flowed 620 b/d of 41° gravity oil on a 1/2-in. choke.

A unit of Repsol-YPF has a gas and condensate discovery at its Sungai Kenawang well on Jambi Merang Block in Sumatra, Indonesia. The well was drilled to 2,580 m TD and found a 124 m gas and condensate column in the Baturaja. On test, the well produced 13.4 MMcfd of gas and 370 b/d of 52° gravity condensate. Repsol-YPF estimates the well could produce up to 88.3 MMcfd of gas and 3,000 b/d of condensate. The national oil company Pertamina already has said the Pulau Gading discovery on the same block is commercial. The Sungai Kenawang well is "considerably larger" than the Pulau Gading well, said Repsol-YPF, which plans to process and market production from the two discoveries together to fulfill a Malaysian contract. YPF Indonesia and Pertamina jointly operate the block, with 25% and 50% interests respectively. Amerada Hess has 25%.

WIND POWER projects are growing in the US, Canada, and Chile.

SeaWest WindPower has developed and constructed 50 one-megawatt wind turbines at Foote Creek Rim, Wyo., for Rock River I, a subsidiary of Shell WindEnergy. Con- struction was completed within 4 months. Rock River I is the first major investment by Shell into the commercial scale US wind market. Shell has more than 1,000 Mw of wind energy projects currently in operation in the US, Europe, and North Africa.

PacifiCorp has a 20-year agreement to purchase the entire output of energy from the operation. The facility will produce enough energy for more than 13,000 average homes, while offsetting about 164,000 tonnes/year of greenhouse gases. PacifiCorp, plans to bring 1,000 Mw of new renewable generation online by 2005.

SeaWest, which undertook engineering, design, procurement, and development of the wind farm and its facilities, will be responsible for long-term operation and maintenance of the project.

The Department of Energy's Bonneville Power Administration (BPA), and SeaWest WindPower, have executed an agreement by which BPA will purchase and market, over a 20-year period, the entire output of power from a wind energy project SeaWest is constructing in Gilliam County, Ore. The project is located near the town of Condon, in central Oregon, south of the Columbia River Gorge. BPA markets wholesale hydroelectric power primarily from the federal hydroelectric projects in the Columbia River Basin. The Condon Wind Energy Project, providing 49.8 Mw of electricity to BPA customers, will be the largest wind project in Oregon. Phase I will be operational by the end of this month, and both phases will be online by the end of May 2002.

Mitsubishi Heavy Industries, of Japan manufactured the 83 (600-kw) wind turbines. Located on private farmland, the turbines will leave most of the land available for wheat production and are expected to bring $15 million in income to the local community over their lifetime.

PSEG Energy Technologies Chairman and CEO E. James Ferland inaugurated the Central Eolica Alto Baguales wind turbine project in Coyhaique, Chile Nov. 14. The project uses state-of-the-art wind turbine technology to provide more than 16% of the electric power needs of a rural area of southern Chile. Three computerized wind units, the first in Chile, displace current diesel generation, generating up to 2 Mw of electricity, improving air quality and lowering customer costs. The wind project was developed by Edelaysen, part of the SAESA group, which joined the PSEG global network of companies in August.

Suncor Energy Alternative & Renewable Development, a division of Sunoco, will work with NA Renewables Canada, a North American subsidiary of EHN, to develop wind power projects in Canada. The JV, SunNar, will employ EHN's technological abilities and Suncor's knowledge of the Canadian market. The European-based EHN Group consists of 25 companies that focus on renewable energy projects worldwide. Suncor recently announced the SunBridge wind power project, a JV between Enbridge and Suncor to develop a 17-turbine wind farm in southeast Saskatchewan, which, when fully commissioned, is expected to produce 11 Mw of electricity for distribution throughout Saskatchewan.

American Electric Power (AEP) has completed the fourth-largest wind farm now operating in the US, the 150 Mw Trent Mesa Wind Project near Abilene, Tex., which began commercial operation last summer. AEP developed and owns the $160 million wind farm, which includes 100 wind turbines on about 8,000 acres. Trent Mesa is expected to generate more than 590 million kw-hr/year of electricity, based on historic wind data for the site. TXU Corp. will purchase the electricity-enough to meet the annual electricity needs of more than 35,000 homes.

NL BULLETIN

At presstime last week, a $9 billion merger between Houston energy companies Dynegy and Enron unraveled in a stunning series of events. On Nov. 28, Standard & Poor's downgraded Enron bonds to below investment grade. Hours later that day, Dynegy terminated its Nov. 9 merger agreement with Enron and said it would exercise an option to acquire the common stock of the company's Northern Natural Gas pipeline.

Enron said it was "reviewing Dynegy's actions" and has 180 days to buy back its pipeline. Enron also said it was suspending all payments except those "necessary to maintain core operations" in the wake of the terminated merger agreement and the credit rating downgrading. The ratings agency also said a "distinct possibility" existed that Enron would file for bankruptcy protection.