OGJ Newsletter

Market Movement

Iraqi oil supply uncertainties loom

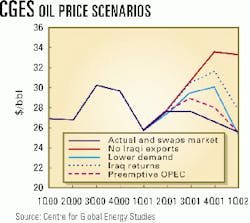

Oil prices softened recently amid reports that Iraq and the United Nations soon may hammer out an agreement allowing for a resumption of Iraqi oil sales under the oil-for-aid accord, plus continuing evidence of growing oil stocks, and word from OPEC that nothing is likely to change at the group's July 3 meeting.

However, the third quarter may prove to be a train wreck for oil markets regardless of what Iraq does.

There has been much political posturing over the nature and design of new "smart sanctions" but all of this is irrelevant to the Iraqis, who insist on a complete and unqualified lifting of all sanctions-which just isn't going to happen.

In addition, Saddam Hussein has no incentive to restart oil exports. In fact, it is in his best interest to keep Iraq's oil off the market. Saddam isn't allowed to touch any of the proceeds from the oil-for-aid sales; proceeds are administered by the UN, and the purchases of food and medicine and other humanitarian aid they fund are also monitored by the UN.

But Saddam sells several hundred thousand barrels per day of crude oil illegally, plus a small sanctioned volume to Jordan, and he earns about $1 billion/year from these oil sales.

The longer approved Iraqi oil supplies remain off the market, the more valuable his illegal volumes become-in part because of the related upward price pressure and by virtue of their availability when comparable Iraqi crude volumes are withheld; conversely, a resumption of legal Iraqi oil exports will only depress oil prices again, devaluing even further his already-discounted illegal supplies. The fact that the resulting high oil prices serve to further undermine western economies-particularly that of the US-is just icing on the cake for him.

OPEC oil needed

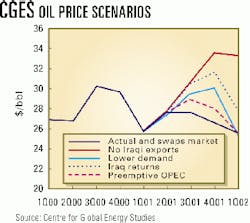

London's Centre for Global Energy Studies continues to raise the warning flag about a need for more oil from OPEC during the third quarter.

CGES estimates that Iraq has taken 2.1 million b/d off the market, and another 350,000 b/d could come off the market if Baghdad's border trade ends. If this suspension lasts the rest of the year, then OPEC needs to act promptly by raising output to replace this crude.

"[OPEC] can always make room for Iraq if it does return, but it will run up against capacity constraints later in the year, if it does not increase output soon enough," CGES said.

The think tank noted, "European crude stocks fell in May, despite low refinery runs," but demand in that region will rebound as more refineries there and in Asia come out of maintenance turnarounds. It pegs the increase in refinery runs in Europe and Asia at 2.0-2.5 million b/d by the fourth quarter, with crude buying increasing ahead of that.

CGES contends that OPEC should begin ramping up output without delay: "If Iraq's exports remain suspended until the end of the year, the other members of OPEC need to boost output close to capacity levels just to prevent a repeat of last year's damaging price spike, unless the US draws on the [strategic petroleum reserve]-in a big way."

No OPEC production hike anticipated

Qatari Oil Minister Abdullah bin Hamad al-Attiyah has said OPEC might not need to boost production this month even if the suspension of Iraq's oil exports is prolonged.

"We act on the signals given by the market, and at present, the signal is that there is a lot of oil in the market. This gives us confidence that even if Iraq extends the cuts after July 3, there will be no shortage of oil," he said.

Meanwhile, API reported US gasoline stocks grew by 3.3 million bbl last week to 222.9 million bbl total, while US oil inventories added 565,000 bbl to 313.5 million bbl total. Distillate fuel stocks added 2.2 million bbl to 110.9 million bbl in all.

That makes it even more unlikely that members of OPEC will make any major adjustments in the production quotas during their meeting in Vienna.

