OGJ Newsletter

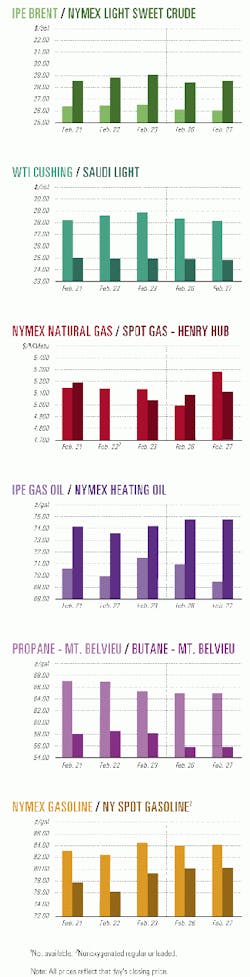

Market Movement

OPEC's gamble with markets

Is OPEC playing "chicken" again with oil markets? Some of the price hawks in the organization-Venezuela seeming to be the chief hawk, a 180° turnabout from just a few years ago-are talking up prospects for yet another production cut at the March ministerial meeting in Vienna.

The fundamentals of the market right now indicate that, while oil prices have moderated since early December, there is little likelihood now of a complete collapse in oil prices that would warrant another sizeable OPEC cut. Nevertheless, some in OPEC see a decline in its marker basket of crude prices below $25/bbl as a green light for another cut.

By the end of the first quarter, WTI will have fallen $10/bbl from its early fourth quarter 2000 peak, predicts Energy Security Analysis Inc., Wakefield, Mass.

ESAI points to the decline in refiner demand that always occurs this time of year as the culprit in near-term price weakness. Already, a number of US refineries are in turnaround, with those in Europe soon to follow.

But the analyst contends that "even as prices decline, evidence is building that crude inventories in the US will remain lean in 2001," citing two main reasons why inventories may have a hard time rising: "1) Even as prices decline in the short term, it is not clear that contango will emerge to the degree necessary to encourage stocking. 2) Refinery throughput should be high enough in the summer to absorb even high crude imports."

ESAI thinks the first quarter price decline may be followed by a significant summertime rally when demand rises again.

Iraqi wild card

Once again, Iraq has emerged as an oil market wild card.

London's Centre for Global Energy Studies points to the continued absence of sustained oil exports from Iraq serving as a crucial support for OPEC's pursuit of higher oil prices.

Because Saddam Hussein sees none of the funds emanating from the UN-sponsored oil-for-aid sales program, he is willing to forego those larger exports for revenues from smaller volumes-about 200,000 b/d via Syria-outside of UN control, CGES contends.

"Potential buyers of Iraqi oil under the oil-for-food deal will lift only if the market is sufficiently tight that they can pass the surcharge on to their customers," the London think tank said. "With the market weak, Iraq's oil is likely to remain at Ceyhan and Mina al-Bakr.

"As a result, oil exports from Iraq remain highly uncertain, and the world cannot rely on this oil to help balance the market in 2001."

Consequently, says CGES, the market this year looks to be a repeat of 2000, with Atlantic Basin stocks of crude and products starting the year at extremely low levels. It pegs the global stockbuild in 2001 at a puny 50,000 b/d-even if OPEC maintains current output and Iraq fully resumes its prior export levels-not enough to even maintain currently low stockcover levels.

Risk to demand

Both ESAI and CGES contend that OPEC runs the risk of collapsing oil demand growth in 2001.

The two analysts project global oil demand growth at about 1.4 million b/d in 2001, below even the recently reduced projections by IEA and EIA of 1.5-1.6 million b/d.

The long-term risk to markets is great, both say.

Noting that OPEC is also trying to realign its basket to better reflect its members' disproportionate volume of medium and heavy sour crudes while still pushing for a $25/bbl target, ESAI contends that strategy will only inflate further the level to which WTI would have to rise to get the basket to $25/bbl.

