Exploration and development in Thailand continue to set a brisk pace.

Among the latest mix of action:

- Unocal Thailand and partners will sharply boost capital spending for Gulf of Thailand exploration and development in 1990.

- British Petroleum Co. plc expects to spend as much as $35 million during the next 10 years to develop two small oil fields in Thailand's central plains.

- Exxon Corp.'s Thai unit plans to step up exploratory drilling for gas in Thailand's northeastern region away from its Nam Phong gas field, due to go on stream by yearend.

- A group led by Total CFP signed final contracts covering the $600 million development of the B structure natural gas field in the Gulf of Thailand.

- Thirty companies were expected to participate in last month's bidding sought by state owned Petroleum Authority of Thailand (PTT) for an interest in and operating oil prone Block 5/27 off Thailand's southern peninsula.

UNOCAL GROUP PLANS

Unocal, Mitsui Oil Exploration Co. Ltd., and Southeast Asia Petroleum Exploration Co. Ltd. will hike Gulf of Thailand outlays to $180 million this year from $140 million in 1989, said Unocal Thailand Pres. Graydon Laughbaum.

Much of that investment will be earmarked for development of Funan field, the first of several fields Unocal will develop under the third gas sales agreement (Unocal 111) with PTT (OGJ, Oct. 30, 1989, p. 31).

Meantime, PTT Exploration & Production (Pttep) has asked Unocal to boost its stake in the Unocal III development project to 10% from 5% offered earlier. Negotiations are under way.

Work under Unocal III will boost the company's Gulf of Thailand gas production to about 700 MMcfd in 1992 from the current level of about 530 MMcfd.

Unocal Thai expects its gulf gas flow to level off at about 550 MMcfd in the mid-1990S.

Unocal and partners plan a total of 13 exploratory wells and 44 development wells on their Gulf of Thailand concessions this year, which is about flat with last year's level of activity.

FUNAN DEVELOPMENT

Plans call for development drilling to begin from the first two Funan A platforms probably in October, after development drilling in Erawan field and fields covered by the second sales agreement (Unocal 11) is completed.

Funan development drilling is to continue through 1991, with first production scheduled for January 1992. Unocal is pressing efforts to put the field on stream ahead of schedule.

Unocal will use the Robray T4 and Robray T7 tender barges to carry out development drilling.

The Unocal group also plans to install a $28.5 million compression platform, now under construction in Thailand, in Erawan's central processing complex in June.

The compression platform, to start up in August, will hike gas deliverability through PTT's 425 km subsea pipeline to 850 MMcfd from 540 MMcfd.

Its cost will be shared 50-50 by Unocal and PTT.

UNOCAL GROUP EXPLORATION

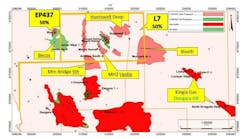

Of the exploratory wells planned this year, nine will be in the Unocal III area and four on prospects in the Block 12/27 gas prone acreage in the central gulf owned jointly by affiliate Unocal Siam and BP (see map, OGJ, Sept. 11, 1989, p. 20).

Drilling in the Block 12/27 area was delayed because of the loss of Unocal's Seacrest drillship with 91 lives in a typhoon last year (OGJ, Nov. 20, 1989, p. 43).

Unocal hired Sedco-Forex's Sedco 601 semisubmersible last month for exploratory and delineation drilling in the Unocal III area and on Block 12/27 this year. It was expected to begin work before the end of March.

The company is targeting a Gulf of Thailand production level of 535 MMcfd the first 7 months of 1990.

That level will jump to 605 MMcfd with greater capacity allowed by increased compression.

Unocal's sales to PTT in 1989 averaged 532 MMcfd vs. 534 MMcfd in 1988. Its condensate production in 1990 is expected to remain flat with last year's level at about 18,500 b/d.

About 75% of Unocal's Thai condensate will continue to be marketed to the U.S. West Coast for lack of a domestic market.

Cumulative production from Unocal's gas fields in the Gulf of Thailand reached the 1 tcf mark Feb. 13 after 9 years. Unocal Thailand's reserves are conservatively estimated at 4.5 tcf. Of that total, 2.8 tcf is covered by the Erawan and Unocal 11 contracts.

BP DEVELOPMENT PLANS

BP plans to install a small production facility and drill as many as 10 appraisal/development wells to place Nueng and Sawng oil fields on stream in Block BP1. Nueng is in the Kamphaeng Saen basin in Nakhon Pathom province, Sawng in the Suphan Buri basin in Suphan Buri province.

BP estimates combined reserves of the two fields at 12 million bbl of oil. Development plans were prompted by the government's liberalization of contract terms for oil development.

