Canadian prospects push toward 30-tcf North American natural gas market

During the 1990s, expectations for significant growth in North American gas demand strengthened. The "30-tcf market" has become a goal towards which industry strategy and government policies have increasingly pointed.

This confidence about growth prospects in the gas industry stands in marked contrast to industry and government attitudes in the 1970s and 1980s.

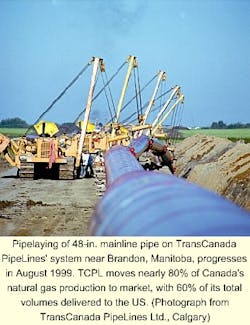

A critical contributor to the renewed confidence in North American gas prospects has been the substantial growth in Canadian gas production.

Since the mid-1980s, marketed Canadian gas production has more than doubled, exceeding 6 tcf (16.5 bcfd) in 1999, almost 25% of North American gas production.

When North American gas production peaked previously in 1972-73, Canada accounted for only about 10% of total production.

If North American gas demand is to reach 30 tcf, Canadian gas production must continue to grow substantially. Growth in Canadian production, however, has slowed since the mid-1990s.

During 1986-94, marketed Canadian gas production grew an average 320 bcf/year (880 MMcfd). During 1995-99, it grew only an average 175 bcf/year (480 MMcfd).

To reach a 30-tcf gas market, growth in Canadian gas production must accelerate.

Almost all (95.5%) of 1999 Canadian gas production came from the Western Canada Sedimentary Basin (WCSB) in British Columbia, Alberta, and Saskatchewan.

The slowing growth in WCSB production indicates, however, that future growth in marketed Canadian gas production must increasingly come from other areas of Canada or unconventional sources in the WSCB, particularly coalbed methane.

Canada has four major current or potential producing areas (Fig. 1): the WCSB, Mainland Territories, Mackenzie Delta-Beaufort Sea, and the Offshore Atlantic.

Although gas discoveries were made in the Arctic Islands in the late 1970s, production from this area would probably not be delivered to North American gas markets until after a 30-tcf market is reached.

WCSB prospects

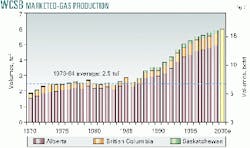

WCSB gas production has gone through two growth periods (Fig. 2). The first lasted to 1973, when WCSB marketed gas production reached 2.5 tcf. During 1973-84, WCSB marketed gas production did not grow, reflecting the lack of growth in Canadian gas exports to the US.

With the beginning of a strong growth in Canadian gas exports to the US after 1986, however, growth in WCSB gas production resumed. By 1990, Saskatchewan gas production exceeded 200 bcf/year, but little growth occurred during the 1990s.

British Columbia gas production also grew, reaching 765 bcf/year (2.1 bcfd) in 1999. This is triple its 1986 production.

Despite the growth in Saskatchewan and British Columbia gas production, more than 80% of WCSB marketed gas production still comes from Alberta.

In 1999, Alberta's marketed gas production was almost 5 tcf (13.6 bcfd), 83% of WCSB production. British Columbia production was 2.1 bcfd, 13% of WCSB marketed gas production. The remaining 4% comes from Saskatchewan.

Thus, prospects for continued growth in WCSB marketed gas production will depend heavily on Alberta prospects.

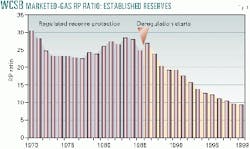

A large part of the production growth since 1986 reflected a drawdown of the reserves inventory built up in response to Canadian government regulations (Fig. 3).

In 1986, established reserves in Western Canada were 72.5 tcf, and production was 2.6 tcf, resulting in a reserves-to-production (RP) ratio of 27.4.

With the beginning of market deregulation in late 1985, however, the regulatory requirement for a 25-year established reserves (proved plus risked recovery from contiguous inferred reserves) to production (RP) ratio to justify exporting Canadian gas to the US was removed.

With removal of this requirement, Canadian gas exports began a rapid growth, and the WCSB RP ratio began to decline. By 1992, WCSB gas production had grown to 4.3 tcf, but established reserves had declined to 68.5 tcf, resulting in an RP ratio of 16.2.

Production reached 6.0 tcf in 1999, and the established reserves declined to 57.2 tcf, resulting in an RP ratio of 9.6. Onshore Lower 48 US gas production had an RP ratio of 9.5 in 1999 for proved reserves.

The decline in the RP ratio has caused concern about future prospects for increased WCSB gas production. Despite a surge in gas drilling in the WCSB to a record level of well more than 8,000 new gas wells in 2000, marketed WCSB gas production will show little growth in 2000.