"It would behoove OPEC to allow their heavy sour prices to fall further in an effort to pull down light, sweet crude prices and give the US economy a little break," ESAI said. "Otherwise, they will surely wound the goose that lays the golden eggs."

Putting the dilemma in historical terms is CGES, founded by former Saudi oil minister Sheik Ahmed Zaki Yamani, architect of Saudi Arabia's market share recapture in 1985: "If OPEC acts to keep prices high, then demand growth will falter and OPEC will enter a vicious circle of successive output cuts to defend an unsustainable price, as happened in 1984-85."

And everyone in this business remembers what happened in 1986.

null

null

null

Industry Trends

The Canadian oil sands boom continues apace.

Husky Energy plans to invest $5.25 billion (Can.) over 10 years in three oil sands projects in northern Alberta.

One project will be at Tucker Lake, west of Cold Lake, Alta. Two others will be at Kearl Lake, on leases about 50 miles north of Fort McMurray.

The Tucker Lake project will be the first of the phased projects and will cost $350-450 million (Can.). Husky said it plans to make a regulatory filing with a target of 15,000-20,000 b/d of production by 2004.

The Kearl Lake No. 87 lease, which will be developed later, covers 48,880 acres. Husky owns 51%, and Imperial Oil has 49%.

The two companies also hold a smaller adjacent lease, No. 6, to the north on a 50-50 basis.

Husky is considering a pit mining operation to recover bitumen on the northern half of lease 87 and part of Lease 6. The southern half of Lease 87 is being considered for steam-assisted gravity drainage recovery.

The southern half of Lease 87 would be developed first at an estimated cost of $1.6 billion. Production would start sometime during 2005-07. The pit mining operation would cost at least $3.2 billion, with a completion date in 2008-12. Husky said it and Imperial still must perform detailed planning on the projects.

Meanwhile, Imperial said last month that it plans a $1 billion (Can.) expansion of its oil sands operations at Cold Lake, Alta.

It filed a preliminary disclosure document with the Alberta Energy and Utilities Board and Alberta Environment.

The expansion would develop an extra 30,000 b/d of bitumen from three new production phases (Phases 14-16) in a new operating area known as Nabiye, which will add 250 million bbl of net proved reserves at Cold Lake.

It will also extend Phases 9 and 10 of the existing Mahihkan operations to an area known as Mahihkan North, adding another 125 million bbl of reserves over the life of the development.

Imperial said it would make formal applications by the end of the year, and assuming the agencies approve them quickly and market conditions remain favorable, Mahihkan North could begin production in 2005 and Nabiye in 2006.

Imperial said the expansions, along with the current development of Phases 11-13 in an area known as Mahkeses, would bring total production to about 180,000 b/d by the end of the decade.

Nabiye would require some wells, associated field facilities, and a plant to generate steam, process bitumen, and treat water.

The Mahihkan North extension would require 600 new wells and other facilities over 5-10 years. Imperial's investment in the Cold Lake area is $1.7 billion.

Government Developments

Industry continues to push for urgent US federal energy policy reforms.

The US urgently needs a national strategy that better balances the realities of energy production and transmission with environmental and consumer concerns, the US Energy Association said last month.

USEA is the US member committee of the World Energy Council. It is an association of public and private energy-related organizations, corporations, and government agencies.

It issued a report aimed at influencing the energy plan the administration of President George W. Bush is expected to propose and energy legislation in Congress (see related story, p. 40).

The report contained a series of policy recommendations, including easing restrictions on domestic production, streamlining approval of new power plants and transmission grids, offering incentives for new technologies such as clean-burning coal, easing taxes on US multinational energy companies, and further deregulation in the electricity market.

Meanwhile, Red Cavaney, API president, said that, due to restrictions on land access, US oil and gas production has been essentially flat in the past 6 years, while demand has increased dramatically.

He said, "You need to be able to have access to federal lands...and there's a series of regulations and permitting issues that have basically taken a lot of the most attractive reserves we have in oil and gas and held them off-limits."

