Drilling Report: Drilling contractors mobilize badly needed rigs and crews

The drilling industry must be commended for finding crews, mobilizing an aging rig fleet, and generating newly built rigs, exceeding the 1997 peak drilling activity, both in terms of rig count and total footage drilled.

The driller had a definite impact, along with other factors during the year, on increasing badly needed gas storage levels, reducing commodity prices, and saving the North American economy further damage from extreme energy costs.

Even though rig counts have come off of their recent peaks and the industry looks to the future with a wary eye on lower commodity prices and softening rig demand, we must celebrate the gains of the past year.

Richard Mason of the Land Rig Newsletter said, "We should raise a glass to the drilling contractor, who in the past year, has done a phenomenal job of mobilizing more rigs and crews than during the peak of 1997, something many thought was impossible a few months ago."

Worldwide activity

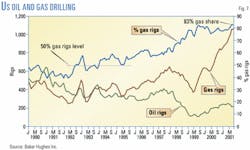

According to Baker Hughes Inc., Houston, worldwide rig activity increased 23% from last year to 2,345 active rigs in July 2001, following a peak in February 2001 of 2,430 active rigs (Fig.1). Coinciding with Canada's annual winter activity spike, the peak in February exceeded the previous peak of December 1997 by 112 rigs, when 2,318 rigs were active.

The international rig count, excluding the FSU, communist countries, Iraq, and North America, averaged 748 rigs in July, up 86 rigs from last year, but dropping 12 rigs from the previous month's recent high of 760 rigs (Fig. 3).

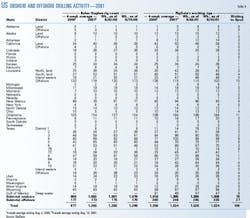

Responsible for most of the increase, the North American rig count averaged 1,597 rigs in July, a 28% increase over the previous year on top of a 55% gain the year before. In July, the US rig count, including onshore and offshore units, averaged 1,278 rigs, up from 941 rigs last year.

In Western Canada, the July active rig count averaged 360 units, up 16 rigs from a year earlier.

In the major international regions (Fig. 4), operators and national oil companies employed 98 rigs in Europe, 181 in the Middle East, 55 in Africa, 262 in Latin America, and 181 in the Far East, up 15%, 13%, 22%, 12%, and 9%, respectively, on top of solid gains the previous July.

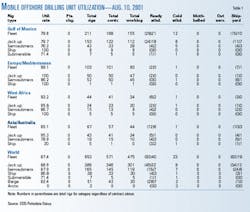

Worldwide offshore activity had a net gain during the year, with a utilization of 73.6% in August 2001 (Fig. 5). This is up from 71% last year, with a peak at 77% in June 2001. According to ODS-Petrodata Group, Houston, the working fleet stood at 475 rigs on Aug. 10, 2001 (Table 1), up 13 rigs from a year ago.

The US picture

By yearend 2001, OGJ estimates that the surge in drilling in the US could result in the largest number of completions in any year since 1987, with operators increasing spending for wells and completions to $32 billion, a 36% increase over last year. As a result, operators should drill and complete 33,600 wells this year, far exceeding the 25,945 wells OGJ estimates were drilled in 2000 (OGJ, July 30, 2001, p. 101).

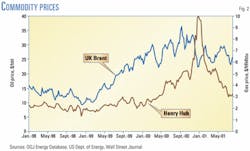

Using West Texas Intermediate (WTI) 40° API, oil prices rose to a peak beginning-of-the-month posted price of $34/bbl in December 2000, but then declined, stabilizing in a range near the July 2001 $25.50/bbl (Fig. 6).

More importantly, with the winter 2000 Henry Hub prices spiking to $10/MMbtu, strength in natural-gas prices were the driver for US rig mobilizations (Fig. 2).

Even though gas prices declined going into summer 2001 to the more modest $3/MMbtu range, the US total active rig count continued its climb to the July 2001 peak of 1,278 active rigs, up from 942 rigs in July 2000. Drilling contractors mobilized an average of 28 rigs/month during this 12-month period or almost 1 rig/day (Fig. 6).

Based on information provided by RigData for wells deeper than 2,500 ft, by August 2001 the top 50 operators in the US had drilled 6,344 wells (average well depth of 8,340 ft) for a cumulative 52.9 million ft drilled (Table 2).