Canada's National Energy Board (NEB) expects that WCSB gas drilling would have to approach 9,000 new gas wells by 2000 for raw WCSB gas production to grow 1.1 bcfd by 2002.1

To grow sufficiently to fill Alliance Pipe line's capacity leaving WCSB (1.6 bcfd) and meet increased Canadian gas demand (about 2.4 bcfd, raw), WCSB gas drilling activity would approach 10,000 wells by 2002.

Given the limited production responses to increased gas drilling activity since the mid-1990s, continued growth in WCSB gas production will depend heavily on unconventional (or "frontier") gas resource prospects in the WCSB.

Unconventional gas resources consist of coalbed methane, tight sands, and shales. The unconventional WCSB resource most likely to be developed first is coalbed methane.

In the Western US, coalbed-methane production exceeded 1.1 tcf (3 bcfd) in 1999, and coalbed-methane production is growing, principally reflecting surging coalbed-methane gas production in the Powder River and Uinta basins.

The coalbed methane resource in Western Canada is likely to prove substantial. NEB used a recoverable estimate of 75 tcf in its recent energy outlook,2 comparable with the 74 tcf used in the recent National Petroleum Council (NPC) study.3

Other estimates suggest a larger resource. Given the conservative nature of initial potential coalbed-resource estimates, coalbed-methane production could play a growing role in future WCSB gas production, allowing total WCSB production to continue to grow.

Mainland territories

Although gas production from north of the 60th parallel (Northwest Territories and Yukon) began almost 30 years ago, it has been quite modest, peaking in 1976 at 34 bcf (94 MMcfd).

Production fell off substantially after 1976 (Fig. 4). This decline reflected two factors:

- Depletion of the initial discoveries.

- Lack of new discoveries reflecting a moratorium on leasing and exploration.

Production recovered in 1992, reflecting production from the Kotaneelee gas field in the Yukon.

Since 1992, "North-of-60" marketed gas production has averaged 22 bcf/year (59 MMcfd). In 1999, production was 22 bcf, with three fourths (17 bcf) coming from Kotaneelee. The remaining production came from the Norman Wells oil field (4 bcf) and Painted Mountain (less than 1 bcf).

North-of-60 production, however, began a significant growth in 2000 that will make it an important player in Western Canada gas production.

Since the resumption of leasing activity in 1994, large discoveries have been made in the Fort Liard structure. The extent of this structure and discoveries to date suggest that Fort Liard may prove to be a world-class play.

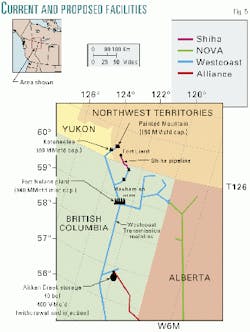

Current facilities can accommodate some near-term growth from the Fort Liard discoveries (Fig. 5). About 200 MMcfd or more of raw gas processing capacity is available at Fort Nelson, BC, and comparable capacity is also available on the Westcoast Pipeline to move that gas from Fort Nelson to North American gas markets.

The Unocal gas storage facility (Aitken Creek) is well-situated (interconnects with Westcoast and Alliance) to assist with transmission-load balancing of new North-of-60 gas production.

The principal reserve holders are Canadian Natural Resources Ltd., Calgary (at least 200 bcf), Chevron Canada Resources, Calgary/Purcell Energy Ltd., Calgary (400-600 bcf), and Paramount Resources Ltd., Calgary (250 bcf). Production from these new discoveries began in April 2000.

Three gas wells were producing from the Fort Liard structure in August 2000, producing 2.8 bcf (raw) and 2.0 bcf (marketed). A fourth well (M-25) began production last November and at presstime was expected to ramp up to 70 MMcfd (raw) in December.

When a fifth well (recompletion of the original discovery well, F25A) begins production in March 2001 at 15 MMcfd (as planned), Fort Liard production will utilize most of the available gas processing capacity at Fort Nelson.

While the reserves discovered to date could support additional gas production, additional production will require expanded gas processing and pipeline capacity to the North American gas transmission network.

Although new gas processing and pipeline capacity to serve further growth in North-of-60 production has been proposed (Westcoast Energy Inc., Vancouver, TransCanada PipeLines, Calgary, Enbridge Inc., Calgary, gas producers), these facilities are unlikely to become available until 2002.

At that point, North-of-60 gas production is likely to grow substantially. By 2005, it could exceed 200 bcf (600 MMcfd).