The US Supreme Court upheld Unocal's reformulated gasoline patent.

The US Supreme Court's opinion Feb. 20 upholding Unocal's patent for cleaner-burning reformulated gasoline (RFG) calls into question the feasibility of the federal Clean Air Act goals that it's supposed to advance, said an industry official.

Urvan Sternfels, NPRA president, said that, with a movement under way to ban the use of MTBE as an oxygenate additive to gasoline and without sufficient ethanol to replace it, the Supreme Court decision has "national implications" for refiners' ability to provide enough RFG at affordable prices.

NPRA had joined with API and the Western States Petroleum Association in urging the Supreme Court to overturn Unocal's patents. California, 33 other states, and the District of Columbia also challenged the validity of the patent.

In the initial trial, a US District Court jury found that five major refiners-ARCO, Chevron, ExxonMobil, Shell Oil, and Texaco-manufactured 13 million gal of RFG that fell under Unocal's designated "393" patent during March-July 1996 in California. The jury awarded Unocal $69 million, plus interest, which the company received in June 2000.

Refiners might have to pay a fee of up to 5.75

Unocal says it is "ready and willing" to negotiate with refiners, blenders, and importers on licensing agreements for its gasoline patents.

Quick Takes

FERC approved construction of the Gulfstream gas pipeline to Florida.

FERC approved construction of the $1.7 billion Gulfstream gas pipeline from Mobile Bay, Ala., across the Gulf of Mexico to central Florida.

It will be the largest pipeline construction project yet in the gulf, said the system operator. Completion is due in 2 years.

Gulfstream Natural Gas System will build and operate the 753-mile, 1.13 bcfd line supplying LDCs and power plants in central and eastern Florida.

Gulfstream also has proposed building supply-area facilities in Alabama and Mississippi. It will install 437 miles of 36-in. concrete-coated pipe across the gulf to Manatee County, Fla., beginning in second half 2001. From there, 292 miles of 16-36-in. mainline and laterals will extend across Florida and terminate in Palm Beach.

In other pipeline happenings, Pak Arab Refinery Co. (Parco) awarded China Petroleum Engineering & Construction a letter of intent to build a 26-in., 817-km products line from Parco's refinery at Mehmood Kot in Punjab Province to Karachi's Port Qasim. The $480 million pipeline is expected to begin service by December 2002. A joint venture, Pak Arab Pipeline, is implementing the project. The pipeline could move 12-18 million tonnes/year of refined products. The multiple-products pipeline will replace an existing line that will be converted to carry crude.

Sinopec PLANS to spend $2.9 billion on gas E&P in the East China Sea in the next 5 years.

The company will drill 20 exploration wells by yearend 2002 and conduct seismic surveys in the sea's Xihu trough.

Sinopec expects its exploration activities in the East China Sea to increase gas reserves there from 54 billion cu m to 150 billion cu m by next year and then to 200 billion cu m by 2003. The biggest discovery to date has been Chunxiao gas field, where Sinopec expects to produce 2 billion cu m/year of gas by 2004 and 10 billion cu m/year by 2010 (OGJ, Feb. 12, 2001, p. 41).

Xihu's gas will be earmarked for industrial and residential consumption in Shanghai and Zhejiang provinces. Their combined gas demand will be 5 billion cu m/year by 2005 and 13 billion cu m/year by 2010.

Elsewhere on the exploration front, Statoil hired the Noble George Sauvageau rig from Dutch company NAM to drill two wells on the Stine prospect 7 km east of the operator's Siri field in the Danish North Sea. The rig is working off Holland for Wintershall and will move to drill one well for NAM before kicking off the 90-day assignment for Statoil, scheduled to start in mid-May. If NAM agrees to extend the sublease, Statoil may use the rig to drill a third well in the area. Should the first Stine well prove commercial, a second would be drilled from the Siri platform to produce the field; if not, the rig would drill a sixth producer at Siri.

