James Schlesinger

Center for Strategic and International Studies

Washington, D.C.

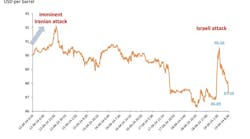

We are now experiencing the first oil crisis brought on by the actions of consumers. Today's oil price runup reflects the novelty of importing nations binding together to refuse to purchase oil rather than an unwillingness or inability of producer nations to supply oil.

That the gulf crisis should trigger (once again) appreciation of the desirability of producer-consumer cooperation is self-explanatory. Yet the paradox is that we have just had a remarkable demonstration why the question for such cooperation will remain secondary.

To punish Iraqi aggression, the United States has rallied most nations to impose an oil embargo-and to accept consequent economic hardships. These events almost make a mockery of the quest for producer-consumer cooperation. Perhaps the time has come to examine why such cooperation inevitably remains elusive.

AN ELUSIVE GOAL

Following are some major themes bearing on the elusiveness of the goal of oil market stability:

- The oil market is peculiarly susceptible to intermittent disruption. This reflects the concentration of international supply in a politically unstable region of the world combined with the immediacy of the requirements of importing nations for this near-essential consumable. The very susceptibility of this market to disruption, however, makes it more or less incumbent on observers to indulge in the piety that we must all strive to prevent the market from being disrupted.

- The quest for oil market stability is akin to the quest for the Holy Grail. The knight errant's quest seems destined to prove quixotic-for the objective of oil market stability is regularly subordinated to some nation's political or military objective.

- Any such disturbance takes place in a market characterized by inelastic short-term demand, long lead times in bringing on additional capacity (which may mean inelastic short-term supply), and very large inventories, expensive to maintain but essential for both refinery operations and the psychological comfort of users. This last leads almost inevitably to a perverse surge of demand relative to consumption, whenever supplies are uncertain and prices are rising.

History provides examples of the priority placed on political objectives, either foreign or domestic, that has regularly meant subordinating the objective of oil market stability.

In 1947 concern regarding U.S. relations with the Arab countries, the security of oil supply, and possible economic instability led both the U.S. Department of State and the U.S. Department of Defense to oppose early recognition of Israel. President Truman simply disregarded the advice, including that of General Marshall, and recognized Israel within a matter of hours.

In 1951, when Premier Mossadegh nationalized the Anglo-iranian Oil Co., the political issue of ownership rights took clear precedence over oil market stability. To adapt the decision of the western governments to cease importing Iran's oil to that political decision required major redirection of supply and a major readjustment of the logistical system.

In 1956 Britain and France (if not Israel) were far more concerned about reversing Colonel Nassar's seizure of the Suez Canal than they were about oil market stability or the risks of oil supply cutoffs.

In 1967, during the Six Days War, neither side demonstrated much concern for oil market stability. That the interruption of supply and the extended closure of the Suez Canal caused such limited impact on the oil market reflected the brevity of the war, the serendipitous existence of a large fleet of supertankers constructed in response to the canal's closure in 1956, the rapid redirection of oil supplies, and the availability and rapid development of Libyan fields producing short-haul crude.

In 1973 the United States concluded that the political imperative of saving Israel transcended by far the risk of an oil supply interruption. Though the United States had tended to discount both the risk and consequences, it had earlier received fair and ample warning. After initiation of the American airlift to Israel, King Feisal felt he had no alternative but to reduce production-irrespective of its impact on the oil market.

In 1979 the Ayatollah Khomeini was prepared to use "the oil weapon," first as an instrument to bring down the shah and subsequently as a way to defy the western imperialist world. (Khomeini himself saw Iranian oil less as an explicit weapon than as the cause of his nation's corruption and something to be rescued from exploitation by Westerners and their tool, the shah.) At the end of 1979, however, the flow of Iranian oil was interrupted once again, this time by the Americans who sought an embargo to punish Iran for its seizure of the embassy.

Thus, in 1990 there is scarcely anything novel in the priority of political objectives over oil market stability. Nonetheless, there is a new element of irony. In the face of limited production capacity, the importing nations have chosen to pressure Iraq by denying themselves Iraqi and Kuwaiti oil-irrespective of the repercussions for their own economies. Moreover, the gulf crisis itself may have been initiated by Kuwait's earlier decision to produce well above its Organization of Petroleum Exporting Countries quota as a means for pressuring its larger neighbor to settle border disputes.

Thus, even a brief review of recent history demonstrates the regular subordination of oil market stability to political objectives, usually external. Indeed, the oil market may most vividly-and painfully-illustrate what the Germans of an earlier era called das Primat der Aussenpolitik.

