New data, old story: US, Canada continue to dominate world's gas processing

Strong energy prices and demand worldwide in 2000 buoyed worldwide gas processing, cushioning processors from high natural gas prices with higher liquids prices. This pattern held especially true in North America.

There, processors whose contracts garnered for them a percentage of the proceeds on the sale of liquids smiled as their plants filled up and their revenues increased.

In addition, new, more accurate data for 2000 gas processing operations in Canada's Alberta province became available earlier this year and have altered the processing picture for the province, the country, and the continent-but the fundamental dominance of North America in gas processing remained unchanged in 2000.

Combined for 2000, Canada and the US held 53.6% of the world's gas processing capacity and produced 44.7% of the world's NGL (Table 1). If you extract Mexico briefly from the Latin America column and add it to figures for Canada and the US, the North American share becomes 55.8% of the world's processing capacity and 50.6% of its NGL production for 2000.

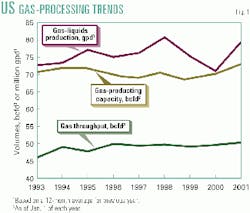

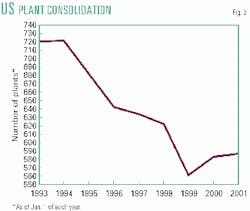

On Jan. 1, 2001, US gas-processing capacity stood at nearly 72 bcfd; throughput in 2000 averaged about 50 bcfd; and NGL production, 79 million gpd (nearly 1.9 million b/d). All figures reflect increases from comparable ones for 1999 (Fig. 1).

As 2001 began, new data for Canadian gas-processing capacity showed it at nearly 50 bcfd with an average of almost 22 bcfd going through the country's plants last year. NGL production was nearly 31 million gpd.

Sources; the world

During 2001 OGJ obtained new plant-by-plant data from Alberta's Energy and Utilities Board (AEUB) that is fundamentally more accurate and current than data used in recent years from the AEUB. Annual throughput information for the province's plants, for example, has generally been an estimate of 80% of nameplate capacity.

These new data, however, reflect actual figures for gas that moved through the province's plants and were reported monthly to the AEUB. OGJ has taken these new data for all of 2000 in Alberta and compiled annual figures.

More broadly, all gas processing activity figures in the breakout tables that start on p. 80 are based on Oil & Gas Journal's most recent exclusive, plant-by-plant, worldwide gas processing survey and its international survey of petroleum-derived sulfur recovery (p. 115).

In addition to AEUB figures for Alberta and to operator responses to its annual survey, OGJ supplements its data with information from the British Columbia Ministry of Employment & Investment's Engineering and Operations Branch and the Saskatchewan Ministry of Energy & Mines.

The 2000 AEUB data for Alberta so radically change the picture of Canada's and North America's gas processing industries that comparisons with previous years' data are meaningless. OGJ will henceforth use 2000 data as a statistical baseline for all comparisons.

Also of note is that NGL production data cited for Saudi Arabia, the world's third largest NGL-producing country, is an aggregate published by the US Energy Information Administration.

Outside Canada and the US at the start of 2001, gas processing capacity stood at nearly 103 bcfd; throughput for 2000 averaged 69 bcfd; and NGL production averaged 136.3 million gpd.

These figures all reflect increases over 1999 as the world outside Canada and the US, especially the countries of Western Europe and the Middle East, produce more gas and gas liquids to meet improving domestic and regional economies.

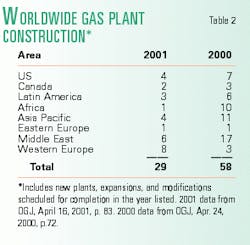

Table 2 provides a snapshot of the current state of gas plant construction in the world.

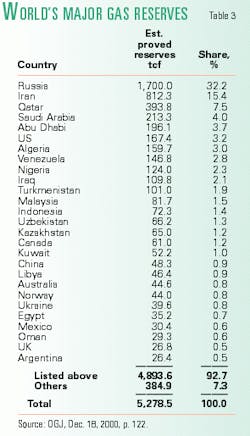

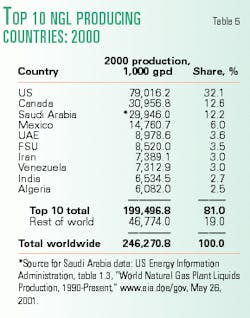

Table 3 ranks the world's major natural gas reserves by country at the start of 2001; Table 4, the world's top natural gas producing countries for 2000; and Table 5, the world's leading NGL producers.

