Plans for pipeline construction remain flat; proposals abound

Despite a dramatic and surprisingly sustained run-up in world energy prices, operating companies' plans for petroleum (oil, condensate, and NGL) and natural gas pipeline installation during 2000 reflect almost no change from those announced a year ago for 1999 (OGJ, Feb. 8, 1999, p. 36).

And long-term plans-those for pipeline construction to begin in or after 2000 and be completed much later-have fallen, although not for lack of several long-distance proposals floated in recent years and whose likelihood Oil & Gas Journal at present discounts.

But with the world's economies, spearheaded by the churning US economic engine, now near fully recovered from the downturn of 1997-98, some of those huge, visionary projects-especially for Asia-may come into clearer focus, sharpened by firmer and growing energy demand.

What a difference a year makes:

As petroleum markets enter a new year, a new decade, and a new century, prices for crude oil, refined products, and natural gas are hanging near levels never seen before-except in times of Middle East crisis, as in 1973, 1979, and 1990-91.

A year ago, those same prices seemed headed inexorably and all too familiarly south: In January 1999, the International Energy Agency forecast world oil-demand growth in 1999 at only 1.5%, a revision from 2% of a month earlier.

But during 1999, the Organization of Petroleum Exporting Countries and large, non-OPEC producing countries cobbled together a series of production quotas that, to the surprise of many observers, have held firm.

The results have been world crude oil prices holding in recent weeks at more than $25/bbl and US motor gasoline retail prices holding at a weekly average more than 40% higher in January 2000 than in January 1999 (OGJ, Jan. 24, 2000, p. 70).

For 2000, pipeline operating companies were projecting slightly less than 16,000 miles worldwide of crude oil, petroleum product, and natural gas pipeline construction to be completed. That level is essentially even with what OGJ reported a year ago.

Plans for construction beyond 2000 are off by slightly more than 14%.

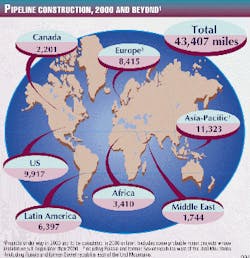

For 2000 and beyond 2000, therefore, nearly 43,500 miles of crude oil, product, and natural gas pipeline are planned worldwide, off by more than 10% from the combined near and long-term projections of a year ago (see map on this page).

With economic recovery and stabilization evident in both Asia and Latin America, however, prospects will improve for many projects OGJ regards as too problematic to include in its numbers now will improve. We might even recover faith in a natural gas line from the North Slope.

Later this year, major volumes of Canadian natural gas will begin flowing south into the US Midwest, pushing to completion many ancillary projects south of the border. At the same time, gas from eastern Canada's offshore region will begin moving in larger volumes into the US Northeast.

The possibility looms of a surplus of deliverability to those two markets, however, especially if the long-running US economic boom loses steam or weather patterns in the regions continue warmer than historically normal.

Elsewhere, gas-grid evolution continues in both Latin America and Europe. And new projects mark progress in the former Soviet Union.

These trends are evinced in the latest OGJ pipeline construction data derived from a survey of world pipeline operators, industry sources, and published information.

Bases, costs

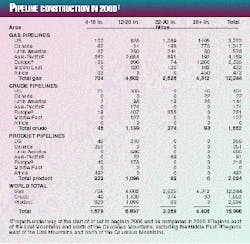

For 2000 only (see Table 1), companies indicated plans to complete nearly 16,000 miles of oil and gas pipeline worldwide at a cost of more than $17.6 billion.

For 1999 only, companies had predicted nearly 17,000 miles at more than $20 billion.

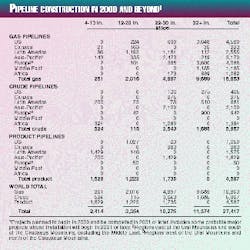

For projects completed after 2000 (Table 2), companies expect to spend another $30.2 billion to lay nearly 27,500 miles of line.

Last year, when these companies looked beyond 1999, they expected to lay more than 32,000 miles at a cost of nearly $40 billion.

- Projections for 2000 pipeline mileage reflect only projects expected to be completed by yearend, including construction in progress at the first of the year or set to begin during it.

- Projections for mileage in 2000 and beyond include construction that might begin in 2000 but will be completed in 2001 or later. A few long-term projects that OGJ judges are probable are included even if they will break ground in 2001 or later.

Cost estimates are based on US average costs per mile for onshore and offshore gas pipeline construction as found in Table 4 of OGJ's most recent Pipeline Economics Report (OGJ, Aug. 23, 1999, p. 45).

