OGJ Newsletter

Market Movement

OPEC unlikely to bolster oil prices in January

It looks as if OPEC can keep oil prices from crashing only by keeping the world on the brink of a shortage. The talk of production cuts at the group's Jan. 17 meeting in Vienna is beginning to look less like jawboning every day (see related story, p. 21).

London think tank Centre for Global Energy Studies thinks that OPEC will find it difficult to keep oil prices at the $25/bbl level favored by most members.

The strongest sign of this scenario emerged at the end of November, when Iraq halted oil exports after yet another tussle with UN officials over a price formula for December, removing more than 2 million b/d from global oil supply, CGES noted.

"Pres. Saddam Hussein fully expected that a halt in his oil exports would send prices soaring and bring the world to his door, ready to accept his terms for a restoration of shipments," the analyst said. "He mistimed his action, though. If he had stopped exports a month earlier, at the height of concerns over use of the oil weapon in reaction to the events in the Palestinian-occupied territories, it may have had the desired effect."

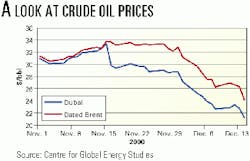

The pledges by US and European governments to bring strategic stocks to the fore and by Saudi Arabia to jump its own production, should Iraqi exports stop, rendered the cutoff largely irrelevant to the market. Instead, prices fell by $2/bbl after the announcement by Baghdad (underscoring the points that there is ample crude on the market and that the high price of oil-reaching as high as $36/bbl by October-had already incorporated a premium for a possible Iraqi cutoff). The plunge didn't end there, as near-month Brent and WTI futures each fell by more than $6/bbl in the week that followed (see chart).

This was a decline just waiting to happen, CGES asserts: "The downward pressures had been building up in Asia for several weeks. With most of OPEC's additional output in late summer heading eastwards, the region was becoming oversupplied."

The think tank wonders why prices didn't fall faster, instead pausing at $27/bbl (Brent) in mid-December, especially as crudes indexed to Brent were driven from the Asian market into the Atlantic basin-where they exacerbated a market weakening begun by the release of 600,000 b/d of oil from the US Strategic Petroleum Reserve.

CGES noted that the price for Dubai crude had already started to slup as early as mid-November, with that crude's differential to Brent widening to $4/bbl from almost zero.

Help from Iraq, arctic blast

If anything, CGES contends, the Iraqi supply cutoff may have helped avert a deeper price collapse.

"By the end of the first week of December, the loss of Iraqi oil was starting to be felt in reduced arrivals at Mediterranean refineries, restoring a better balance of supply and demand in the region."

The renewed tightness would have been more deeply felt had not 200,000 b/d of Iraqi oil made its way into Syria via a newly repaired pipeline during the purported cutoff, the analyst said.

CGES also noted that crude oil markets got some support from the arctic blast that raked the US in December, which in the first week of December pulled down heating oil stocks by 4.5 million bbl, or to a level 17 million bbl lower than the same time a year ago.

The resumption of Iraqi exports a couple of weeks later again put downward pressure on oil prices, but the next couple of waves of frigid weather across most of the US during that time acted as something of a counterbalance.

In any event, for all the talk of production cuts at OPEC's Jan. 17 meeting, CGES thinks that oil prices are unlikely to fall far enough to trigger an output cut at that time.

A different scenario could be shaping up for the March OPEC meeting, however, when the group "must take stock of what it wants for oil prices in the coming year."

"Once commercial stocks of crude and products return to more-normal levels, prices can be expected to gravitate towards their 1990s' average of $17-20/bbl," CGES said. "If OPEC wishes to keep prices at $25/bbl, it will have to prevent stocks from being rebuilt, keeping the world on the edge of an oil shortage."

Industry Scoreboard

null

null

Industry Trends

SOME companies are taking UNUSUAL STEPS TO TAKE advantage of the SPIKE in natural gas prices.

Mitchell Energy opted not to process gas last month at Exxon Mobil's Katy, Tex., plant-a decision that it may carry forward into 2001, depending on whether gas prices remain high. Despite the resulting reduction in NGL capacity by 14,000 b/d, the company said that the decision would impact revenues "favorably."

"We process gas at Katy under a 'keep whole' contract," explained Allen J. Tarbutton, president of Mitchell's gas services division. "Although NGL prices are at historically high levels, it will be more profitable to sell the NGLs as part of the even more valuable natural gas stream, since Katy is an older plant that is not as efficient as Mitchell-owned plants."

Meanwhile, Mississippi Chemical stands to gain $16 million from the sale of its natural gas futures contracts. The company said that the majority of its contracts being sold were for delivery in January.

"We remain committed to the nitrogen business and our customers, but we also have to take advantage of opportunities to optimize cash flow during these challenging times. It is our belief that the current unprecedented natural gas prices are unlikely to be sustained during the intermediate term," Charles O. Dunn, president and CEO said.