Recent gas discoveries bring marketable reserves in the Fort Liard area to more than 1.5 tcf with an ultimate potential of 3.5 tcf.

This potential is more than half of the undiscovered resources that NEB used in its recent outlook for the entire Mainland Territories region.4

Prospective hydrocarbon basins exist north of the Fort Liard discoveries in the Mainland Territories.

The Mackenzie Corridor (Northwest Territories), which extends northward to the Mackenzie Delta and contains the Norman Wells oil field (reserves of 260 million bbl), has 400 bcf discovered gas reserves and a currently estimated potential of 3 tcf.

This largely unexplored area is attracting new exploration efforts.

Successful exploration activity north of Fort Liard could assist development of a gas transmission corridor that might ultimately extend to the Mackenzie Delta.

Mackenzie Delta; Beaufort Sea

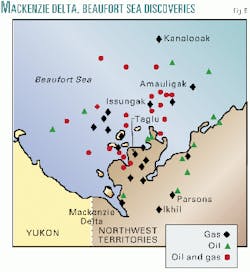

Exploration in the Mackenzie Delta and Beaufort Sea area began in the early 1970s (Fig. 6). In 1974, the first reserves (5.7 tcf) were booked. Subsequent activity resulted in established reserves reaching 10.5 tcf in 1989.

In 1994, however, following a sustained period of low prices and surplus gas availability in the Lower 48 and WCSB, these reserves were debooked as uneconomic.

The NEB currently reports 27 discoveries (18 with gas) in the Mackenzie Delta and 26 discoveries (22 with gas) in the Beaufort Sea.5 The mean estimates of marketable gas reserves (nonassociated and associated) that could be recovered from these discoveries is 4.9 tcf in the Mackenzie Delta and 4.0 tcf in the Beaufort Sea.

NEB estimates that the undiscovered resource potential is about 55 tcf.6

The two largest gas accumulations in the Mackenzie Delta are Taglu (mean estimated recovery of 2.1 tcf) and Parsons (mean estimated recovery of 1.3 tcf).

In the Beaufort Sea, the two largest gas accumulations are Amauligak (mean estimated recovery of 1.4 tcf) and Issungnak (mean estimated recovery of 1.1 tcf). NEB characterizes both Beaufort Sea gas accumulations as oil fields. The largest gas discovery in the Beaufort Sea is Kenalooak (estimated mean recovery 0.2 bcf). As a result, significant gas production from the Beaufort Sea discoveries is unlikely until after oil production begins.

Given the sizes of Beaufort Sea oil fields (Amauligak, the largest, has less than 250 million bbl), significant oil and gas production in the Beaufort Sea will probably lag the onset of Mackenzie Delta production by some years, unless new, much larger discoveries are made.

While gas deliveries from the Mackenzie Delta and Beaufort Sea area to the North American pipeline grid will probably not begin for about 7-10 years, gas production has begun in the Mackenzie Delta to serve the local market.

On Sept. 10, 1999, gas deliveries from the Ikhil field to the town of Inuvik began. NEB estimates that marketable gas reserves for the Ikhil field are 26 bcf (mean estimate).7 Current marketed production is about 1 MMcfd.

The last 2 years have seen a renewed interest in Mackenzie Delta exploration with Crown lands being offered in 1999 and 2000. Recent advances in exploration technology-3D seismic, seismic processing, sequence stratigraphy, and petroleum-systems concepts-will reduce the risks and costs for the new round of exploration.

Interest has also been renewed in developing a gas pipeline to bring Mackenzie Delta and Beaufort Sea gas to the North American gas transmission grid.

Proposed capacity for gas deliveries from the Mackenzie Delta and Beaufort Sea is 1-2 bcfd.

While current total reserves in the area might support such a pipeline, reserves in the Mackenzie Delta discoveries alone would not support a pipeline of 1 bcfd.

As a result, current pipeline plans to deliver gas from the Mackenzie Delta area would rely on further discoveries.

Given the resource prospects, sufficient discoveries to support a 1-2 bcfd pipeline could be made to support the beginning of such deliveries within the next 7-10 years.

Offshore Atlantic

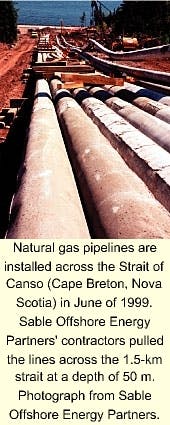

Three areas in Offshore Atlantic Canada (Fig. 7) have had significant gas discoveries: the Scotian Shelf (off Nova Scotia), the Grand Banks (east of Newfoundland), and the Labrador Shelf (off Labrador).