The statistics prompted Chakib Khelil, Algeria's energy minister and OPEC conference president, to reiterate that he sees no need for the group to increase production. "We are witnessing higher stocks levels," he said.

null

null

null

Industry Trends

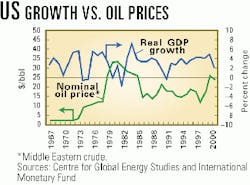

A CORRELATION EXISTS BETWEEN NOMINAL CRUDE OIL PRICES AND GROWTH OF THE US ECONOMY, according to the Centre for Global Energy Studies.

In a recent report, CGES stated, "Crude oil prices rose 46% in 2000, the third largest increase since 1973. Every time oil prices rose steeply in the past, the world's largest economy slipped into recession, and the question arises whether the same will happen this time (see chart).

"We estimate that last year's oil price increase is equivalent to a 'consumer tax for the US,' as Alan Greenspan has called it, of $100 billion. While the direct negative impact on US economic growth is small, the indirect effects are more damaging.

"The impact on US inflation of the 29% rise in retail oil prices in 2000 is around 1.5%...US inflation rose to 3.4% in 2000 from 2.2% in 1999, leading to a tightening of interest rates during 2000. Higher interest rates inhibit investment and slow consumer spending; they also reduce asset values. Growth in the US is faltering and interest rates have been reduced to prevent a hard fall.

"High oil prices are having a huge impact on company profits too. In a more competitive market, companies are unable to pass the higher input costs on to their consumers, reducing their profitability and investment. The US economy would have slowed down anyway, but high oil prices have made the situation worse."

OIL SERVICE COMPANIES' SECOND QUARTER EARNINGS ARE LIKELY TO BE STRONG. So says UBS Warburg analyst James Stone in a weekly research note.

Natural gas inventory concerns and weaker gas prices continued to pressure service companies' performance: "We remain quite bullish about the outlook for oil field service companies' earningsellipse," Stone wrote. Stone estimated 3.4% revenue growth in the second quarter vs. second quarter 2000 and 33% year over year. Operating income is also expected to rise 135% year over year.

INVESTOR OPTIMISM SLIPPED IN JUNE TO A 4-YEAR LOW on concerns about US energy problems, said the Index of Investor Optimism, a joint effort of UBS PaineWebber and Gallup.

Of the investors surveyed, 82% said current problems are serious, and 57% believe the problems will significantly affect the economy. Veteran and novice investors were divided about how to solve the problems.

Among investors having 5 years or less experience in the markets, 25% supported exploration and production, while 49% favored conservation. Conversely, 40% of the investors having more than 20 years in the markets endorsed exploration and production compared with 29% of the experienced investors who favored conservation.

Government Developments

PRIVATIZATION OF STATE-OWNED OIL AND GAS FIRMS CONTINUES APACE.

Peru's President-elect Alejandro Toledo is expected to revive privatization of Peru's state petroleum company and to maintain a free market. Petroperu, meanwhile, currently is evaluating alternative possibilities for its refineries. The company owns the 62,000 b/d Talara refinery, the 10,500 b/d Iquitos refinery, the 6,500 b/d Conchan refinery, and the 200,000 b/d North Peruvian pipeline from northern jungle fields to the Bayover terminal on the north coast.

In 1996, Petroperu sold a majority interest in the 100,000 b/d La Pampilla refinery, now Relapasa, to a consortium led by Spain's Repsol. Petroperu retains a 31% stake in Relapasa.

Meanwhile, Peru's interim government appointed Petroperu's chairman Raul Pasco president of the company's privatization committee. The committee is not expected to make decisions before the Toledo government takes office July 28.

Pasco said a US company and a Latin American company have indicated interest in Petroperu's refineries, although no companies were identified.

Some government officials favor the option of Petroperu finding a strategic partner to invest in the refineries in exchange for a management contract and a share participation.

A REPORT OUTLINING CROATIA'S OPTIONS FOR PRIVATIZING STATE-OWNED OIL AND GAS COMPANY INDUSTRIJA NAFTE (INA) is expected to be presented to the Balkan country's government early this month.