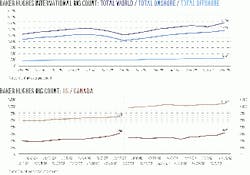

CANADIAN E&P companies will have to set a record drilling pace for natural gas over the next 3 years to meet strong demand and counteract declining well output, says Canada's National Energy Board. It said Canadian industry would need to drill 25,000 new gas wells over the period to meet demand for the commodity.

The board said that well productivity is declining and new wells can lose up to 40% of daily production within 1 year. The average decline for Canadian wells is about 20%. The NEB estimated annual decline in production at close to 3 bcfd. It also expects future wells will be generally less productive than those drilled a few years ago.

NEB officials said an increased drilling effort would be needed to offset declines from existing wells to maintain or increase overall deliverability from the Western Canada Sedimentary Basin.

Canada now exports more than half of its gas production to the US, and strong demand has sharply increased prices for producers.

NEB projects 8,100 gas wells will be drilled in Canada this year, 8,700 in 2001, and 8,900 in 2002. That would increase Western Canada's production to 17.5 bcfd in 2002 from a current level of 16.4 bcfd.

Len Coad, vice-president, North American Gas, for the Canadian Energy Research Institute, said more than 7,000 gas wells were completed last year to the end of November. He said production is expected to grow, but the total number of wells drilled may drop in the future as producers drill more wells in deep formations in northern Alberta, British Columbia, and the Northwest Territories.

Government Developments

US EPA late last month announced rules requiring cleaner-burning diesel engines and a 97% reduction in the sulfur content of highway diesel fuel to 15 ppm from 500 ppm. Industry groups complained the rules were regulatory overkill.

EPA said the diesel engine rule "would provide the cleanest running heavy-duty trucks and buses in history. These vehicles will be 95% cleaner than today's trucks and buses."

Carol Browner, EPA administrator, said the action will result in "the greatest reduction in harmful emissions of particulate matter, or soot, ever achieved from cars and trucks."

EPA said that, to enable modern pollution-control technology to be effective on trucks and buses, diesel fuel had to be significantly cleaner.

The standards will be phased in for engine manufacturers during 2007-10. The fuel provisions are effective June 2006, but refiners can request more time, and there are exemptions for small refiners.

EPA said the cost of diesel fuel would increase 4-5¢/gal.

Sixteen organizations, including API, NPRA, and US Chamber of Commerce, objected to the rules.

They said, "We are deeply disappointed that EPA has issued a rule that threatens to limit essential diesel supplies to farmers, truckers, bus operators, food distributors, small businesses, and other users.

"The rule puts the nation's diesel supplies at risk, because some refiners may not be able to afford the changes to their refineries needed to make the ultralow-sulfur diesel fuel EPA has mandated.

"In turn, significantly less diesel on the market could sharply increase prices, similar to what we experienced earlier this year in some of the nation's gasoline and heating oil markets, but perhaps for a longer duration. Diesel fuel users could pay substantially more, and consumers everywhere could feel the impact as the higher costs ripple through the economy.

UK Environment Minister Michael Meacher last month put out an open invitation to fuel producers, automobile manufacturers, and environmental groups to submit information on a range of environmental, health and safety, and vehicle performance issues as part of a government initiative looking into alternate fuels.

The so-called Green Fuel Challenge, launched by the governing Labour party in its pre-budget report in November, aims to "stimulate industry to propose practical options to conventional fuels," said the UK Department of the Environment, Transport, and the Regions in a statement.

The scheme targets fuels that will cut emissions of local pollutants and greenhouse gases, as well as help reduce the volume of environmentally damaging waste products.

"The public and the government want viable green fuels," said Meacher. "The best fuels from the Green Fuel Challenge will be given significant duty reductions in the budget to achieve this aim."

Quick Takes

MCDERMOTT has marked progress on the Gulf of Mexico'S Brutus development project.

J. Ray McDermott (JRM), a unit of McDermott Internation- al, has nearly completed the topsides for Shell E&P's Brutus tension leg platform in the deepwater Gulf of Mexico. JRM also said it has completed installation of oil and gas pipelines for the Brutus development, which covers Green Canyon Blocks 158 and 202 in 3,000 ft of water 165 miles southwest of New Orleans.

The development is expected to cost $900 million. JRM installed 24 miles of 20-in. pipeline from South Timbalier Block 301 to Green Canyon Block 158 and will lay a 23-mile, 20-in. natural gas pipeline from Ship Shoal Block 332 to Green Canyon Block 158 (OGJ Online, June 9, 2000).