CONTINUATION LIKELY

This state of things, curiously enough, is likely to continue as long as the United States remains the international leader. The American society may reject the precepts of Realpolitik as an ignoble European invention, but it has an abiding faith in the rightness and efficacy of economic sanctions that leads to the same outcome.

One does not need to go back to such early history as the 1951 embargo of Iran.

In the last decade the United States, under Jimmy Carter, attempted to isolate Iran, under Ronald Reagan attempted to isolate both Iraq and the conquered nation of Kuwait-all by organizing oil boycotts.

Right now U.S. oil companies are not supposed to import oil from Iran, Iraq, Libya, Kuwait, and part of the Neutral Zone. They are effectively deterred from drilling in Vietnam. Earlier they were discouraged from having any dealings in oil or gas production in the Soviet Union, though lately they have been encouraged to go into joint ventures with the Soviets. These things can complicate life for an American oil company.

In addition, beyond oil, the United States in recent years has imposed economic sanctions on Cuba, Nicaragua, and Panama-not to mention Rhodesia and South Africa. The faith vested in economic sanctions abideth still, though it does not appear to have been matched by their performance.

Economic sanctions seem a relatively painless way of demonstrating political disapproval, The American nation, with its immense gross national product and its comfortable living standards, may find it easier to sustain such economic sanctions than would nations closer to the economic edge. If the international community were led by a more commercially minded country, say Japan, things might be different.

However, so long as the United States is the one to propose remedies, the international community will find itself encouraged to have early recourse to economic sanctions. That will remain the case even though in the case of the embargo against Iraq and Kuwait, it is plain that such sanctions will be anything but painless.

SEEKING STABILITY

Too few major players assign a sufficiently high priority to oil market stability to make it an attainable objective. However, it is important to consider what can be achieved at the secondary level, Even here-at the level of economics-the quest for cooperation is fraught with difficulties.

Preeminent among them is that cooperation requires an ability to take the long term view-and to forgo short term advantage. Neither comes readily either to individuals or to governments. When cooperation depends on the sustaining of collaboration by a set of governments over extended periods, the difficulty increases.

Moreover, in economic policy, that temptation to exploit short term advantage is bolstered (not to say ennobled) by veneration of the discount rate. The latter proclaims to both consumers and producers: carpe diem. Importing nations must seize the advantages of lower prices now-and through higher rates of economic growth will thereby be in a better position to withstand higher energy prices later. For producers higher revenues now, especially if properly invested, will compensate for reduced revenues at a later date.

This calculation is reinforced by the diversity of cost conditions and reserve positions among the producers. Cooperation has a much higher payoff over the long run for some than for others. But, in a political agreement which cooperation makes unavoidable-all interests must be accommodated-or, in other words, compromised.

Of course, there is a counterpart among the importing nations. They vary with respect to economic, as well as political and military, objectives. Some will be specially vulnerable to balance of payment concerns-and seek to minimize foreign exchange outflows. Some may have high-cost domestic energy resources which they seek to protect or to foster. Some will, for security reasons, be particularly wary regarding dependency on insecure sources of supply. All will prefer to label those political or military motives for not wholly trusting pledges of cooperation in energy markets as their responsibilities.

Finally, we inevitably find the tempo of the market leads to a counterpoint in concern and eagerness for cooperation as between the producers and consumers.

Under conditions of excess capacity and a potential for oil glut, the producers will press forward, pleading the necessity for cooperation. But the consumers, sensing a windfall, will likely hold back. By contrast, in periods of tight supplies, rising prices, or anticipated capacity limitations, the consumers will urge cooperation, but many of the producers will then hold back.

Only the low-cost producers, concerned about the preservation of their market shares (and their revenues) relative to alternative sources of energy, can be expected consistently to push for long term cooperation.

Any agreement to cooperate unavoidably means a compromise of interest-and built-in incentives to ignore or back out of the agreement. The failure of members of the International Energy Agency to honor their commitments during periods of stringency is similar in this respect to the failure of members of OPEC to observe target prices or adhere to their quotas in periods of market weakness.

When one contemplates putting together in a master agreement between producers and consumers both sets of incentives to violate the agreement, one can scarcely be sanguine about the outcome.

Nonetheless, there is no excuse to failing to try. Over the long run, the world economy and both producer and consumer nations on the whole benefit from lessened disruption of the oil market and greater predictability regarding both availability and price.

Even though cooperation cannot be expected to work perfectly-and will intermittently break down-it pushes in the right direction. It may only be a palliative, but palliatives are not without use. One should not pitch one's expectations too high-and therefore one should avoid placing too much strain on any hypothetical agreement.

