OGJ Newsletter

Market Movement

$5/Mcf gas looms as US heat wave hampers gas injection

The surge in US cooling load demand as temperatures routinely topped 100° F. across much of the Sun Belt last week has weakened natural gas storage injections at a time when the pace of storage refill needs to remain robust if the Nov. 1 heating season onset target of 3 tcf is to be met. This has contributed to natural gas futures prices hovering near $5/Mcf.

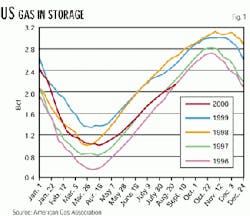

US AGA data show the storage deficit as climbing and not shrinking. Industry injected 52 bcf of gas into storage for the week ended Aug. 25, down from 55 bcf the previous week and 69 and 57 bcf in the comparable weeks of 1999 and 1998, respectively (see chart). That left the year-to-year storage deficit for the week ended Sept. 1 at 377 bcf, compared with 360 bcf the prior week and 365 bcf the week before that. Given this rate of injection and the expected continuance of hot weather, the market can likely count on the storage deficit to remain pretty much where it is now for weeks to come. That can be seen in a comparison with historic trends suggesting that last week's injection rate would have needed to reach 66 bcf to keep from losing still more ground.

In addition to forecasts calling for continuing warmer-than-normal temperatures in the western third of the US and expectations for sizeable volumes of nuclear power capacity going off line, there isn't much in the way of incentives for operators to inject gas now. Looking at the historic-trend comparisons, injection rates should be escalating sharply through mid-September-81, 78, and 79 bcf, according to PaineWebber estimates-in order get the pace of injection back on track. Given the very slight likelihood of that happening, one can expect the year-to-year storage deficit to grow this month, not shrink.

For industry to reach the magic 3 tcf number by Nov. 1, it would have to inject gas at a rate of 89 bcf/week from last week on. Compare that with the refill rates of 50 bcf/week for the same period last year and 59 bcf/week for the preceding 5-year average for the period.

Given this situation, PaineWebber estimates that storage will come in at 2.7 tcf or less on Nov. 1, with the latter a growing likelihood.

Crude market continues bullish trend, nudging $35/bbl

Things are just as bullish on the oil side of the market aisle.

OPEC's meeting, due to start Sept. 10, is likely to be a "bloody affair," contends Canadian Energy Research Institute.

"The price of WTI is flirting with $34/bbl, despite Saudi efforts to quell the romance," CERI said, last week, shortly before NYMEX October crude closed at almost $35/bbl.

The analyst predicts that members with little or no excess productive capacity, notably Iran and Venezuela, will be fighting to hold the quota increase to 500,000 b/d-hewing to the price-band mechanism-while the Saudis push for at least 1 million b/d. The upshot? A quota likely close to the former, but with Saudis making up the difference "on the side," CERI predicts.

Even with the Saudis' continuing attempts to drive down the OPEC basket price to at least $25/bbl, "increased OPEC production may be a moot point," said CERI.

The Canadian analyst notes that current high crude prices are being driven by a growing squeeze on distillate supplies, spurring a fear of heating oil shortages this winter, in turn exacerbated by the lagging availability of refiners' desulfurization and high conversion capacity, which further crimps distillate production.

Venezuela offers PR push to explain high oil prices

Such downstream issues behind high crude prices are the focus of OPEC jawboning in response to the outcry against high oil prices.

Venezuelan Energy and Mines Minister Alí Rodríguez Araque said that, during the Sept. 10 OPEC conference, he will propose the launch of a world information campaign aimed at explaining the real issues behind oil prices.

In an extensive interview published in Venezuela's El Nacionál newspaper, Rodríguez, who is OPEC conference president, said speculation on the international oil market and high taxes in industrialized oil-consuming countries are major factors in the behavior of world oil prices.

"There are days when up to 80,000 contracts are purchased, which represent some 150 million [b/d] -in other words, double the world oil production," he said, speaking of oil price speculation on world futures markets. "What are we going to do together to reduce the high level of speculation that fills the pockets of some people?

"Regarding this issue, there are people who suggest that, in order to balance the market, production must be increased. Of course, I believe that production will have to be increased-but up to what level?" he asked.