In petroleum-derived sulfur recovery, Canada and the US continued to dominate the world in 2000, holding more than 47% of processing capacity and almost 48% of actual production.

For worldwide production of sulfur derived from refining and natural gas, Canada last year accounted for more than 22% of the overall total; the US, more than 24%.

World developments

In Europe in January of this year, Statoil officially opened new processing facilities at and commissioned the Åsgard gas transport system.

North of Stavanger, Kårstø is Europe's largest natural gas treatment complex and third largest exporter of LPG in the world, says the company.

Gas from Åsgard moves through a 707-km long trunkline to Kårstø, where it is fractionated into separate components. Norwegian gas deliveries to Europe will reach a plateau in 2005, exporting about 70 billion cu m/year. Roughly 15% of this amount will come from the Åsgard field in the Norwegian Sea.

Expansion of Kårstø capacity doubled gas reception and treatment capacity at the plant to about 64 million cu m/day (nearly 2.3 bcfd).

The Kårstø development project embraced more than the new Åsgard receiving station and a plant to extract gas liquids from the rich gas, says Statoil.

A fractionation plant for separating propane, butanes, and naphtha was completed, along with two large rock caverns for storing propane, and a separation-treatment plant for ethane. New jetties were also installed.

Cavern A, first completed of the two new rock cavern stores, transferred its first cargo to a ship on May 12, 2000. The first propane cargo from the Kårstø development project totaled 10,000 tonnes and was consigned to Antwerp.

The caverns provide 125,000 and 150,000 cu m of space, respectively.

The new processing produces a new product: First ethane from Kårstø actually was produced and shipped in August 2000. In full operation, the separation facility will produce 620,000 tpy for conversion to polyolefins.

In Africa, Nigeria's Escravos gas project, a joint venture of Nigeria National Petroleum Corp. (60%; NNPC) and Chevron Corp. unit Chevron Nigeria Ltd. (40%) moved nearer its goals of reducing the country's gas flaring and finding commercial outlets for its huge natural gas reserves.

As originally envisioned, the project consisted of three phases that spanned 1997-2005. Phase 1 started up in 1997; Phase 2, at yearend 2000; and Phase 3 targets 2005.

In an added twist to the project, the joint-venture partners announced in early September 2000 an addition to Phase 3: installation of a gas-to-liquids (GTL) plant that will be able to produce and ship into international markets as much as 33,000 b/d of clean liquids from natural gas fed from the Phase 3 gas-plant expansion.

The partners are investing a total of $2 billion in Phase 3 and the GTL plant.

Phase 1 can process 185 MMscfd of gas from offshore fields and produce 8,500 b/d NGL or 7,000 b/d LPG. Phase 1 also produces 130 MMcfd of residue (dry) gas.

Phase 1 started in 1997 with the production of NGL but switched in June 1999 to LPG production to improve netback, expand market base, and enhance FOB sales, a representative of NNPC told OGJ in late 2000. LPG mix has a wider market than NGL because of the presence of C5+ and the need to fractionate it.

In early 2000, Chevron Nigeria sent tenders out to both international and Nigerian (local) markets for sales of Escravos LPG production beyond Phase 1.

The response led Chevron to anticipate the joint venture would be able to sell future LPG production for the period extending to Dec. 31, 2001, on FOB basis and with better netback.

The potential markets for Escravos LPG are Brazil, Ecuador via Panama Canal, Northwest Europe, China, countries of the Eastern Caribbean, and the US Gulf of Mexico, among others.

Nigeria is a gas province with some crude oil in it. Nonassociated gas reserves are about 120 tcf. Oil reserves, by comparison, are likely to last only about 30 years at current production rates.

On the average, about 1 Mcf of gas is produced with every barrel of oil in Nigeria. Therefore, about 2 bcfd of associated gas are produced with nearly 2 million bbl of oil. Flared gas soaks up more than 70% of this quantity.

The Nigerian government resolved to eliminate all gas flares by 2010, except for those required for safety. This governmental position is fueling the production of more gas liquids, particularly LPG.

Another important benefit of the project has been replacement of fuel oil in the country's industries with clean, dry gas.

