OGJ Newsletter

Market Movement

IEA shrinks 'missing barrels' number

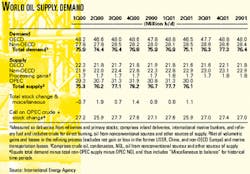

IEA has left its estimate of worldwide oil demand growth unchanged in its latest report, but the total numbers have shifted upwards as the agency has revised its non-OECD demand figures back to 1999. This in turn has slightly affected its estimates of the call on OPEC crude plus stock change. The greater effect, though, has been a reduction in the miscellaneous-to-balance item-often referred to as "missing barrels"-in the supply-demand equation.

Because so many non-OECD demand figures are not available on a timely basis, IEA must estimate them based on growth rates and historical trends. The new upward revisions to the 1999 and 2000 data are for the former Soviet Union, Indonesia, Brazil, Algeria, the Philippines, Iraq, and Singapore. More revisions may appear later as data from China, the FSU, and the Middle East are further analyzed. The agency notes that unreported petrochemical feedstocks, unrecognized refineries, and direct burn are typically undercounted in official figures.

The new estimates for 1999 result in an upward revision to total demand of 383,000 b/d. Carrying this through to the following year, the miscellaneous-to-balance number for 2000 is reduced to 500,000 b/d from 800,000 b/d.

This revision ripples through the equation, ultimately increasing the call on OPEC for crude by 300,000 b/d for 1999 and 2000.

Other revisions

Two revisions to OECD data also appear in the latest figures. Preliminary US demand estimates for May 2001 have been increased by 400,000 b/d.

Also, Norwegian stocks, which generally have been overstated, are now calculated differently. Norway has begun using new definitions and a new reporting system that should generate more accurate and more timely inventory figures. IEA has adjusted Norway's historical data back to 1990 based on the new system. The net effect of all the latest revisions is that while actual demand growth remains unchanged from previous estimates, IEA's number for global oil demand has been increased by 380,000 to 76.4 million b/d for this year and by 390,000 b/d to 77.2 million b/d for next year.

OECD stocks

In June, crude oil inventories shrunk while product stocks grew. OECD crude oil stocks fell by 680,000 b/d.

"This decline reflects constrained supply as producers cut production to maintain prices," IEA commented, adding, "While effective, crude stocks are rapidly approaching previous-year levels, which were tight and contributed to a round of production target increases."

North America accounts for 510,000 b/d of this stockdraw. Another 250,000 b/d withdrawal from storage was posted for OECD Europe, but OECD Asia added 90,000 b/d of crude to storage.

Meanwhile, OECD product stocks, mainly gasoline and middle distillates, gained 1.1 million b/d in June on weak demand. Most of this seasonally atypical build is attributed to North America, as Europe's gain of 80,000 b/d was mostly offset by Asia's 70,000 b/d decline in product inventories.

Preliminary July figures show a drop in US crude and gasoline stocks in line with seasonal patterns. IEA reports that some refiners reacted to weak margins by conducting maintenance and converting their production to higher distillate yields, which would boost heating oil stocks well in advance of winter.

null

null

null

Industry Trends

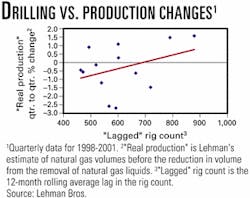

US GAS PRODUCTION is rising faster than some realize.

That word comes from Lehman Bros. "We estimate that wellhead production [includes both dry gas and natural gas liquids] increased by 0.5%," in the second quarter vs. the first quarter for a sample of 37 large gas producers, said analyst Thomas R. Driscoll. The sample group accounts for about 60% of US production.

Lower gas prices prompted the industry to increase NGL production in the second quarter compared with the first quarter. That trend has misled investors about wellhead production volumes, Driscoll said.

"We expect the sharp rise in US production volumes to continue into the first half of next year as a result of continued strong drilling activity levels," Driscoll said.

For the past 6 months, US gas production has risen 1.7%, which implies a full-year increase of 3-4% from 2000 levels, the analyst said.

ALTERNATE FUELS investment is growing.

Shell Hydro- gen, Ballard Power Systems, and Westcoast Energy have created Chrysalix Energy, a private capital joint venture that will provide funding to early-stage companies specializing in fuel cells, hydrogen, and related technologies.

Don Huberts, Shell Hydrogen CEO said, "We feel it is essential to help develop the ideas and work being conducted in this area alongside the work we are already doing in our own business."

