OGJ Newsletter

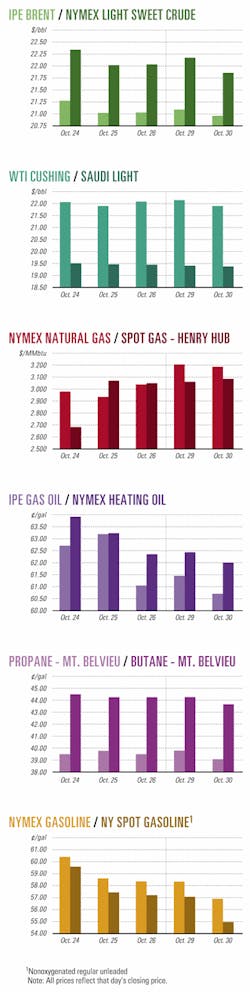

Market Movement

OPEC seeks support

The 10 members of OPEC currently bound by production quotas, which excludes Iraq, agreed to reduce output by a total of 3.5 million b/d, or 13%, on three separate occasions earlier this year. But the organization is seeking support of non-OPEC producers for the next round of cuts.

Late last month at the World Energy Congress in Buenos Aires, OPEC Pres. Chakib Khelil told a press conference that his group would hammer out its production cut accord well ahead of the group's Nov. 14 ministerial meeting in Vienna. No official information was released from the Oct. 29 Vienna meeting of OPEC technicians with seven non-OPEC peers (OGJ, Oct. 29, 2001, Newsletter, p. 5). Instead, the issue of output cuts will be debated by both groups at the Nov. 14 meeting

However, the scope for non-OPEC producers to reduce output is limited. Russia has said that, if anything, its production will have to rise to meet internal demand this winter, although it may consider curbing exports. Mexico said its economic needs rule out a production cut.

Norway has said its production is an internal matter. Falling income from oil sales announced by Statoil late last month will maintain pressure on Norway to leave production unchanged.

The only non-OPEC oil exporter to confirm it would go along with OPEC in cutting production is Oman, which currently exports 800,000 b/d.

Another cut required?

The biggest problem OPEC faces in its proposal to cut oil output quotas is to break the market's misperception "that prices cannot recover," a London-based financial analyst said late last month.

Many other market analysts claim OPEC could not afford to reduce its output if other non-OPEC producers step in to take more of its market share.

But Paul Horsnell of J.P. Morgan Chase & Co. said that OPEC members apparently achieved full compliance during October with their last production cut of 1 million b/d, effective Sept. 1, which "is sufficient to lead to prices firming," even without another cut.

OPEC is expected to affirm another 1 million b/d cut Nov. 14.

The average price for OPEC's basket of seven crudes has remained below its targeted price band of $22-28/bbl since Sept. 24, when international energy markets experienced the biggest 1-day drop in prices since the US and its allies launched the Desert Storm attack on Iraq in 1991.

Horsnell described it at the time as "a direct challenge to the [OPEC] price band" by speculators who assumed key OPEC members such as Saudi Arabia and Kuwait would be pressured by the US not to reduce oil production while it takes military action against Afghanistan and Osama bin Laden's terrorist network (OGJ Online, Sept. 25, 2001).

Although they have hesitated to act so far, OPEC ministers are under economic pressure to restore their command of the market and to boost the oil revenues on which their countries depend.

Supply-side pressure returns

However, previous cutbacks in OPEC production this year are "greater than the fall in demand [for oil] plus the rise in non-OPEC production," Horsnell said.

"For the last month, market perceptions have been dominated by the demand side, but now we seem to be returning to a supply sideellipsestory," he said.

Following a meeting late last month in Abu Dhabi, the oil ministers of Oman, Saudi Arabia, and the UAE released a joint statement in which Oman became the first non-OPEC producer to express its readiness to cooperate with OPEC in reducing production.

Moreover, Saudi Arabia officially endorsed in that statement the proposal to reduce OPEC production in order to boost oil prices. That, said Horsnell, "confirms that Saudi policy has not changed," despite any pressure from US government officials to hold the line on production during the military campaign against terrorists in Afghanistan. The ministers denied in their statement that they had been submitted to such pressure.

