General Interest — Quick Takes

Removing oil export ban would raise product prices

Ending the decades-old ban on exporting US-produced crude oil would raise prices by $3/bbl and increase product prices, a study commissioned by Consumers and Refiners United for Domestic Energy (CRUDE) concluded (see related story, p. 30).

The study by Alan Stevens of Stancil & Co. in Irving, Tex., also found that ending the crude export prohibition would make crude and product imports climb and product exports drop; and reduce domestic refinery utilization and possibly shutter some refineries.

"This report is a holistic and thorough analysis of energy markets, which shows that American consumers and businesses will take a major hit if Congress lifts export restrictions," CRUDE Coalition Executive Director Jay Hauck said on July 27. CRUDE Coalition members include Alon USA, Monroe Energy, PBF Energy, and Philadelphia Energy Solutions.

"This is more evidence that Congress should think long and hard before rushing to change our 40-year-old energy independence law," Hauck said.

The study also noted that US refining capacity and utilization are at all-time peaks, the Organization of Petroleum Exporting Countries continues to control crude prices indirectly through its members' production volume limits, and allowing exports would make the US-which still imports 47% of its crude supply-more reliant on less secure foreign sources.

It was released a day before the US Senate Banking Committee's scheduled hearing on possible impacts of removing the crude export ban. Senate Energy and Natural Resources Committee Chair Lisa Murkowski (R-Alas.), who introduced legislation last week which included a provision to end the crude exports ban, was scheduled to testify (OGJ Online, July 24, 2015).

SSE E&P UK buys interest in West of Shetland fields

SSE E&P UK Ltd. has agreed to acquire 20% interest in Laggan, Tormore, Edradour, and Glenlivet fields in the West of Shetland area from Total SA for $876 million.

Laggan and Tormore fields lie in 600 m of water 140 km west of the Shetland Islands on Blocks 206/1a, 205/4b, and 205/5a. Development of the fields was launched in 2010 and launch of gas production is expected in the coming months (OGJ Online, Feb. 16, 2010). The development concept consists of the 140-km tie-back of five subsea wells to the new onshore Shetland gas plant, with peak production of 500 MMscfd.

Development of Edradour and Glenlivet fields launched in 2014. The Edradour discovery lies in 300 m of water 75 km northwest of Shetland on Block 206/4a, while the Glenlivet discovery lies in 400 m of water north of Edradour on Block 214/30a.

Edradour will be developed by converting the discovery well into a production well, connected to the main Laggan-Tormore flowline by a 16-km subsea tie-back (OGJ Online, July 3, 2014). Glenlivet will be developed via two wells and a 17-km production pipeline tied back to Edradour (OGJ Online, Oct. 30, 2014). Edradour is expected to start up in 2017, followed by Glenlivet in 2018.

"The sale of these minority interests is aligned with Total's portfolio management strategy and target of divesting $5 billion of assets in 2015," explained Arnaud Breuillac, Total's exploration and production president. "It allows us to capitalize fully on this new deep offshore development, while retaining a majority interest and operatorship."

Following completion of the deal, Total will have 60% operated interest in Laggan, Tormore, Edradour, and Glenlivet fields alongside partners Dong E&P (UK) Ltd. 20% and SSE E&P UK 20%. The sale also includes 20% of Total's interest in the Shetland gas plant and interests in several exploration licenses in the West of Shetland area, including the Tobermory discovery.

CBM producer Walter Energy files for Chapter 11

Walter Energy Inc., Birmingham, Ala., and its US subsidiaries filed for restructuring under Chapter 11 bankruptcy in the US Northern District Court of Alabama.

Walter Energy produces coalbed methane although its primarily business is providing coal for steel producers in Europe, Asia, and South America. The bankruptcy did not involve Walter Energy's holdings in Canada and abroad.

Walter Energy Chief Executive Officer Walt Scheller said, "We must do what is necessary to adapt to the new reality in our industry."

Walter Energy has sufficient cash to assure that vendors, suppliers, and other business partners will be paid in full for goods and services that they provide during the reorganization process, the company said.

Black Warrior Methane Corp. is owned by Jim Walter Resources Inc., now a Walter Energy subsidiary that produces CBM.

Some 1,440 CBM wells in the Walter Black Warrior basin are owned by Walter Energy, which acquired the assets from Highmount Exploration & Production LLC in May 2010. The wells are spread over 230,000 acres in Tuscaloosa and Walker counties in central Alabama.

Blackstone Advisory Partners LP was retained by Walter Energy as its financial advisor and Alix Partners LLP as its restructuring advisor.