Phase 2 focused on improving the environmental conditions in the swamp fields through the reduction of oil-associated gas flaring. Gas gathering systems have been or are being installed in the Abiteye and Olero Creek areas, said the NNPC representative.

Phase 2 will add 100 MMscfd of capacity, bringing total Escravos gas processing capacity to 285 MMcfd.

Estimated combined production from Phases 1 and 2 are 870 tonnes/day (tpd; 10,200 b/d) of LPG, or approximately 320,000 tpy.

Phase 3 will more than double capacity, adding another 400 MMcfd and extracting about 15,000 b/d of NGL.

Additionally, the new Phase 3 plant will send up to 300 MMscfd of natural gas to the Escravos GTL plant, which will produce approximately 33,000 b/d.

Escravos gas project LPG is stored aboard a floating storage and offloading vessel (FSO) some 32 km offshore Escravos. It supplies refrigerated LPG to the export vessels and has a capacity of 54,000 cu m (340,000 bbl).

As of the beginning of 2000, about 400,000 tonnes of NGL and 100 tonnes of LPG had been exported from Escravos' FSO.

In Asia, the Thai and Malaysian state oil firms announced in 2000 a plan to study building a $150 million NGL separation plant in Myanmar. The proposed facility would extract propane and butane from natural gas pipelined from Yetagun, Myanmar's second largest gas field, in the Gulf of Martaban, to make LPG.

Petroleum Authority of Thailand (PTT) and Malaysian state oil firm Petronas proposed a plant capable of processing 250-300 MMcfd of natural gas with an LPG output of 200,000-300,000 tpy. The complex would be in southern Myanmar, on the Daimensek coast in Mon state, where the 210-km offshore pipeline from Yetagun field comes ashore, said PTT Gas, a unit of PTT.

Part of the LPG from the proposed plant-the first of its kind in Myanmar-would be sold domestically, where LPG is a much sought-after form of household fuel for cooking. Some of the LPG output would be exported to neighboring countries, but not to Thailand, which is self-sufficient in LPG.

PTT and Petronas hoped to include Burmese state firms, including Myanmar Oil & Gas Enterprise, as partners in the project.

PTT and Petronas were looking at Yetagun gas for separation, rather than gas from Yadana, the country's largest gas field, because the qualities of Yetagun gas are more suitable. The proposed gas separation plant would create added value for the Yetagun gas stream, which has officially begun to flow to Thailand through an onshore cross-country pipeline.

The full take-or-pay contract requires PTT to take 200 MMcfd of gas from the pipeline, but PTT, the sole gas buyer, had not as of yearend 2000 been able to take all the contractual rate because of a delay in the construction of Ratchaburi power plant and a domestic west-east gas pipeline.

Petronas is a partner in the $650 million Yetagun gas field development, led by Britain's Premier Oil PLC. Partners include Japan's Nippon Oil Co. and PTT Exploration & Production PLC of Thailand.

Proved reserves at Yetagun have risen from about 2.92 tcf from 1.1 tcf. The 165% increase came as a result of additional drilling last year.

The proposed NGL fractionator would be the second natural gas infrastructure project revealed for Myanmar. The Burmese military junta approved a project by a three-company consortium led by Unocal Corp. involving a $200 million gas pipeline from Yadana to an onshore location near Rangoon to fuel power plants.

North America

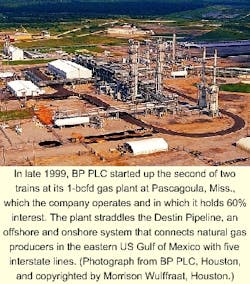

Along the US Gulf of Mexico, BP PLC started up Train B of its 1-bcfd gas plant at Pascagoula, Miss., in late 1999 (OGJ, Mar. 16, 1998, p. 87). OGJ's gas plant survey for 2000 reflects this addition to US capacity.

BP operates the plant and holds 60% interest in it, with Enterprise Products Partners LP, Houston, holding the remaining 40%. The plant straddles the Destin Pipeline, a 255-mile offshore and onshore gathering and distribution system that serves natural gas producers in the eastern US gulf and delivers gas to markets through five interstate lines.

In early 2000, BP bought Southern Natural Gas Co.'s one-third interest in the line, increasing its interest to two thirds, with Tejas Destin LLC holding the remaining.

The line has a 121-mile offshore segment and a 134-mile onshore segment. The 36-in. offshore mainline extends 76 miles from Main Pass Block 260 to the Pascagoula plant.

