Worldwide, US E&P spending will likely be higher than expected in 2001

Worldwide spending on exploration and production of oil and natural gas will likely increase more than the 20-30% forecasted previously by many analysts (see Capital Spending Outlook special report, beginning on p. 66). Similarly, increases in E&P spending in the US this year could conceivably surpass previous estimates.

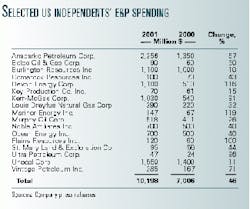

According to reports from a selected group of US independents compiled by Oil & Gas Journal, worldwide E&P spending will undoubtedly eclipse companies' outlays in 2000, barring a collapse in oil and gas prices. This sample group's worldwide E&P spending plans are expected to rise 46% above spending last year (see table).

In addition, Dain Rauscher Wessels Inc. (DRW), in a report released last month, revealed that actual E&P spending in the US this year will likely rise by close to 50%. And recent indicators from many US-based independents would seem to track these predictions. These companies have reported increases in their originally proposed E&P budgets in the US and elsewhere for 2001.

Price the catalyst

According to DRW's report, the year-over-year increase in E&P spending in the US will, in all probability, be linked to "pricing improvement" rather than to an upsurge in activity levels.

In its report, DRW said that-as was the case last year-there was an overall "under-expectation" that took place this year regarding companies' spending plans. In 2000, many of industry's more widely trusted capital spending surveys had forecast a spending increase of 18-22%, while actual spending made a 48% jump.

"This same under-expectation is occurring again this year," DRW said. "In the popular surveys, oil companies based prospect economics and cash flow generation of natural gas and oil based on prices lower than are currently being realized.

"Since the focus is on production growth and the fact that [US] independents reinvest free cash flow, any higher cash flow generation vs. expectation is likely to be reinvested. Any expectation that much of the independents' cash flow would be dedicated to buying properties up for sale by the majors is being dashed as well, with virtually no properties for sale and majors indicating the opposite, being better buyers."

In addition, DRW noted that, at a recent energy conference, a number of US independents spoke of intentions to boost their 2001 E&P budgets-some by as much as 40%.

"A survey of 16 leading [US] independents shows an [average] increase closer to 35%," DRW noted.

"The total number of rigs that can be put to work this year would increase the total by no more than 15%. Against a 35% spending increase, this implies that [service] pricing will move up by 20%. This is probably close to correct and has a significant impact on [earnings per share] estimates and price targets of oil field service companies."

DRW concluded with the expectation that company budgets should rise by about 35%, "based on public statement."

"Commodity pricing is staying high enough that there is little current risk to these budget statements. The number of rig reactivations is based on public statements by companies and is supported by continual industry surveys and studies showing capacity, the number of rig yards, and other factual reviews. Pricing is already moving up. Pricing accelerates up through a cyclical industry's recovery," DRW said.

"So not only is spending by oil companiesellipseexpected to increase, it is likely to increase at a faster rate, to a higher level, and significant data and a great deal of history exist to confirm this.

"This means that [service company] revenues and earnings in most models are too low and that earnings have much greater upside relative potential than the revenue increase due to margins expanded by price increases rather than just utilization-driven incremental gains."

Anadarko's budget revisions

Earlier this year, Anadarko unveiled a $2.8 billion capital spending plan for 2001. This is a 65% increase over 2000 spending.

Anadarko's plan will focus primarily on finding new natural gas reserves, along with increasing production from the Lower 48, the Gulf of Mexico, and Canada, said Robert J. Allison Jr., the company's chairman and CEO.

"Natural gas is and will continue to be in tremendous demand in North America," he said. "Given our current outlook for commodity prices, we expect Anadarko's cash flow to be significantly higher than this initial spending plan. The company is looking at potential uses for additional capital, including acquisitions of producing properties in core operating areas, improvements to the company's balance sheet, repurchase of stock, and other strategies. We'd like to have that cash in hand before we commit to a specific plan," Allison said.

Anadarko has earmarked $1.4 billion for development projects. Of this amount, the company plans to spend 79% in North America, 12% in Algeria, and the remaining 9% on other international projects, mainly in Venezuela.

Anadarko has budgeted $830 million for its exploration activities. The lion's share of this amount, 90%, will be spent in North America, the company said.