These projections assume, based on historical analysis, the following:

- That 90% of all construction will be onshore and 10% offshore.

- That pipelines 32 in. OD or larger are onshore projects.

Under these assumptions and with OGJ pipeline-cost data, here is a breakout of costs by line size:

- Total onshore construction (14,832 miles) for 2000 only will cost $16.3 billion-$1.6 billion for 4-10 in., $6.8 billion for 12-20 in., $3 billion for 22-30 in., $4.9 billion for 32 in. and larger.

- Total offshore construction (1,158 miles) for 2000 only will cost more than $1.3 billion-$185.1 million for 4-10 in., $753.6 million for 12-20 in., and $338.3 million for 22-30 in.

- Total onshore construction (25,813 miles) for beyond 2000 will cost $28.4 billion-$2.4 billion for 4-10 in., $3.3 billion for 12-20 in., $10.2 billion for 22-30 in., and $12.5 billion for 32 in. and larger.

- Total offshore construction (1,604 miles) for beyond 2000 will cost nearly $1.8 billion-$266.1 million for 4-10 in., $369.7 million for 12-20 in., and $1.1 billion for 22-30 in.

North American picture

Later this year, the Alliance Pipeline will begin flowing gas and associated liquids through its massive high-pressure system from northeast British Columbia, across Alberta and Saskatch- ewan, into the US to near Chicago.

It is arguably the most important gas pipeline project built in North America since the first lines linked Canadian producers and US markets.

The effect of Alliance has been nothing less than to cause a reconfiguration of the Alberta gas transportation picture, the merger of Canada's two largest gas pipeline companies, and-most significantly-the relief of significant gas supply bottlenecks preventing large volumes of Canadian gas from reaching US markets.

And on the downstream end of the system, companies have been scrambling to receive approval for installing transportation infrastructure to take advantage of what Alliance has wrought.

Millennium Pipeline will extend about 440 miles from Lake Erie, at a point on the Canada-US border, to Mount Vernon, NY. It will link Canadian and US supplies with growing markets in the US Northeast and mid-Atlantic.

Upstream of Millennium, several projects have been proposed and are under review by the US Federal Energy Regulatory Commission to take volumes from Alliance. These include the TriState Pipeline from near the Aux Sable gas plant (terminus for Alliance), to connect with TransCanada Pipe- Lines' (TCPL) proposed Lake Erie crossing-and ultimately Millennium-into Pennsylvania markets and points east.

The Independence Pipeline project, a venture of a Williams unit, Coastal Corp., and National Fuel Gas Corp., entails building 370 miles of 36-in. pipeline from western Ohio to Pennsylvania. Late last year, FERC staff issued a favorable final environmental impact statement on the Independence and related SupplyLink and MarketLink projects. These would carry gas supplies further into US mid-Atlantic and eastern markets.

MarketLink is a 42 and 36-in. expansion of Williams' Transco system in Pennsylvania and New Jersey. Orders for the pipe went out in June to Napa Pipe Corp. and Berg Steel Pipe Corp.; compressor units were ordered from Solar Turbines and Dresser-Rand.

Construction is set to start this spring, with completion slated by the 2000 heating season.

Another project to bring Canadian gas to the US Midwest is the Vector Pipeline, a project of Enbridge Inc., Calgary, and MCN Energy Group Inc., Detroit. Construction of the 360-mile line in the US and Canada has begun after US and Canadian authorities approved respective segments in 1999.

Yet another project growing out of the terminus of Alliance south of Chicago is the Atlantic Alliance Pipe- line, envisioned to carry up to 735 MMcfd to eastern US markets, especially New York, Pennsylvania, and New England.

It would use existing facilities and ROW and targets full deliverability by Nov. 1, 2001. The joint venture of El Paso Energy Corp. unit Tennessee Gas Pipeline Co. and Dominion Resources Inc. unit CNG Transmission Corp. extended its open season in late 1999 to Nov. 30 to accommodate what it said were shipper uncertainties over Millennium, Independence, and MarketLink projects.

And in late 1999, Guardian Pipeline project partners filed an application with FERC to build and operate a 147-mile, 36-in. interstate gas line that would interconnect near Jolliet, Ill., with Alliance, Northern Border Pipe- line, Midwestern Gas Transmission, and Natural Gas Pipeline of America to target markets in northern Illinois and southern Wisconsin. Capacity on Guardian is slated for 750 MMcfd, with possible expansion up to 1.1 bcfd. Cost was estimated at $230 million.

