Worldwide E&P spending expected to jump sharply in 2001

Worldwide spending on exploration and production of oil and natural gas will jump more than 19% next year, based on what Lehman Bros. called "the largest, most comprehensive study ever" of capital spending plans by independent and integrated operators.

And early indicators from companies are making good on the analyst's predictions.

Gulf Canada Resources Ltd. and Suncor Energy Inc., both of Calgary, are among the Canadian oil and gas companies to announce hefty increases in their 2001 spending programs.

Mitchell Energy & Development Corp., The Woodlands, Tex., and Phillips Petroleum Co. were among the US-based oil and gas companies to announce substantial budget increases for 2001.

Meanwhile, Unocal Corp., El Segundo, Calif., said it expects to make a small increase in its budget.

Survey results

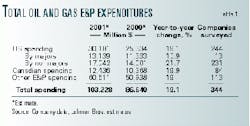

A Nov. 13-Dec. 15, 2000, Lehman Bros. survey of 344 producers revealed that most plan to increase US upstream spending by an average 19.1% in 2001. Among the independents-which have been the primary drivers in the upstream recovery over the past 18 months-the proposed increase is even larger, with 231 of those companies increasing their budgets an average 21.7%.

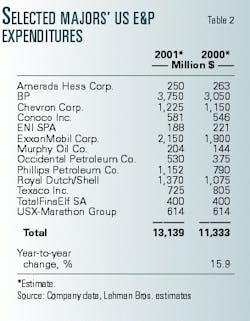

The major integrated companies are increasing their US upstream spending by 15.9% on average, according to the report authored by James D. Crandell, who did similar surveys for Lehman Bros. in May 2000 and in December 1999.

But the "most encouraging" news from the latest survey is that budgets for E&P outside the US also will rise significantly next year, with 113 of the surveyed companies planing an average increase of 19%, Crandell reported. "That's well above the 4.1% increase estimated for 2000," he said. Producers generally underspent their non-US E&P budgets last year.

Most of the gain in non-US spending is a result of large budget increases by two supermajors, BP and the Royal Dutch/Shell Group, up from depressed levels in 2000. However, Lehman Bros. also reported substantial budget increases among large US independents, ranging from a 11% increase by Pogo Producing Co., Houston, to a 79% increase at Cross Timbers Oil Co., Fort Worth.

For the second consecutive year, Canada is poised to show the most improvement with an average 19.9% increase in spending this year by 84 of the companies surveyed, Lehman Bros. reported. Both US and Canadian projected E&P expenditures are above original estimates of the midyear survey conducted in May 2000.

The projected strong increase in E&P spending this year is being driven primarily by high natural gas prices-particularly in the US and Canada-and the resulting strong cash flow to producers.

However, Crandell said, "Unlike 2000, where the growth in spending was highly skewed towards North American natural gas drilling, the planned increases in 2001 E&P expenditures are broad-based."

Lehman Bros.' bullish outlook for increased upstream spending this year is supported by reports of other industry participants and analysts. Raymond James & Associates Inc. last month said that budget increases already reported by 21 independents averaged 25%, supporting "a consensus increase of about 20%" (see related story, p. 20).

Indeed, respondents to Lehman Bros.' latest survey said they were basing their projections on average prices of $25/bbl for oil and $3.75/Mcf for natural gas. But they said they would increase their budgets another 19%, if oil prices stayed at $30-35/bbl.

Moreover, Raymond James officials predicted, "Given the limited service company infrastructure, E&P costs are likely to explode over [in 2001]. In other words, E&P budgets will be up 20% [this year] only if companies drill the same number of wells as [in 2000]. Our guess is they intend to drill more wells [this] year."

Of those companies surveyed by Lehman Bros., 94% said they expect drilling costs to rise this year, especially day rates for drilling rigs. A solid majority, 63%, said higher rig rates would affect their drilling programs.

As a result, more producers are trying to lock in suppliers-particularly drilling contractors-through long-term contracts or multiple-well deals. They also plan to put more jobs out for bid and to do more turnkey deals in an effort to reduce costs, Lehman Bros. reported.

The report said 71% of the companies surveyed expressed concern over a lack of equipment to carry out their drilling programs. A substantial majority is even more concerned about the availability of qualified personnel.

"This is especially true for North American-oriented companies, many of whom think it is the largest problem that the industry faces today," Crandell said.