The price-boosting market speculation must be studied by OPEC and the heads of state, Rodríguez said, "because it would be dangerously ingenuous to think that, today, with a simple increase in production, the problem of market stability will be resolved."

Rodríguez says OPEC has fulfilled its obligation by responding to "real oil demand." The consuming nations, he said, contribute to increasing product prices for their own citizens in taxes and environmental measures.

The minister said, "What punishes the end consumer is not the raw material-not even the product itself. It is the taxes. In the principal industrialized countries, the average tax amounts to about 60% [of fuel prices]. The measure of the petroleum component is 12%. The rest is distillation and commercialization."

Rodríguez told the newspaper that "it is difficult" to fight speculation on the oil market "if there is no accord between producers and consumersellipseI believe that the meeting that is going to be held in Saudi Arabia during the first half of November, the so-called meeting of producers and consumers, is very important."

He added, "The price band, if applied in a disciplined way, contributes towards reducing the level of speculation, because the behavior of prices [thus] can be predicted. But that alone is insufficient. That is why I believe that producers and consumers must reach an agreement.

"Some analysts believe that oil prices could reach $40/bbl by the end of the year. We, as producers, will do everything possible for that not to occur. But, I insist, the problem does not involve only OPEC...It does not [even] depend principally on OPEC," he was quoted as saying.

Industry Scoreboard - Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

Industry Trends

Prospects for an upturn in the European offshore oil and gas sector were buoyed by Statoil, which released figures suggesting more than 1 trillion kroner will be spent on the Norwegian continental shelf (NCS) over the coming decade.

As the "leading industrial architect" on the NCS, Statoil expects to account for nearly half this amount-some 450 billion kroner-according to Chief Executive Olav Fjell. The oil company further calculates investment in new field developments on the NCS over the next 10 years to total more than 350 billion kroner, with Statoil contributing 60 billion of that sum (see Watching the World, p. 41).

In a new report, Douglas-Westwood and Infield Systems project that total capital spending in the region will jump by $3.5 billion over the next year. The report authors forecast capital expenditure increasing in 2001 to $12.96 billion from $9.49 billion this year. However, the downside to this rising investment trend is that it will be followed by a "long, slow decline." Expenditure totaling some $53 billion will be infused into further developing fields off Europe over the next 5 years-of which $46 billion will be split between the Norwegian and UK sectors.

Higher commodity prices are driving late spending hikes by independents.

Driven by continued buoyancy in oil and gas prices, Mitchell Energy & Development and Barrett Resources both have decided to boost 2000 capital spending for the remaining months of the year-Mitchell by 21% and Barrett by 37%.

Mitchell is raising its capital budget to $302 million from the $250 million level set in June. More than half the increase will be spent on upstream work. Barrett, meanwhile, is increasing its outlays to $227 million from about $166 million.

Mitchell said $33 million of its budget increase has been allocated to field development. It will be used to drill 25 more development wells-213 total for the year-and recomplete or refracture an additional 128 existing wells. The remainder will be used to expand and upgrade midstream infrastructure in North Texas to handle the company's rapidly increasing gas production from the Barnett shale (OGJ, Aug. 28, 2000, p. 20).

Barrett is raising its planned spending for 2000 by $61 million in an effort to drill a total of 1,224 wells for the year. Ninety-six percent of the outlays will focus on Barrett's natural gas operations, notably coalbed methane (CBM) in the Rocky Mountain region, said the company.

Barrett said its "Piceance basin and Powder River basin CBM pays remain the focus of the revised budget, with 49% and 23% of the budget being directed towards these properties, respectively."

The firm plans to drill 1,088 wells in the Powder River basin this year vs. an original budget of 800. The revised plan includes 175 wells in 10 pilots targeting the Big George and other deep coals, says Barrett.

Government Developments

Efforts to privatize pertamina are gathering steam.

Indonesia's new coordinating minister of economy, Rizal Ramli, said his office would take charge of the country's 155 state enterprises in order to speed up their privatization. Jakarta planned to raise some $790 million from the privatization of 10 state firms during April-December 2000. And last fall, efforts to strip state oil firm Pertamina of much of its strength stalled after more than 4 months of debate in the House of Representatives (OGJ, Sept. 13, 1999, Newsletter).

None of the state entities have been privatized, because the market remains weak.

