Unlike many other US independent producers these days, Mitchell Energy & Development Corp., The Woodlands, Tex., has resisted the urge to merge and has decided to go it alone as a niche player in the US natural gas market.

Sitting atop an enviable acreage position concentrated in North Texas, Mitchell is again poised for growth to maintain its status as one of the top independent producers of natural gas and NGL in the US.

The company is using the newly developed light sand fracturing technology in the Barnett shale in Newark East field in North Texas to increase its natural gas production. Natural gas sales for first quarter fiscal 2001 have already exceeded this year's goal by escalating 14% to 279 MMcfd, and NGL production has climbed 22% to an average 51,400 b/d.

The emphasis on production growth notwithstanding, the 54-year-old Texas independent has embraced the view that now dominates US independents' thinking: Take whatever steps are necessary to build shareholder value.

Background

In 1946, Mitchell was founded as a small wildcatter, which has since become one of the largest US independent producers of natural gas and NGL.

During 1991-96, the company's natural gas sales and NGL production grew by an average 4%/year. By fourth quarter fiscal 2000 (ended Jan. 31, 2000), the company's accelerated Barnett shale development program had pushed gas production to a record 266 MMcfd. With improved NGL economics, the acquisition in October 1999 of the Jameson, Tex., gas processing plant, and increased gathering throughput, NGL production averaged 50,400 b/d, a level not seen since the early 1990s, when Mitchell operated more than twice as many plants.

The company now owns and operates six major gas-processing plants throughout Texas.

One characteristic that sets Mitchell apart from other independents is an extensive acreage holding that provides a long-term backlog of prospects for continuing development, the company said. The company's largest producing area covers 597,000 gross acres in North Texas and accounts for almost half its production and reserves.

But even an emphasis on natural gas and minimal exposure to dry hole costs didn't save the company from the same price-related downturn that afflicted the rest of the industry last year.

For fiscal 2000, the company reported net earnings of $97.1 million compared to the prior year's net loss of $49.7 million.

Strategic review

In October 1999, Mitchell engaged investment banking firms Goldman Sachs & Co. and Chase Securities Inc. to advise the company on strategic alternatives, which included a possible sale or merger. Another option was to continue to operate as an independent oil and gas company.

W.D. Stevens, Mitchell's president and COO, said, "The driver for considering a merger or sale was [the image of] a dissatisfied shareholder-the value our shareholders were recognizing versus others' companies. We thought that there was a fair chance that the right sort of sale, merger, and price would come along, but that didn't materialize. We just didn't get an offer we considered fair value for our shareholders."

Stevens added, "We told companies when they came to our table, 'Don't think that we're in a position where we feel we have to sell the company-we don't.'

"As a company, we believe that we have a bright future and [that] we can continue to exist as an independent if we don't get what we think is a fair offer; some companies tested us on that."

Stevens said he doesn't believe that the quality of the company's asset base had anything to do with not receiving what Mitchell considered was a fair offer but, instead, was the result of depressed oil and gas company stock prices, which made prospective buyers very conservative.

Even though the stock price nearly doubled in the past year, Mitchell was convinced its shares were undervalued when comparing its earning ratio and cash flow multiple with those of its peers. So when it decided, in April, to continue to operate as an independent company, as part of its strategic review, it combined its Class A and Class B shares into a single voting class. The idea was to improve market liquidity and eliminate confusion of a two-class share structure. The company also initiated a balanced program to repurchase 2.5 million common shares of its stock and to reduce its long-term debt. In the first quarter, Mitchell funded its capital expenditures from cash flows and reduced debt by $45 million.

Market downturns

Its focus on natural gas wasn't the only reason Mitchell was able to emerge from the oil price collapse in better shape financially than many of its peers.

The prior 2 fiscal years weren't great periods for the US natural gas business, and Mitchell's strong NGL component was hit hard by downturns in the oil and petrochemical industries. So far this year, NGL prices have averaged over $22/bbl, more than double the $10.68 received last year.

Stevens said the key to surviving market downturns is "you got to have your cost structures down lean and mean.ellipse Then, when the upturns come you can really move all that price improvement to the bottom line, because your cost structure has gotten better. That's what we've been doing with this company, going back to the early '90s, getting our cost structure down to what I consider a bare minimum."

Stevens noted that, in 1995, the company had about 1,300 employees but reduced that number to about 800 by 1998.

He said, "We've gone through two significant downturns in '95 and '98, and that hasn't been a pleasurable experience for any of our employees and certainly not for us in management, but in order to get through [it]...it was absolutely essential."

Resource potential

In the last couple of years, the company's enviable acreage position has enabled it to jokingly express its strategy as: "We don't find gas- we manufacture it," said Stevens.

"I laugh and tell my exploration people, 'I don't need geologists. We don't find [gas]-it's there. Everybody's known it's there for 50 years; we just didn't know how to produce it economically.'"

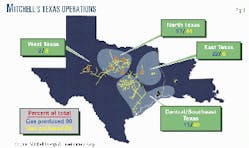

Mitchell's exploration and production is concentrated in three core areas-North, East, and onshore Gulf Coast Texas (Fig. 1). For the past 7 years, the company has focused on developing Newark East gas field, which continues to provide the best economic returns and development opportunities.

The field, some 40 miles north of Fort Worth, produces from Mississippian Barnett shale at 7,000-8,000 ft that averages 550 ft of pay(Fig. 2). The US Geological Survey, in 1998, estimated Barnett shale reserves at 10 tcf of gas, the equivalent of a 1.67 billion-bbl oil field.