"Adding to this the growing tide of other ministerial statements, the impetus for a further production cut at OPEC's [next] meeting has continued to build," Horsnell said.

null

null

null

Industry Trends

OIL TANKER rates seem to have bottomed out.

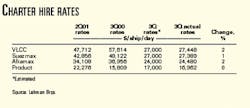

Tanker time charter equivalent (TCE) rates, on average, have reached their low point for the year. In addition, TCE rates for the third quarter were down 30-40% from second quarter and 30-50% year-on-year, Lehman Bros. said in a research note.

TCE rates for the third quarter, however, were in line with Lehman Bros. estimates, noted analyst Daniel L. Barcelo (see table).

Barcelo said that, despite oil tanker company share values showing a decline over the quarter-falling 33% on average-the current rate structure has been trading upwards over the past few months.

"Rates in the beginning of the third quarter saw weakness in all class vessels, especially for [very large crude carriers], which had been earning near par with Suezmaxes since mid-April," Barcelo said. "However, following the July 6 resumption of 2.1 million b/d of Iraqi output, this trend soon reversed itself.

"Average rates for the quarter," the analyst said, "were 20-25% higher than the levels at the very beginning of the quarter."

THE WORLD ENERGY COUNCIL late last month unveiled a new electronic database that tracks energy company projects, coming on stream from 1999 to 2010, that are designed to reduce emissions of gases linked to purported catastrophic climate change.

The database was developed under the WEC's pilot program on greenhouse gas (GHG) emissions and monitors voluntary projects designed to cut or offset GHG emissions when compared with business-as-usual projections.

WEC originally planned to identify and record emissions reductions of 1 billion tonnes/year of carbon dioxide equivalent (CO2e). The database now encompasses over 700 projects in 92 countries with emissions reductions totaling more than 1.3 billion tonnes of CO2e/year.

WEC Sec. Gen. Gerald Doucet said his organization has set a new target of identifying projects for reductions totaling 2 billion tonnes of CO2e/year by 2005 and has extended the tracking time to 2010.

Anders Nordström, chairman of the GHG pilot program committee, noted that a cut of 2 billion tonnes of CO2e represents about 6% of current annual global GHG emissions and is within the range of reductions required under the Kyoto Protocol on climate change.

"There seem to be many more projects under way that have not yet been recorded in the database, and we are inviting companies and countries to enter their projects in the database to provide a comprehensive global picture of actions that are anticipated over this decade," he said.

Government Developments

THE US EPA wants to give refiners more flexibility to meet federal clean fuels programs.

In an Oct. 24 letter to President Bush, EPA Administrator Christine Todd Whitman said her agency would propose rules that may help the nation's gasoline delivery network run more efficiently.

"EPA is prepared to act quickly on a set of administrative and regulatory actions to provide new flexibility to refiners in advance of next year's spring transition season, particularly in the Midwest," Whitman said. "We are committed to protecting our environment while ensuring our nation's energy security."

EPA said the regulations would ensure that terminals are able to make the transition from winter to summer grade fuels more gradually. The agency said that offering more lead times could help avoid temporary fuel shortages that, in the past, have been associated with localized spikes in gasoline prices. The agency cautioned, however, that its action is not a panacea.

"While many factors contributed to the gasoline price spikes this year, we want to ensure that using summer blend fuel is not a contributor to price hikes," Whitman said.

US ENERGY SEC. Spencer Abraham Oct. 30 said the Bush administration is near a decision on whether to fill the nation's crude oil stockpile to its 700 million bbl capacity.

The Strategic Petroleum Reserve-which holds 544 million bbl in salt caverns along the Texas and Louisiana coast-is 80% full.

Industry sources say the White House has decided to fill the SPR, although it has not determined when and how to do it.

Abraham would not confirm those reports but acknowledged that the interagency SPR task force had finished its meetings.

Filling the stockpile to its capacity could be expensive, depending on market prices.

The administration is weighing several proposals. An industry-supported plan would take royalty oil from federal lands to fill the reserve. But some oil-producing states fear that allowing leaseholders to fulfill royalty obligations under the "royalty in-kind" method could reduce their revenues.