Mladen Prostenik, advisor to INA's chairman, said PricewaterhouseCoopers and Deutsche Bank are preparing recommendations covering reform of Croatia's oil and gas market, along with the restructuring of INA. The recommendations will examine alternatives "including an [initial public offering] and strategic partnership agreements." Prostenik expects the Croatian government to decide on a privatization model in September, with the process of restructuring the company starting next year.

During the last 5 years, independent UK consultants audited INA's accounts along with its oil and gas reserves. INA prepared a "comprehensive" plan for environmental protection following an environmental audit, he said.

INA calculates that it has proved and probable oil and gas reserves of some 36 million cu m in Croatia, and another 8.8 million cu m abroad.

CHINA'S 5-YEAR OIL AND GAS DEVELOPMENT PLAN EMPHASIZES FINDING NEW RESERVES.

The government also will encourage Chinese companies to explore and develop reserves abroad, focusing on Russia, Kazakhstan, Turkmenistan, Iran, Iraq, Sudan, Venezuela, and Indonesia. China plans to produce 170 million tonnes/year of crude oil and 50 billion cu m/year of gas by 2005, up from 162 million tonnes and 25 billion cu m, respectively, in 2000.

China plans to transport 15-25 million tonnes/year of equity oil from its oil fields outside the country back to China by 2005. The plans call for China to establish oil reserves for national energy security purposes and to help cushion price swings.

Quick Takes

TOTAL PRODUCTION FROM STAGE 1 OF THE STUART OIL SHALE PROJECT IN GLADSTONE, QUEENSLAND, HAS REACHED 95,000 BBL.

Since buying out former Canadian partner Suncor in April, Australia's oil shale "twins"-Southern Pacific Petroleum and Central Pacific Minerals-have produced 60,000 bbl of naphtha and medium shale oil from the project.

Also, over the past few months the partners have made steady progress toward improving the plant's reliability and emissions performance. One such enhancement has been the self-imposed implementation of a 160-tonne/hr restriction on the plant's processing rate in an effort to minimize odor emissions from the shale dryer.

SPP/CPM discovered that higher feed rates and the associated higher dryer furnace temperatures increased odors from the dryer, probably due to premature pyrolysis of the shale fines. Work is now under way to find cost-effective ways to remove this drying capacity and odor generation bottleneck.

The companies remain confident that the plant will reach its target average production rate of 1,600 b/d-the op- timal operating cash flow breakeven point-during fourth quarter 2001.

First shipments from the plant, bound for markets in Southeast Asia, were made in early May (OGJ, May 21, 2001, Newsletter, p. 9). A subsequent shipment of 40,000-50,000 bbl of hydrotreated naphtha is planned for early July.

PARTNERS IN DEVILS TOWER OIL FIELD HAVE REVEALED PLANS FOR THE FIELD'S DEVELOPMENT.

Dominion Exploration & Production and partner Pioneer Natural Resources approved development of the deepwater Gulf of Mexico field, which lies in 5,610 ft of water on Mississippi Canyon Block 773, 140 miles southeast of New Orleans. The field's reserves are estimated at 50-75 million boe. Oil production is due to begin in 2003 and increase to 8,000-10,000 b/d, net to Pioneer. Field operator Dominion holds 75%, while Pioneer has 25% working interest.

The field will be developed using a truss spar with slots for eight dry tree wells and the flexibility to accommodate future subsea tiebacks. J. Ray McDermott division SparTec will provide the spar, which will be the eighth production spar in the gulf and the world's deepest dry tree platform, Pioneer said. The companies have completed two development wells at Devils Tower, with the No. 4 well penetrating 350 ft of net pay in five sands within a previously untested fault block. The No. 5 and No. 5 sidetrack extended the hydrocarbon column in six previously penetrated sands and contained over 400 ft of net pay. Both wells will be abandoned temporarily and completed as producers when the spar is installed.