MOL completes Ithaca Norge acquisition

MOL Group, Budapest, has completed its acquisition of Ithaca Petroleum Norge from Ithaca Energy Inc. for $60 million plus possible bonuses of up to $30 million if exploration is successful. The acquired company holds 14 exploratory licenses offshore Norway. The initial payment earlier was reported incorrectly as $600 million (OGJ Online, Apr. 24, 2014).

Exploration & Development — Quick Takes

UK awards 41 more licenses in offshore round

The UK government has awarded 41 licenses for exploration and production in the second tranche of the 28th Offshore Licensing Round.

In the first tranche late last year, it awarded 134 licenses (OGJ Online, Nov. 6, 2014).

The combined results make the 28th round "one of the largest rounds in the 5 decades since the first licensing round took place," according to the new Oil & Gas Authority, which recently took over licensing from the Department of Energy and Climate Change.

The round, opened in January 2014, drew 173 total applications. The 175 licenses awarded in both tranches cover 353 blocks on the UK Continental Shelf.

The new awards were confirmed after supplemental environmental assessment and consultation.

Work obligations in the new tranche include one firm well, by E.On E&P with partner Bayerngas on Block 48/3, and two contingent wells. Other firm work commitments are acquisition or reprocessing of seismic data.

Awardees in the latest tranche are a mix of large and small independent producers and integrated operators.

Among the latter group are BP PLC, Eni SPA, Idemitsu Kosan Co. Ltd., OMV AG, Royal Dutch Shell PLC, Statoil ASA, Suncor Energy Inc., and Total SA.

EQT reports high IP from Utica dry gas well

EQT Corp., Pittsburgh, said a deep, dry gas Utica well averaged 72.9 MMcfd with an average flowing casing pressure of 8,641 psi during a 24-hr deliverability test. The well was completed using a 18-stage fracturing job and a 3,221-ft lateral.

"To the best of our knowledge, this is the highest reported [initial production rate] of any Utica well to date," said Steven Schlotterbeck, EQT executive vice-president. "I want to make note of the fact that we were able to flow this well directly into the sales pipeline without shutting in production from our other wells."

EQT tied the well to a sales pipeline without impacting field pressure by diverting a Marcellus gathering system to another sales pipeline. The company plans to drill additional appraisal wells with the first slated for the third quarter in Wetzel County, W.Va.

Julius well discovers gas in King Lear area

Statoil ASA said its Julius exploratory well, drilled in the King Lear area of the Norwegian North Sea, has discovered gas and condensate (OGJ Online, Nov. 7, 2013).

The 2/4-23S was drilled 5,548 m subsea in 68 m of water by Maersk Drilling's Maersk Gallant jack up rig. The well was drilled in production license 146, about 17 km northeast of Ekofisk field.

Statoil estimates 15-75 million boe recoverable from Julius, which also was drilled to appraise the King Lear gas and condensate discovery in 2012 by the PL 146/PL333 partnership of Statoil and Total E&P Norge.

The Norwegian Petroleum Directorate said Julius encountered 41 m of gas and condensate-filled sandstone "with moderate reservoir quality" in the Ula formation.

The well also encountered 30 m of water-filled sandstone with poor reservoir quality in the Byrne formation, NPD said. A 20-m gas-condensate column in the Farsund formation confirmed pressure communication with the 2/4-21 King Lear discovery but will not lead to any change in resource estimates.

The King Lear and Julius discoveries "confirm Statoil's view that even such mature areas of the NCS still have an interesting exploration potential," said May-Liss Hauknes, North Sea vice-president, exploration.

Statoil said the Julius discovery will be included in the resource base for a future development decision on PL146/PL333.

Drilling & Production — Quick Takes

Petrobras workers stage 24-hr strike

Workers at beleaguered Petroleo Brasileiro SA (Petrobras) staged a 24-hr strike across Brazil to protest plans by the state-owned company to liquidate assets for debt service, according to news reports.

An official of the National Oil Workers Federation was quoted as saying 90% of the company's 86,000 employees participated.

Brazil produces 2.3 million b/d of crude oil and has 13 refineries with total crude capacity of 1.9 million b/d.

Late in June, Petrobras, which dominates Brazilian production and refining, reported plans to divest assets totaling $15.1 billion in 2015-16-30% in exploration and production, 30% in downstream, and 40% in natural gas and power.

The company said it expected additional restructuring, demobilization of assets, and additional divestments totaling $42.6 billion during 2017-18.

Petrobras is at the center of a massive corruption scandal that has rocked the government.