US DOE confirmed that EIA, its independent statistical agency, will soon provide weekly gas storage estimates.

The move comes a few weeks after the American Gas Association announced it would discontinue its own weekly gas report at yearend (OGJ, Oct. 22, 2001, Newsletter, p. 7).

DOE did not say when EIA's survey would begin, only that the department "is working closely with AGA to avoid any lapse in coverage of this important market indicator."

DOE told analysts it planned to take over the report (OGJ Online, Oct. 26, 2001). But it was not immediately certain whether EIA would require companies to furnish the storage inventory numbers, as it requires some energy companies to do for other market reports. Currently, weekly gas inventory data is collected by AGA on a voluntary basis.

Quick Takes

TWO TLP contracts have been awarded.

Atlantia Offshore has given Keppel FELS a $22 million contract to build a tension leg platform hull for use in the Gulf of Mexico. - Atlantia Offshore Ltd. owns the SeaStar tension-leg platform design.

The Keppel Group unit will build the TLP to Atlantia's proprietary SeaStar design.

The system will be installed on TotalFinaElf's Matterhorn field on Mississippi Canyon Block 243. It will support a self-contained topsides with full production, work- over, utility, and accommodation capabilities.

The 84-ft diameter column hull structure, to be built at the Pioneer yard in Singapore, consists of a central moonpool and a Y-shaped base pontoon for attachment of the mooring tendons.

The project is slated for completion by the end of 2002.

In addition, Esso Exploration Angola awarded ABB a contract to design, build, and commission a deepwater TLP for the Kozomba A project on deepwater Block 15 off Angola. ABB, in partnership with Heerema, will complete the work by third quarter 2003. The TLP will be anchored in 1,250 m of water.

In other development news, Kerr-McGee has approved development of Gunnison field in 3,100 ft of water in the Gulf of Mexico, using the Kerr-McGee Global Producer VII truss spar. Gunnison and Durango fields are estimated to have reserves totaling more than 120 million boe. Kerr-McGee operates the Gunnison area, with 50% interest. Partners are Nexen Petroleum, with 30%, and Energy Resource Technology, a unit of Cal Dive International, 20%. The truss spar, which will be designed for production of 40,000 b/d of oil and 200 MMcfd of gas, will be installed on Gunnison Block 668. Initial development will include nine wells connected to the spar-six dry tree and three subsea wells for Gunnison and Durango. If successful, Dawson will then be produced as a subsea tieback to the Gunnison spar. Initial production is expected in early 2004. Kerr-McGee will invest $300-350 million in Gunnison development and Nexen, $180-210 million. Finding and development costs are expected to be less than $5/boe, company officials said, with operating costs projected at $1.10/boe. Kerr-McGee also expects to proceed with a fast-track development at nearby Aspen field, with first production in second half 2002.

Tanzania says that all financing is now in place for the Songo Songo gas development project-which includes installation of facilities for transporting and marketing 1 tcf of natural gas reserves on the small island of Songo Songo and in shallow water off southern Tanzania. Five wells are already in place at the 27-year-old discovery. The project includes a gas gathering and processing system and construction of a 25-km offshore pipeline and a 217-km onshore pipeline to the existing 112-Mw Ubungo thermal power plant near Dar Es Salaam. The plant will be converted from diesel fuel use to natural gas, and a fifth 35-Mw turbine will be added. Bid documents will be issued in mid-November for the major contracts-construction of gas processing facilities, the pipelines from Songo Songo Island, and conversion of the Ubungo power plant. Awards are expected in March 2002, and construction will begin soon after. Commercial operation is expected in October 2003. Electricity will be sold through a 20-year power purchase agreement with Tanzania Electricity Supply Co. (Tanesco), and Tanzania Petroleum Development will market gas not dedicated to electricity production. Tanesco will be privatized once the project is operational. AES is lead investor in the project, with a $250 million commitment. AES Tanzania purchased the majority stake in the project from TransCanada Pipelines International and PanAfrican Energy, which was involved in the original discovery (OGJ Online, July 27, 2001).

OUTAGES top this week's production happenings.