Additionally, the five most active operators in terms of wells drilled included BP Exploration Inc. (451), Occidental Petroleum Corp. (404), Anadarko Petroleum Corp. (400), EOG Resources Inc. (316), and Louis Dreyfus Natural Gas Corp. (256). Anadarko was the most active operator in terms of total footage drilled, with almost 4.3 million ft, averaging 10,678 ft/well (Table 2).

US land rigs

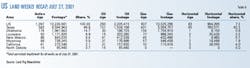

Based on a 4-week, mid-August 2001 average for US onshore activity, RigData says 1,385 land rigs were drilling, up 363 units or almost 36% from last year (Table 4).

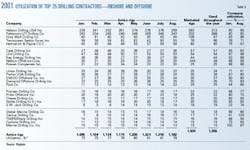

Drilling utilization for the top 25 US drilling contractors began the year at 73%, climbing to 79% in August 2001, with highs in June and July of 81% (Table 3). The data in this table include both onshore and offshore rigs and are not completely accurate as an indicator strictly of land rig utilization.

However, US land rigs make up most of the statistics in Table 3, making it a good off-the-cuff reference. It's safe to conclude that mid-year 2001 land rig utilization had increased 8-10% over last year.

Land rig utilization during the 4-week, mid-August 2000 average was 74.6%, based on RigData's 1,022 rigs running and 1,370 available land rigs in 2000 from the 48th Annual Reed-Hycalog Rig Census.

Wages, dayrates

Although rig demand and day rates have flattened on lower commodity prices in July, rig day rate increases from 2000 through the second quarter 2001 have been dramatic.

A simple average of reported US day rates for all land rig classes increased from just under $5,000 in first quarter 1999 to $10,000 in the second quarter 2001 (the Land Rig Newsletter, July 2001, p. 2).

Drilling companies have reported record earnings, making as much money during the first half of 2001 as they did all of last year.

During the second quarter 2001, operating margins were higher than actual day rates 2 years ago. Grey Wolf reports that it will enter 2002 with 22 rigs under term contacts, with average daily margins in excess of $7,000.

David Wehlmann, senior vice-president, Grey Wolf Inc. said, "The current spot market price for 1,000-3,000 hp rigs currently range $12,000-17,000. Grey Wolf expects to have an average 94 rigs running in the third quarter 2001, which is the extent of our forecast."

When asked about wages, Wehlmann said, "We had a pay increase last September and again in June 2001, which combined, totaled 20%. We see no additional wage increases, now that the rig market is softening."

Richard Mason of the Land Rig Newsletter commented recently that people in the industry always complain about manpower and having a hard time finding skilled workers. We've heard this in 1978, in the 1980s and we're hearing it now.

However, when commodity prices and rig day rates go up as dramatically as they have during the past year, the drilling contractors come through, delivering rigs and crews. "Roughly speaking we've seen the land rig fleet go from 1,000 to 1,500 rigs, or 50% increase in 18 months, which is truly phenomenal," said Mason.

Consolidation and valuation

Patterson Energy Inc. and UTI Energy Corp. completed their merger in May 2001, creating Patterson-UTI Energy Inc., North America's second largest drilling contractor with $2.2 billion combined market value and 302 land-based rigs, 286 located in the US and 16 in Western Canada.

Other than Patterson-UTI, the merger and acquisition frenzy that occurred through the mid-to-late 1990s has slowed in the US land market.

Share prices for land drillers declined sharply in July, on lower commodity prices, particularly for natural gas. Some analysts believe that rig counts could drop 10-15% by yearend, depending on what happens to gas prices. Other analysts believe softening gas prices are temporary and will recover to higher sustained values within a few months.

Gas, directional wells

The lion's share of drilling activity in the US is for natural gas to meet domestic demand. According to Baker Hughes, 83% of the total US drilling rig fleet was drilling for gas in July, up from 79% a year ago (Fig. 7).

As of July 27, 2001, US operators had a cumulative permitted depth of 10 million ft seeking natural gas, compared to only 3.2 million ft for oil wells (Table 5).

The relative percentage of vertical, horizontal, and directional wells remains at typical historic levels, despite continued improvements in directional drilling technologies and the maturity of US oil and gas fields that can require advanced techniques.

Canada

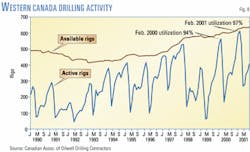

Don Herring, president of the Canadian Association of Oilwell Drilling Contractors (CAODC) expects another record year for Canadian drillers, forecasting 19,455 well completions by yearend 2001. As of Aug. 14, 2001, the Western Canadian rig fleet had expanded to 635 rigs, with 403 rigs operating, up 35 units from last year (Fig. 8).