On the western side of North America and to move more Western Canadian Sedimentary Basin gas, BC Hydro, Vancouver, BC, and Williams Gas Pipeline want to build an 84-mile link from Northwest Pipeline at Sumas, Wash., to Vancouver Island. The project (see story and map on this page) would initially move gas to industrial and residential customers.

Elsewhere in the US, even as Florida Gas Transmission Co. was completing Phase IV of its expansion of the 4,800-mile system from Texas to Florida, it filed for Phase V approval from the FERC.

This would consist of 231 miles and an additional 90,000 hp of compression at a cost of about $438 million. Construction would begin early next year and be in service by spring 2002.

Also in the US South, Carolina Power & Light and the Albemarle-Pamlico Economic Development Corp. (APEC) announced plans to build an 850-mile gas line and distribution system to eastern North Carolina.

In October 1999, CP&L and APEC jointly filed a request with the North Carolina Utilities Commission for a $186-200 million state bond package approved by North Carolina voters in November 1998 to be used partly to pay for the project. CP&L will invest an additional $11.5 million, bringing the total estimated project cost to $197.5 million.

CP&L will build 600 miles of 4-12-in. transmission line and 250 miles of distribution line in five phases. APEC told OGJ that it anticipates a NCUC order by June 2000. Furthermore, the company said Phase I construction of the transmission pipeline could begin by fourth quarter 2000 with Phase II during first quarter 2001, Phase III in fourth quarter 2001, Phase IV in early second quarter 2002, and Phase V in late third quarter 2002.

Elsewhere in North America, the Corridor pipeline in northern Alberta moved ahead. This is a 306-mile, 12 and 24-in. system as part of the Alberta Athabasca oil sands project undertaken by Shell Canada Ltd. with Western Oil Sands Inc. and Chevron Canada Resources. Target date for operation is 2002.

The system will move diluted bitumen from the Muskeg River mine to an upgrader adjacent Shell's Scotford refinery near Fort Saskatchewan, Alta. Cost of constructing the pipeline and tankage, project members estimate, will be $600 million (Can.). The pipeline will be operated by BC Gas subsidiary TransMountain Pipeline Co. Ltd., Vancouver, BC.

A 24-in. line will move 215,000 b/d to the upgrader; a 12-in. return line will transport 65,000 b/d of solvent to the Muskeg River mine. A 20-in. line will transport 95,000 b/d of synthetic crude oil from the upgrader to existing terminals in the Edmonton-Strathcone, Alta., area. A 16-in. return line will move 8,000 b/d of supplementary feedstock to the upgrader.

But the really big news in Canada hit late in 1999 as TCPL announced it was returning to its core business and would sell all assets not associated with its $21 billion (Can.) pipelining, power generation, and marketing activities in Canada and the northern US.

This is the latest in moves resulting from the merger in 1998 of TCPL and the former intra-provincial system of NOVA. TCPL will put on the block many of the pipeline and related assets it picked up in that merger, including oil and gas pipelines, electric-generating plants, and related facilities in place or under development in Colombia, Venezuela, Argentina, Chile, Brazil, Mexico, Indonesia, Thailand, Tanzania, Australia, and the Dutch North Sea.

TCPL is also to sell the recently completed Express Pipeline System, a crude oil system from Hardisty, Alta., to Wyoming.

Latin American network

Major natural gas networks began flowing gas last year as South America moved closer to energy integration.

Early in the year, the $2 billion, 1,978-mile Bolivia-Brazil natural gas export pipeline was dedicated by officials from Bolivia and Brazil.

The line consists of 464 miles in Bolivia from Rio Grande and passes through Puerto Suarez on the border with Brazil. It then extends to the Brazilian town of Corumba and crosses the states of Mato Grosso do Sul, Sao Paulo, up to the city of Campinas and on to Parana and Santa Catarina states, terminating at Porto Alegre, the capital of Rio Grande do Sul state.

Capacity for Bolivian gas is 8 million cu m/day (MMcmd) to move to southern Brazil; later, pipeline capacity may be expanded to 16 MMcmd, depending on market demand.

The project is widely considered a cornerstone of efforts to establish an energy grid in the Southern Cone nations of South America. If, for example, Bolivian supplies prove inadequate in volume or timing to meet demand in Brazil, gas in northern Argentina could be moved through a reversed line into Bolivia and on into the new line into Brazil.

Elsewhere from Argentina, Gasoducto Cruz del Sur SA, a 50-50 venture of BG PLC and Pan American Energy LLC, plans to move gas between Buenos Aires and Montevideo and ultimately Brazil.

The trunk line from Colonia, Argentina, would be 100 miles of 18-in. OD pipe, with laterals to feed several cities. The laterals consist of 77 miles of 3-18-in. OD pipe. The line is part of an intended 528-mile, 24-in. line to Brazil via Uruguay.