Statoil was to halt production from the Gullfaks A and B platforms in the North Sea Nov. 1-2 to upgrade process security systems and perform scheduled upgrading and maintenance on Gullfaks A. The shutdown also affects Norsk Hydro-operated Vigdis and Visund fields, which produce oil through the Gullfaks pipeline system.

Maintenance and modification work that cannot be done while the platform is producing will be conducted on the B platform, but drilling operations are continuing during the shutdown. Full production from the fields is due to resume Nov. 9. Gullfaks is on Block 34/10 in the Norwegian North Sea.

Meanwhile, the 5-day strike of Brazilian oil workers has ended after causing Petrobras $85 million in losses and dropping national oil production 60%. The strike held up production of 4.2 million bbl of oil.

Upon restarting operations Oct. 28, Petrobras produced only 521,000 b/d of oil-62% less than its normal output of 1.4 million b/d-and 24 million cu m/day of gas, down from the normal 38 million cu m/day. At presstime last week, Petrobras said production was back to normal.

Unlike previous strikes, the 34,000-member National Oil Workers Union did not strike downstream operations, part of a strategy to retain public support (OGJ Online, Oct. 25, 2001).

Petrobras, which had proposed a 6% raise, agreed to a 6.4% salary increase, although the workers had sought 8.3%. Petrobras also agreed to a bonus system tied to worker productivity and seniority.

Production also has resumed at Suncor Energy's oil sands base plant near Fort McMurray, Alta. It had been shut in for a week due to mechanical problems, maintenance, and repairs to the fractionator.The unit was down 7 days, and Suncor said the unscheduled interruption would impact fourth quarter production, which is expected to average 155,000-165,000 b/d.

WILLIAMS marks progress on a couple of major pipelines in the US heartland.

Williams received Interior approval to build a petroleum products line from Bloomfield, NM, to Salt Lake City. The approval process took almost 3 years. The line will carry up to 75,000 b/d of gasoline, diesel, and jet fuel. The $200 million project includes construction of 260 miles of new pipeline, modifications to 220 miles of existing pipeline, and the development of storage and distribution facilities at Crescent Junction and Nephi, Utah.

Work will begin by yearend. Modifications to the existing segment of pipeline from Bloomfield to eastern Utah will begin first and will be completed in 2003. Construction of the segment from eastern Utah to Salt Lake City is expected to begin in late 2002 and to be completed in late 2004 or early 2005.

In addition, Williams unit Western Frontier Pipeline has applied to FERC for a permit to construct a 400-mile, 30-in. natural gas pipeline from Colorado to Oklahoma.

The $365 million line would transport up to 540 MMcfd from the Cheyenne Hub in northeastern Colorado to Williams's Central pipeline system and other interconnects in southwestern Kansas and the Oklahoma panhandle. Storage would be available through the Central line (OGJ Online, June 19, 2001).

Williams proposes to access other Midcontinent lines, including ANR Pipeline, Panhandle Eastern Pipeline, Northern Natural Gas, and Natural Gas Pipeline of America. The pipeline is scheduled to be in service by Nov. 1, 2003.

In other US pipeline action, Pacific Gas & Electric has begun expansion of its Line 401 pipeline system in northern California. The $39.5 million Redwood Path pipeline will add a total of 14.1 miles of line-in two separate sections in Shasta and Modoc counties-to the existing 425-mile system that brings Canadian natural gas from Malin, Ore., to Panoche station in San Benito County, Calif. The expansion will supply an additional 200 MMcfd-enough gas to run a 1,200-Mw power plant, the company said. Line 401 has been running at more than 95% capacity since 1998. The court-adopted bankruptcy review process for capital expenditures has approved the project, and the line is slated for completion in September 2002.

Alaska has tightened security along the 800-mile trans-Alaska oil pipeline route, responding last week to a US national alert against possible terrorist attacks. Alaska Gov. Tony Knowles increased Alaska state trooper presence on the highway that parallels the Trans-Alaska Pipeline System and called to active duty the Alaska State Defense Force to work with the troopers. State officials also contacted Alyeska Pipeline Service, the US Coast Guard, and other public and private agencies to ensure that steps are taken to tighten security along the pipeline's route.