Chrysalix marked the second recent joint venture for Shell Hydrogen, which owns half of HydrogenSource, a company formed in June to develop, manufacture, and sell fuel processors and hydrogen generation systems for fuel cell and hydrogen fuel applications.

Shell Hydrogen, part of Royal/Dutch Shell, was established in 1999.

Meanwhile, a US manufacturer of wind turbine generators has set up a JV to produce the wind turbines in China.

Aeromag, a private company, said it worked closely with Qingdao, Jiaozhou city officials to create the manufacturing plant, which has started production.

Aeromag joined with Qingdao Wind Energy Generation Equipment Works, in Quingdao, Shangdong Province, to form Qingdao Aeromag Wind Energy Equipment Works.

The JV will build wind turbine generators for use in homes, villages, and power stations in China, the US, and rural markets worldwide.

Customers include homeowners, tele- communications companies, and anyone who lacks convenient access to a utility grid, a spokesman said.

"Chinese leaders are anxious to continue to industralize and to reduce pollution," Aeromag said. A sister company, Aeromax, will market worldwide the Aeromag products made in China and the US.

Government Developments

NEW FERC CHAIRMAN Pat Wood will take office on Sept. 1.

As expected, President George W. Bush has named former Texas utilities regulator Pat Wood FERC chairman, succeeding Curtis Hebert, who is leaving the agency Aug. 31.

Hebert resigned to become an executive vice-president with Entergy, a New Orleans-based utility holding company.

A Republican ally of Bush, Wood became one of five FERC commissioners in May. He is a former chairman of the Texas Public Utility Commission.

At that time, political insiders expected Wood to be named chairman of the agency, which regulates the wholesale electricity market and the interstate gas pipeline industry. During Hebert's brief tenure, the commission came under intense criticism and congressional scrutiny for its handling of California's electricity crisis. FERC still must decide the controversial issue of how much to order in refunds for California from generators who are alleged to have overcharged for wholesale electricity sold in the state.

Wood also takes over at a time when various congressional committees are considering expanding the agency's responsibilities to include some oversight of the interstate electric transmission system.

BRITISH COLUMBIA is considering lifting a moratorium on offshore drilling.

The province has a longstanding drilling moratorium in the environmentally sensitive region near the Queen Charlotte Islands off the province's north coast. The Geological Survey of Canada estimates the area has possible reserves of 9.8 billion bbl of oil and 25.9 tcf of natural gas (OGJ, Nov. 13, 2000, p. 26).

The federal and provincial governments froze activity on 22 million acres of federal leases off British Columbia in 1972. Some companies still hold drilling rights in the region.

Energy Minister Richard Neufeld said the recently elected Liberal government would act on the offshore oil and gas issue "in an expedited fashion."

The Liberal government says it would support drilling only if it can be done in an environmentally responsible way. The federal government, British Columbia, and aboriginal communities would have to agree before the ban could be lifted.

Supporters of development say offshore drilling would trigger an economic boom for the region.

MMS AWARDED A CONTRACT to study effects of offshore oil and gas activity on three Louisiana ports.

The National Ports and Waterways Institute at the University of New Orleans will conduct the study.

MMS said the study would analyze the logistics of the offshore oil and gas industry's supply and fabrication system in the Gulf of Mexico and would measure activity related to Outer Continental Shelf drilling.

The institute will examine operations at Port Fourchon, a service base port; Port of Iberia, a fabrication port; and Port of Morgan City, both a service base and a fabrication port. The study will define the transportation network connecting the ports to inland supply and fabrication systems.

Quick Takes

SHALE OIL PRODUCTION from the first stage of the Stuart oil shale project at Gladstone, Queensland, has reached a total of 130,000 bbl.

According to Stuart project partners Southern Pacific Petroleum and Central Pacific Minerals, this production volume is nearly double the firms' initial expectations. Due to this accelerated success, SPP and CPM have increased the project's oil production outlook for 2001 to 300,000 bbl, or an increase of 18%, which is up from the forecast given at the time of the buyout of former partner Suncor Energy earlier this year.

In early August, the companies sold the project's first shipment of 50,000 bbl of shale oil-derived naphtha to a Brisbane refiner. The sale came shortly after the sale of 40,000 bbl of medium shale oil to Singapore for use in the Southeast Asian fuel oil market-the project's first product shipment (OGJ, July 2, 2001, Newsletter, p. 8).

A brief shutdown for maintenance has been scheduled for late September. The work schedule includes alterations to the main stack burner to achieve more complete flue gas combustion from the retort's preheat zone, shale dryer modifications, and the addition of a silencer to the main stack.