A snapshot in August doesn't accurately portray Canadian trends, since drilling activity is highest in winter following freeze-over, with the peak in February. Western Canadian rig utilization was 97% at 608 rigs running in February 2001, compared to February 2000's 94% utilization with 561 rigs running, a 47 rig increase.

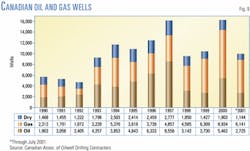

Drilling for natural gas has been the focus in Western Canada as well as the US, representing 62% of all wells drilled in 2000 and 69% of the wells drilled to July 2001 (Fig. 9).

For the coming winter drilling season, CAODC expects a very busy year with near full rig utilization. To attract workers needed to staff the rigs, Canadian rig operators will be offering a 10% pay raise, giving drillers an hourly rate of $31.00 (Can.), increased from $27.70 (Can.). Floormen will earn $20.50 (Can.), up from $18.40 (Can.), according to recommended CAODC guidelines.

Offshore markets, dayrates

According to ODS-Petrodata Group (ODS), Houston, 567 rigs held contracts on Aug. 17, 2001, 4 fewer than the previous week but 19 more than a year ago, for a worldwide utilization rate of 86.8%.

Europe and Mediterranean markets maintained fleet utilization rates of 97.1%, with 99 rigs holding contracts, out of 102 rigs in the fleet. ODS said rig- use rates in the Gulf of Mexico, however, have dropped below 80% during the past month, to 77.8% on Aug. 17, 2001.

In an Aug. 9, 2001, report, Simmons & Co. International reduced its earnings estimates for offshore drillers for the third and fourth quarters 2001, by an average 8% and 36%, respectively.

The action was based on a consensus opinion that day rates and earnings are at risk and on a historical relationship between rig day rate and utilization. There is an inflection point at 80% utilization. Below the inflection point, day rates drop rapidly to cash breakeven levels as utilization declines.

According to Michael Dawson with Global Marine Inc., lower gas prices have clearly put downward pressure on Gulf of Mexico jack up rig rates, but internationally, markets have remained stronger on stable oil prices than most in the industry had expected.

Oil companies have maintained a conservative posture, ensuring that most of their projects remain economic at $14-18/bbl oil, which inherently adds stability to the offshore rig market.

Dawson also noted that smaller gas prospects, developed in the Gulf of Mexico at high gas prices, also have rapid decline rates making softness in the rig market self-correcting.

Operating company budget considerations may be another factor putting downward pressure on the rig market, with many companies gearing up in the fourth quarter 2000 to spend the 2001 budget early. Now that this work has run its course, people have pulled back going into the summer vacation season.

Manpower issues

Robert Moers, senior news editor for ODS-Petrodata said, "During an informal survey of offshore drilling contractors, none of them appeared concerned that the current softening rig demand would adversely affect staffing levels. In fact one company was actively trying to hire rig personnel."

Dawson of Global Marine said, "Given the skill and experience levels required to work in many offshore positions, companies are not easily willing to let people go. There is a relatively small pool of people with the right skill sets, and companies often hire employees from each other." He indicated that Global Marine had a 5% across the board pay raise on July 1, 2001.

Offshore construction

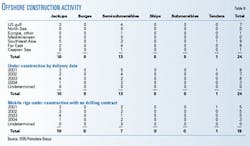

This year, 10 jack ups, 13 semisubmersibles, and 1 tender are being built, or have been proposed, with 8 of these vessels to be finished by the end of 2001 (Table 6).

Out of the 24 offshore rigs under construction, 9 units will go to work in South- east Asia, 6 will go to the Far East, and 7 in the Gulf of Mexico.

Offshore consolidation

Global Marine Inc. and Santa Fe International Corp. announced merger plans Sept. 3, 2001 creating GlobalSantaFe Corp., the world's second largest offshore drilling contractor, with $6 billion market capitalization and a combined rig fleet of 59 offshore and 31 land drilling rigs.

Pride International Inc. and Marine Drilling Co. Inc. announced in the second quarter 2001 their intent to merge, with Pride International Inc. as the surviving entity. The combined company will have 76 offshore rigs and 246 drilling and workover land rigs.

The transactions for both mergers are expected to close by yearend 2001.

The largest offshore drilling contractor was created with the Transocean Sedco Forex Inc. and R&B Falcon Corp. merger completed in first quarter 2001, creating a combined rig fleet of 169 offshore rigs.