GENERAL INTEREST — Quick Takes

OTC: Petrobras has full government support, Braga says

Petroleo Brasilierio SA (Petrobras) still has "full and unconditional support" from the Brazilian government, said Eduardo Braga, the country's minister of mining and energy, to an industry luncheon on May 4 at the Offshore Technology Conference in Houston.

This despite bribery charges that led to the resignation of six senior executives earlier this year and a $2.1 billion write down last month (OGJ Online, Apr. 23, 2015). Petrobras faces challenges, said Braga, but the people of Brazil are still proud of its most successful company.

The minister was more eager to discuss the potential for foreign operators and investors in his county citing the upcoming 13th oil and gas licensing round. The auction, scheduled for October of this year, will have 269 blocks in 10 different basins including the Brazil presalt.

OTC: IADC well-control training program launched

An industry-wide collaboration enabled the International Association of Drilling Contractors to develop a new well-control training and assessment program that is targeted toward an individual's actual job, IADA executives told an Offshore Technology Conference news briefing May 6 in Houston.

The new program, WellSharp, emphasizes training for every employee having any well-control responsibilities, whether the employee is based in the field or on the rig, said Mark Denkowski, IADC executive vice-president, operational integrity.

Denkowski said the new program seeks to focus on providing knowledge key to specific individuals to better do their jobs. Training categories were expanded in the new program to five levels.

The first level is awareness, which is something that an office worker might fine useful. The other levels are introductory, new driller, supervisor, and engineer.

"Industry said we need better well-control training. We need more consistent human behavior," Denkowski said.

WellSharp succeeds IADC's well-control program called WellCap. Denkowski said the WellSharp program represents a complete redesign in the way the training program operates. "In the future, WellSharp will be expanded to include cementers and loggers," Denkowski said.

IADC Pres. and Chief Executive Officer Stephen Colville said the WellSharp program "ensures that rig crews know what they need to do in any circumstance; they have the skills to do it right every time, all the time."

Colville said early response from operators and regulators indicates they believe the program to "be a step-change in industry well-control training."

IADC accreditation program, including WellSharp, guide companies to ensure comprehensiveness in critical training content and adherence to recognized industry standards.

Hollub named successor as Oxy CEO

Occidental Petroleum Corp. has approved a plan in which Vicki A. Hollub will succeed Stephen I. Chazen as the company's chief executive officer following "a thorough transition period." Chazen has served in the position since 2011 (OGJ Online, Oct. 14, 2010).

Vicki A. Hollub also is currently being promoted to senior executive vice-president from executive vice-president (OGJ Online, July 11, 2014). She remains president of Oxy Oil & Gas.

Hollub has nearly 35 years of experience in the oil and gas industry, holding a variety of technical and leadership roles, both in the US and internationally. In 2013 she was appointed vice-president of Oxy and executive vice-president, US operations, Oxy Oil & Gas (OGJ Online, Oct. 11, 2013). She previously served as executive vice-president, California operations; and president and general manager, Permian basin operations.

Deirdre Michie takes helm at Oil & Gas UK

Deirdre Michie assumed the position of chief executive of Oil & Gas UK on May 1, succeeding Malcolm Webb. She was appointed by the OGUK board in February (OGJ Online, Feb. 27, 2015).

"This is a difficult time for the offshore oil and gas sector," Michie said. "We need to ensure a step up in its performance to deliver a positive and sustainable future. I look forward to working with industry, unions, governments, and the regulators in moving this industry forward."

Michie, who worked for Shell for nearly 30 years, will be based in Aberdeen and will have an office in London.

Webb retires from OGUK May 31, after 40 years in the oil and gas industry. He joined the UK Offshore Operators Association as chief executive in 2004 and helped transform UKOOA into OGUK in 2007 by broadening membership to contractors.

Exploration & Development — Quick Takes

Central Tunisia discovery yields 4,300 b/d

The Chouchet El Atrous-1 (Cat-1) well, drilled by Mazarine Energy Tunisia BV in the Zaafrane permit in central Tunisia, has discovered two net oil-bearing reservoirs with combined 38-m net pay. Primary objectives of the Cat-1 were to test the Ordovician El Hamra and El Atchane formations.

Each zone has confirmed 19-m net pay.

On test, the Cat-1 flowed 4,300 bo/d and 395,000 cu m/day of natural gas. The Cat-1 is the first of a two-well campaign, the company said. Compagnie Tunisienne de Forage drilled the Cat-1 well, which reached a total depth of 3,950 m. The DGH-1 well will follow.