Chairman and CEO George P. Mitchell said, "Over the last few years, our estimated recovery efficiency in the Barnett has more than doubled, but we are still only recovering less than 10% of the total gas in place. Light sand fracture technology has helped us tremendously in our efforts, but we continue to look for new ways to increase reserves."

Light sand fracture technology has improved the flow of natural gas in the Barnett by forcing large volumes of water and a minimal 100,000 lb of sand into the formation. It has become the preferred alternative to costly frac gels and has resulted in a savings to the company of $140,000/well in sand, chemicals, and gel. Moreover, it has reduced unit development costs to 47¢/Mcf from 64¢ (OGJ, Sept. 27, 1999, p. 89). As a result of this technology, the company has expanded the field limits and completed wells in the previously uneconomic Upper Barnett interval (Fig. 3).

"We knew we had found a crucial key to unlocking the potential of this tight gas reservoir when the results from our light sand fracture completion technology came pouring in," said Mitchell. "But now we're also able to use this technology to significantly extend the life of a well and increase the amount of reserves recovered per well. The benefits of this combination are magnified when you consider that we likely have another 2,000-5,000 undrilled locations even after working the Barnett play for nearly 20 years," he said.

To set the stage for those potential 5,000 locations, the company has started three pilot programs to evaluate the impact of reduced well spacing. Initial results show that 27-acre spacing, vs. the current 55-acre spacing, show no adverse effects on neighboring wells, said the company. A decision on whether to move aggressively on a field-wide spacing reduction will be made early next year.

Natural gas reserves

The application of light sand fracture technology has led to the largest single increase of natural gas reserves in the history of the company.

For 12 consecutive years, the company each year has added more proven natural gas reserves than were produced, while still expanding the significant backlog of undrilled prospects. The company said, "At yearend, we reached a record reserve base of 1.1 tcf of natural gas equivalent and are confident of our ability to add substantially to that amount with work now under way to determine the ultimate reserve potential of the Barnett."

Aggressive field development in the Barnett has added 507 bcf of natural gas and 41 million bbl of NGL to its proven reserve base. Total estimated proven reserves have rocketed to an all-time high of 1.467 tcf of natural gas and 210 million bbl of NGL, up 45% and 18%, respectively, from the prior year.

In order to keep up with rising natural gas supplies from the Barnett, the company is expanding its Bridgeport plant northwest of Fort Worth. The expansion will increase processing capacity of the plant to 310 MMcfd from 210 MMcfd and will boost NGL production to over 27,000 b/d from the current 19,000 b/d. Total estimated cost of the project is $15 million.

"Our acquisition of the remaining 50% of the Jameson plant was a significant step enabling us to handle the added volume," the company said, "just as the 100 MMcfd expansion of the Bridgeport plant, to be completed by December, should allow us to sustain our current double-digit growth in fiscal 2002.

"Already, we are producing more NGL with just six plants than we did 5 years ago, when we held interests in 31. The Bridgeport expansion will improve efficiency by increasing methane recovery to 90% and reducing our consumption of fuel and power."

Spending outlook

For fiscal 2001, the company has increased its budget by 50% to $221.5 million, up from last year's expenditures of $147.8 million, excluding the Jameson plant acquisition.

"We have stepped up our capital spending to take advantage of the favorable outlook for natural gas and our extensive drilling backlog in the Barnett shale formation in North Texas, where we will drill more than twice as many wells as last year," said Mitchell.

The bulk of the company's new budget, $183.1 million, will fund exploration and production, with $36.2 million going for gas services and the remainder for corporate projects.

As part of the company's accelerated drilling program, it has budgeted $127 million to drill 196 net wells, up from last year's $85 million spent on 111 net wells. The focus remains on developing the Barnett shale, where 136 wells are planned. The company said it will use the same light sand fracturing technology applied in the Barnett and extend it to wells in Limestone and Freestone counties in East Texas, with 26 wells scheduled for that area.

Other areas

The company has just started an infill drilling program in North Personville field in East Texas. North Personville and several smaller fields make up the company's second largest lease block, consisting of 74,000 acres, in Limestone County. Nearly 300 wells have been drilled in the area since 1970, primarily targeting the Cotton Valley limestone formation.

The company will use light sand fracture technology to reduce the cost to drill and complete a typical limestone well by about $350,000, or 30%. These improved field economics should allow a reduced spacing pattern of less than 160 acres/ well, which could prove up significant additional reserves, the company said. Depending on rig availability, about 18-24 wells are planned this year, and 110 infill locations could ultimately be drilled. The company expects the infill program to increase production from North Personville by 25% to 50 MMcfd by yearend.

In Pinehurst and East Lake Creek fields in Montgomery County, Tex., development of the multipay Wilcox section continued last year with the completion of seven new wells. One of the wells was a 14,500-ft deep test of the Lower Wilcox sands. The well encountered four sandstone gas pay zones and is producing 3.5 MMcfd of natural gas.

A 1-mile step-out of this well is slated for first quarter 2001, and two exploratory wells will be drilled into the Frio and Yegua sandstone formations. Six additional development wells will target the Upper and Middle Wilcox, and 16 recompletions of existing wells are planned, the company said.

Outlook

"Last year's progress in all dimensions of the company enables us to enter fiscal 2001 in the best shape ever-both operationally and financially," said the company. "Supported by the strong improvement in energy price fundamentals, we expect to increase production of both natural gas and NGL by 15% this year and maintain a higher level of growth than in the past."

"We've come so far in 10 years, that I wouldn't say we were at the limit," said Stevens. "Where we will be 10 years from now, I don't know, but I'll say one thing: We'll still have that acreage block, and we'll probably still be farming it."