Premier Oil Natuna Sea said it has completed appraisal drilling on its Ujung Pangkah field in East Java, Indonesia, confirming reserves on the Pangkah Block structure in excess of 450 bcf of rich gas. Premier says there is a possibility of developing an oil layer beneath the gas reservoir. All three wells in the appraisal program-two vertical and a planned sidetrack of an earlier well-encountered commercial hydrocarbons. Coring, logging, and sampling programs are under way, and a seismic shoot is planned for later this year to size up a possible western extension to Ujung Pangkah.

Enterprise Oil is "not closing any doors" in deciding how it might develop its North Sea Howe prospect. Appraisal drilling has indicated a reservoir holding up to 55 million bbl of oil. Exploration manager Karen Leadbitter said preliminary estimates of the discovery's in-place hydrocarbons suggest 30-55 million bbl, but well data analysis will help "frame the shape and size" of the find's reserves. The Howe discovery is in 90 m of water in the Central Graben area of the North Sea, 12 km from Enterprise's Nelson field.

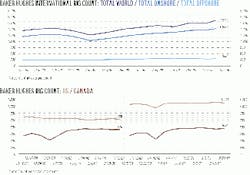

Australian operators have indicated they will drill 125 exploration wells this year, a 31% increase from the 95 drilled in 2000. The survey by the Australian Petroleum Production & Exploration Association indicated 80 of those wells would be onshore and 45 offshore. Also, industry is expected to drill 65 development wells-43 onshore and 22 offshore. Barry Jones, APPEA executive director, said most of the exploration will be in the mature Cooper-Eromanga basin of South Australia and Queensland and on the North West Shelf. He said coalbed methane drilling in the Bowen and Surat basins of Queensland and the Gunnedah and Sydney basins of New South Wales should increase due to higher gas prices. Jones said Australia must find substantial quantities of oil to offset the major decline expected within the next 10 years.

US DOE launched a research effort to see if high-powered lasers can be adapted for oil and gas drilling.

The Gas Technology Institute (GTI), DOE's National Energy Technology Laboratory, and several other project partners will conduct the research, which will build on a basic study completed by the gas industry in 1999.

DOE said that if drilling with lasers proves viable, it could be the most radical change in drilling technology within the past century. It said laser drilling would transfer energy from lasers on the surface down a borehole by a fiber optic bundle to a series of lenses that would direct the laser light to the rock face.

"Researchers believe that state-of-the-art lasers have the potential to penetrate rock at 10-100 times faster than conventional boring technologies-a huge benefit in reducing the high costs of operating a drill rig," DOE said.

The federal government will pay $500,000 of the cost of the 3-year study, while GTI will pay $214,000.

In other drilling sector action, Odfjell Drilling has signed a letter of intent to acquire Smedvig's West Delta semisubmersible drilling rig for $110 million. The agreement is subject to board approval, the buyer's inspection of the rig, and approval by Norsk Hydro. Closing of the transaction and delivery of the rig are planned for March.

Talisman energy is making plans to develop Halley field in the UK North Sea.

Talisman Energy said the UK government has approved its plans to develop Halley oil field on Block 30/12 in the central North Sea.

At Halley field, drilling will begin in March with two extended-reach wells from the Fulmar platform. Talisman has a 12.71% interest in Fulmar field, which is operated by a UK arm of Royal Dutch/Shell.

Initial production from Halley is expected to be 18,000 b/d starting in mid-2001, with production sold through existing oil and gas pipeline systems.

Talisman said the field holds 11 million boe of reserves, and development costs will be below $7/boe. The expected field life is 5 years, although opportunities to add reserves will be evaluated.

In other development action, Enterprise Oil said the Irish government had approved its £500 million (Irish) subsea development of Corrib gas field off southern Ireland. Enterprise will develop the field, in more than 1,100 ft of water, with seven subsea wells tied back to a central gathering manifold. A pipeline will move the gas to an onshore facility. Enterprise Energy Ireland opened the field in 1996 on Block 18/20. Development of Corrib, thought to hold 25 billion cu m of gas, is due to start this year and be completed by 2003. The terminal and processing plant will be built on the coast of County Mayo in northwestern Ireland, said Enterprise. More than £146 million has been spent in the exploration and appraisal process. Last October, the Irish government announced a £100 million project to construct an onshore pipeline linking the processing plant with the national grid to ensure that gas sales could start in early 2003.