Ramli also said the government would review its planned hike in fuel prices, due to start in October, as the result of an expected windfall of $1.3 billion from oil exports.

Rachmat Sudibyo, director general of oil and gas at the energy ministry, pointed out that Jakarta would earn an additional $350 million/year from oil exports for every dollar increase in the crude price. But at the same time, subsidies on imported oil products had also gone up, by $200 million, he added.

Suffering from strikes by truckers and farmers hit by high diesel fuel prices, not to mention general consumer discontent, the French government wants the oil industry to contribute to the 2001 national budget in order to make up for a 30% tax cut it has decided to grant on domestic fuel oil.

The government's offer of a tax cut, plus other measures, has been rejected by truckers and farmers as insufficient, however.

Taxes on oil products in France range from 68% of fuel prices for diesel to around 75% for premium gasoline.

The striking laborers have blockaded some 50 fuel depots and refineries in the country in protests over high diesel prices and high taxes on oil products. If the strikes continue, they could have serious consequences on fuel supplies in many areas of France.

Warning that US natural gas prices could increase further this winter, the Natural Gas Council urged Pres. Clinton and Congress to increase funding for the Low Income Home Energy Assistance Program (LIHEAP). They also asked Clinton to consider releasing emergency funds earlier in the winter season for low-income households hit by large gas bills.

In letters sent Sept. 1 to Clinton and House and Senate appropriations committee chairs C.W. Bill Young and Ted Stevens, NGC expressed concern that the administration's request for funding for LIHEAP may not be adequate for the upcoming winter. They urged approval of at least $300 million in additional funding for regular LIHEAP appropriations for fiscal year 2001.

The administration's request for LIHEAP funding for FY 2001 is $1.1 billion, with $300 million available for emergency release.

"Although some portion of the $600 million in additional emergency funds provided by the FY 2000 supplemental appropriation may also be available this winter, current LIHEAP funding can serve only 12-15% of eligible households. These recipients could possibly need up to 35% more assistance this winter just to provide the same level of benefit as last winter," NGC executives said.

Funding levels for LIHEAP will be determined this fall through negotiations between Congress and the administration.

Quick Takes

Statoil is gearing up for phase two of its gullfaks satellites project.

Statoil has just added two large modules weighing 750 and 850 tonnes, respectively, to its Gullfaks C platform in the North Sea.

The installation of these two modules is part of the second phase of its Gullfaks satellites project. Statoil is converting the platform in order to start receiving gas from Gullfaks South and Rimfaks beginning in fall 2001. From October 2001 through 2015, 50 billion cu m of gas will be piped from the two satellites to Gullfaks A and C platforms. The gas will be carried via a 14-km flowline bundle from the satellites and then delivered to continental Europe via Statoil's Kårstø complex north of Stavanger.

In other development news, FX Energy says its Kleka-11 well on western Poland's Kleka East structure will begin commercial production in November. FX says this will make it the first western gas producer in Poland. Kleka-11 is in the Fences Project Area of the Kleka East structure, 2 km southeast of Polish Oil & Gas Co.'s (POGC) Kleka field. Fences Project area interest holders are operator POGC 51% and FX Energy 49%.

TOTALFINAELF wants TO EXPAND its MIDDLE EAST ACREAGE.

TotalFinaElf entered negotiations with Libya to expand its acreage holdings there and to bid for new blocks in Libya's upcoming licensing round. TotalFinaElf wants to build on its interests in Mabrouk field, which it operates, and on the Al Shahra field development. The company is also carrying out exploration work in Libya's Murzuk basin.

The new licensing round, understood to cover some 130 blocks-20 offshore-has attracted the interest of, among others, Lundin Oil, Edison Gas, and Lasmo.

Elsewhere on the exploration front, operator TotalFinaElf says it made a 10th "promising" deepwater oil discovery on Block 17 off Angola (see map, OGJ, Oct. 18, 1999, p. 40). On test, Perpetua-1, drilled in the eastern portion of the block in 795 m of water, flowed at a rate of 8,740 b/d of 20° gravity oil. The well is about 33 km east of the Tulipa find and 35 km east of Dalia. Block 17 production is scheduled to begin in second half 2001, and output is expected to plateau at about 200,000 b/d for 5-6 years, says TotalFinaElf.