AGREEMENTS AND DISRUPTIONS

At the outset, one should recognize that an agreement is most useful in dealing with those disruptions that almost all can recognize as having harmful long term consequences.

The willingness of OPEC nations to tolerate above-quota production during the current gulf crisis is an obvious example. Damage to the world economy and, therefore, to the market for oil-as well as oil's share of the overall energy market relative to other competitors-implies that the long term costs of not attempting to offset the loss of Iraqi and Kuwaiti crude would have been far too short sighted even from the standpoints of those producers who could expand production.

Similarly the need for a gradual expansion of capacity to meet growing import requirements can profitably be discussed in the framework of producer-consumer cooperation. In its absence the growth of demand may outstrip capacity-with consequent price surges that may turn some users permanently away from oil and, more importantly, may slow the growth of the world economy.

Over the years this could be the most useful fruit of producer-consumer cooperation. If we anticipate world oil demand will again begin to grow-inevitably it has been stalled for some years by the gulf crisis and its effects-then the need for cooperation gradually, to bring on the required additional capacity, will reassert itself.

I have stressed the need not to pitch one's expectations too high. Cooperation will work best either under extreme conditions or under conditions of relative stability. The advantage of a gradual adjustment of capacity to meet but not significantly exceed the growth of demand is precisely that it tends to preserve that condition of relative stability in which cooperation can most readily flourish.

One will note that I have not suggested any substantial measures to be taken by the consumer nations. It is not because their stake is not high. Rather it is that the expected direct contributions may be low.

Aside from the maintenance of inventories to mitigate the upward movement of prices during periods of stringency, the principal contribution would be to avoid major economic fluctuations with their destabilizing effect on the oil market. Needless to say, however, the direct benefits of avoiding such fluctuations are a far more powerful motive than is the impact on oil market stability.

To be sure, it is in the interest of importing nations that the price of oil not be so low that it fails to elicit the necessary growth of productive capacity. I think it is important continuously to make this point. One of the benefits of cooperation is that the point would be somewhat better appreciated in importing countries.

Nonetheless, I do not expect (however desirable it might be) for the consumer countries to take the measures necessary to sustain price, if there is capacity. It may be a moral imperative, but it is not a practical imperative. It would be Utopian, in my judgment, to believe that cooperation could go that far. The consumer nations just do not have the requisite self-restraint.

However, the notion that the oil price can be too low as well as too high needs to be understood and to be regularly preached-even though it has no direct impact on policy in the form of price stabilization measures. It may have an indirect impact. It will certainly improve the appreciation of the measures producers take in gradually bringing on additional capacity. Though the principal burden for stabilization will rest on the producers, the understanding and support of the consumer nations will be quite helpful in that effort.

An appropriate framework for such discussion should be created on a multilateral basis. I think formal consultation between the IEA and OPEC with invitations to other interested parties-is now appropriate. I fully understand the historical reasons why the members of the IEA have been reluctant to authorize such consultation, but those reasons, in my judgment, are no longer valid. The long term position of both consumers and producers could be improved if such conversations were authorized.

One would not expect such conversations to end the high priority that nations assign to objectives other than oil market stability. It would not end the diversity of interests between and within the consumer and producing groupings. It certainly would not end fluctuations in the oil market. But it would serve to mitigate such fluctuations-certainly in the long run and likely in the short.

QUEST FOR COOPERATION

Those nations and those individuals whose lives and livelihoods are bound up in the production and use of oil quite naturally feel that governments and policy makers do not give to the goal of oil market stability the eminence that it deserves. They feel, understandably, that cooperation between producers and consumers is preeminently important. They are regularly disappointed.

When will so high a degree of cooperation be attained? Only when nations are prepared to subordinate other political objectives to achieving oil market stability. That will be a long time coming. To pretend otherwise is just wishful thinking.

Napoleon once opined that, if one wishes peace one must avoid the pin pricks that lead to war. That aphorism appears particularly relevant to the recent developments in the gulf. At this time it is evident that nations have not been prepared to avoid those pin pricks that disrupt the stability (and peace) of the oil market.

The quest for producer consumer cooperation has again become a buzzword as understandably it must in periods of market disruption. But one should avoid wishful thinking. To achieve such cooperation requires a mechanism for enforcement. As yet there is no such mechanism.

It is all too easy to speak of the Imperative of Producer-Consumer Cooperation. But actually it is Kant's Categorical Imperative-scarcely attainable in other than most modest form in this world of conflicting interests and aspirations of nations.

Copyright 1990 Oil & Gas Journal. All Rights Reserved.