Pipelines, 44 rigs facilitate Powder River basin coal gas play

Several dozen operators are forging ahead in the burgeoning Powder River basin coalbed methane play, one of the largest U.S. drilling programs in terms of number of wells.

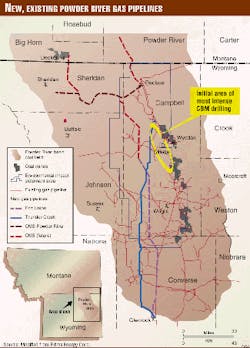

Pipelines designed expressly to carry gas from the coal seams are in advanced stages. Capacity to move coal gas out of the basin is to climb sharply during the rest of this year.

Completion of the $80.5 million, 143 mile, 24 in. Medicine Bow lateral from Glenrock to Cheyenne in January 2000 should boost interstate transportation of Powder River CBM volumes. Its 260 MMcfd capacity could grow to 440 MMcfd by late 2001.

June 1999 coal seam gas production from the Powder River basin averaged 153 MMcfd from 962 wells, Wyoming Oil and Gas Conservation Commission figures show. That contrasts with early 1997, when 240 coal wells were on production in the greater Gillette area (OGJ, Mar. 10, 1997, p. 79).

Publication of an environmental impact statement that relates to CBM development on federal lands is delaying some development. Release of the EIS is now anticipated in late 1999.

The CBM play is developing alongside the basin's extensive conventional oil and gas infrastructure. Some operators see significant CBM drilling levels persisting there for 5-10 years.

Scope of the play

Perhaps as much as 4,000 sq miles are under lease for CBM exploitation in the basin, which covers 26,000 sq miles in northeastern Wyoming and southeastern Montana.

The commission has approved 5,612 drilling permits for coal gas wells since the first one in April 1987, said Don J. Likwartz, oil and gas supervisor. That includes 284 in May, 392 in June, 486 in July, and 608 in August 1999. The state has a backlog of 150 permit applications.

As of Aug. 31, 2,826 of the wells were drilled and 1,946 of those were reported completed.

Likwartz said 44 small water well and seismic shot hole rigs are drilling CBM wells in northeastern Wyoming. Depths generally range from 300-1,500 ft, although some of the permits specify as deep as 2,500 ft in the deeper western part of the basin.

The commission has issued permits to 65 different operating entities in the play, none of which is a major oil and gas company.

Wyoming gas production for January through May 1999 was 506 bcf, up 4.4% on the year, with 19 bcf coming from coal gas wells.

No field names have been designated for CBM in the Powder River basin since the wells are being drilled into a continuous coal deposit, Likwartz said.

Transportation projects

Likwartz noted that 511 coal gas wells were completed and shut-in waiting on pipeline connections as of late August.

Devon Energy Corp., Oklahoma City, and KN Energy Inc., Lakewood, Colo., completed the $100 million, 126 mile, 24 in. Thunder Creek pipeline from Gillette and Glenrock on July 23 and began taking gas Sept. 1.

Capacity is 450 MMcfd of gas. Thunder Creek has connections to four existing or planned gas pipelines: KN Interstate, CIG, Wyoming Interstate Co.'s proposed Medicine Bow Lateral, and KN's proposed Pathfinder line.

The Buckshot carbon dioxide removal plant associated with Thunder Creek is to start up in November.

Fort Union Gas Gathering LLC is starting up a $46 million, 106 mile, 450 MMcfd system that terminates near Glenrock. It is a venture of CMS Energy Corp., Enron Capital & Trade Resources Corp., Western Gas Resources Inc., and CIG Resources Co. It will gather coal gas as far away as 30 miles north of Gillette.

Pennaco Energy Inc., Denver, and the Bear Paw Energy Inc. unit of TransMontaigne Inc., Denver, earlier this year started up gathering systems and compression for 8,600 gross acres of Pennaco's leases 10 miles south of Gillette. The facilities serve 100 wells, and 200 more could be added.

Wyoming Interstate added more than 7,000 hp of compression at Laramie and Cheyenne in late 1998, boosting east and westbound capacity off its Powder River basin lateral.

Methane is compressed from about 250 psi in the coals to 1,000 psi or more for pipeline shipment.