JRM also installed steel catenary risers that will be raised and suspended from the Brutus TLP in spring 2001. Installation of the eight-slot TLP-which will serve as a hub for future subsea projects in the area-is slated for mid-2001. Production, to start in late 2001, is expected to reach a peak capacity of about 100,000 b/d of oil and 150 MMcfd of gas (OGJ, Apr. 19, 1999, p. 40).

In other development news, TotalFinaElf launched basic engineering studies for the Dalia project. The field is on Block 17, 135 km off Angola, in 1,300 m of water. TotalFinaElf, which has a 40% interest, operates the block. ExxonMobil holds 20%; BP, 16.67%; Statoil, 13.33%; and Norsk Hydro, 10%. Discovered in 1997, Dalia is located near Girassol oil field, which is due to be on stream in late 2001, with peak oil production of 200,000 b/d. Like Girassol, Dalia will be developed via subsea wells and an FPSO vessel. TotalFinaElf expects to award the main Dalia contracts at yearend and anticipates that the field will come on stream in late 2004.

Unocal Thailand awarded JRM a platform construction contract for the North Pailin development in the Gulf of Thailand. The platform will produce 200 MMcfd of gas and 11,000 b/d of condensate. The deal includes fabrication, transportation, installation, hookup, and precommissioning of the central processing platform and a tripod-supported flare bridge assembly. JRM said the platform substructure will be a conventional eight-leg jacket. The 12,500-ton topsides, to be constructed in modules, will consist of a support frame and three modules, along with a 400-ft flare bridge. The facilities will be built at the JRM yard on Batam Island, Riau, Indonesia. Work will begin early in 2001 and will be complete in 13 months.

Apache reported confirmation of another discovery in egypt's Khalda area.

Repsol Exploracion, a unit of Repsol-YPF, and its partners have applied for a declaration of commerciality for the Khalda Offset concession in Egypt. Concession partner Apache said the Neith South-3X appraisal well confirmed the 2,634 b/d 1X discovery made earlier this year.

Neith South-3X tested at 1,170 b/d of 44 degrees gravity crude and 1.3 MMcfd of gas through a 2-in. choke with 100 psi flowing tubing pressure (OGJ Online, Nov. 30, 2000). Once the declaration is granted, Apache said it can use existing production on the adjacent Khalda concession to recoup the $40 million it has invested in the Khalda Offset.

The 1.575 million-acre Khalda Offset concession is 267 miles west of Cairo. It is adjacent to the Khalda concession, which produces 43,000 b/d of oil and condensate and 200 MMcfd of gas. Repsol operates the Khalda Offset concession and holds a 50% interest. Apache holds 40%; and Novus Petroleum, 10%.

In other exploration action, Statoil has a "promising" discovery on the Falk structure northeast of its Norwegian North Sea Norne field, although the company said the size of the find remains "uncertain." Exploration well 6608/11-2, drilled from the West Navion drillship in 350 m of water, was terminated 2,200 m below sea level. Statoil said the well proved oil in early Jurassic sands. Through the well, Statoil had hoped to firm up a connection between the Falk area and its earlier Svale discovery to the south (OGJ Online, Nov. 1, 2000).

Chevron confirmed Lobito field on deepwater Block 14 off Angola. The Lobito 2 was drilled in 1,650 ft of water 4 miles northwest of the Lobito 1 discovery. The appraisal identified 200 ft of net oil pay and encountered an oil column measuring as thick as 770 ft. The discovery tested 10,200 b/d of 35

Production began last month from the $4 billion Sincor heavy crude project in Venezuela, said stakeholder Statoil.

The project's partners, led by TotalFinaElf, are developing the field in the Zuata region, about 200 km from Caracas. Work began in 1998. Production will rapidly reach 40,000 b/d of very heavy crude-8.5

The oil will be blended with 25,000 b/d of 30

A plant under construction at Jose on the Caribbean coast, due to be completed in late 2001 or early 2002, will upgrade Sincor oil to a 32

Sincor production will thereafter be gradually increased to 200,000 b/d of extra-heavy crude oil, which will be diluted so it may be piped to the Jose facility. First exports of Zuata Sweet are expected in early 2002.

Elsewhere on the production front, Conoco and partners recently completed a development well in Rang Dong oil field off Viet Nam, boosting production there by 11,000 b/d to a total 50,000 b/d. The Conoco group also completed a stepout they said "significantly" extends Rang Dong, which lies in 165 ft of water on Block 15-2, 120 miles southwest of Ho Chi Minh City in the Cuu Long basin. The well tested 8,500 b/d from one zone. The 400,000 acre block is near Bach Ho and Ruby fields. Conoco has increased its interest in Block 15-2 to 36% from 30%. Other partners are Japan Viet Nam Petroleum, with 46.5%, and state-owned Petrovietnam, with 17.5%. Conoco holds interests in five blocks off Viet Nam totaling 5.75 million acres.

UK operators plan to increase funding for a drill cuttings study.