In other development action, Statoil and its partners in the Mikkel gas and condensate field, which straddles Blocks 6407/6 and 6407/7 in the Norwegian North Sea, awarded a $40 million contract to FMC Energy Technologies for equipment and technology solutions to develop that field. Production will be tied back to the

MEANWHILE, BRAZIL'S ANP COMPLETED THE COUNTRY'S THIRD LICENSING ROUND.

Held June 19-20, the 2-day session offered 53 blocks scattered across 12 sedimentary basins.

Phillips Petroleum was the high bidder for an individual block, offering 117.7 million reals ($48.7 million) for Block BM-ES-11. Ocean Energy and Amerada Hess jointly bid 74 million reals for BM-C-15. Ocean will operate the block, with 65% interest. Amerada Hess and Ocean jointly bid 59 reals for BM-S-22, in which Amerada Hess bought 80%. El Paso CGP was another sizable bidder, offering 52.2 million reals for BM-S-13. It was the lone bidder for the stake.

Petrobras won 19 concessions, taking a 100% stake on 7 of those blocks. Otherwise, Petrobras was involved with various consortiums winning the concessions.

ANP said 42 oil companies qualified to participate, with 17 companies from the US, 12 from Europe, 10 from Latin America-of which 6 are from Brazil-2 from Asia, and 1 from Australasia. Only 10 blocks were onshore. Of the offshore blocks, 12 were in less than 400 m of water, while 31 were in deepwater, with the deepest reaching 3,000 m.

Elsewhere on the exploration front, Phillips Petroleum UK and BP subsidiary ARCO British agreed to exchange interests in four license blocks on the UK Continental Shelf. Phillips will swap its 62.74% stake in UKCS Block 22/28a-home of the Kate/Tornado discovery-for BP's 21.38% interest in Block 30/2a and 100% interest in Block 30/1b, excluding the Kessog discovery. Blocks 30/2a and 30/1b are straddled by the 30/2-1 Paleocene find. Block 30/2a borders Phillips's Jade field, which is tied in to its J-Block infrastructure and is in an area of "high exploration potential," according to Henry McGee, vice-president of Phillips's European division. In addition, Phillips will take 0.45% of BP's stake in the Britannia field unit, raising its share to 7.23%, along with an undisclosed cash payment.

QATAR VINYL CO. (QVC) ON JUNE 21 OFFICIALLY OPENED A $695 MILLION PETROCHEMICAL PLANT AT MESAIEED INDUSTRUAL CITY, SOUTH OF DOHA.

The plant has nameplate capacity of 230,000 tonnes/year of vinyl chloride monomer, 175,000 tonnes/year of ethylene dichloride, and 290,000 tonnes/year of caustic soda. The last of the three units, the VCM unit, came on stream June 4.

QVC is owned by Qatar General Petroleum (31.9%), Norsk Hydro (29.7%), Qatar Petrochemical (25.5%), and Atofina (12.9%). The first cargo left the plant in April. QVC is able to use surplus ethylene from Qatar Petroleum as feedstock.

Germany's Krupp Uhde and Italy's Technipetrol built the plant, which Hydro said has customers in Australia, India, Japan, Malaysia, Indonesia, and Thailand. A 120-Mw natural gas-fired power plant has also been built at the site.

Elsewhere in the petrochemical sector, Shell Chemical announced plans for a $400 million expansion of its lower olefins plant in Deer Park, Tex. Shell plans a major cracker debottlenecking project, adding 500,000 tonnes/year of ethylene capacity. When completed, the facility will be able to produce 1.3 million tonnes/year of ethylene. The plans involve a lower olefins plant that was built in 1971 but shut down in 1981 due to overcapacity. Shell said that in 1996, a partial refurbishing and startup of the fractionating facilities (cold side) of the plant was completed. The expansion project would refurbish those facilities and recondition all furnaces as well as mechanical and companion equipment. It would be fitted with electronic control systems and modern nitrogen oxide reduction technology. Shell said the refurbishment, to come on stream in late 2003, would amount to 70% of the cost of building a new plant. A major part of the Deer Park output will feed a higher olefins and detergent development project at Geismar, La., and a butadiene joint venture at Port Arthur, Tex. Shell is planning to connect these developments by pipelines with Deer Park.