Its new plan slashes investment during 2015-19 by 37% from a predecessor to $103.3 billion-83% for E&P, 10% for downstream, 5% for gas and power, and 2% for other areas.

Petrobras lowered its forecast for Brazilian production of crude oil and natural gas liquids in 2020 to 2.8 million b/d from the earlier-projected 4.2 million b/d.

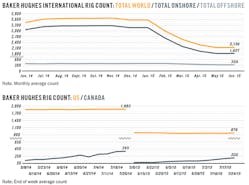

BHI: US rig count jumps 19 units to 876

The US drilling rig count jumped 19 units to reach 876 during the week ended July 24, according to data from Baker Hughes Inc.

The gains came primarily from rigs drilling on land. Land rigs were up 17 units to 841. Those drilling in inland waters also increased, up 2 units to reach 4 rigs working.

During the week, rigs targeting oil jumped 21 units to 659. Gas-directed rigs, meanwhile, were down 2 units to 216. Rigs considered unclassified were unchanged at 1 rig working.

Rigs engaged in horizontal drilling increased 12 units to 662. Directional drilling rigs lost 1 unit to 83.

Rigs drilling offshore and in the Gulf of Mexico were both unchanged this week, both maintaining counts of 31.

Canada's rig count continued its upward climb, increasing 8 units to an even 200. Its count has now risen in 9 of the last 11 weeks. This week's gain was spurred by a rebound in gas-directed rigs, which were up 8 units to 102. Oil-directed rigs, meanwhile, were unchanged at 98 rigs working. Canada's overall count is still down 195 year-over-year.

Among the major oil- and gas-producing states, Texas was up 8 units to 374. Louisiana jumped 7 rigs to 76. Oklahoma, at 107 rigs working, was up 2. Four states were up 1 unit each: North Dakota, 69; New Mexico, 51; Pennsylvania, 44; and Ohio, 20. Eight states remain unchanged from last week: Colorado, 39; Wyoming, 21; West Virginia, 18; Alaska, 11; California, 11; Kansas, 11; Utah, 7; and Arkansas, 4.

Statoil drilling first production well at Gina Krog

Statoil ASA has started drilling the first production well at Gina Krog field, 30 km northwest of Sleipner in the North Sea (OGJ Online, Oct. 28, 2014).

Gina Krog has 20 well slots, and Statoil said Maersk Drilling's Maersk Integrator jack up rig will drill wells until 2019.

The current plan is to drill 14 wells. Ten will be production wells and four will be combined gas injection and production wells. During the first years of production, gas will be injected as pressure support to extract more oil.

Statoil will drill the top sections of six wells after ten 30-in. conductors are installed. Two or three wells will be drilled into the reservoir before the topsides arrive from South Korea.

Statoil said installation of the steel jacket and predrilling module was completed in June.

Gina Krog, previously known as Dagny, was originally a minor gas discovery that had been considered for development on a number of occasions since its discovery in 1974. A plan for development and operation of the field was submitted in 2012. Most recently, Statoil let a contract for design and installation of topsides for the field's platform (OGJ Online, Feb. 20, 2013).

Centrica to boost production from Morecambe Bay

Centrica PLC reported a project to boost gas production from Morecambe Bay in northwest England (OGJ Online, Jan. 31, 2012). The £16-million project involves installing new equipment on the North Morecambe platform, which will use the high pressure of the nearby Rhyl field to boost pressure and production from North Morecambe wells.

"We have been producing gas from Morecambe Bay for 3 decades, and we want to continue our operations in the region into the 2020s and beyond," said Andy Bevington, Centrica's director of UK operated assets.

The North Morecambe platform is normally unmanned. Project teams will be working from the Seajacks Kraken jack up barge. The company said teams can "walk to work" across a gangway connecting the barge to the platform, rather than relying on daily helicopter flights offshore.

Gazprom Neft brings fifth Badra field well onstream

JSC Gazprom Neft said a fifth well has been brought into production in Badra field in eastern Iraq (OGJ Online, June 26, 2015). The P-04 is in testing mode but potential output is estimated at 10,000 b/d. The five wells are producing 35,000 b/d.

In addition, drilling of P-13 is nearing completion with anticipated production of 10,000 b/d. P-09 and P-15 are also drilling. Gazprom Neft, the operator, expects to receive in August its second consignment of oil as payment for investment.

PROCESSING — Quick Takes

Chevron Phillips Chemical makes appointments

Chevron Phillips Chemical Co. LLC has made several executive appointments, all effective Aug. 1.