The 30 members of the UK Offshore Operators Association will pay another £4.5 million to finance the second phase of a joint industry initiative to deal with accumulations of drill cuttings on the seabed, officials said last month. The initiative also is supported by the Norwegian Oil & Gas Industry Trade Association, OLF.

The program, which has the backing of all operators with drill cuttings accumulated at production sites on the UK continental shelf, is intended to determine whether it would be better to lift those cuttings from the seabed or leave them in place.

If the cuttings are to be lifted, participants must then decide whether to reinject them into wells or to bring them ashore for treatment. If the cuttings are left in place, officials must determine whether to allow natural degradation, apply enhanced bioremediation, or cover the cuttings. There is no proven remediation method.

Topping gas processing news this week, Saudi Aramco awarded Technip two major contracts to provide utilities, offsites, and pipeline systems for a grassroots gas plant at Haradh, 280 km southwest of Dhahran.

The plant will increase deliveries into the Saudi gas transmission system by 1.6 bcfd, said Technip. The contract includes compression and heat recovery systems, a 230-kv substation, sulfur-loading facilities, and all the utilities and offsites needed for the program. Technip's engineering bureau in Rome and Technip's affiliate in Saudi Arabia will head up this project.

Technip will also provide two pipeline packages. The first will connect the Haradh gas plant to the Saudi gas transmission system via 394 km of 42-56-in. pipeline. The system will have 16 mainline valve stations, including scraper stations and related facilities.

The second package involves installation of 229 km of 18-in. and 24-in. pipelines to carry unstabilized condensate from the Haradh and Hawiyah gas plants to the Abqaiq plants for stabilization. It will include 10 mainline valve stations, including scraper stations. Both projects, which are believed to have a combined total cost of 500 million euros, are scheduled for completion in mid-2003. Utilities and offsites will become operational in 2003. x

In other gas processing action, Duke Energy Field Services-a 70-30% JV of Duke Energy and Phillips Petroleum-said that an expansion has been completed at the Roggen natural gas plant in Colorado, northeast of Denver. The expansion doubles the plant's processing capacity to 58 MMcfd. Duke Energy said the upgrade increases capacity near gas reserves in Weld County, Colo. NGL production from the plant is expected to increase to more than 4,300 b/d from 2,100 b/d. NGL produced at the Roggen plant will be delivered into Phillips Pipe Line Co.'s NGL pipeline, which runs from the Powder River basin of Wyoming to the Texas Panhandle (OGJ Online, July 19, 2000).

US ferc granted preliminary approval for Questar to construct a 75-mile natural gas pipeline in UTah.

The $80 million, 24-in. line-dubbed Main Line 104-will extend from Price to Payson, Utah, then 18 miles west, where it will tie into a Kern River Gas Transmission system near Elberta, Utah.

The 1,400-psi line, expected to be in service prior to the 2001-02 winter heating season, will provide at least 272,000 dekatherms/day of firm gas transportation for delivery to Wasatch Front markets and the proposed interconnect.

Questar awarded Sterling Construction Co., Sterling, Colo., a contract to build the pipeline. Mountain West Construction, Fruita, Colo., will design and install 9,300 hp of additional compression at Questar Pipeline's Oak Springs compressor station near Price, Utah.

In other pipeline news, a new 2.7-mile lateral from Tennessee Gas Pipeline's 200 Line near Cedar Hill, NY, to Niagara Mohawk Power Corp.'s gas distribution system near Albany has the capacity to supply the proposed Bethlehem Energy Center power plant being developed nearby, officials said last month. Tennessee Gas, a unit of El Paso Energy, started service on that connection Dec. 1, providing gas from its system to a rapidly growing segment of Niagara Mohawk's service area. The new lateral provides Niagara Mohawk and area industrial end-users with a more diverse supply base through the Tennessee Gas system and eliminates rate stacking of costs through multiple pipelines, the officials said. As a result, they said, marketers could reduce transportation costs to supply those markets while maintaining more options to balance their supply and market portfolios.

A consortium studying development of arctic natural gas in Canada's Mackenzie Delta says it has made "significant progress" in a joint evaluation and will soon begin preliminary engineering on a proposed pipeline. Imperial Oil Resources, Mobil Oil Canada, Gulf Canada Resources, and Shell Canada said they are ready to begin conceptual engineering and the gathering of baseline biophysical data for a pipeline to southern markets. The group said it could begin preparing a regulatory application for the pipeline as early as next year. The companies, which hold about 6 tcf of gas reserves in the region, began the study in February. Cost of a 1 bcfd capacity pipeline through the Mackenzie Valley to mainline connections in northern Alberta is estimated at up to $6 billion (Can.). Spokesman Hart Searle said the focus of the Canadian study is to ensure that Canadian gas can flow profitably to market on its own. He said the study will only address the feasibility of developing onshore Mackenzie Delta gas.