Anadarko in the Rockies

Anadarko said it would more than double spending to over $131 million in the Rocky Mountains area this year.

Anadarko is looking for gas and coalbed methane. It plans to drill more than 20 exploration wells and 130 development wells in Wyoming, Colorado, and Utah and plans to participate in more than 275 wells operated by other companies. It will also acquire and interpret more than 500 sq miles of 3D seismic.

"Because of the large acreage position that we hold in the region, Anadarko has certain economic advantages that can't be matched by our competitors," said John N. Seitz, Anadarko president and chief operating officer. "Our strategy this year is to deploy more resources in the Rockies in an effort to unlock the full potential in this underexplored area. In fact, we view the Rocky Mountains as one of the richest areas capable of providing new natural gas supplies for the US."

In Utah, Anadarko intends to invest more than $20 million in Helper and Drunkard's Wash coalbed methane fields.

In Wyoming, Anadarko has interests in seven coalbed methane plays. It plans to drill 35 wells in the Powder River basin in 2001.

Anadarko also plans to drill 60 wells this year in Greater Wamsutter gas field in Wyoming.

Anadarko's Canadian plans

Anadarko also increased capital spending plans for its Canadian operations by 49% to $386 million this year.

James Emme, Anadarko Canada Corp. president, said the acquisition of the Berkley Petroleum Corp. assets provides excellent opportunities in addition to existing prospects in British Columbia, Alberta, Saskatchewan, and the Northwest Territories.

Anadarko acquired Berkley Petroleum for $11.40/share (Can.) in cash for an equity value of $777 million and assumed an estimated $250 million of Berkley debt (OGJ, Feb. 26, 2001, p. 28).

Anadarko originally set a $259 million budget for its Canadian operations this year. The acquisition will increase capital spending by $127 million for the combined companies, which includes $38 million of additional spending above Berkley's original 2001 plans.

Anadarko is the sixth most active driller in Canada and plans to increase its winter activity level from a peak rig count of 28 rigs working this year to as many as 35 rigs in winter 2002.

In addition, Anadarko Canada expects to run 15 rigs this summer in Alberta, British Columbia, and Saskatchewan.

The Berkley acquisition increased Anadarko's Canadian reserves 42% to 312 million boe, 65% of which is gas. It also increased the company's holdings in Canada to 4.7 million acres from 3 million.

Vintage budget increase

Vintage Petroleum has recently hiked its spending plans for 2001. The company's original estimate, announced last year, was for a budget of $225 million. Earlier this year, Vintage increased its expected E&P outlays to $285 million-a 71% increase from spending in 2000.

The company said it would focus a majority of its outlays on exploitation projects in the US and Argentina. Additional projects are slated for Ecuador and Bolivia.

Of the total budget, $212 million has been earmarked for "lower-risk" exploitation projects; these will be split evenly between North America and outside North America.

The remainder of the budget will be used mainly for exploration projects in North America, the company said.

Other independents

Triton Energy Ltd., Dallas, has budgeted $320 million for its 2001 capital expenditures. The spending plans are a 19% in- crease over the company's 2000 spending.

The bulk of this total, $211 million, will be spent for Triton's continued appraisal and development of La Ceiba field off Equatorial Guinea. About $42 million will be allocated for the exploration of Blocks F and G in that area. Triton also plans to expand the topsides facilities of its floating production, storage, and offloading vessel in the Gulf of Guinea.

Also, the company plans to spend $39 million to contribute to development of the Cusiana and Cupiagua oil fields in Colombia. This work is to include drilling on the adjacent Recetor license.

Louis Dreyfus Natural Gas Corp., Oklahoma City, has increased its outlays to $290 million for 2001 vs. the $220 million budgeted for 2000. Of this sum, Louis Dreyfus's exploration and development drilling plans break out as $106 million on the Gulf Coast, $119 million in the Permian basin, and $65 million in the Midcontinent.

"We are completing another very active year with the drillbit and have aggressively increased our budget for 2001, said Louis Dreyfus CEO Mark Monroe. He said that the company hopes the increase in spending will lead to "double-digit production growth" this year.