Mark Lashier, currently executive vice-president, olefins and polyolefins, will become executive vice-president, commercial. In his new role, he will serve as the lead commercial executive for all product lines in Chevron Phillips Chemical's portfolio.

Ron Corn, currently senior vice-president, specialties, aromatics, and styrenics, will become senior vice-president, projects and supply chain. He will be responsible for the projects organization, including the execution of the company's USGC petrochemicals project, and the formation of an integrated supply chain organization serving all customers and product lines in the Chevron Phillips Chemical portfolio.

Scott Sharp, currently senior vice-president, projects, will become senior vice-president, manufacturing, with functional responsibility for all of the company's global manufacturing operations.

Lashier, Corn, and Sharp will report to Peter L. Cella, president and chief executive officer.

Dave Smith, currently vice-president, olefins and NGL, will become senior vice-president, petrochemicals, responsible for the olefins, NGL, and aromatics product lines.

Dave Morgan, currently vice-president, polyethylene, will become senior vice-president, polymers, responsible for all resins as well as the performance pipe division.

Mitch Eichelberger, currently general manager, normal alpha olefins and polyalphaolefins, will become vice-president, specialties, responsible for normal alpha olefins, polyalphaolefins, specialty chemicals, and drilling specialties product lines.

Smith, Morgan, and Eichelberger will report to Lashier.

South Africa's Enref refinery due maintenance

Engen Petroleum Ltd. will shut down its 125,000-b/d Enref refinery in Durban, South Africa, for planned maintenance beginning on July 9, the company said.

The scheduled outage comes as part of the refinery's ongoing maintenance program designed to ensure safe, reliable operations at the plant, as well as to secure a steady and stable supply of petroleum products for the country, Engen Petroleum said.

The company, which warned of potential supply disruptions during the shutdown period, did not disclose a timeframe for when planned maintenance activities would conclude.

Details regarding the specific nature of the scheduled maintenance work remained unavailable.

The Enref refinery, South Africa's second largest, produces automotive, industrial, aviation, and marine fuels, as well as bitumen, lubricants, and a range of chemicals and solvents.

TRANSPORTATION — Quick Takes

Excelerate gets FERC okay for GasPort project

Excelerate Energy LP, The Woodlands, Tex., has been granted authorization by the US Federal Energy Regulatory Commission, in cooperation with the Puerto Rico Electric Power Authority (PREPA), to site, construct, and operate the proposed Aguirre Offshore GasPort Project offshore Puerto Rico (OGJ Online, Apr. 9, 2014).

The order confirms the final environmental impact statement (EIS) that resulted in a finding of no significant environmental impact. As part of the order, the project will comply with all the environmental conditions outlined by FERC.

The proposed project will be a floating LNG terminal that will consist of a floating storage and regasification unit, minimal infrastructure to moor the vessel, and a subsea pipeline to deliver the gas onshore.

The terminal, off Puerto Rico's southern coast near the town of Salinas, would provide fuel to the Aguirre central complex and underpin the conversion of power generation from imported oil to natural gas.

Report: Old crack caused Canadian pipe break

The early-2014 rupture of a natural gas pipeline south of Winnipeg, Man., resulted from a fracture at a crack that formed in the pipe wall during construction but remained stable more than 50 years, according to the Transportation Safety Board of Canada (OGJ, Feb. 3, 2014, Newsletter).

A TSB statement said the crack probably resulted from "inadequate welding procedure and poor welding quality." It noted there was no requirement for radiographic inspections of every weld when TransCanada PipeLines Ltd. Line 400-1 was laid.

Incremental stresses caused the fracture at a mainline valve near Otterburne, TSB said in its investigation report. They resulted from factors such as weakened soil support due to years of pipeline maintenance, record-low temperatures, recent work at and around the valve site that might have driven frost deeper into the ground, and thermal contraction that might have occurred when the pipeline cooled due to the absence of gas flow for 20 days before the rupture and brief fire.

The incident caused no injuries or environmental damage. TransCanada returned the pipeline to service after performing investigations and tests.

Financing set for gas line in northern Mexico

Financing is set for construction of a 289-mile pipeline that will carry natural gas produced in Texas to power plants in Mexico, reports Milbank, Tweed, Hadley & McCloy, which represented the funding group. The La Laguna pipeline will connect power plants owned by state-owned Comision Federal del Electricidad in El Encino, Chihuahua, and La Laguna, Durango.

Fermaca Global LP will build the $820-million pipeline, which is expected to be operational in first-half 2017. Capacity will be 1.5 bcfd. Members of the financing group include Citigroup, ING, NordLB, Banco Santander, Sabadell, and Goldman Sacha.