Petrovietnam awarded a consortium of Technip and Samsung Engineering a turnkey 400 million euro contract for the design, engineering, equipment and materials supply, construction, commissioning, startup, and training of personnel for a fertilizer complex to be located at Phu-My in Baris Vun-Tau Province, Viet Nam. It will produce 1,350 tonnes/day of ammonia and 2,200 tonnes/day of urea.

Equistar Chemicals said it will extend the current outage at the olefins plant at Lake Charles, La., until market conditions improve. An 850 million lb/year ethylene unit was taken out of service Feb. 17 because of reduced demand and escalating oil, natural gas, and utility prices.

Chevron Phillips Chemical and Qatar Petroleum plan to build a petrochemical plant at Ras Laffan in Qatar. The companies said the project involves a 1.2 million tonne/year ethylene cracker, a 750,000 tonne/year polyethylene plant, and associated utilities and offsite facilities. The plant, which should be completed in 2006, will use ethane feedstock from Qatar's North field. It will use Chevron Phillips's proprietary loop process technology.

IN GAS PROCESSING NEWS THIS WEEK, Taylor NGL plans to build a $45 million (Can.) NGL extraction plant at Joffre, Alta.

The Joffre Ethane Extraction Plant, or JEEP, will be near Nova Chemicals's world-scale Joffre petrochemical complex. JEEP will process the fuel gas being used at the complex to recover ethane, propane, butane, and condensate.

Taylor operates a similar facility, the Younger plant, at Taylor, BC. The plant is the fourth largest NGL plant in western Canada and the only straddle plant in British Columbia.

JEEP will be rated at 250 MMscfd and will have initial production of 10,400 b/d of gas liquids. Ethane will be sold to Nova Chemicals and the other liquids will be marketed through a partner.

JEEP will process pipeline-specification gas, the same gas quality used by Alberta industrial and residential consumers. As such, the plant will be a sweet gas processing facility and will have minimal emissions. Construction is due to begin in the fourth quarter, if regulatory approvals are granted.

In other gas processing news, Edison Gas agreed to buy 3.5 million tonnes/year of LNG from RasGas for 25 years. Financial terms were not disclosed. RasGas, a joint venture between Qatar Petroleum and an ExxonMobil unit, will begin delivering the LNG in 2005 to a regasification terminal in the North Adriatic off Italy. RasGas is expanding its LNG facilities at Ras Laffan in Qatar by adding a fourth train, bringing total capacity to 16 million tonnes/year. The gas will be produced from Qatar's North field. The announcement follows one outlining an agreement under which RasGas will supply 5 million tonnes/year of LNG to Petronet of India. Earlier this month, ExxonMobil signed a letter of intent to conduct a feasibility study for a gas-to-liquids plant in Qatar (OGJ, June 25, 2001, Newsletter, p. 9).

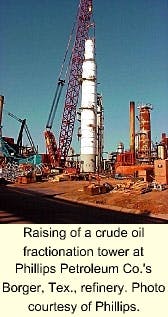

THE EXPANSION OF PHILLIPS PETROLEUM'S BORGER, TEX., REFINERY IS NEARING COMPLETION.

The halfway point was punctuated late last month with the erection of a 170-ft crude oil fractionation tower.

When the ex- pansion is completed in early 2002, the refinery will have the capacity to process an additional 20,000 b/d of oil and to increase gasoline production by more than 200,000 gal/day.

The Borger refinery, which is one of Phillips's largest facilities, currently processes 130,000 b/d of crude and produces 81,000 b/d of gasoline.

The project also will increase by 500,000 b/d the refinery's production of low-sulfur diesel fuel.