Naftex Energy subsidiary Coplex Petroleo do Brasil and two other companies agreed to a farmout with Petrobras that will give them a combined 65% working interest in Block BS-3 in the Santos basin off Brazil's southeast coast. The new joint venture plans to drill an exploratory well on the block and develop the Coral and Estrela do Mar fields. Water depths on Block BS-3 are 330-750 ft. The companies plan to drill and complete a new well in Coral field and reenter, drill a sidetrack from, and complete an existing well in Coral. In Estrela do Mar, they will reenter and complete a well. Aggregate reserves for the two fields are estimated at 26.9 million bbl of 37-42° gravity, low-sulfur oil. The other two partners are Brazil's Queiroz Galvao Perfuracoes and Starfish Oil & Gas. The three companies will carry operator Petrobras through the development phase.

Triton Energy says Global Marine's R.F. Bauer drillship spudded the Ceiba-6 delineation well on Block G off Equatorial Guinea and the Sedco 700 semi started completion of the Ceiba-2 well after completing Ceiba-4. Ceiba-6, 2.5 miles south of Ceiba-4, is designed to delineate the southeastern extent of the main field and test the potential of laminated sands and other secondary reservoirs. Triton expects oil to begin flowing from Ceiba by yearend from the first four wells drilled and completed in the field. Operator Triton also plans to drill up to six exploration wells after Ceiba-6.

American International Petroleum Corp. (AIPC) subsidiary American International Kazakhstan received permits from Kazakhstan authorities to reenter the Begesh 1 oil well on License 953 in southwestern Kazakhstan. The main target is the Upper Jurassic, which has not been tested before on the 12,000-acre Begesh structure. AIPC owns a 70% working interest in the 4.7 million-acre exploration license. Work is to begin this month. Plays for gas in Ordovician and perhaps Cambrian zones in central West Virginia have grabbed the attention of many formerly without interest in Appalachian basin operations. Columbia Natural Resources touched off the play about 18 months ago with a Trenton discovery in Roane County that evidenced bottomhole pressures of 6,600 psia and indicated flow capabilities of around 50 MMcfd (see map, OGJ, Nov. 8, 1999, p. 81). One source told OGJ that as much as 3,000 ft of Cambrian sediments may exist beneath the Ordovician carbonates in at least one of the areas CNR is working.

Conoco's vixen project has come in early and under budget.

Conoco UK brought its subsea Vixen natural gas development on stream ahead of schedule, under budget, and-at 140 MMscfd-at a higher rate than originally planned.

The project, in 33 m of water on Block 49/17 in the southern North Sea, came on line 2 months earlier than anticipated and at £24 million-some 11% under budget.

Vixen is being produced via a single subsea well developed by reentering the field's discovery well and completing a 49° sidetrack through the reservoir; gas is being transported by pipeline 8.6 km to Conoco's Viking B central complex and then on through the Viking transportation system to the Theddlethorpe gas terminal on the east coast of England. Vixen is thought to contain some 117 bscf of natural gas and have a field life of 6 years. Operator Conoco and BP have equal interests in the field.

MMS plans its first pilot project offering federal royalty oil from Gulf of Mexico leases. The agency plans to offer 35,000 b/d of oil from 58 federal leases in the gulf. Delivery will be for a 6-month period beginning Nov. 1, with the opportunity for a 6-month extension. MMS Director Walt Rosenbusch said, "This is the first sale of royalty in-kind (RIK) oil open to all bidders. Previous oil sales have been open exclusively to eligible small refiners. MMS will monitor the effectiveness of the RIK approach to taking crude oil royalties in the Gulf of Mexico."

Hyundai still has high hopes FOR building a petrochemical complex in North Korea.

South Korea's Hyundai Group says it still hopes to build a petrochemical complex in North Korea by 2008, although it adds that the original plan to build a refinery alongside it now looks doubtful.

These basic petrochemicals facilities would be subsumed under the third phase of a larger project to establish a special economic zone at Kaesong, 8 km from the border with South Korea. The zone will occupy some 56 million sq m of land in the first phase.

Although Hyundai says the petrochemical complex is still in the very early stages of planning, "The idea is to eventually turn Kaesong into a world-scale light and heavy industrial complex," Hyundai Assan, the subsidiary in charge of the project, told OGJ.