PROCESSING news this week leads off with a lawsuit update.

A federal appeals court has upheld ExxonMobil Chemical's patent for a polyethylene manufacturing process, confirming the patent on metallocene catalysts used to manufacture polyethylene and overruling a decision by a Houston US district court judge.

The company has consequently initiated a cross-licensing deal with Chevron Phillips Chemical, a joint venture of Chevron and Phillips Petroleum, that resolved all patent disputes between the two companies related to metallocene catalysts.

Chevron Phillips will use the "loop slurry process" of Univation, a JV of ExxonMobil Chemical and Dow Chemical for polyethylene manufacturing.

In other processing action, Chile's state oil firm ENAP let contract to a Foster Wheeler subsidiary to build a $300 million delayed coker at its 94,350 b/d Concon refinery in Chile. Foster Wheeler will perform basic engineering, followed by a second phase to include engineering, procurement, and construction. Companies signing letters of interest with ENAP to participate in the project include Petrobras, Argentina's Perez Companc, Germany's Ferrostaal, and Calgary-based Alberta Energy. The coker will process 20,000 b/d of heavy oil. Foster Wheeler's scope of work will include building a 44,000 b/d diesel and naphtha hydrotreating plant and units for LPG treatment, amine regeneration, sour water stripping, and other equipment. Construction is due to begin in 2002, with start-up in 2005.

BG GROUP of the UK and Italy's Edison International have confirmed the largest gas column discovered in Egypt, improving prospects for an Egyptian LNG export project. (OGJ Online, Apr. 9, 2001).

The two companies drilled the Sapphire 3, the second Sapphire appraisal well, on the West Delta Deep Marine concession (WDDM) 60 km off the Nile Delta.

The well, in the south central area of the concession, 20 km north of Rosetta field, was drilled to 2,900 m TD in 450 m of water. The first target was the previously undrilled Saffron Channel C in the Scarab-Saffron complex.

The well proved pressure communication between Channel C and the Saffron discovery, indicating a gas column in excess of 575 m, the largest recorded in Egypt.

A second target was the Sapphire sands. The well penetrated all sands present in Sapphire 1 and Sapphire 2, located 15 km west of Sapphire 3. Pressure data and geochemical analysis indicate that all three wells are in communication.

Stuart Fysh, vice-president of BG Egypt, said, "Early evaluation of the data from the well indicates greater reserves than previously modeled. BG Egypt, Edison International, and Egypt General Petroleum are targeting this gas and further reserves from the concession for their proposed Egyptian LNG project."

Burullus Gas, a JV of EGPC 50%, BG Egypt 25%, and Edison International 25%, is responsible for the drilling and field development on the WDDM concession.

Sapphire 3 is the 12th successful appraisal well drilled on the concession and the 15th well overall. In September 2000, Sapphire 1 flowed on test at a rate of 35 MMcfd and 1,100 b/d of condensate, and in December 2000 the Sapphire 2 appraisal well flowed on test 33 MMcfd and 805 b/d of condensate (OGJ Online, Feb. 15, 2001).

In other exploration news a sale of Alaskan North Slope and Beaufort Sea state leases drew $12.88 million in high bids Oct. 24. In the North Slope sale, bidders offered apparent high bids of $7,445,081 for 110 tracts totaling 469,760 acres. Shell had the highest bid ($1.7 million) and highest bid per acre ($297) for Tract 0109. In all, it paid $2.44 million for 10 tracts. Anadarko Petroleum picked up 17 tracts for $1.6 million. The North Slope sale offered 1,225 tracts totaling 5.1 million acres in an area between the Canning River and Arctic National Wildlife Refuge on the east and the Colville River and the National Petroleum Reserve-Alaska on the west. The southern boundary was the Umiat Meridian baseline. The Beaufort Sea sale drew winning bids of $5,441,216 for 24 tracts. Armstrong Resources dominated that sale, acquiring 10 tracts for $4.2 million. It had the highest bid ($809,959) and the highest bid per acre ($316) for Tract 378. The Beaufort Sea sale offered 573 tracts totaling 2 million acres of tidal and submerged lands, all between the Canadian border and Point Barrow.