Gas recovery from these discoveries was estimated to be about 15 tcf as of the end of 1999: 6 tcf were on the Scotian Shelf, associated with the Sable Island discoveries; Grand Banks reserves were estimated to be 5.1 tcf; and Labrador reserves, 4.2 tcf.

Scotian Shelf gas reserves began production in 2000. Because Grand Banks reserves are mostly associated gas, marketed gas production will be governed by impacts on oil production economics.

Thus, Grand Banks marketed gas production is more likely a mid-term (7-10 years) prospect. The remoteness of the Labrador Shelf reserves puts their production more on the time line of Beaufort Sea production or later.

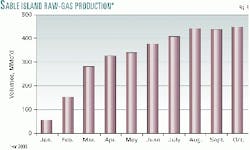

Sales of natural gas production from Offshore Nova Scotia began in January 2000 (Fig. 8). By August, raw gas production averaged more than 440 MMcfd.

With the opening of the Halifax (November) and St. John (December) laterals to serve Nova Scotia and New Brunswick markets, respectively, offshore Nova Scotia production should increase, approaching full capacity of the Maritimes & Northeast Pipeline LLC, Halifax, NS (530 MMcfd).

The Maritimes & Northeast Pipeline was expected to provide a catalyst for future exploration and development of the Scotian Shelf. This expectation bore early fruit with the Deep Panuke discovery by PanCanadian Petroleum Ltd., Calgary, in 2000. Estimates of its recovery are 1-3 tcf, and production should begin in the next few years.

The recent aggressive bidding for Scotian leases indicates that producers do not believe that the Sable Island and Panuke discoveries have captured all the "low-hanging fruit" on the Scotian Shelf. As a result, the critical challenge to developing Offshore Atlantic gas production may be to develop sufficient pipeline capacity to keep pace with industry discoveries.

Maritimes & Northeast Pipeline capacity can be expanded to 900 MMcfd by additional compression.

Beyond 900 MMcfd, looping or a new pipeline would be needed. Given the Panuke discovery and recent leasing, Scotian Shelf production could exceed 1 bcfd in the near term.

Opportunities

The slowing of the growth in Canadian gas production since the mid-1990s reflects the maturing of the WCSB; it does not reflect the maturing of Canada as a whole.

Significant near and mid-term "frontier" opportunities exist for total Canadian gas production to continue to grow at a robust rate. Therefore, Canada should be able to "pull its weight" in supplying a 30-tcf North American gas market.

Some of the opportunities for increased production are beginning to be realized with the start of gas production from the Mainland Territories (Fort Liard) and the Scotian Shelf.

Production growth from at least the Scotian Shelf would be a long-term phenomenon. In the medium term (7-10 years), production could begin to develop in the Mackenzie Delta and possibly the Grand Banks. Therefore, continued long-term growth in Canadian gas production is a plausible expectation.

A critical uncertainty for future Canadian gas production is the extent and timing of coalbed-methane gas production. The pace at which this substantial resource could be developed reflects the extent to which technology developed for US basins could be applied to the WCSB coalbed methane.

References

- National Energy Board, Short-term Natural Gas Deliverability from the Western Canada Sedimentary Basin, 2000-2002, An Energy Market Assessment, December 2000, p. vii.

- National Energy Board, Canadian Energy Supply and Demand to 2025, June 1999, p. 42.

- National Petroleum Council, Meeting the Challenge of the Nation's Growing Natural Gas Demand, Volume II, December 1999, p. S-79.

- National Energy Board, Canadian Energy Supply and Demand to 2025, June 1999, p. 43.

- National Energy Board, Probabilistic Estimate of Hydrocarbon Volumes in the Mackenzie Delta and Beaufort Sea Discoveries, 1998, p. 4.

- National Energy Board, Probabilistic Estimate of Hydrocarbon Volumes in the Mackenzie Delta and Beaufort Sea Discoveries, 1998, p. 7.

- National Energy Board, Probabilistic Estimate of Hydrocarbon Volumes in the Mackenzie Delta and Beaufort Sea Discoveries, 1998, p. 7.

The author

Thomas J. Woods is vice-president for US gas services for Ziff Energy Group, Houston. He joined Ziff in 1997. He is responsible for consulting services in gas supply, transportation, and markets. He is also involved in petroleum and gas liquids supply and demand issues and electricity supply and demand issues. Woods received a BS in physics from Loyola University, Los Angeles, and earned an MS in physics and PhD in experimental nuclear physics from UCLA.