As for the refinery, "originally, the industrial complex was to be located on the coast, which would have made it suitable for also hosting a refinery. But Kaesong is some 90 km inland, and given North Korea's poor transportation infrastructure as well as Kaesong's proximity to South Korea, a refinery at Kaesong does not look a very viable proposition," the official said.

Topping refining news, Sunoco on Aug. 31 experienced an emergency shutdown of the 93,000 b/d FCC unit at its Marcus Hook, Pa., refinery.

Company emergency personnel responded immediately, and the unit was quickly put into a safe condition and shut down. The shutdown was the result of an electrical malfunction, said Sunoco. The firm said it is taking measures to correct the cause of the shutdown and to prepare the unit for restart which was expected last week. A detailed investigation into the cause of the incident is being conducted.

Ecuador's pipeline dilemma roils again with controversy.

Ecuador's Army Corps of Engineers (CIE) was a surprise last-minute entry in what was supposed to be a bidding contest for private companies to build a second major oil export pipeline in that country.

A CIE representative refused to tell reporters the names of that government entity's civilian partners. However, Ecuadorian media identified those partners as the Brazilian firms Andrade Guti

Stan E. Hooley, an international managing director for Tulsa-based Williams, which is competing to build and operate a heavy oil pipeline in Ecuador, said CIE submitted the proposal as its own, with AG listed as technical advisor. By submitting the application, CIE "certainly signals its technical support" for that proposal. Hooley said CIE's involvement raises the question of whether Ecuadorian government officials can fairly evaluate two private industry proposals against a plan submitted by another government entity.

In other pipeline action, Midcoast Energy Resources said a JV it owns with Associated Pipe Line Contractors, Midcoast del Bajio, was awarded a 10-year natural gas transportation contract to serve the Silao, Mexico, plant belonging to General Motors de Mexico. Midcoast also reached agreement to serve the Fipasi Industrial Park, which includes facilities owned by American Axle, Weyerhaeuser, and Avintech. Plans call for laying a 59.1 mile, 16-in. pipeline from an interconnection with a Pemex pipeline near Valtierrilla to Leon. The system will provide gas transportation services to parts of central Mexico that do not currently have access to natural gas, said Midcoast. Both customers are in central Mexico's Bajio region, near Leon, Guanajuato. Under the terms of the contract with GM, Midcoast del Bajio will provide 100% of the Silao plant's gas requirements for a 10-year term beginning in spring 2001. A unit of Williams is holding an open season through Sept. 29 for shippers interested in incremental firm transportation service created by the Momentum expansion project. Momentum is a proposed expansion of the Transcontinental Gas Pipeline system from Louisiana to Virginia designed to meet increasing natural gas demand in the southeastern US. The project is anticipated to be in service by May 1, 2003.

BP ordered two new LNG carriers worth over $300 million-and options to buy another three vessels-from Samsung, as part of a strategy to develop the group's international traded gas business.

Construction of the vessels, which will feature the Technigaz MKIII containment system with a storage capacity of 136,000 cu m, will begin next April. Delivery of the first tanker is scheduled for fourth quarter 2002, and the second for first quarter 2003.

In other tanker news, a Lukoil ice-breaking tanker was loaded with crude at Varandey on the Pechora Sea coast in Russia's Nenets Autonomous Okrug. The marine transportation system, created in less than a year, includes an onshore tank farm, an offshore loading terminal with capacity of over 1 million tonnes/year, a subsea pipeline, ice-going tankers, ice breakers, logistics vessels, and oil-spill gathering facilities. Oil produced onshore will be transported via surface pipeline to the onshore tank farm and marine terminal for transport by Lukoil's ice-going tanker fleet to the Russian market and to West European ports.

Duke has purchased market hub partners for $250 million.

Duke Energy Gas Transmission agreed to purchase the natural gas salt cavern storage business known as Market Hub Partners from subsidiaries of NiSource for $250 million in cash plus the assumption of $150 million in debt. The business has 23 bcf of storage capacity.

The present storage facilities are in Liberty County, Tex., and in Acadia Parish, La. MHP is also developing salt cavern storage facilities in Copiah County, Miss., and Tioga County, Pa.

The stock purchase is expected to close later this year, pending US Federal Trade Commission approval.

Gullfaks C platform. Photo by Oyvind Hagen, courtesy of Statoil.