The Zaafrane permit spans an area of 5,168 sq km in central Tunisia. Mazarine Energy is the operator of the permit, with state-owned Enterprise Tunisienne d'Activites Petrolieres (ETAP) and Medex Petroleum (Tunisia) Ltd. as partners.

Nelson's bill would bar seismic activity off Florida coast

Saying that it puts him at odds with the Obama administration, US Sen. Bill Nelson (D-Fla.) introduced legislation on Apr. 30 that would prohibit oil and gas seismic activity off Florida's entire coast.

S. 1171 would ban such activities in the area until the National Oceanic and Atmospheric Administration administrator determined that "reasonably foreseeable impacts" of such activities to individuals and marine life are minimal.

Nelson said he drafted the bill after the US Bureau of Ocean Energy Management issued a final programmatic environmental impact statement for proposed geologic and geophysical activities along the South and Mid-Atlantic US Outer Continental Shelf in February.

"Drilling off Florida's Atlantic coast would be unwise and impractical," Nelson said on May 1. "It would interfere with military operations off of Jacksonville, and rocket launches from Kennedy Space Center and Patrick Air Force Base, not to mention the environmental hazards it would pose. If you're not going to drill there, then why do the seismic testing?"

A moratorium on federal oil and gas leasing off Florida's Gulf Coast through 2022 was included in the 2006 Energy Independence and Security Act, the senator said. One is not in place for the state's Atlantic coast where communities economically rely on recreation and tourism, he noted.

Santos, Drillsearch find wet gas in Cooper basin

The Santos Ltd.-led joint venture with Drillsearch Energy Ltd. has had made it six out of seven with a new discovery of wet gas in the western flank of the Cooper basin in South Australia.

The joint venture's Emery-1 wildcat in PEL 513 encountered good gas shows in the Permian-age Patchawarra Formation from 2641-3174.5 m.

Wireline logs indicate 18.6 m of net pay across several zones with a gross interval of 533 m. There is also 8 m of net pay in the underlying Tirrawarra Sandstone with a gross interval of 37 m.

In addition the partners say the well found several zones with potential for unconventional pay.

Emery-1 has been cased and suspended as a future gas producer. It lies 7 km and 10.3 km southeast of Santos' producing gas fields at Moonnanga and Raven, respectively. It is also close to the Large Gidgealpa oil and gas fields to the northeast.

Drillsearch managing director said the discovery is the company's sixth wet gas discovery with Santos and its eighth this year overall.

Drillsearch is free-carried by Santos throughout 2014-15.

Drilling & Production — Quick Takes

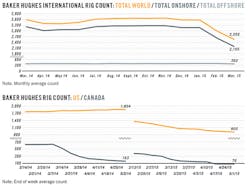

BHI: US rig count loses 27 units to 905

The US drilling rig count fell 27 units-all on land-to 905 rigs working during the week ended May 1, according to Baker Hughes Inc. The count has now plunged 1,015 units over 21 weeks since the week ended Dec. 5.

The total of 905 is the lowest since June 19, 2009, and 949 fewer units vs. this week a year ago. The rig count's nadir during the 2008-09 downturn was 876 units on June 12, 2009.

During the week, oil rigs fell 24 units to 679, down 848 year-over-year and 930 since a recent peak of 1,609 on Oct. 10. Gas rigs fell 3 units to 222. Rigs considered unclassified were unchanged at 4.

Land rigs now total 868, down 918 year-over-year. Rigs engaged in horizontal drilling dropped another 21 units to 699. Since Nov. 21, 673 horizontal units have gone offline. Rigs drilling directionally, meanwhile, gained 2 units to 93.

Offshore rigs and rigs drilling in inland waters were unchanged at respective totals of 34 and 3.

Wintershall submits PDO for Maria field

Wintershall Holding GMBH submitted a plan for development and operation (PDO) for Maria field in the Norwegian Sea to the Norwegian Ministry of Petroleum and Energy.

Maria lies 20 km east of Kristin field and 45 km south of Heidrun field. Recoverable reserves from the field are estimated at 180 million boe (OGJ Online, Dec. 18, 2014). Production startup is expected in late 2018, along with an estimated production period of 23 years.

Planned development involves two subsea templates on the sea floor tied back to several host platforms in the area.