Production is to begin at 1,000 b/d from the BP1-1 discovery and BP1-3 and BP1-7 confirmation wells. Flow probably will build to 3,000 b/d.

BP is negotiating a sales contract with PTT for the initial 1,000 b/d of the fields' 34 gravity waxy crude. It offered a wellhead sales price of $18/bbl, based on a formula pegged to the resulting product price obtained at Singapore refineries.

PTT rejected that as too high compared with what PTT pays Thai Shell Exploration & Production for the better quality Phet crude from Sirikit oil field and suggested BP use a formula similar to Thai Shell's.

BP won't conduct further work on the block until a sales agreement can be worked out. It has drilled 12 wells on the 1,400 sq km block.

EXXON THAI E&D

Exxon unit Esso Exploration & Production Khorat plans several exploratory wells in 1990 on its 12,500 sq km Khorat concession in Khon Kaen province.

The first, 1 Dong Moon, will be about 55 km northwest of Karasin in Nong Kung Si district. Exxon has not disclosed further drillsites.

The rest of Esso's 1990 drilling program will depend on results from 1 Dong Moon, analysis of the fourth development well in Nam Phong, and seismic data from other prospects still being processed, said Esso Khorat Chairman Roy Weiland.

Esso completed drilling 4 Nam Phong earlier this year to prepare for start-up of production from the field in December.

The company could choose to first drill another well to further delineate Nam Phong, where reserves are estimated at 1.5 tcf.

Esso is obliged to drill five wells at Nam Phong under an interim gas sales accord with PTT covering delivery of about 40 MMcfd. It recently completed 3 Nam Phong, on stream at 17 MMcfd, about the same as 2 Nam Phong.

Esso hopes to build Nam Phong production to 250 MMcfd. It has budgeted $7 million for Nam Phong production facilities to be installed at 1 Nam Phong, the 1981 discovery well that flowed 29 MMcfd of gas.

Gas gathered from the remaining Nam Phong wells will move by pipeline to a 200,000 kw power plant under construction by the Electricity Generating Authority of Thailand near the field.

Esso has spent more than $125 million on its northeastern concession, including five exploratory wells and 8,680 line km of seismic surveys.

B STRUCTURE DEAL FINAL

Pttep was able to sign a final accord with the Total group on B structure development after determining project interests with British Gas plc and Norway's state owned Den norske stats oljeselskap AS.

Operator Total earlier this year signed a contract with Thailand's Industry Ministry that called for it to take a 30% interest in the project and Pttep 40% (OGJ, Jan. 15, Newsletter).

The remainder was to be distributed between BG and Statoil, pending the final agreement. BG will take a 20% stake, Statoil 10%.

The final agreement was worked out after Pttep dropped its attempt to allocate some of its shares to financial institutions and its partnership talks with Mitsui failed.

Development of the B structure's 1.8 tcf of gas and 32 million bbl of condensate is scheduled to begin this year.

Production is expected to begin in late 1993 or early 1994 at 150 MMcfd. Pttep hopes to sustain peak flow of 250 MMcfd for the 20 year life of the field.

The Total group will sell the gas and condensate at the wellhead to PTT. The state company will be responsible for processing the production and for installation of a 110 mile pipeline to Erawan field, where B structure gas will be transported to the mainland.

Plans also call for a comprehensive exploration program on the rest of the concession, BG said. The project is BG's first major upstream effort in the Far East.

STRONG TENDER RESPONSE

Among the companies responding to the call for bids for partnership and operatorship of Pttep's Block 5/27 in the Gulf of Thailand are Petro-Canada, Kuwait Petroleum Corp., Total, Unocal, and Shell.

The number of companies responding to the tender exceeded Pttep's expectations. Only one company will be chosen.

Pttep will give the winning bidder a 50% stake in the concession. The winner will be required to commit at least $8 million for work, including drilling four wells the first 8 years.

The operating partner will carry costs in the first 3 years of development, with Pttep thereafter assuming a share of expenses through deduction from production earnings.

Block 5/27 covers about 15,320 sq km off the southern peninsular province of Prachuab Khiri Kan, just north of Thai Shell's suspended Nang Nuan oil field.

Four exploratory wells have been drilled on the concession formerly held by Amoco Corp. and Idemitsu Kosan Co. Ltd. Two wells on the eastern portion of the block yielded oil but were abandoned as noncommercial.

A subsequent 3D seismic program sponsored by PetroCanada International Assistance Corp. in the area prompted estimates of a potential oil resource in the targeted structure of as much as 165 million bbl of oil in place (OGJ, Feb. 27, 1989, p. 114).

Copyright 1990 Oil & Gas Journal. All Rights Reserved.