On the western side of the continent, two more systems tapping Argentine gas began moving supplies into Chile.

In the north, Gasoducto Atacama Cia. Ltda. (GasAtacama) was completed, a 300 MMcfd, 584-mile, 20-in. natural-gas pipeline from Argentina to Chile. It is the second line to bring Argentine gas to Chile; GasAndes started up in August 1997 supplying gas to Santiago.

GasAtacama is a joint venture of four companies, including major shareholders CMS Energy Corp., Dearborn, Mich., and Chilean power generator Endesa, Santiago, each with 40%. Remaining ownership is split between two Argentine gas producers: Pluspetrol SA, 16%; Astra Capsa, 4%.

The pipeline transports gas from gas fields in Argentina's Noreste basin, near Salta, to Mejillones, Chile. Total cost of the pipeline and power plant near Mejillones was estimated in 1998 at $750 million.

A portion of the gas shipped to Mejillones is to be transported further south to a 350-Mw plant Endesa is building at Taltal, Chile. The 160-mile Gasoducto Taltal extension was estimated in 1999 to cost $30 million but is currently under review.

In southern Chile, the first phase of the 335-mile Gasoducto del Pacífico-recently completed-from Loma de la Lata in Argentina's Neuquén Province to Concepción-Talcahuano, in Region VIII, is supplying natural gas to the communities of Concepción, Talcahuano, Coronel, Penco, and Lirquen. When the second phase starts up in April, gas will flow to Laja, Los Angeles, Nacimiento, Lota, Escuadrón, and Arauco. Initial capacity of the pipeline is 3.8 MMcmd.

Gasoducto del Pacífico shareholders are TransCanada International, Calgary, 30%; Gasco, Santiago, 20%; El Paso International, Houston, 21.8%; Chile's state oil company ENAP, 18.2%; and Repsol-YPF SA, 10%. Total investment in GasPacífico amounts to $317 million, broken down as Argentina, $127 million, and Chile, $190 million.

In the Mexican Yucatan peninsula, another TCPL project, Energía Mayakán, started up in late 1999. The 435-mile, 24-in. line is capable of moving 370 MMcfd of gas from Ciudad Pemex, Tabasco, to power plants in Campeche and Yucatan (OGJ, Mar. 8, 1999, p. 62).

FSU work

A flurry of rehabilitation work is under way and scheduled to start, as Russia tries to bring its leaky oil and gas pipelines up to the standards of Europe and North America. Details on much of this are sketchy; financing woes have forced many of these projects to jump between active and on-hold. Delays are chronic.

But a couple of major projects did make substantial progress in 1999.

Late last year, Russian gas transmission company Gazprom finished Phase 1 of the Yamal-Europe transcontinental gas pipeline project (OGJ, Nov. 8, 1999, p. 30). The 4,000-km pipeline will carry gas from the Yamal Peninsula region of western Siberia through Belarus and Poland and into eastern Germany. There it connects with the Western Europe gas grid.

Last year, Gazprom began the first phase of the Yamal-Europe project by debottlenecking its existing gas pipe- line network and adding new sections. The system has a throughput capacity of 30 billion cu m (bcm)/year.

The Polish section began flowing in November. Gazprom plans to route 14 bcm/year of gas through Poland. Gas deliveries to Poland are likely to increase two-fold in a few years.

The company plans to increase gas exports by as much as 45 bcm/year by 2010.

Elsewhere in the former Soviet Union, work continued on the 900-mile crude oil pipeline from western Kazakhstan's Tengiz oil field to the Russian port city of Novorossiisk on the Black Sea. Completion was expected by mid-2001.

In late 1999, the Caspian Pipeline Consortium (CPC) began laying pipe for a new 450-mile section of the CPC export line from Komsolmoskaya, Russia, to Novorossiisk.

CPC equity interest holders are Russia, 24%; Kazakhstan, 19%; Chevron Caspian Pipeline Consortium Co., 15%; Lukarco BV, 12.5%; Rosneft-Shell Caspian Ventures Ltd., 7.5%; Mobil Caspian Pipeline Co., 7.5%; Oman, 7%; Agip International (NA) NV, 2%; BG Overseas Holdings Ltd., 2%; Kazakhstan Pipeline Ventures LLC, 1.75%; and Oryx Caspian Pipeline LLC, 1.75%.

Another oil line in the region was finished last year. Early oil was flowing from Chirag field in the Caspian Sea along the 115,000 b/d, 830-km line from Sangachal, near Baku, to Supsa on Georgia's Black Sea coast.