Maria will be linked via subsea tieback to the Kristin, Heidrun, and Asgard B production platforms.

The Maria well stream will go to the Kristin platform for processing. Supply of water for injection into the reservoir will come from the Heidrun platform, and lift gas will be provided from Asgard B via the Tyrihans D field subsea template.

Processed oil will be shipped to Asgard field for storage and offloading to shuttle tankers. Gas will be exported via pipeline to the Asgard Transport gas line to Karsto.

Operator Wintershall Norge holds 50% in the field. Partners include Petoro AS 30% and Centrica Resources (Norge) AS 20%.

PROCESSING — Quick Takes

ESAI: At-risk refining capacity might hit 2 million b/d

Global refinery closures by yearend 2016 could be more than the previously announced 1 million b/d of capacity, Energy Security Analysis Inc. reported. "The total capacity at risk of closure by that time is as high as 2 million b/d," ESAI Refining Manager Christopher Barber said.

Weaker refining margins in Europe and Asia will put more pressure on marginal operations as changing government policies put even more capacity at risk in Asia and Russia, the Wakefield, Mass., energy and power market research and strategic advisory firm said in its latest Global Refining Outlook.

ESAI said refiners in Europe already plan to rationalize 320,000 b/d of capacity by yearend 2016, while petroleum product manufacturers in former Soviet Union countries intend to shut another 280,000 b/d. Refiners in Taiwan, Australia, and Japan plan to cut another 420,000 b/d, the analysis said.

Reports also suggest that Saudi Aramco is planning to close its 88,000-b/d Jeddah refinery, now that two new joint venture refineries are operating. Altogether these announced capacity rationalizations total 1.1 million b/d, ESAI said.

"On top of announced cuts, policy changes in Japan, China, and Russia put as much as an additional 700,000 b/d of capacity at risk of closure by the end of 2016," Barber said.

Another round of rationalization is expected in Japan by March 2017 under a new directive from the country's Ministry of Economy, Trade, and Industry, putting as much as 300,000 b/d at risk of closure before the March 2017 deadline, he said.

A new crude import quota policy for independent refiners in China will put as much as 240,000 b/d of additional capacity at risk of closure, Barber said. ESAI also has identified another 160,000 b/d of capacity at risk in Russia, as changing product export duties mean refiners there are less protected from international price dynamics, he noted.

Unipetrol takes 100% ownership of Czech refineries

Unipetrol AS, a subsidiary of Polski Koncern Naftowy SA (PKN Orlen), has completed its purchase of former partner Eni SPA's interest in Ceska Rafinerska AS (CRC) to become sole owner of the company, which operates two refineries in Czech Republic (OGJ Online, Dec. 22, 2014).

Unipetrol acquired Eni's nearly 32.5% stake in CRC to become the refining company's sole shareholder in a transaction that was finalized on Apr. 30, Unipetrol said.

The acquisition price, which was adjusted downward from an originally announced 30 million euros ($40.8 million) in July 2014 following a retained earnings payout by CRS prior to the transaction's Apr. 30 closing, amounted to 24 million euros ($26.8 million), according to the company.

In a related transaction, Unipetrol also has agreed to purchase crude oil and refined product inventories from Eni for about 3.3 billion Czech koruna ($131.5 million).

A final purchase price for this deal, however, will be based on actual confirmed volumes of inventories and market prices, which are to be determined at the end of second-quarter 2015, Unipetrol said.

Unipetrol's buyout follows the company's overall strategy for 2013-17, released in June 2013, in which the operator said it planned to increase capital spending on projects designed to further integrate the refining and petrochemical segments of its business in order to guarantee secure feedstock supplies for its petrochemical operations (OGJ Online, July 3, 2014).

CRC operates Czech Republic's only two running refineries-in Litvinov and Kralupy-which have a combined crude oil processing capacity of 8.7 million tonnes/year, according to Unipetrol.

With two crude distillation units, four conversion units, and a series of additional installations for further improving the quality of primary distillate products, the refinery in Litvínov - Zaluzi has a total crude processing capacity of 5.4 million tpy, Unipetrol said.

The Kralupy refinery, which includes a fluid catalytic cracking unit, processes about 3.3 million tpy of crude, according to Unipetrol.

ETP unit plans fourth fractionator at Mont Belvieu

Lone Star NGL LLC, a unit of Dallas-based Energy Transfer Partners LP, will build a fourth NGL fractionation plant at Mont Belvieu, Tex., east of Houston, parent ETP has reported.