The plant straddles the Destin pipeline next to slug-catching facilities designed to remove retrograde condensate that may form in the pipeline.

The slug catcher holds 5,000 bbl of liquids from the pipeline that are fed into the condensate stabilizer designed to produce about 2,000 b/d of 12-psia Rvp condensate. The stabilizer started up in July 1998 along with the Destin pipeline.

Gas from the slug catcher is dehydrated, then processed in two identical trains, each with a capacity of 500 MMscfd. Each train provides inlet-gas cooling, dehydration, expansion, demethanization, NGL recovery, and residue-gas compression.

Train A started up in March 1999. Molecular-sieve dehydration is used for the plant's inlet gas. A three-bed system used for Train A was expanded to a four-bed system to handle Train B.

Condensate is delivered to truck loading, NGL is delivered by pipeline, and residue gas is compressed and returned to the pipeline network.

In the upper Midwest last year, the Aux Sable gas plant, one of the largest plants recently built in the US, came on stream in December 2000 to process up to 2.1 bcfd and produce as much as 70,000 b/d of NGL at its site about 50 miles southwest of Chicago.

The plant was part of the Alliance Project from its conception and is, according to owners Fort Chicago Energy Partners LP, a significant supplier of propane and ethane in the US Midwest, particularly for Illinois and neighboring states.

It is initially recovering NGL consisting of 40,000 b/d of ethane, 19,000 b/d of propane, 8,000 b/d of butane, and 3,000 b/d of pentane plus. With a small amount of capital, the Aux Sable plant can be expanded to produce 110,000 b/d of NGL, says Fort Chicago Energy Partners.

Installed extraction consists of two trains, each with a 175-ft demethanizer capable of processing approximately 1 bcfd of natural gas.

Installed fractionation includes: a 135-ft de-ethanizer recovering 40,000 b/d; a 125-ft depropanizer recovering 19,000 b/d; a 90-ft debutanizer and 185-ft butane splitter recovering 8,000 b/d of normal and isobutane and 3,000 b/d of natural gasoline.

The plant was mechanically complete at fourth quarter 2000 and officially began operations on Dec. 1.

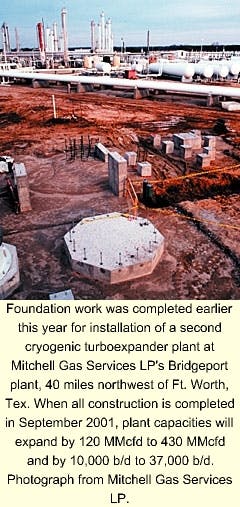

Also in December 2000, Mitchell Energy & Development Corp., The Woodlands, Tex., announced plans to double inlet capacity at its Bridgeport, Tex., gas processing plant in 2001. This will be the second expansion at the North Texas plant.

Construction of a new processing train and a related residue-gas sales pipeline is to accommodate rapidly growing gas production from Mitchell's Newark East Barnett Shale field, said the company.

The first plant expansion, completed at yearend 2000, increased processing capacity by 100 MMcfd to 310 MMcfd, with maximum NGL production increased by 8,000 b/d to 27,000 b/d.

The 2001 expansion, said the company, will bring capacity to 430 MMcfd and 37,000 b/d, respectively, when completed next month.

The latest project, estimated to cost $64 million, also includes construction of a 49 mile, 24-in. pipeline and addition of 27,000 hp of compression to move residue gas south from Bridgeport to two major gas transportation systems.

Also in December, Duke Energy Field Services (DEFS) completed expanding its Roggen natural gas plant northeast of Denver, doubling its processing capacity to 58 MMcfd. DEFS is a 70:30 joint venture by Duke Energy Corp. and Phillips Petroleum Co.

DEFS said the upgrade increased capacity near gas reserves in Weld County, Colo. The company owns and operates six plants and more than 2,200 miles of gas gathering pipelines in the area.

DEFS projected NGL production from the plant to increase to more than 4,300 b/d from 2,100 b/d. NGL produced at the Roggen plant is being delivered into Phillips Pipe Line Co.'s NGL pipeline, which runs from the Powder River basin of Wyoming to the Texas Panhandle.

In Canada, the ongoing restructuring of TransCanada PipeLines Ltd. continued last year when a unit of Williams Cos., Tulsa, completed the purchase of the NGL portion of TransCanada's midstream operations.

