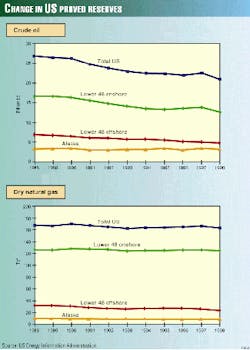

US crude reserves plunged 7% in 1998

The US Energy Information Administration reports proved reserves of US crude oil fell 7% in 1998, the largest percentage decline in over 50 years. Crude reserves were 21.03 billion bbl, down 1.5 billion from the end of 1997.

An EIA study noted crude oil prices plunged in December 1998 to levels last seen in 1935, after adjusting for inflation. It said falling crude prices led to a drop of almost 60% in rigs drilling for oil during 1998. This led to a decline in the number of new and producing oil wells, which was followed by the drop in oil reserves.

Only 24% of 1998 oil production was replaced by proved reserve additions.

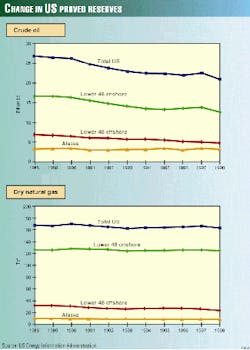

The report said US dry gas reserves slipped 2% in 1998, ending 4 years of increases and offsetting two thirds of the gain from the prior 4 years. Natural gas reserve additions in 1998 replaced only 83% of gas production.

US dry gas reserves at the end of 1998 were 168 tcf, down 3.2 tcf from the end of 1997. Gas liquids reserves were 7.5 billion bbl, down 449 million bbl from the previous year.

The EIA study said, "Estimates of the overall US natural gas resource base, which includes undiscovered gas and unproved gas reserves, are clearly large enough to support future growth in domestic supplies. However, the 1998 decline in natural gas proved reserves demonstrates that the oil and gas industry faces economic and technical challenges in meeting the forecasts of increasing demand."

Oil reserves

EIA said crude oil reserve additions would have been even smaller in the absence of a few large, long-term development projects that were continued by their operators in the face of low oil prices, especially in California's heavy oil fields, where such projects helped that state's reserves to increase.

The agency noted that some proved reserves become uneconomic and unproved with lower prices. The annual average domestic price for crude oil declined 37%, from $17.23/bbl in 1997 to $10.88/bbl in 1998.

"Low prices imply poor economics for oil producers, and poor economics leads to low drilling levels. Only twice over the last 100 years have fewer oil wells been drilled.

"Despite a small drop in natural gas prices, gas well drilling increased," noted EIA.

"During 1998, even large offshore and Alaskan North Slope projects were delayed or canceled. The low prices were much tougher on smaller and marginal oil well operators, as thousands of wells were shut in because they could not meet their direct operating costs, much less turn a profit.

"As a result, oil production and proved reserves dropped sharply in most Lower 48 States areas. Texas's proved reserves fell 13% in 1998, which for the first time in a decade placed Texas second to Alaska in oil reserves."

EIA noted that wellhead prices began increasing in March and are above $20/bbl, but drilling for oil has yet to rebound.

Natural gas

For both of the two leading US producing areas-Texas and the Gulf of Mexico federal offshore-proved reserves of natural gas were down in 1998.

The report said small increases in the deepwater gulf did not offset the persistent decline of proved gas reserves on the shallow gulf shelf.

Reserves and production of gas from unconventional sources like coalbed methane continued to grow in 1998, despite the decline in reserves and production of conventional gas. Coalbed methane reserves accounted for 7% of 1998's proved gas reserves.

Although the number of gas wells increased, the quantity of gas discovered per exploratory gas well was down 32% in 1998.