Estimated to cost about $450 million, the plant is to be operating by December 2016. ETP said the 120,000-b/d fractionator is "fully subscribed by multiple long-term contracts" and will be filled with flows through the new 533-mile, 24-in. and 30-in. Lone Star Express Pipeline.

That pipeline, currently under construction, will move up to 475,000 b/d, expandable to 705,000 b/d, of NGLs from the Permian's Delaware and Midland basins to Mont Belvieu. Phases I and II of the pipeline, said the announcement, are on schedule for completion in second-quarter 2016 and fourth-quarter 2016, respectively.

In addition, Lone Star's third Mont Belvieu fractionator, currently under construction, remains on schedule for completion in January 2016 (OGJ Online, Nov. 6, 2014; Nov. 4, 2013).

TRANSPORTATION — Quick Takes

Schumer bill would phase out older rail tank cars

US Sen. Charles E. Schumer (D-NY) said he would introduce legislation requiring US railroads to replace tank cars carrying crude oil and other hazardous substances more quickly than new US Department of Transportation rules require. His announcement came 2 days after US and Canadian railway transportation regulators jointly announced the regulations (OGJ Online, May 1, 2015).

The regulations are a step in the right direction, but do not go far enough, Schumer said during a May 4 appearance in Menands, NY. Specifically, he said DOT's new rules DOT-111 tank cars and their Canadian CPC-1232 tank cars to remain in service through 2023. His measure would require them to be gone within 2 years, he noted.

"Allowing these outdated oil cars to continue rolling through our communities for another 8 years is a reckless gamble that we can't afford to make," Schumer said.

Railroads and refiners have warned that requiring rapid replacement or retrofits of the tank cars could strain manufacturing capacity and potentially disrupt crude shipments by rail. Schumer dismissed that argument.

"For far too long, the rail and oil industries have taken advantage of the lack of rules by making excuse after excuse to delay phasing-out the dangerous and outdated tanker cars," he said. "While DOT's announcement has finally forced the industry's hands to update these rules, there is no question that the new rules don't go far enough."

Schumer said his bill also would require DOT to formulate a volatility standard for crude shipments, and add speed restrictions for crude-bearing trains traveling through populated areas.

He was one of seven US Senate Democrats cosponsoring a bill introduced on Apr. 30 to regulate crude-by-rail shipments the day before the US and Canadian transportation regulators announced their new rules (OGJ Online, May 1, 2015).

Enterprise plans Midland-Sealy crude line

Enterprise Products Partners LP (EPP) has secured long-term agreements with shippers that it says warrant construction of a 416-mile, 24-in. crude and condensate pipeline between Midland and Sealy, Tex., west of Houston.

The pipeline, with capacity of 540,000 b/d, will connect the company's Midland terminal with storage at Sealy. An interconnect with the 88-mile, 36-in. Rancho II pipeline scheduled to begin service in July, would link Sealy with the Enterprise Crude Houston (Echo) terminal (OGJ Online, Nov. 2, 2012).

The Midland-Sealy pipeline will receive oil by truck and pipeline and deliver it to Sealy in up to four segregated batches. It will carry West Texas Sour, West Texas Intermediate, and Light West Texas Intermediate crude as well as condensate.

Golar reaches terms for Equatorial Guinea FLNG

Golar LNG signed a binding heads of terms with Ophir Energy PLC for provision of the Golar floating LNG (FLNG) vessel Gimi. Ophir's Equatorial Guinea Block R upstream partner GEPetrol approved the terms and will formally ratify them next week. The agreement will be structured as a 20-year tolling contract, starting commercial operations first-half 2019.

Gimi is Golar's second FLNG vessel following Hilli, which is scheduled to begin commercial operations off Cameroon first-half 2017. Golar with its partners Keppel Shipyard and Black & Veatch committed to the Gimi FLNG conversion last year (OGJ Online, Jan. 5, 2015). Gimi will use the same configuration of utilities and liquefaction plant as Hilli, with variations to accommodate production direct from the deepwater Block R reservoir.

At full production Gimi will have a contracted capacity of 2.2 million tonnes/year of LNG, to be marketed by Ophir and GEPetrol. Block R has 2.5 tcf of high-purity proved and probable natural gas in an area of benign sea states, Golar said.

The integrated Ophir-GEPetrol-Golar project is expected to make a first-half 2016 final investment decision, following completion of its upstream front-end engineering and design study.