The overall asset package, located in western Canada, represents a total of approximately 6 bcfd gas processing capacity, about 225,000 b/d of NGL production capacity, an NGL pipeline system, and more than 5 million bbl of NGL storage capacity.

The $540 million (US) purchase included TransCanada's interests in the Cochrane, Redwater, Empress II, Empress V, and Younger NGL extraction plants, as well as the West Stoddart natural gas processing plant.

The Empress and Younger plants continue to be operated by third parties. Under the purchase, Williams became operator of the Cochrane, Redwater, and West Stoddart sites.

Also in Alberta earlier this year, AltaGas Services Inc. said it had expanded its natural gas processing capacity by 21 MMcfd with expansions in two of the company's operating areas.

AltaGas added 7 MMcfd of gas processing capacity in its Birch Wavy operating area at its Iron Creek plant near Viking, Alta. Total capacity of the plant is now 12 MMcfd and throughput in mid 2001 was about 11 MMcfd.

The Birch Wavy area, said the company, is one of AltaGas's largest operating areas with 12 processing plants and processing capacity 94 MMcfd.

AltaGas also said it increased processing capacity in its Central Border operating area by constructing a 14-MMcfd sour natural gas processing plant near Esther, Alberta. The plant started up in February 2001, processing 12 MMcfd of natural gas.

AltaGas first invested in the Central Border area in 1996 with the purchase of a 4-MMcfd processing plant. Total processing capacity at the Central Border complex is 115 MMcfd, including the Esther plant.

Company assets include natural gas gathering and processing facilities in Alberta and Saskatchewan, interests in two Alberta ethane and NGL-extraction plants, and ownership of AltaGas Utilities Inc., a natural gas distribution company serving more than 90 Alberta communities.

AltaGas also has a 33% interest in the Ikhil gas project, the first Canadian commercial natural gas development project north of the Arctic Circle.

More recently, Abraxas Petroleum Corp., San Antonio, completed expansion of its gas processing facilities in the Pouce Coupe-Valhalla area in the Peace River Arch of northwestern Alberta.

A 10-mile sour gas pipeline connects the drilling area at Pouce Coupe to Abraxas' wholly owned gas processing plant at Valhalla. Abraxas owns 90% of the plant; Grey Wolf Exploration Inc., 10%.

The pipeline, owned 100% by Abraxas, delivers 5 MMcfd at a savings of 42¢ (Can.)/Mcf, compared with processing costs charged by the previous third-party processor, said the company.

It will connect another 2.5 MMcfd to the pipeline once it has determined remaining available sour gas processing capacity. Meanwhile, engineering for additional future plant expansion is under way, said Abraxas.

The Valhalla plant will reach capacity, it said, and drilling successes will demand additional gas processing capacity.

About the time the company was announcing completion of processing capacity expansion, Abraxas and Grey Wolf Exploration obtained 2,400 acres of new leases for $2 million (Can.), with Abraxas having 55% interest in the leases and Grey Wolf Exploration 45%.

At about the same time, ATCO Midstream and BP Canada Energy Co. signed a joint venture agreement to develop the full potential of their Cranberry and Chinchaga natural gas gathering systems and gas plants in the Manning area of northern Alberta.

The companies said the joint venture provides a "significantly improved level of processing services for producers by optimizing facilities, gathering systems, and leveraging resources to achieve economies of scale that ensure enhanced long-term competitive operations."

Under terms of the arrangement, BP Canada Energy will provide operating resources and ATCO Midstream will be responsible for business development and third-party contracts.

ATCO Midstream is majority owner of the Cranberry gas processing plant while BP Canada is majority owner of the Chinchaga plant. Combined, the plants provide 125 MMcfd of sweet gas processing capacity.

And in Mexico earlier this year, Petréleos Mexicanos (Pemex) awarded a $5 million engineering, procurement, and construction contract to Grupo Profesional Planeació y Proyectos, SA de CV (PYPSA), Mexico City, to modernize 10 sour gas sweetening plants at the Cactus petrochemical complex, state of Chiapas.

The contract award follows PYPSA's nearly completed $13 million rehabilitation of Pemex's compressor station No. 7 at Cempoala, Veracruz.

The Cactus project includes the gas conditioning plants; PYPSA pledged to hold plant shutdowns to a minimum. Procurement was completed last month, with all equipment following a standardized design to reduce the need for spare parts, said PYPSA.