Mitchell Energy

Independent Mitchell Energy jumped its 2001 budget by 45% to $473 million, with $346 million allocated to E&P spending.

"This is our highest capital spending program since the early 1980s and reflects plans for accelerated development of the extensive inventory of undrilled locations in our core fields," said George P. Mitchell, chairman and CEO.

"At this spending level, we expect to add significant proved reserves during 2001 and increase production of both natural gas and natural gas liquids by at least 25% and 20%, respectively, vs. [last] year's volumes. These targets exceed our previously announced growth expectations of 20% and 15%," he said.

The company has earmarked $263 million to drill 364 gross wells, primarily in Texas, up from the estimated $159 million spent on 211 wells in 2000. Most of that will go into drilling operations in the Barnett shale, with 276 new wells scheduled on a 12-rig drilling program.

Another $40 million is budgeted to continue Mitchell Energy's aggressive workover program. Company officials plan 95 combined completion-refracturing jobs in the Barnett and 85 recompletions in other fields.

Mitchell said the company plans to maintain exploration and development spending at that level "for at least the next 3 years" to increase gas production more than 20%, compounded annually.

The company last month announced a $64 million project to construct a 120 MMcfd processing train at its Bridgeport gas processing plant and a related 24-in., 49-mile residue gas sales pipeline (OGJ Online, Dec. 7, 2000).

Gulf Canada

Gulf Canada said its 2001 capital spending program is set at $1.2 billion (Can.), with 68% earmarked for a large inventory of development and production projects and 32% to be spent on exploration.

Some 67% of the total budget will be spent in Western Canada, officials said. Another 20% is planned for Indonesia, with one third earmarked for exploration and two thirds for development of mostly natural gas resources. About 9% will go to the Netherlands, where gas production is projected to double over the next 2 years. The remaining 4% is mostly for frontier work in northern and eastern Canada and North Africa.

Gulf's total production is expected to grow in 2001 to 817 MMcfd of gas and 148,000 b/d of liquids. Almost 75% of that gas production is expected to be in North America.

Gulf Indonesia Resources Ltd., a 72% subsidiary of Gulf Canada, said that two thirds of its $150 million (US) 2001 capital budget will be directed at development opportunities, with the other third to be spent on exploration and delineation drilling, primarily in South Sumatra.

That budget will be split evenly between natural gas and oil operations. Of the $75 million targeted for gas, 80% will go for development projects, and 20% is earmarked for gas exploration and delineation. Of the $75 million directed at oil operations, 50% is for development and exploration in South Sumatra; 40% for offshore oil exploration; and 10% for other capital requirements.

Suncor Energy

Suncor Energy Inc. plans to spend $935 million (Can.) on capital programs in 2001, about half its 2000 outlay, as its Project Millennium oil sands expansion program nears completion.

It will allocate $450 million to complete the northern Alberta project, which is due to start up in the second half.

It is expected to double production to 225,000 b/d by 2002. The company said it also will improve plant reliability and enhance environmental performance. Suncor estimates the project will total $2.8 billion when completed.

In addition to Millennium, Suncor plans to spend more than $300 million on strategic growth projects and sustaining capital. About $125 million will be part of a plan to invest $750 million by 2005 to further expand oil sands production through a commercial-scale in situ project and by increasing upgrading capacity.

The company will also spend $100 million on natural gas exploration and development, mostly in western Canada.

Suncor intends to spend $73 million in 2001 on refining and marketing operations and at least $13 million on alternative and renewable energy initiatives. The latter will launch a program to invest $100 million over 5 years on research and development into wind, hydro, biomass, landfill gas, and solar energy.

Phillips

Phillips approved a $2.5 billion capital budget for 2001. This is up from estimated spending of $2 billion last year, excluding the $6.7 billion to purchase ARCO's assets in Alaska.

Jim Mulva, Phillips's chairman and CEO, said the new budget "reflects the dramatic change our company has undergone in the past year. We are building on our legacy asset positions in Alaska and Norway and moving forward with the development of our three international legacy projects-Hamaca, Bohai Bay, and Bayu-Undan."

Phillips plans to allocate 87% of its new budget to E&P. Another 10% will fund its refining, marketing, and transportation business, for which Phillips plans to pursue a 50-50 joint venture in late 2001 or 2002. The remaining 3% will be used for general corporate purposes.

Cash generated from continuing activities is expected to fund the capital program while providing for continued debt reduction, officials said.