Development areas

All activity described is in Campbell County, Wyo., unless noted.

Western, operating as Lance Oil & Gas, controls about 425,000 net acres in the play. Western controls the largest amount of acreage in the play and has a large joint venture with Barrett Resources Corp., Denver.

Of the 1,760 wells completed in the play through June 30, Lance/Barrett completed or purchased 815, of which 535 were producing. Lance had drilled 514 wells by that time, and Lance/Barrett were to drill 500 wells this year and 600-800 next year.

Joint production averaged 90 MMcfd in second quarter 1999 and was to grow to 110 MMcfd this month and 140 MMcfd in early 2000.

Barrett is working on several new pilots on behalf of the joint venture.

The joint MIGC pipeline carried 165 MMcfd of gas in second quarter, including 124 MMcfd of CBM and 34 MMcfd of third party production.

Devon is drilling 200-300 wells and spending more than $100 million this year in the basin, where it holds 250,000 net acres.

Devon is drilling in southern 42n-75w, about 24 miles southwest of Wright and just east of Pine Tree oil field.

Palo Petroleum Inc., Dallas, filed a development plan for its Northeast Spotted Horse CBM Project entailing 69 wells on 4 sq miles in part of Recluse oil field in 56n-74w.

Yates Petroleum Corp., Artesia, set up for a 15 well program west of Gillette in 36-51n-74w, just northwest of Kitty oil field.

J.M. Huber Corp., Houston, announced a program in northern Sheridan County within 3 miles of the Montana line. This area is in 36-58n-84w, southwest of CX field, a CBM area Redstone is developing in Big Horn County, Mont. The company is also working in Johnson County about 15 miles north of Buffalo.

MTG Operating Co., Buffalo, is working an area 14 miles northeast of Buffalo in Johnson County.

CMS is active in northwestern 52n-75w, 12 miles west of Kitty oil field, and 56n-75w, 10 miles west of Recluse, in a joint venture with Pennaco.

Prima Energy Corp., Denver, said about 80% of its 135,000 net undeveloped acres in the basin are on federal lands. Drilling is subject to release of the EIS, but the company has filed several hundred intents to drill. Its largest blocks are in Campbell County west of Gillette and south of Wright.

Prima has drilled eight initial wells and plans to drill 15 more, most on fee/state acreage, most by yearend.

Coleman Oil & Gas Inc., Denver, has a program midway between Wright and Sussex.

Pennaco, in addition to its development south of Gillette, holds acreage north and south of Sheridan and large spreads in northeastern Campbell County and southeastern Montana.

Redstone Gas Partners, Denver, has several hundred locations staked in 9s-39e, 40e, and 41e, Big Horn County, Mont., all within a few miles of the town of Decker.

Gas, coal statistics

Various entities estimate 30-40 tcf of original gas in place in the Paleocene Fort Union and overlying Eocene Wasatch formations of Tertiary. Tongue River, or upper Fort Union, is deemed the most prospective part of that formation.

The basin contains an estimated 1.3 trillion short tons of coal in place, 3.5 times that of the San Juan basin and 21 times that of the Black Warrior basin. A typical well in the play will penetrate 250 to 1,000 ft of coal (OGJ, Apr. 26, 1999, p. 35).

With the coals at 1,000 ft or less along the basin's eastern flank, drilling and completion costs are $40,000-65,000. Coals range as deep as 3,000 ft farther west in the basin.

Well performance varies greatly, but the basin has largely defied previous wisdom about coal reservoirs, Scott Montgomery points out in Petroleum Frontiers.

That wisdom in the early 1990s was that higher rank coals with relatively high gas contents were necessary for commercial rates of production. These and other assumptions "have been shown largely irrelevant to the Powder River basin, where thick, shallow, low-rank, high-permeability coal beds appear to produce mainly free and dissolved gas at rates often well above those measured for deeper, higher rank coals in other basins."

Wyoming also has coalbed methane resources in the Bighorn, Green River, Hanna, and Wind River basins and on the Overthrust Belt, Gas Research Institute points out. Likwartz said the commission has issued several permits to drill exploratory coalbed methane wells in Carbon, Sweetwater, Uinta, and Natrona counties.