The company is also responsible for plant commissioning and start-up.

One of the significant enhancements to the Cactus plant and the entire national gas transmission system, said Jose Luis Vera, PYPSA's vice-president of operations, is implementation of a centralized gas-detection and fire system.

Activity at Cempoala has been prompted by new developments offshore Mexico and upgrades to the prolific Cantarell field. Additional facilities are needed to handle associated gas from the fields coming ashore at the Atasta gathering station in Chiapas.

From Atasta, gas moves to the Cactus plant along Mexico's Gulf Coast and onward to Cempoala, tapping into a nationwide 780-mile, 48-in. OD trunk line.

The Cempoala facility, some 275 miles from Cactus and near Mexico City, ties into a 1,366-mile gas network. At Cempoala, the 48-in. OD pipeline splits, moving gas north to Santa Ana and Reynosa.

Pemex's Cempoala station re-compresses gas from the Cactus plant and has a design capacity of some 1.5 MMcfd. The facility also will supply gas to Mexico City.

Upgrades to Cempoala were completed this month; the Cactus plant is to start-up in mid-September.

Cempoala station No. 7 is designed for continuous operation, with gas recompression carried out by means of a centrifugal turbocompressor operated by a gas turbine. The system design actually provides for two turbocompression trains in parallel, one in normal operation, and another for backup.

If both turbocompressors go down, the station has the flexibility to operate without recompressing the gas via bypasses to Monterrey, Nuevo Leon, and Santa Ana, said PYPSA. Plant design also offers Pemex the option of reversing the transmission flow to accommodate any necessary imports.

US LNG

The rapid rise in natural gas prices in 2000 and into 2001 has hastened a rebound in the already recovering LNG industry.

More supply projects are being conceived, planned, or implemented. And receiving terminal projects that have languished or moved at a snail's pace are now accelerating. Nowhere is this revival more evident than in the world's largest energy market, the US.

Major receiving terminals are undergoing or will soon undergo expansion. And new terminals are being discussed. Even a terminal on the West Coast is being seriously considered, so frantic are natural gas suppliers to get into that constrained market.

On the East Coast, work is under way at Cabot Corp.'s Everertt, Mass., LNG receiving terminal to double vaporization capacity to more than 1 bcf from 435 MMcfd. Cabot is a unit of Belgium's Tractebel.

In Maryland, Williams received approval from the US Federal Energy Regulatory Commission (FERC) to reactivate its LNG import services at its Cove Point, Lusby, Md.

The reactivation includes modifications to existing facilities and construction of new facilities. They include renovation and reactivation of the offshore pier and related facilities to accommodate unloading of LNG tankers, construction of a fifth storage tank capable of holding 850,000 bbl of LNG, and construction of a btu-reduction system.

The firm LNG tanker discharging service is fully subscribed under 20-year binding precedent agreements for the 750-MMcfd send out capacity offered an open season.

Total LNG storage capacity will increase to 7.8 billion cu ft from 5 billion cu ft as a result of the expansion.

Reactivation of the existing facilities and the initial import service targets start up on Apr. 1, 2002, while the proposed in-service date for the fifth storage tank is Sept. 1, 2003.

Total project is estimated to cost $103 million. Williams owns 100% of the property on which all of the proposed facilities will be constructed.

The Cove Point facility will become the largest of the four LNG import facilities in the US with a send-out capacity of 1 bcfd.

The terminal operated from 1978 to 1980 and was partially reactivated in 1995 to provide natural gas peaking services. Williams purchased Cove Point LNG LP from affiliates of Columbia Energy Group in June 2000.

Finally on the East Coast, El Paso Corp. is spending $25 million to reactiviate its LNG terminal on Elba Island off Savanah, Ga., to receive shipments from Trinidad.

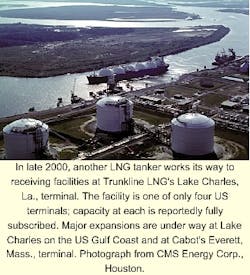

On the Gulf of Mexico, CMS Trunkline LNG, a unit of CMS Energy Corp., Houston, is expanding peak sendout capacity of its LNG terminal at Lake Charles, La.

That 700-MMcfd terminal is the largest operating LNG facility in the US, said CMS. The terminal sendout capacity will increase to 1 bcfd. CMS is evaluating a further expansion to 1.3 bcfd.