Phillips's 2001 E&P budget is $2.2 billion, which is 30% more than estimated E&P expenditures of $1.7 billion last year.

The largest portion of this year's budget, 53%, will be spent in the US, with the Alaska business unit receiving $914 million.

That will fund a study under way on a prospective North Slope natural gas pipeline to the Lower 48 and construction of four Millennium Class tankers to transport North Slope crude. It also includes funds for development of the Alpine and Meltwater fields and various satellite fields of both Prudhoe Bay and the Greater Kuparuk area.

In the Lower 48, the company plans to develop coalbed methane projects in the San Juan, Powder River, and Uinta basins, as well as natural gas fields in north Louisiana.

Phillips budgeted $202 million for worldwide exploration activities, with 44% of that allocated for the US.

Outside the US, the company plans to participate in exploration drilling activities in Kazakhstan, China, Oman, Nigeria, the UK, Denmark, and the Faroe Islands.

Phillips is directing $1 billion toward development projects outside the US. Those projects include the Hamaca extra-heavy oil development in the Orinoco oil belt of Venezuela, phases I and II of the company's PL 19-3 field in China's Bohai Bay, and the Bayu-Undan liquids recycle and regional gas pipeline projects in the Timor Sea.

Unocal

Unocal expects to raise its 2001 capital spending to $1.5-1.6 billion, up slightly from an estimated $1.4 billion last year. The new budget estimate does not include significant acquisition expenditures.

"We will maintain discipline in our capital spending even in the face of extremely high commodity prices," said Roger C. Beach, former Unocal chairman and chief executive officer. "The spending will add production in Southeast Asia and in the Gulf of Mexico shelf and the US Permian basin, which will allow us to take advantage of higher expected natural gas realizations," he said.

That spending forecast includes increased exploration drilling on Unocal's Gulf of Mexico and East Kalimantan, Indonesia, deepwater prospects, as well the company's first deepwater wells off Brazil and Gabon, said Charles R. Williamson, executive vice-president, international operations, who was elected Unocal's new CEO effective Jan. 1 (see related story, p. 28).

"Our spending plan, particularly in North America, is flexible enough that we can adjust it if commodity prices significantly change. If prices hold up at today's levels, we will allocate most of the excess cash flow to debt reduction," Williamson said.

Unocal's North American spending will total $930 million. That includes $130 million for deepwater exploration drilling in the gulf-more than double last year's spending level. The company expects to spend $530 million for exploration and development projects on the US gulf shelf and in the Permian basin through its 65%-owned Pure Resources Inc. subsidiary.

Unocal expects to spend $425 million this year on projects in Thailand and Indonesia. That includes development of Pailin gas field and Yala oil field in the Gulf of Thailand, and West Seno oil field in the Makassar Strait off East Kaliman- tan.

The company expects to spend about $50 million for exploration drilling on deepwater prospects off Brazil and Gabon in West Africa.

Other US independents

Burlington Resources Inc., Houston, ratcheted up its capital spending for 2001 by 10% from last year's expected outlays, to $1.1 billion, excluding acquisitions. BR's program will focus on high-impact exploitation and development projects in New Mexico's San Juan basin, Wyoming's Madden field, Western Canada, East Irish Sea, and Algeria. About 20% will go to exploration worldwide.

Nuevo Energy Co., Houston, set a $181 million capital budget for 2001, with potential for another $24 million, depending on drilling success. It will spend $141 million on development projects, mostly in California, and $27 million for exploration in California and Africa.

St. Mary Land & Exploration Co., Denver, plans to spend $155 million this year, up 35% from last year's budgeted amount. Spending plans include $60 million for property acquisitions and $95 million for E&P. The latter is up from the $66 million spent last year and will more than double company spending in the Gulf of Mexico.

Remington Oil and Gas Corp., Dallas, set a $66.4 million budget. Included is $39 million for 30 wells, mostly offshore. About $13 million is planned for development of discoveries in the East Cameron and Eugene Island-Green Canyon areas in the Gulf of Mexico.

Houston-based Ocean Energy Inc. earmarked $700 million in 2001 capital outlays, up 22% from estimated 2000 spending. Ocean hiked its estimate for 2001 because of development outlays related to its Magnolia deepwater discovery in the Gulf of Mexico and other additions to its deepwater portfolio. High-impact exploration activities will account for 25% of the firm's total worldwide spending in 2001, notably in the deepwater gulf, off Equatorial Guinea and Angola, and in the Gulf of Suez.