Stone Energy Corp., Lafayette, La.-which has recently completed the acquisition of Basin Exploration Inc., Denver-expects to spend $253 million in 2001 (OGJ, Nov. 13, 2000, p. 28). The merger with Basin, Stone said, has increased the combined companies' daily production, reserves, and prospect inventory. Stone said that it expects to drill 77 gross wells this year.

Cabot Oil & Gas Corp., Houston, said it plans to spend $167 million in 2001, a 36% increase over spending in 2000. Cabot attributed the gain to "record high commodity prices." The total for 2001 includes $112 million for drilling projects-respectively split 42:58 between exploration and development.

"As we have over the last several years, we intend to continue to build on our exploration activities in the Gulf Coast and Rocky Mountains," said Ray Seemiller, Cabot Oil & Gas chairman and CEO.

Pure Resources Inc., Midland, Tex., said that it will spend $160 million in 2001. Of this total, $60 million will be used for development projects, $34 million for exploration programs, $42 million for probable projects, $22 million to acquire additional acreage and seismic, and $2 million for other corporate items.

The company's budget comprises 300 capital projects, Pure said. These are split among the Permian and San Juan basins and South Texas.

ATP Oil & Gas Corp., Houston, anticipates spending $130 million in 2001. Of this sum, $85 million will be used to start production from some of the company's proved undeveloped properties. The remaining $45 million will be spent on acquisitions as well as the development of new properties with proved reserves.

ATP focuses primarily on the acquisition, development, and production of natural gas in the Gulf of Mexico and the southern gas basin of the UK North Sea.

Comstock Resources Inc., Frisco, Tex., plans to spend $100 million for development and exploration projects in 2001. The company's spending plans are a 43% increase over the prior year.

Comstock said it intends to drill 76 wells this year. Of these, 50 will be development wells, and the remainder will be exploration wells. A substantial portion of Comstock's budget-$46 million-will be spent on wells drilled in and around the Gulf of Mexico. Comstock plans to drill 21 wells in shallow waters in the gulf and another 8 wells onshore along the Gulf Coast.

The company expects to spend $29 million in its East Texas-North Louisiana region to drill 30 infill wells, which will target the natural gas-productive Hosston, Travis Peak, and Cotton Valley sands at depths of 8,000-10,500 ft.

M. Jay Allison, Comstock president and CEO, said that the company was able to increase spending on drilling this year due to last year's "very successful drilling program."

This program, Allison said, would be funded "exclusively" through operating cash flow. Given current oil and natural gas prices, Allison added that the company "should have additional cash flow available" that it will use to reduce its debt and otherwise improve its balance sheet.

Magnum Hunter Resources Inc., Irving, Tex., has budgeted $85 million to participate in the drilling of 142 wells during 2001. This sum includes 17 wells to be drilled in the shallow waters of the Gulf of Mexico and 125 wells to be drilled onshore in Magnum's chief operating areas-West Texas and the Texas Panhan- dle, southeastern New Mexico, and western Oklahoma. Of the planned exploratory wells, 13 will be offshore and 14 onshore.

Ultra Petroleum Corp., Houston, said it plans to spend $47 million in 2001, which is double the firm's 2000 spending plan. This year, Ultra plans to spend $35 million to participate in 39 wells in Wyoming and $12 million for 15 wells in China's Bohai Bay.

"I believe that Ultra is positioned for extraordinary growth over the next 5 years and is probably the premier small-cap E&P company in terms of growth potential," said Michael D. Watford, chairman, CEO, and president.

Abraxas Petroleum Corp., San Antonio, Tex., increased its capital spending budget for this year to $41.7 million. This compares with its $39 million budget established for 2000.

The 2001 budget breaks out as $19.4 million for US projects, $12.5 million for wholly owned subsidiary Canadian Abraxas' projects, and $9.8 million for 49%-owned Grey Wolf Exploration Inc. projects.

"This budget allows us to grow our current production while maintaining financial flexibility," said CEO Robert Watson. "Our improved cash flow and inventory of projects should allow us to grow the company for 2-3 years without going to the capital markets."

Dallas-based Wiser Oil Co. increased its 2001 capital and exploration budget to $36 million from previously announced spending plans of $20 million. Wiser said it will spend $16 million on exploration activities and $20 million on development projects. Of the total sum, $22 million will be spent in the US and the remainder has been allocated for Canadian activities.