CMS expected to have the peak capacity available by this month.

Modifications to the CMS Trunkline LNG facility will eliminate operational bottlenecks in the regasification process, said CMS. LNG receipt capability and storage capacity of 6.3 bcf will not be affected.

In 2000, 55 LNG tanker ships unloaded at the CMS Trunkline LNG terminal. The company said it expected the number to be higher this year.

Recently, BG Group PLC announced it would take all available capacity at the Lake Charles plant for 22 years starting Jan. 1, 2002.

The terminal can store and vaporize 6.3 bcf. It can deliver 630 MMcfd of gas and has access to 15 interstate gas pipelines.

BG will have 80% of the capacity of the terminal until Aug. 31, 2005, and 100% thereafter.

BG said the agreement will allow it to supply growing markets throughout the US and provide an outlet for its developing LNG export projects around the world.

The Lake Charles facility receives gas from Africa, Asia, Australia, Europe, and South America. The value of the contract was not disclosed, but CMS said it has firmed up present-value revenues totaling $450 million from the facility.

Also on the US Gulf Coast, Texaco Inc., White Plains, NY, is studying development of an LNG receiving and regasification terminal.

The study is examining and evaluating infrastructure requirements and costs of the proposed terminal, which would be designed to process 1 bcfd initially, said the company.

The proposed terminal would connect with Texaco's offshore infrastructure, which has excess capacity, and which is connected onshore to several interstate pipeline systems and the Henry Hub, operated by a Texaco subsidiary.

The terminal could be operating in 4-5 years, said Texaco, and could then be expanded to 2 bcfd. The LNG would be produced from one or more potential projects in the Atlantic Basin in which Texaco holds an equity interest.

High prices in the US West have helped spur interest in LNG shipments from the Asia Pacific area.

El Paso Corp. said in March it tentatively agreed to begin purchasing LNG from a Phillips Petroleum Co. plant near Darwin, Australia, and ship it to California or Mexico. El Paso said it is still evaluating potential terminal sites.

Chevron Corp. also reported it was studying plans to start shipping LNG from Australia to the US West Coast by 2005.

El Paso Corp. is looking for a site for a new LNG terminal on the US West Coast, said Kathleen Eisbrenner, senior managing director, Global LNG, an El Paso unit.

El Paso earlier this year tentatively agreed to begin purchasing LNG in 2005 from an export terminal Phillips Petroleum Co. will build near Darwin, Australia, with plans to ship it to California or Mexico.

By midyear, the companies said they expect to have negotiated and executed a definitive agreement, including permits for the Australian terminal, under which El Paso would buy 4.8 million tpy of LNG. The LNG would be shipped to North America, where it would be regasified and sold as 680 MMcfd of natural gas.

Eisbrenner said the search has been narrowed to "viable sites" in California and Mexico.

The company is reviewing land-based sites but also has a contingency plan for an offshore facility. She said the LNG facility would help boost the in-state gas infrastructure which is widely considered inadequate to serve rising demand.

Eisbrenner also said this will be the first Asian LNG to be priced off North American gas prices. Phillips and El Paso are looking at using a combination of new and existing tankers to transport the LNG. They will range in size from 138,000-145,000 cu m; and some shipyards have proposed tankers capable of hauling 160,000 cu m.

Cost of the project, including the LNG plant, ships, and a West Coast receiving terminal, is estimated at $3-3.5 billion, depending upon the size of the LNG plant, said Phillips.

The Darwin LNG facility, using Phillips' LNG technology, will be supplied from the Greater Sunrise fields with reserves of 9 tcf.

And in January, Enron Corp. said it was considering a new LNG import terminal in the Bahamas, connected by a 90-mile pipeline to Florida.

If all four exisiting LNG receiving terminals reopen, it would be for the first time since 1982.

Sulfur recovery

Oil & Gas Journal's survey of petroleum-derived sulfur production capacity worldwide in 2000 found 160,000 tpd.

Canada reported nearly 36.9 tpd capacity in 2000 (22.7% of the world's total); the US held more than 38,000 tpd (24.4% of the world's total).

Worldwide capacity in 2000 outside the US and Canada was at 114,500 tpd.

Worldwide production of petroleum-derived sulfur last year reached slightly more than 80,000 tpd. Canada accounted for nearly 23,000 tpd; US, for nearly 16,600 tpd.