In other alternate fuel news, US DOE has selected four teams to begin developing ultralow-cost fuel cell technology in a bid to mass-produce fuel cells. The goal of the $500 million, 10-year effort is to produce fuel cells that cost one tenth of currently marketed systems and one third the cost of the more advanced concepts now beginning to reach commercial readiness. At $400/kw or less, cheaper future fuel cells could find widespread market acceptance well beyond the niche applications of today's systems, DOE said. Fuel cells are being installed commercially today, but high costs have limited their use to customers who need premium, highly reliable onsite power. Because fuel cells don't rely on combustion and operate much more efficiently than traditional power plants, they release 25-50% less carbon dioxide than today's gas or coal-fired power generators.

ALGERIA'S IN SALAH gas fields development has reached a milestone.

BP and Sonatrach awarded three contracts worth a total of $2.5 billion to an international consortium for development of the fields.

BP and Sonatrach agreed in 1997 to develop the seven fields; another field, Boutraa, has been earmarked for later development.

The consortium includes Halliburton unit Kellogg Brown & Root, as well as Bechtel, Japanese company JGC, and Algerian drilling firm Enafor.

KBR and JGC will provide treatment units and a gas gathering network. Bechtel will build gathering lines and a 460-km gas pipeline to link the project to Hassi R'mel. Enafor will drill 71 producing wells and complete well workovers.

The project will come on stream in 2003 from three of the fields-Krechba, Teguentour, and Reg-and eventually will peak at 9 billion cu m/year. BP will pay 65% and Sonatrach 35% of development costs.

In other development news, Shell Canada will lead an evaluation of long-term development opportunities on its oil sands resources in Alberta's Athabasca area, joined by its partners in the Athabasca Oil Sands Project-Chevron Canada and Western Oil Sands. The schemes include optimization and expansion of the Muskeg River Mine project on the western portion of Lease 13 and on Lease 90. The companies are considering bringing production capacity to 225,000 b/d from the current design of 155,000 b/d. If approved, work on the project would likely take place during 2005-10. The Muskeg River Mine is on track to come on stream in late 2002. The partners also are considering a stand-alone oil sands mine and extraction facility in the eastern portion of Lease 13. Jackpine Mine Phase One would have capacity of 200,000 b/d of bitumen. The project would likely follow the Muskeg River Mine expansion. The third project would be a Jackpine Mine expansion, dubbed Phase Two. It would involve resources on Leases 88 and 89 and add 100,000 b/d.

A FLOATING LNG SCHEME off Australia tops gas processing news.

Shell Development (Australia) (SDA) proposed to other owners of the Greater Sunrise fields-Sunrise, Sunset, and Troubadour-that they use floating LNG technology to develop that complex, which lies in the Timor Sea off Australia.

Shell said this would be the first floating LNG project. Earlier this year, another consortium concluded that the floating LNG concept is a viable option for deepwater development (OGJ, Apr. 9, 2001, p. 62).

Shell's proposed facility would be located on a barge close to the drilling platform.

SDA CEO Alan Parsley said, "This breakthrough results from an innovative combination of three well-established technologies: floating production storage and offtake vessels for oil production, LNG shipping, and LNG plant design.

"The floating LNG approach to development of Sunrise offers cost reductions over construction of an onshore plant and thus generates commercial returns for shareholders in Sunrise and substantial tax revenues, which will deliver benefits for the people of Australia and East Timor," Parsley said. Also, the project would release less greenhouse gas emissions than an onshore plant, he added.

Meanwhile, CNOOC International signed an agreement with Chevron Australia to explore the feasibility of acquiring equity interests in the Gorgon gas fields area off Australia and developing the LNG import market in China. LNG imports into Guangdong and adjacent markets in coastal China are planned to meet increasing natural gas demand. The first phase of the Guangdong LNG project is designed to import 3 million tonnes/year from suppliers, still to be determined. CNOOC International, which is 70.6% owned by CNOOC, has an option to acquire its parent's equity interest in the Guangdong LNG terminal and associated infrastructure. The Gorgon gas complex is Australia's largest, with reserves of more than 9.6 tcf.

IN RECENT PIPELINE ACTION, Petroleum Authority of Thailand and Japan National Oil awarded a consortium led by Japanese firm Osaka Gas Engineering (OGE) a feasibility study for future gas transmission systems in the greater Gulf of Thailand, said consortium partner Kværner. Japan Oil Engineering (JOE) is the third consortium partner.

The study will examine current markets for Gulf of Thailand gas and associated main pipeline transmission systems.