Statoil's 2 billion kroner development of its Mikkel gas condensate field in the Norwegian Sea involves subsea facilities and well flow transfer via Midgard field to the operator's Åsgard B platform. The state-owned company's plan for development and operation of the field, which straddles Blocks 6407/6 and 6407/7, will be submitted to the Ministry of Petroleum in May. It said first flow would be Oct. 1, 2003 "at the latest." Project Manager Kjetil Ohm said that development involves production of 20 billion cu m of gas and 30 million bbl of condensate through four production wells. Statoil said the gas will be moved through the new 707-km, 42-in. Åsgard trunkline to the Kårstø treatment plant and then on to continental Europe.

Topping gas processing news this week, Syntroleum said that preliminary engineering work has indicated that its proposed 10,000 b/d Sweetwater GTL plant in western Australia would cost $506 million.

The estimate by Tessag Industrie Anlagen covered engineering, procurement, and construction (EPC).

Syntroleum said the quote includes provisions for broader refining capabilities than originally proposed, but does not include interest during construction or the costs of Syntroleum's proprietary catalysts.

Syntroleum and Tessag are working on a fixed-price EPC contract, said Syntroleum, and when that is executed, Syntroleum could proceed with completing financing.

The plant, on the Burrup Peninsula, would convert natural gas into ultraclean and sulfur-free synthetic specialty products, such as lubricants, industrial fluids, and paraffins, as well as synthetic transportation fuels.

Syntroleum has signed a 20-year gas supply contract for the plant with the North West Shelf venture partners.

In other gas processing news, three major companies have agreed to begin a $10 million feasibility study of an LNG project in southern Iran. Reliance Industries, National Iranian Oil, and BP will study a proposed two-train, 8 million tonne/year plant. The study will examine using gas from Iran's South Pars field and moving it via pipeline to the proposed plant at the Pars Special Energy Economic Zone at Assaluyeh on the Persian Gulf. Exports would go to India and other markets in Asia and Europe. Reliance, with a 25% share, will conduct a market study; BP, with 25%, will lead the technical effort and evaluate financial options; and NIOC, with 40%, will be involved in all aspects. The holder of the remaining 10% was not disclosed.

The Polar Lights project in Russia has passed the 75 million bbl production mark.

Polar Lights Co., a JV of Conoco and Russian partners Arkhangelskgeoldobycha and Rosneft, announced last month that Ardalin field has passed the 75 million bbl production milestone.

The field, in the Nenets Autonomous Okrug of the Timan Pechora basin, began production in August 1994. It is in a harsh arctic tundra environment about 1,000 miles northeast of Moscow.

Oil from Ardalin field is moved through a 42-mile line to the Russian pipeline system. When Polar Lights was established in 1992, it was the first Russian-American JV company to develop an oil field in Russia.

In other production work, Shell Iran said it has begun a 12-well drilling program to redevelop the shallow-water Soroosh and Nowrooz oil fields off Iran's Kharg Island in the northern Persian Gulf. Shell employed the Maersk Viking rig to spud the first of 10 horizontal production wells and 2 water disposal wells on Feb. 15. Work has started at the Off-shore Industries yard in Bandar Abbas on modules needed for the early production system on Soroosh, which is scheduled for completion in August. Shell said Soroosh field contains 500 million bbl of heavy crude oil reserves and Nowrooz 550 million bbl. Shell expects to reach production of 100,000 b/d from Soroosh and 90,000 b/d from Nowrooz by 2003.

Production facilities at Ardalin field. This photo was inadvertently included in an earlier, unrelated item (OGJ, Feb. 19, 2001, p. 9).