The study includes Thailand, Malaysia, Viet Nam, Cambodia, and Myanmar.

The companies will use the information gathered to determine requirements for future main gas pipeline transmission systems through 2020.

Kværner said its Bangkok office will participate in the portion of the study involving the pipeline systems, including collation, review, and analysis of data on existing main transmission systems in the five countries. JOE will undertake the supply study, while OGE will carry out the demand study, as well as the overall management of the project.

All three studies should be completed at the same time under a fast-track schedule, said Kværner.

IN STORAGE NEWS, Williams leased underground salt storage caverns in LaFourche Parish, La., that it intends to develop into a 10 bcf gas storage facility in phases over the next 5 years.

Williams entered into the agreement with brine provider Texas Brine Co. for the Chacahoula salt caverns 10 miles southwest of Thidobaux, La. Williams said the facility will eventually have a 1 bcfd withdrawal capacity.

Williams plans to market the storage capacity through an open season. The facility will be connected to several pipeline systems-including Williams's Transco and Texas Gas systems-to create a hub.

Steve Malcolm, president and CEO of Williams's energy services group, said, "The Chacahoula gas storage facility is the first of several planned to expand our natural gas infrastructure in support of our power commitments and natural gas peaking services."

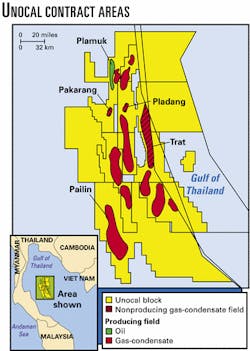

UNOCAL' FIRST OIL PRODUCTION has started up in the Gulf of Thailand.

Plamuk field came on stream at 2,500-3,000 b/d, which is expected to increase to 15,000-18,000 b/d in first quarter 2002 (see map).

In March, Unocal said it intended to work on Gulf of Thailand oil fields Plamuk, Yala, and Surat (OGJ Online, Mar. 5, 2001).

"We expect to significantly increase production once we have completed installation of a new oil processing platform adjacent to existing gas processing facilities in the nearby Platong field," said Randy Howard, president of Unocal Thailand. "We are drilling additional wells in the Yala and Plamuk fields that will help us boost production."

Production from Yala will be added once the Thai government approves the application.

A new floating storage and offloading vessel, Sibea, was installed. In total, Unocal plans to produce from four new production platforms-two in Plamuk and two in Yala-in addition to two existing platforms in Ka- phong field and one in Surat field (OGJ On- line, Oct. 19, 2000).

Operator Unocal's partners in the area include Mitsui Oil Exploration with 23.75% interest and PTT Exploration & Production with 5%.

Elsewhere on the production front, Veba Oil Nederland brought on stream Hanze oil field in the North Sea off the Netherlands. The initial flow rate is 11,000 b/d, but peak production of 30,000 b/d is expected by yearend. The peak is expected to account for two thirds of overall oil production in the Dutch North Sea. The development includes a production storage platform, dedicated oil offloading systems, and gas export pipelines. The oil is offloaded via a single-anchor loading system and shuttle tanker. The Betty Knutsen dedicated shuttle tanker will offload the first crude in mid-August. Associated gas is used to power the platform. Any excess is exported via the A6-F3 pipeline and the NOGAT pipeline to Den Helder on the Dutch coast.

Russia's Geoilbent began production from its first development well in South Tarasovskoye field in Western Siberia, said Benton Oil & Gas, which owns 34% of the Russian firm. The discovery and first production of oil from South Tarasovskoye field came from adjacent Purneftegas acreage in May. The well was drilled to 9,535 ft TD and found a 365 ft gross oil column in multiple pay zones. It is producing 1,000 b/d of 40° gravity oil with no water. This is the first production from the Urabor Yakhinsky Block, in which Geoilbent holds 100% interest. Two more rigs are now drilling development wells on the block to accelerate production. Geoilbent also is drilling an appraisal well 2 km west of the first well.

PetroChina plans to raise crude production capacity in the Tarim basin in northwestern China's Xinjiang region by 10% to 6 million tonnes/year in 2002. The bulk of the increase in production capacity will come from Tarim's Hade-4 field, where PetroChina is moving to raise its capacity to 800,000 tonnes/year in 2002 from 300,000 tonnes/year now. Hade-4 has a thin pay zone at 5,000 m. PetroChina launched a massive exploration effort in the Tarim basin more than 10 years ago. The company expects to produce 4.78 million tonnes of crude from Tarim this year.